Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

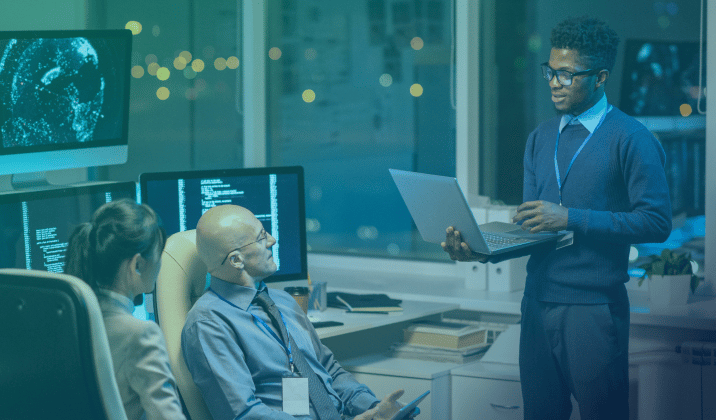

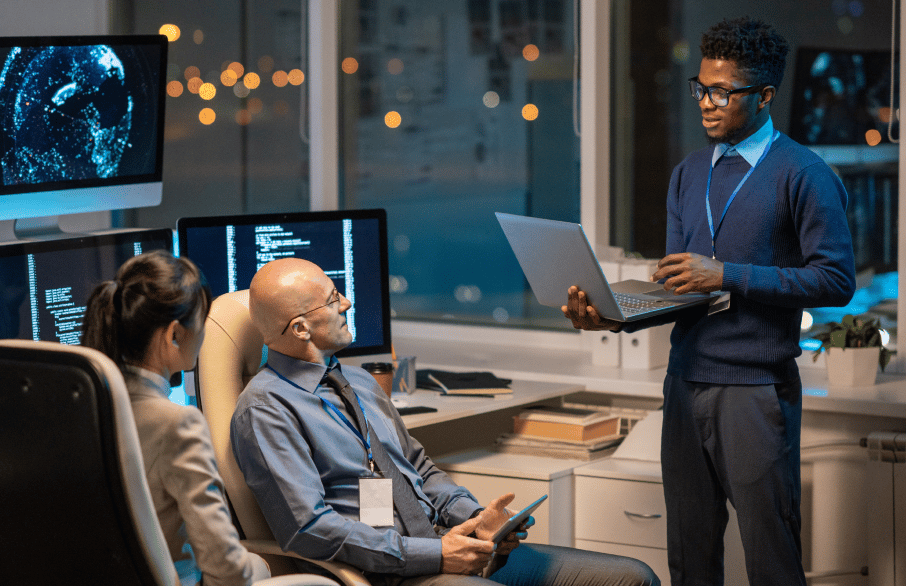

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Fill out the form below to receive a link to the article.

Related Content

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Related Content

Cyber Insurance Continues to Skyrocket—Do You Have a Security Strategy in Place?

Cyber Insurance Continues to Skyrocket—Do You Have a Documentable Security Strategy in Place to Show You’re Prepared?

Cyber risk is a growing critical concern for organizations of all sizes and public entities globally, as we continue to rely on information technology and digital devices. But in the wake of steadily rising digital threats, cyber insurance is getting increasingly expensive—and difficult—for companies to procure.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Related Content

Cyber Insurance Continues to Skyrocket—Do You Have a Security Strategy in Place?

Cyber Insurance Continues to Skyrocket—Do You Have a Documentable Security Strategy in Place to Show You’re Prepared?

Cyber risk is a growing critical concern for organizations of all sizes and public entities globally, as we continue to rely on information technology and digital devices. But in the wake of steadily rising digital threats, cyber insurance is getting increasingly expensive—and difficult—for companies to procure.

Increasingly Difficult Security Requirements Complicate Cyber Insurance Renewal

Have you received a cyber insurance renewal notice with a shocking sticker price? With an ever-increasing number of security incidents involving data breaches, ransomware, phishing scams and more, the cyber insurance landscape has changed. It’s no longer possible to get premium discounts for implementing certain security controls—more is now required. And, without enhanced security measures, you may not get cyber insurance at all.

Threats evolve over time, meaning your security posture needs to evolve in order to not only remain operational, but also be compliant to qualify for most insurance policies.

Insurance companies are now requiring more precautionary measures than ever before due to the constant—and costly—increase of threats. Premiums are increasing and coverage is being denied even for companies that have no history of breaches or claims—cyber insurance renewal rates have increased by up to 200% over the past two years, even for companies who have not made any claims.

The average cost of a data breach has raised from a massive $3.86 million in 2020 to a staggering $4.24 million in 2022.

The Solution

With the risks of operating in an increasingly digital world, cyber insurance is essential for your business to function and remain protected in the event of an attack. Aunalytics’ Advanced Security experts have the talent and technology to audit your security and discuss precautionary measures an insurance company may want you to take before renewal. With a dedicated team, your business can avoid costly data breaches, ransomware, and get your security up to snuff.

Are you ready to assess your security before your company is the victim of a bad actor, costing you upward $4.24 million dollars? See if an audit by our security experts makes sense, and whether your insurance company has outright dictated (or hinted by their renewal questionnaires) new precautionary measures that they expect your enterprise to adopt to obtain coverage.