Focusing on Business Outcomes Leads to Analytics Success

Most organizations today realize that their everyday data holds value, yet is a resource that often remains untapped. Community banks and credit unions in particular are beginning to see the necessity of investing in these initiatives to compete with large banks and fintechs. However, despite investment in technology solutions that enable advanced analytics, many organizations still fail to succeed in realizing the value. According to Gartner, through 2022, only 20% of analytic insights will actually deliver business outcomes. Why do so many of these projects fail? For many organizations, they lack a clear vision of success. Their success measures should not be to simply build a data warehouse or hire a data analyst. The success measures should center around specific business outcomes.

In the video clip below, Rich Carlton, President and Chief Revenue Officer at Aunalytics, talks about how the right combination of technology, data and analytics talent, and a focus on achieving specific business objectives leads to analytics success.

Aunalytics provides an end-to-end data and analytics solution, including the technology, talent and expertise to help organizations focus on achieving actionable business outcomes. This insights-as-a-service model removes the pressure of building up an analytics infrastructure so businesses can focus their energies on realizing the value in their data much sooner. To learn more about how Aunalytics empowers community banks and credit unions with the ability to turn their data into actionable insights, watch our webinar, “Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions.”

Aunalytics Selected for Inc. Magazine’s 5000 List of the Nation’s Fastest-growing Private Companies for Two Years in a Row

Leading Cloud Data Management & Analytics Company Demonstrates Continued Momentum With its Focus on Helping Mid-market Businesses Accelerate Their Digital Transformation

South Bend, IN (August 18, 2022) - Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, has been named by Inc. magazine as one of the nation’s fastest-growing private companies included in its annual Inc. 5000 list. This marks the second consecutive year that Aunalytics earned a spot on the prestigious ranking, representing a one-of-a-kind look at the most successful companies within the economy’s most dynamic segment—its independent businesses. Facebook, Chobani, Under Armour, Microsoft, Patagonia, and many other well-known names gained their first national exposure as honorees on the Inc. 5000.

“The accomplishment of building one of the fastest-growing companies in the U.S., in light of recent economic roadblocks, cannot be overstated,” said Scott Omelianuk, editor-in-chief of Inc. “Inc. is thrilled to honor the companies that have established themselves through innovation, hard work, and rising to the challenges of today.”

The companies on the 2022 Inc. 5000 have not only been successful, but have also demonstrated resilience amid supply chain woes, labor shortages, and the ongoing impact of Covid-19. Among the top 500, the average median three-year revenue growth rate soared to 2,144 percent. Together, those companies added more than 68,394 jobs over the past three years.

Aunalytics offers a robust, cloud-native platform built to deliver enterprise data management, powerful analytics, and AI-driven answers. From the onset, Aunalytics has been dedicated to empowering enterprise and mid-sized businesses located in secondary and tertiary markets, with advanced data management and analytics tools. Typically in these markets, the technical talent needed to use, maintain, and achieve value from the solution is scarce. Aunalytics provides its technology as a managed service paired with the expert talent needed to achieve ROI.

The analytics portion of the platform represents Aunalytics’ unique ability to unify all the elements necessary to process data and deliver AI end-to-end, from cloud infrastructure to data acquisition, organization, and machine learning models – all managed and run by Aunalytics as a secure managed service. Aunalytics continues to gain traction in industries such as financial services, healthcare, and manufacturing where companies are challenged with undertaking the digital transformation required to succeed in the modern world.

“We’re thrilled to be selected for the Inc. 5000 two years in a row – this truly demonstrates the accelerated growth Aunalytics has experienced as a result of providing advanced talent and tools that are typically not affordable for mid-market businesses,” said Rich Carlton, President of Aunalytics. “Our goal from the very beginning has been to address the midsize business sector and we remain committed to serving the best interests of our customers in this category because it is so critical for both innovation and the economy.”

Complete results of the Inc. 5000 can be found at www.inc.com/inc5000.

Tweet this: .@Aunalytics Selected for Inc. Magazine’s 5000 List of the Nation’s Fastest-growing Private Companies for Second Consecutive Year #Inc5000 #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Inc.

The world’s most trusted business-media brand, Inc. offers entrepreneurs the knowledge, tools, connections, and community to build great companies. Its award-winning multiplatform content reaches more than 50 million people each month across a variety of channels including websites, newsletters, social media, podcasts, and print. Its prestigious Inc. 5000 list, produced every year since 1982, analyzes company data to recognize the fastest-growing privately held businesses in the United States. The global recognition that comes with inclusion in the 5000 gives the founders of the best businesses an opportunity to engage with an exclusive community of their peers, and the credibility that helps them drive sales and recruit talent. The associated Inc. 5000 Conference & Gala is part of a highly acclaimed portfolio of bespoke events produced by Inc. For more information, visit www.inc.com.

For more information on the Inc. 5000 Conference & Gala, visit https://conference.inc.com/.

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Aunalytics Extends Its Presence in Greater Columbus Area

Leading Data Platform Provider Joins One Columbus Organization to Help Foster Economic Development in the 11-County Region, and Is a Featured Presenter at a Cybersecurity Forum in Sydney on August 19

South Bend, IN (August 17, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today its membership in One Columbus, the economic development organization for the 11-county Columbus, Ohio region. With an office in Bellefontaine, Aunalytics is committed to contributing its resources to foster the economic well-being of the broader Columbus region.

Working with local and state partners, One Columbus serves as the business location resource for companies across Central Ohio and around the world as they grow, innovate, and compete within the global economy. Its mission is to lead a comprehensive regional growth strategy that develops and attracts the world’s most competitive companies, grows a highly adaptive workforce, prepares its communities for the future, and inspires corporate, academic and public innovation throughout the greater Columbus area.

“As with other regions of the country, the organizations in the Greater Columbus area are interested in increasing their competitive advantage through digital transformation,” said Robert Lizotte, Ohio Local Market Leader for Aunalytics. “As a member of One Columbus, we look forward to demonstrating how this shift can be accomplished in a more secure and efficient way to drive a higher return on business initiatives.”

Aunalytics also announced that its Chief Security Officer, Kerry Vickers, will speak in Sydney, Ohio at the Sydney Shelby Chamber of Commerce cybersecurity forum, “Do You Have a Plan?” on August 19, at 8amET. Vickers is one of nine subject matter experts who will outline the threats and the measures that can be taken to mitigate cyber invasions which occur on a daily basis, to organizations large and small.

Tweet this: .@Aunalytics Extends Its Presence in Greater Columbus Area #Cybersecurity #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list two years in a row, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Backup vs Disaster Recovery: What’s the Difference?

Your data is vital for your business to function. Often, companies are not completely confident in what should be a part of their Business Continuity Plan (BCP), and do not understand that they need both data backup and disaster recovery to re-operationalize the business to be covered for outages and disasters.

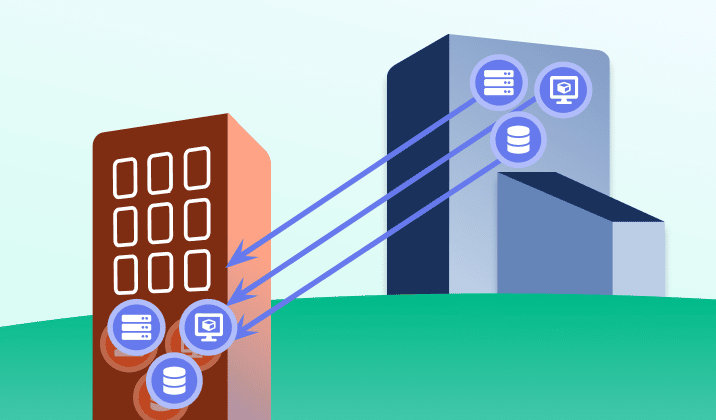

Backup

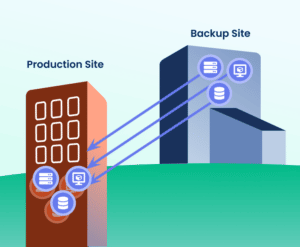

Backup services ensure your data is replicated to a separate, secure location and able to be quickly and easily restored after an outage or disaster event. Many instances of data loss occur due to accidental deletion or corruption, short of an attack or disaster. If you have a backup, what you technically have is a copy of your original data that was last backed up in a virtual or physical location. A backup can be used in case of outage or database failure. It will return data to the last restore point, meaning you may lose some information in the process. Colocation services to store back-ups in multiple separate, secure locations are recommended for resiliency.

Backup services ensure your data is replicated to a separate, secure location and able to be quickly and easily restored after an outage or disaster event. Many instances of data loss occur due to accidental deletion or corruption, short of an attack or disaster. If you have a backup, what you technically have is a copy of your original data that was last backed up in a virtual or physical location. A backup can be used in case of outage or database failure. It will return data to the last restore point, meaning you may lose some information in the process. Colocation services to store back-ups in multiple separate, secure locations are recommended for resiliency.

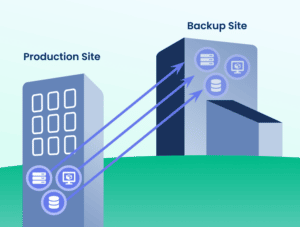

Disaster Recovery

Disaster recovery services are designed to bring a business back online after a failure at the primary business site. Disaster recovery includes steps to operationalize the data back-ups, and bring back online networks and systems should an attack or outage occur. With a disaster recovery solution in place your organization’s data and the functioning of your IT systems are restored. An all-encompassing Disaster Recovery plan restores business functions and minimizes losses and downtimes. It includes server level and site level restoration. You may have to invest in an entire secondary IT infrastructure unless you have a Disaster Recovery as a Service (DRaaS) provider.

Most midsized institutions do not have a team of disaster recovery experts in house to help them to get their business up and running in case of an unforeseen disaster. Gartner reports that in a recent survey, 86% of IT leaders state that their recovery capabilities meet or exceed CIO expectations, but only 27% reported having a disaster recovery plan in place that included base elements of recovery: formalizing scope, performing a BIA to understand business requirements, and creating detailed recovery procedures. On the other hand, “those with a solid disaster recovery program are 40% more likely to demonstrate a stronger overall resilience posture.” Disaster recovery experts supplement your IT team to restore systems and business operations.

Most midsized institutions do not have a team of disaster recovery experts in house to help them to get their business up and running in case of an unforeseen disaster. Gartner reports that in a recent survey, 86% of IT leaders state that their recovery capabilities meet or exceed CIO expectations, but only 27% reported having a disaster recovery plan in place that included base elements of recovery: formalizing scope, performing a BIA to understand business requirements, and creating detailed recovery procedures. On the other hand, “those with a solid disaster recovery program are 40% more likely to demonstrate a stronger overall resilience posture.” Disaster recovery experts supplement your IT team to restore systems and business operations.

Business Continuity Plan

A Business Continuity Plan should include both backup procedures so that you protect your business from data loss, and disaster recovery plans to restore networks, systems and data after failure at your primary business site. For IT resiliency, your plan should include: active monitoring and assessment of IT hazards; resiliency risk assessment including potential consequences; risk and mitigation strategies; understanding of business relevance of the assets to understand business drivers and classify assets in terms of business criticality; and setting IT resilience priorities. Recovery plans should be drilled and tested regularly.

Aunalytics Backup and Disaster Recovery services will give your organization the peace of mind that, no matter what circumstances come, a trusted partner will have your back. You will not have to worry about data loss or theft, as backing up your on-premises data to the cloud will allow your company to have a business continuity plan in place to save critical business information, and you will have experts on hand to help your IT team restore networks, systems and data after a disaster.

Aunalytics to Showcase Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at August Financial Services Events

Leading Data Platform Provider Will Feature Its Aunalytics Daybreak for Financial Services and How Data-driven Marketing Can Help Win Business and Strengthen their Position in Regional Markets

South Bend, IN (August 9, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today its participation at three financial services events in August. The company will showcase its DaybreakTM for Financial Services advanced data analytics solution and demonstrate how midmarket banks and credit unions can use artificial intelligence (AI)-powered data analytics to increase business wins and compete more effectively.

August events include:

- Community Bankers Association of Ohio Annual Conference, August 9-11

- CULytics Day 2022, August 22

- Jack Henry Annual Conference, August 29-September 1

Daybreak for Financial Services enables midsize financial institutions to gain customer intelligence and grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Personalized marketing in a digital world matters more than ever before, especially for midmarket banks and credit unions that have traditionally relied upon hometown, white glove service to win customers,” said Katie Horvath, Chief Marketing Officer of Aunalytics. “Using Aunalytics Daybreak for Financial Services, mid-market banks and credit unions can now deploy advanced analytics to more highly personalize their interactions with customers and members. It enables them to target-market more efficiently with the right product offering at the right time, and win business away from competitors to increase revenue. We look forward to meeting with bankers and credit unions in August, and demonstrating how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Tweet this: .@Aunalytics to Showcase Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at August Financial Services Events #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Timing is Everything in Delivering Data-Driven Insights for Bankers

Many banks and credit unions have set their sights upon initiatives that would allow their teams to make informed, data-driven decisions to improve their business. But when it comes to delivering data-driven insights, timing is everything. Currently, too many mid-sized credit unions and banks rely upon reporting modules from their banking cores for trying to understand business performance and making business decisions. The problem with doing this is two-fold.

First, core reporting only shows you what happened in the past. It does not give you predictive insights for acting now or in the future. As we know, market conditions can rapidly change. Looking back on what worked for your institution three months ago may be informative on past performance, but it is of limited value in deciding what to do next. Your analysis is limited to a review of the past, and then guesswork for what to do today. This is a business review, not data analytics.

Second, by the time that most financial institutions get their core reports, it is months later. This means that if you are basing decision-making on analysis of the core reports, you are making decisions based upon stale data. As we know, market conditions can rapidly change. For example, if you are looking back 3-6 months, you may likely see strong mortgage lending performance. But as we know, with climbing interest rates and inflation, mortgages are not the hot product that they were six months ago. If you decided to double-down on marketing and sales campaigns for achieving new mortgage loans, you would not have the return on this investment that you might have had six months ago. The core report data is stale and does not reflect the market changes.

Timing is Crucial

For this reason, it is critical that your team be enabled to act based upon fresh data. This allows your team to be nimble and pivot strategy as the market changes. The change in the mortgage lending business is an obvious one, given changes by the Fed in interest rates. But what about subtle changes in the market? What about changes for each of your members or customers individually in their life circumstances and behaviors? Having information on what was relevant to a customer three months ago does little to help you act today.

For this reason, it is critical that your team be enabled to act based upon fresh data. This allows your team to be nimble and pivot strategy as the market changes. The change in the mortgage lending business is an obvious one, given changes by the Fed in interest rates. But what about subtle changes in the market? What about changes for each of your members or customers individually in their life circumstances and behaviors? Having information on what was relevant to a customer three months ago does little to help you act today.

For example, when a member changes jobs you have a window of opportunity to market an IRA product before the member likely settles into a new 401(k). If you market the IRA to the member three months later, she likely has rolled over into the new 401(k) and you missed your opportunity. Yet if you had a data analytics solution that provided daily insights, such as a change in the income stream pattern by amount or timing of payroll deposits, this could alert you to a change in employment status as it is happening. This gives your team the ability to sell an investment product when the opportunity is ripe.

Delivering Fresh Data-Driven Insights

Only predictive data analytics can deliver daily insights at scale for all of your customers or members. By detecting trends and patterns revealing growth drivers through predictive analytics, your team can be nimble and positioned for informed decision-making. This leads to doing more of what is working and less of what is not effective in growing operating income and customer loyalty.

2022 Jack Henry Connect

2022 Jack Henry Connect

San Diego Convention Center, San Diego, CA

Aunalytics participates as a Beverage Break Sponsor at 2022 Jack Henry Connect

Aunalytics is excited to attend the 2022 Jack Henry Connect and sponsor the beverage break. Aunalytics will be demonstrating Daybreak™ for Financial Services at their booth. Daybreak enables community banks and credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.