Banking software is vital to the success of all financial institutions. With an increasing focus on digital transformation, banks and credit unions amass a collection of platforms and software systems. Financial institutions not only rely on their banking core, but also CRM systems, online and mobile banking applications, loan management software, payment processing systems, and wealth management, risk, and compliance software, to name a few. Not only do these systems make banking more efficient, but they are collecting data that can be used to improve the business itself.

How can financial institutions best utilize their existing data? Thanks to their existing banking software, every institution holds valuable information about each customer or member that can be used to increase their lifetime value. PWC estimates that banks can generate a 70% return on initiatives targeting existing customers versus 10% when targeting new customers. Therefore, one of the best ways to use data to achieve better returns and higher margins is to focus on improving the customer or member experience.

Having access to an abundance of data points across various systems presents a tremendous opportunity to strengthen existing relationships—but it also poses a challenge. While each banking software system includes valuable information, it does not give the whole story. The problem for many institutions is that they have no way of getting a complete, 360-degree view of each individual from disparate software systems.

The Importance of an Analytics Platform

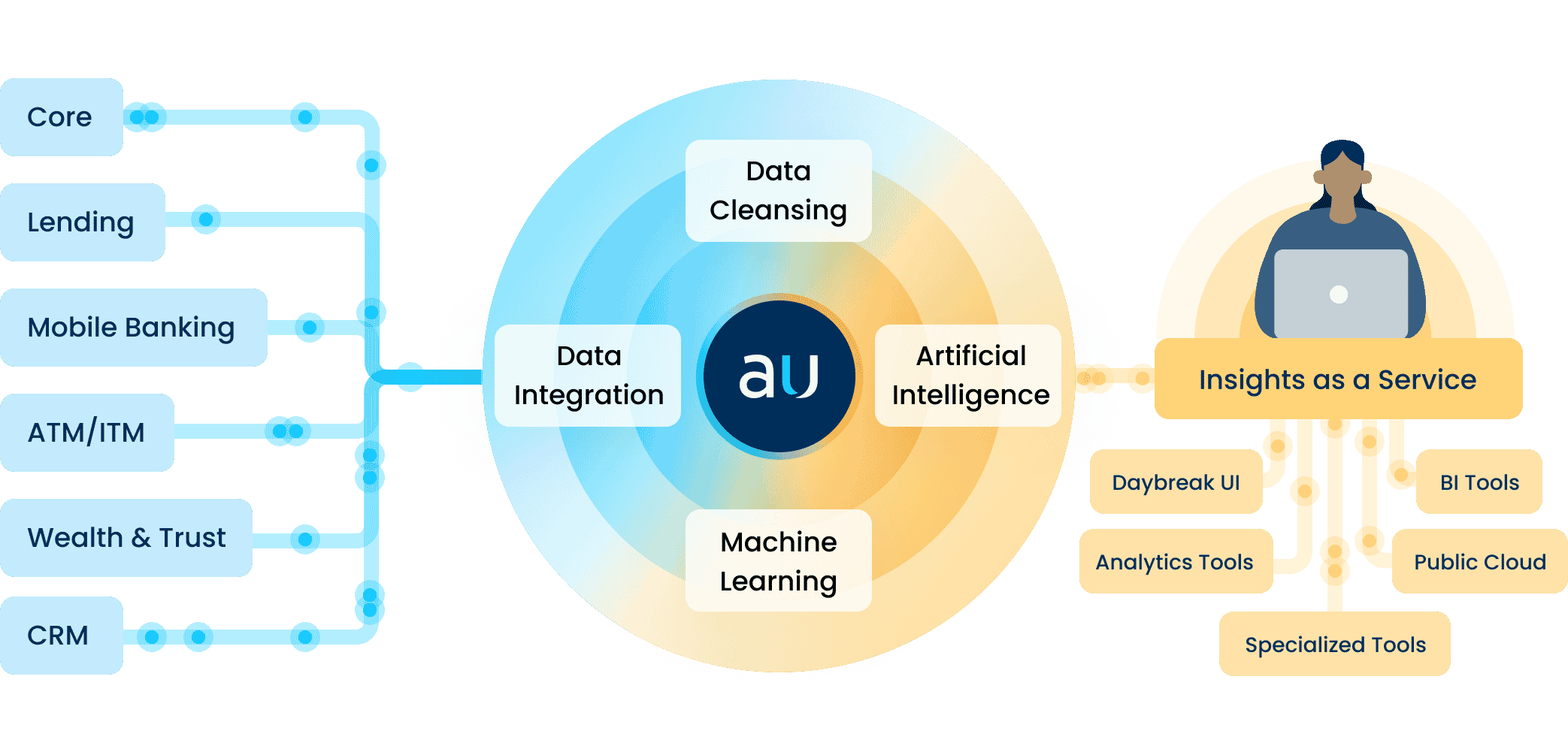

That is why a data and analytics platform is essential. An analytics platform can aggregate data from multiple systems, cleanse and organize that data into a 360-degree customer view, then apply artificial intelligence (AI) and machine learning algorithms to gain data-driven insights.

Once an analytics platform has been implemented, there are many customer intelligence use cases that can help banks and credit unions target the right customers, with the right offer, at the right time, including:

- Gaining transaction insights – Gaining access to transaction data, paired with AI and machine learning, gives great insights into consumer spending habits and preferences.

- Identifying competitor payments – By mining transactional data, financial institutions can discover customer payments going to competitors, then use that information to reach out to customers or members and win back business with a more attractive offer.

- Generating product recommendations – With access to data points from several software systems, machine learning and AI models can make predictions such as the next best product to offer for each customer.

- Predicting churn – AI algorithms identify trends in transactional data, and determine which customers are most likely to churn—so financial institutions can take actions to prevent it.

- Calculating Customer Lifetime Value – An analytics platform can calculate customer value scores based on a large number of relevant data points using AI and machine learning. Banks and credit unions can use this information to allocate resources toward targeting customers with higher customer lifetime value scores.

These are just a few of the ways banks and credit unions can implement insights from a data and analytics platform that mines data from across their organization’s many software systems. Once the platform is implemented, any number of use cases can be developed using AI and machine learning—getting the data collected, aggregated, updated, cleansed, and organized for analytics is one of the largest obstacles for organizations.

Thankfully, Aunalytics has developed a robust data and analytics platform called Daybreak for Financial Services. Daybreak provides all of these services and more to make sure your bank or credit union is making the most of its banking software data to reduce risk, optimize processes, increase revenue, and most importantly, improve the customer or member experience.