Credit Union Uses Daybreak to Deliver Insights Specific to Its Business

Case Study:Credit Union Uses Daybreak to Deliver Insights

The President of a Michigan credit union wanted to incorporate data analytics for better executive decision-making. As new community banks and credit unions kept moving to his region, he was concerned about the credit union’s ability to compete and distinguish themselves from other local, white glove financial services options. To meet this goal, the president wanted a dashboard to view all member data in one place, but he did not know where to begin.

This case study summarizes how the credit union was able to laser in on what it needed based upon their failed attempts. It needed a solution with a focus on reporting to the end user to deliver insights that would give business outcomes. It needed Daybreak™.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Cornerstone CU League Impact Virtual

IMPACT Virtual Attendees: Enter to Win!

Fill out the form below for a chance to win a $75 Amazon gift card!

Our Virtual Booth

Come chat with us and learn more about how Aunalytics powers credit unions like yours.

Aunalytics Joins 2021 CULytics Summit as Gold Sponsor

Leading Data Platform Provider to Showcase Daybreak for Financial Services Providing Credit Unions with Advanced Analytics and Valuable Business Insights to Accelerate Competitive Advantage

South Bend, IN (March 24, 2021) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, today announced it is a Gold Sponsor at the upcoming 2021 CULytics Summit. CULytics attendees are invited to join Aunalytics President, Rich Carlton and customer Benjamin Smith of Communication Federal Credit Union for a joint Q&A session on April 1st @ 9:45 am titled, “How to Leverage Your Data to Win Against National Banks.”

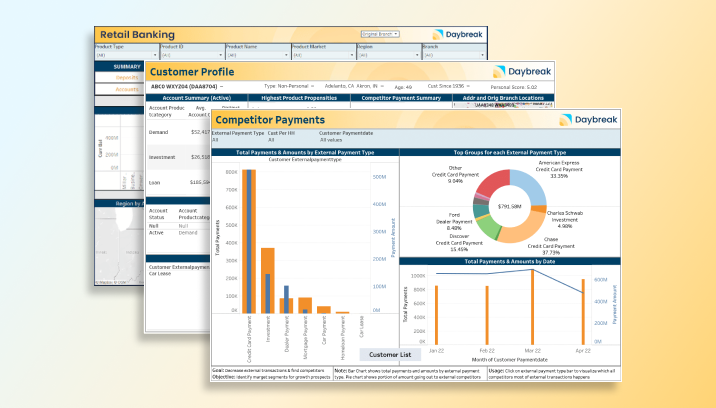

Aunalytics will showcase its DaybreakTM for Financial Services solution at the CULytics virtual event from March 29 to April 1, 2021. Built from the ground up for credit unions and mid-sized banks, Daybreak for Financial Services is a cloud-native data platform with advanced analytics that empowers users to focus on critical business outcomes. The solution seamlessly cleanses data for accuracy, ensures data governance and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and business insights for competitive advantage.

“Utilization of digital banking platforms has grown exponentially in the wake of Covid-19 and consumers are not looking back,” said Rich Carlton, President of Aunalytics. “This shift is forcing credit unions and other financial institutions to accelerate their digital transformation plans to meet the needs of their members and remain competitive. We are excited to be a gold sponsor at the upcoming CULytics event and to demonstrate to attendees how our Daybreak for Financial Services solution can help them harness the power of their data with advanced analytics producing valued insights to target and deliver new services and solutions for their customers.”

Tweet this: .@Aunalytics Joins CULytics Summit as Gold Sponsor

#Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML#CreditUnion #DigitalTransformation #FinancialServices

About CULytics

CULytics brings peers from the Credit Union industry together to help them drive real outcomes by excelling in managing data and then using insights to compete better in the market. Naveen Jain, Founder and President, is a credit union leader experienced in actionable strategic planning, data analytics, marketing, and innovation that deliver immediate ROI at multi-billion-dollar institutions.

CULytics offers, CULytics Membership, a community-based program of education, exchange and inspiration. The topics are data-centric, interactive and, in large part, selected by their members. Membership, tiered to be cost-effective for any size credit union, covers individual CU Leaders or the entire organization throughout the year and provides access to Webinars, Case-Studies, Vendor Evaluations and a variety of tools, including the Data Governance Application and Credit Union Peer Benchmark tools. In addition, members can take advantage of CULytics Workshop series and special events like CULytics Annual Summits and CULytics Days.

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and midsized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Sabrina Sanchez

The Ventana Group for Aunalytics

(925) 785-3014

sabrina@theventanagroup.com

Provident Bank Case Study

Bank Jumpstarts Journey to Predictive Analytics & AI

Provident Bank, a mid-sized bank with $10 billion in assets, is the oldest community bank in New Jersey with branches across two states. Although they have successfully met their customer’s needs for more than 180 years, they knew that they needed to invest in technologies today that would carry them into the future.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Global Manufacturing Company Automates Data Flow Between CRM and Webportal for Improved Customer Experience