Aunalytics to Showcase Daybreak for Financial Services at August Industry Events Attended by Illinois, Indiana, Ohio, and Tennessee Bankers

Leading Data Platform Provider Will Demonstrate Its Advanced Analytics Solution Designed to Help Community and Midsize Banks Compete Against National Financial Institutions

South Bend, IN (August 3, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will feature its advanced analytics solution for midsize and community banks at four industry events attended by bankers from Illinois, Indiana, Ohio, and Tennessee in August. Aunalytics DaybreakTM for Financial Services enables bankers to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

Aunalytics will demonstrate Daybreak for Financial Services at:

- Community Bankers Association of Ohio Annual Convention, August 10-12

- Illinois Bankers Association Annual Conference (virtual), August 11-14

- Indiana Bankers Association Convention, August 15-17

- Tennessee Credit Union League Annual Convention & Expo, August 18-20

Aunalytics’ Daybreak for Financial Services offers the ability to target, discover and offer the right services to the right people, at the right time. The solution empowers mid-market financial institutions with advanced analytics and valuable business insights to improve customer relationships, strategically deliver new products and services through data-driven campaigns, and increase competitive advantage with Aunalytics’ side-by-side digital transformation model.

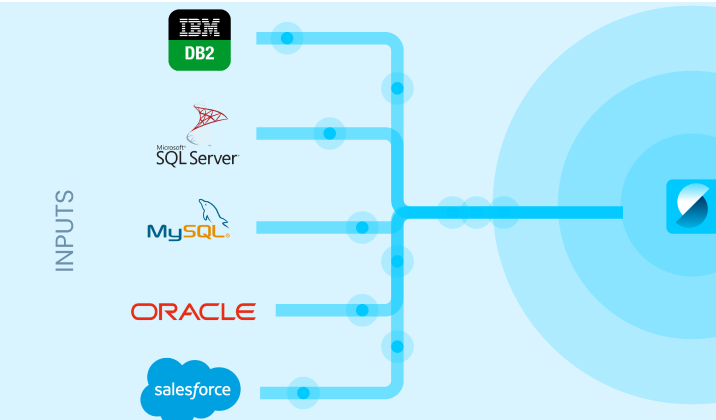

Built from the ground up for midsize and community banks, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Massive amounts of siloed data are difficult to integrate and present a real challenge to midsize and community banks that want to get a better foothold against their larger counterparts,” said Rich Carlton, President, Aunalytics. “Daybreak for Financial Services mines transactional bank data every day to deliver timely insights, such as which product is a customer most likely to purchase next. This enables mid-market banks to more efficiently target and deliver new services and solutions for their customers so they can compete with national banks. We look forward to meeting with bankers from Illinois, Indiana, Ohio, and Tennessee, and demonstrating how Daybreak helps them anticipate customer needs to deliver the right products and services at the right time to gain a critical edge.”

Tweet this: .@Aunalytics to Showcase Daybreak for Financial Services at August Industry Events Attended by Illinois, Indiana, Ohio, and Tennessee Bankers #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

How to Identify Which of Your Banking Customers are at Risk for Crypto Scams

The allure of investing early in the “next big thing” has led to interest in investing in cryptocurrency. Cryptocurrency is a type of digital or virtual money that exists in electronic form (no printed dollars or coins). As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big loss.

Crypto Buyer Profile

Crypto investors tend to be younger adults. They decide to put money into a crypto currency investment with the idea that the currency will gain value over time. When compared to current low and no interest checking and savings accounts rates, where money will not grow in a conventional banking account, crypto provides the promise of potential growth.

People use cryptocurrency for quick payments, to avoid transaction fees that regular banks charge, or because it offers some anonymity. It is typically exchanged person to person online (such as over a phone or computer) without an intermediary like a bank. This means that there is often no one to turn to if there is a problem with the exchange.

Crypto Risks

While some crypto investment opportunities may be speculative long term plays, unfortunately unscrupulous scammers have been attracted to the emerging industry. Investors may find their investment to be worth nothing and the value stolen by a scammer. New crypto currency brands emerge often and many consumers do not know which are legitimate. Because crypto currency is stored in a digital wallet, it is at risk from hackers stealing it. Because there is no banking intermediary, there is no one to turn to if there is fraud.

Crypto currencies are not backed by the government. So, if you store your crypto with a third party company that disappears or is hacked and your money is stolen, there is little to no recourse and the government has no obligation to help you get your money back.

Unlike with credit card purchases, returns and refunds are often not possible for purchases made with crypto because the unregulated industry does not offer these protections as standard.

Crypto currency values change rapidly and constantly. Value is based upon supply and demand. Unlike many investments that may fall in value but typically regain value over time, crypto is less stable. A purchase of $1000 could fall to a value of $100 in minutes. Conversely, it could rise to a value of $10,000 in minutes. But then it could change again – even while you are trying to cash out on your gain while up, it could result in a loss due to the value changing again before the transaction is complete.

How can you protect your banking customers from crypto fraud?

DaybreakTM for Financial Institutions was built specifically for mid-market banks and credit unions to get business outcomes using analytics. Daybreak can mine your transactional data to determine which of your customers has money leaving or entering your bank from a crypto currency company. This will give you an actionable list of customers for outreach and education on risks. If enriched with a listing of crypto companies known to be fraudulent, targeted outreach may be done by you to save your customers from fraud. Further, after explaining the risks of crypto and educating your customers, you may be able to offer an alternative investment opportunity to keep your customers safe and their dollars in your bank.

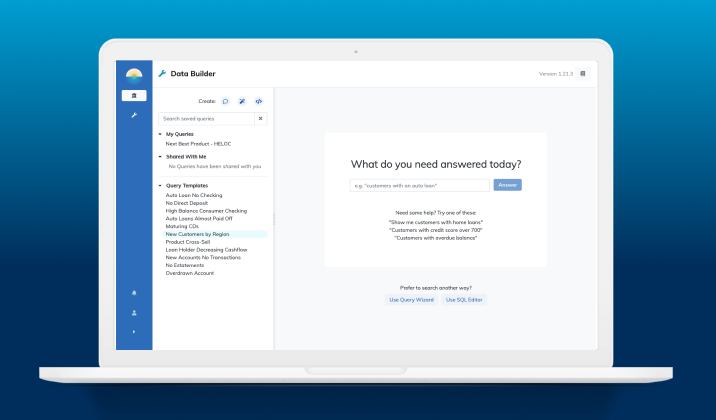

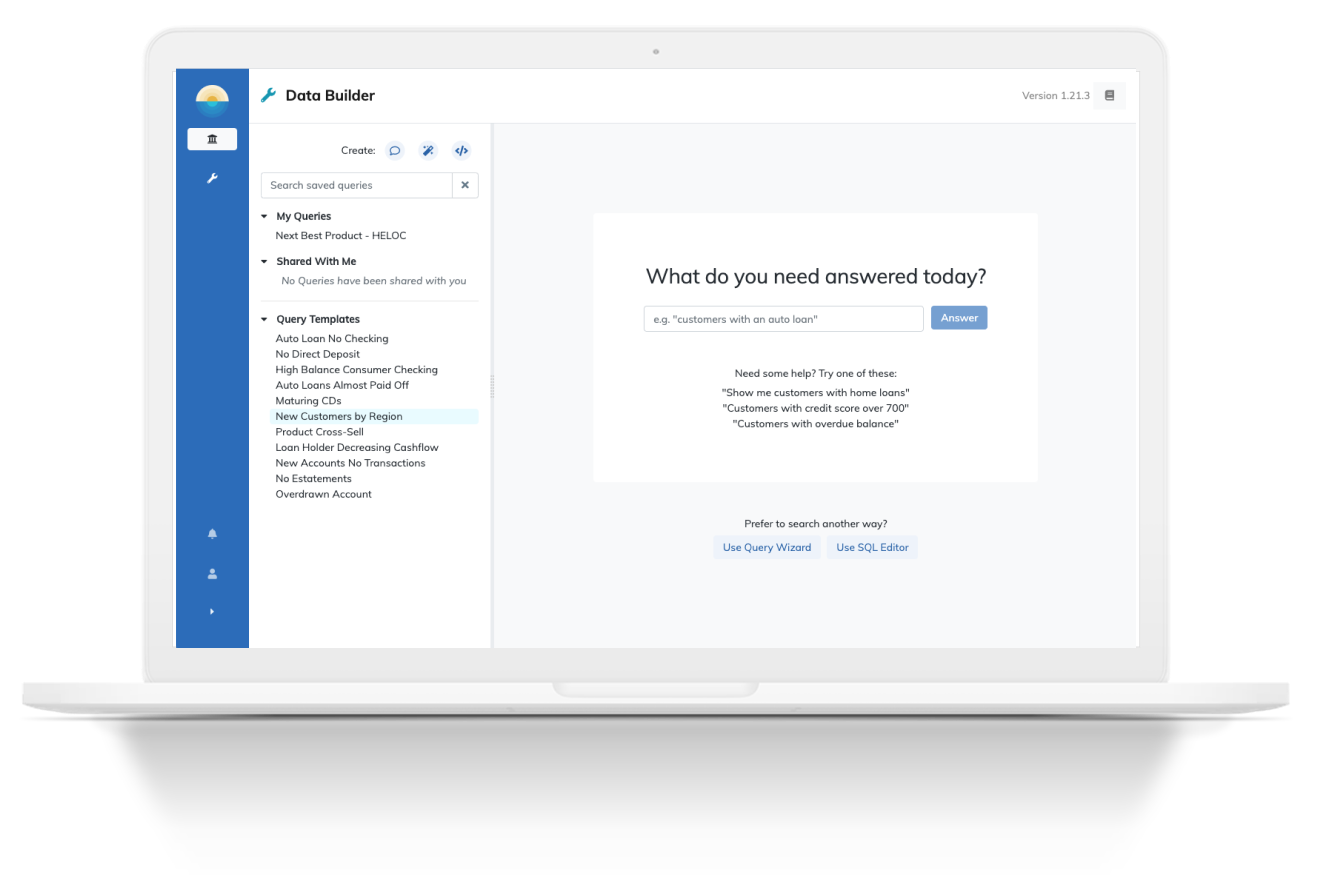

What are Natural Language Answers?

Imagine the ability to get answers from the data in your organization by simply asking a question like “how many residential accounts opened last month,” “give me a list of all accounts 90-days overdue,” or “products with monthly sales volume over 1,000 units.” Over the past few decades, advances in machine learning have made it easy to get answers from search engines like Google using natural language questions. Consumers can easily search for products and services by entering phrases like “Find mortgage lenders near me” or “grocery stores within five miles.”

At Aunalytics, we understand that the competitive edge in today’s business environment depends on data-driven decisions based on a dependable and accurate datamart. To that end, we have built the Daybreak™ analytical database to provide a relational data model of industry focused data points that deliver maximum value to businesses in a specific industry like financial services, healthcare billing, or retail.

Daybreak Natural Language Answers™ extends the power of this data to all members your business. Natural Language Answers is a machine learning solution that turns finding answers to industry specific business questions into a Google-like experience for your datamart. Finding answers is easy using natural language search phrases. Just ask a question and our machine learning models will translate your question into a structured query and return results that you can download as CSV files, or visualize as bar charts, line charts, or other graphs in the Insights dashboard within the Daybreak app.

Natural Language Answers brings the revolutionary power of search that consumers have had access to since the birth of the modern search engine to business users looking for answers within their proprietary data. Business leaders with an eye to the future will understand just how revolutionary a data search tool like Natural Language Answers can be to operations. Just as it is difficult to remember life before the advent of the search engine, the advent of data search tools like Natural Language Answers represents a similar transformation in decision making for business in the next ten years.

AC3 Achieves Significant Efficiency Gains Through Automation and Data Enrichment Using the Aunalytics Daybreak Solution

AC3 Achieves Significant Efficiency Gains Through Automation and Data Enrichment Using the Aunalytics Daybreak Solution

With Aunalytics, AC3 automates billing processes and provides revenue cycle insights to oncology providers for greater visibility into missing revenue opportunities.

Fill out the form below to receive the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

Aunalytics Accelerates Insights-as-a-Service Offering Through Ohio Expansion

South Bend, IN (July 15, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service to answer the most important business and IT questions, today reported expansion of operations into Ohio. Aunalytics acquired Ohio-based managed services provider NetGain in February 2021 and today announces integration and rebranding of the Ohio operations and data centers as Aunalytics. Leveraging NetGain’s footprint throughout Ohio, Aunalytics extends its solution portfolio, including AunsightTM Golden Record and the DaybreakTM Analytic Database, to new customers in the region.

With Aunalytics’ expansion, the company will continue providing IT and security expertise to government and mid-market businesses in the areas of financial services, healthcare, manufacturing and professional services. Aunalytics will continue to offer state-of-the-art cloud and managed services to companies in the region, adding data cleansing, data management and machine learning powered data analytics services that allow Ohio businesses to strengthen their competitive edge and achieve greater success.

The integration of NetGain allows for a greater footprint in Columbus and Dayton. Growing companies in the state will benefit from the additional technology efficiencies and features enabled, allowing for increased revenues and lower operational costs. Business leaders seeking sound IT foundations have relied on quality managed services for years with NetGain, and with digital transformation top-of-mind across industries, Aunalytics is poised to bring best-of-breed solutions to clients looking to advance their business objectives.

"Digital transformation remains a top priority for our organization and is absolutely critical to drive the business forward," said Tom Kiefer, CFO, Environmental Management Services, Inc. (EMSI). "We rely on the advanced insights available through our strategic IT partner, helping us to achieve a higher level of business intelligence from multiple data sources, across all operational areas."

“NetGain’s legacy as an ISP brings a strong network management/network engineering expertise and a technology suite for multi-site locations. Together, the integrated companies will offer ironclad redundancy, reliability, and IT solutions to meet any business challenge,” said Kelly Jones, vice president of Integration Services at Aunalytics. “This is complemented with the deep knowledge of our team, making Aunalytics well-positioned to deliver strategic computing services and build-out resilient IT stacks for all clients.”

Tweet this: .@Aunalytics Accelerates Position in Managed Services; Expands Ohio Operations Through NetGain Acquisition #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Why the Data Lake – Benefits and Drawbacks

A data lake solves the problem of having disparate data sources living in different applications, databases and other data silos. While traditional data warehouses brought data together into one place, they typically took quite a bit of time to build due to the complex data management operations required to transform the data as it was transferred into the on-premise infrastructure of the warehouse. This led to the development of the data lake – a quick and easy cloud-based solution for bringing data together into one place. Data lake popularity has climbed significantly since launch, as APIs quickly connect data sources to the data lake to bring data together. Data lakes have redefined ETL (extract, transform and load) as ELT, as data is quickly loaded and transforming it is left for later.

However, data in data lakes is not organized, connected, and made usable as a single source of truth. The problem with disparate data sources has only been moved to a different portion of the process. Data lakes do not automatically combine data from the multiple relocated sources together for analytics, reporting, and other uses. Data lakes lack data management, such as master data management, data quality, governance, and data accuracy technologies that produce trusted data available for use across an organization.

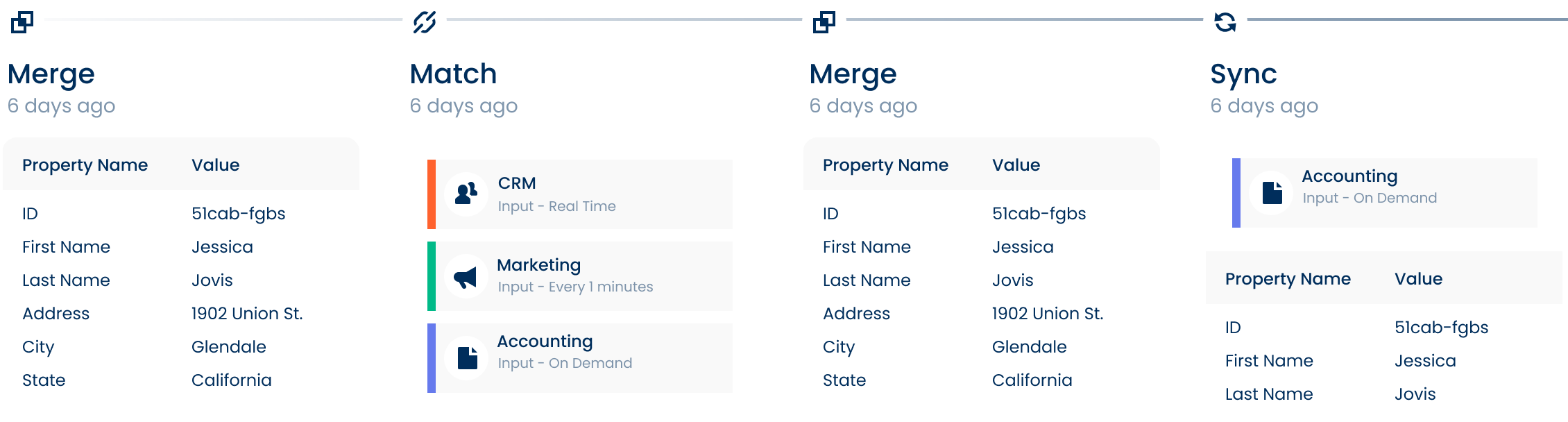

Solutions, such as the cloud-native AunsightTM Golden Record, bring data accuracy, matching, and merging to the lake. In this manner, data lakes can have the data management of data warehouses yet remain nimble as cloud solutions. Ultimately, the goal is to bring the data from the multiple data silos together for better analytics, accurate executive reporting, and customer 360 and product 360 views for better decision-making. This requires a data management solution that normalizes data of different forms and formats, to bring it into a single data model ready for dashboards, analytics, and queries. Pairing a data lake with a cloud-native data management solution with built in governance provides faster data integration success and analytics-ready data than traditional data warehouse technologies.

Aunsight Golden Record takes data lakes a step further by not only aggregating disparate data, but also cleansing data to reduce errors and matching and merging it together into a single source of accurate business information – giving you access to consistent trusted data across your organization in real-time.