How An End-to-End Analytics Solution Helps You Avoid Hidden Costs

As the new year approaches, digital transformation should be at the top of every mid-market organization’s to-do list. As organizations begin to understand the value of business analytics for their daily operations, the need for an end-to-end analytics solution becomes evident. Yet, many companies struggle to obtain the right analytics solutions to fit their specific needs.

Unfortunately, the analytics solution market can be difficult to navigate. Since building an analytics tool in-house is incredibly time-consuming and very costly, many mid-market companies would be better served by working with a solution provider who can provide both the tools and talent necessary to achieve their business goals.

Digital Transformation Roadblocks

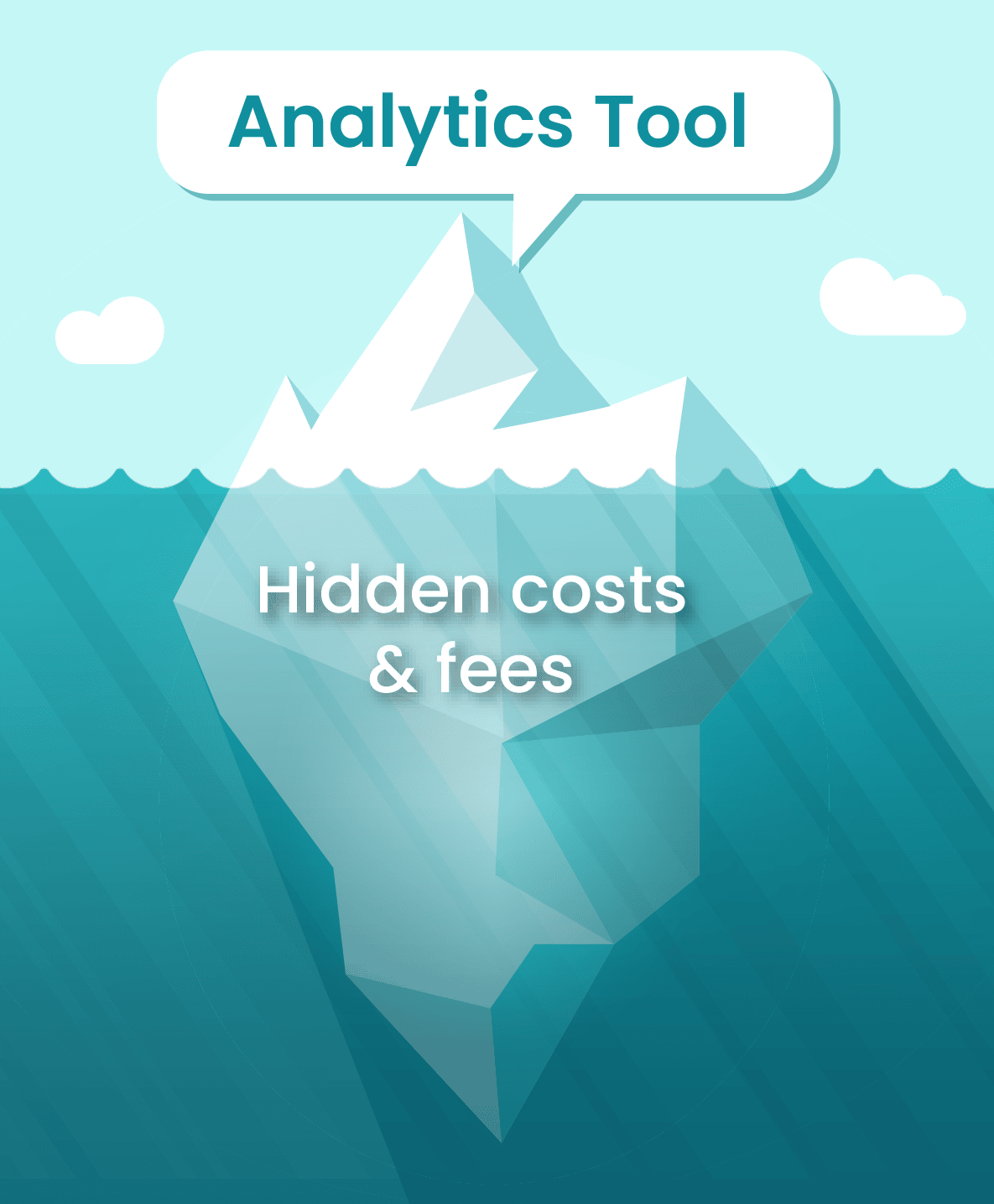

One major roadblock in the pursuit of digital evolution is determining how much an analytics solution is going to cost. Analytics solutions are complex, and when an analytics company gives a quote, they often fail to mention additional add-ons their solution needs to be functional. For instance, charges for a third-party cloud to host your analytics solution and individual charges for connectors that allow your disparate data sources to flow into the solution are the most common up-charges.

Your organization could get stuck with unexpected licensing fees or overage charges from a third-party cloud provider. Worse yet, you may end up piecing together various technologies, while lacking the adequate technical talent to keep the solution functioning and show actionable results. To achieve value from your investment, it is vital to look for a partner that can provide you with a solution where extra charges do not come into play. Budgets are an integral part of the decision-making process when it comes time to choose a solution provider.

With hidden costs, figuring out how a particular solution is going to fit into your budget becomes increasingly difficult. The most effective solution is opting for a partner who can provide your company with an end-to-end analytics solution.

Why Mid-Market Organizations Need End-to-End Analytics Solutions

To compete with larger institutions, mid-market organizations need to leverage their existing local data to gain insights to better serve their clients. An end-to-end solution ensures you do not end up with a solution your team cannot utilize to achieve your business goals and thrive in an increasingly competitive market.

It is a known fact that mid-market businesses struggle with retaining talent for data management, IT, security, and advanced analytics. Opting for an end-to-end solution gives you access to a team of experts who will always be by your side, assisting you every step of the way.

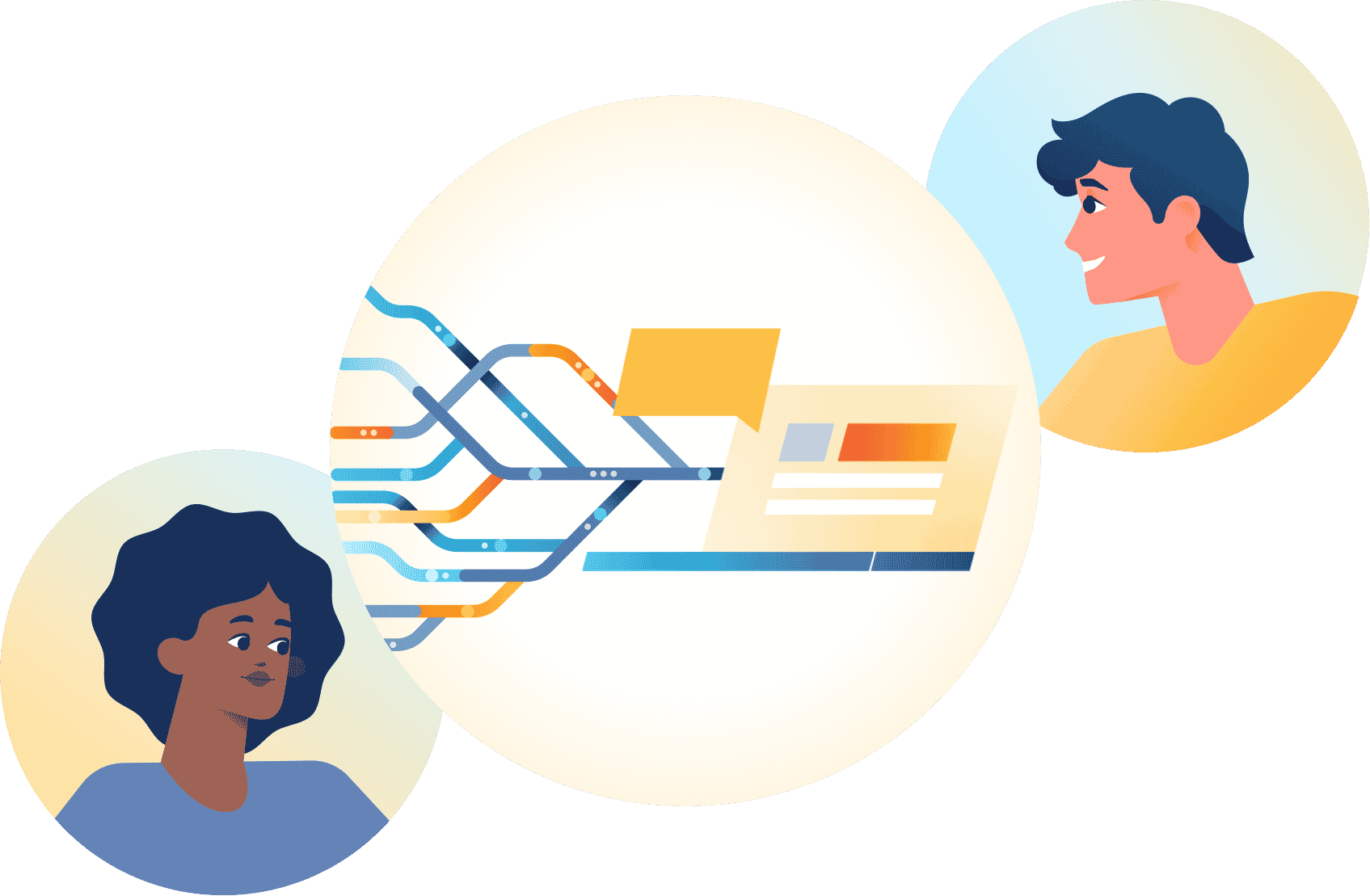

With Aunalytics, you get the technology and the expertise required to complete your journey from disparate data to actionable business results. Using our platform, your entire organization can reap the benefits of having a reliable and robust data platform.

Aunalytics Provides a Complete, End-to-End Analytics Solution for Mid-Sized Organizations

Aunalytics offers an end-to-end analytics solution that includes the right technology paired with experts who work by your side to help you accomplish your business goals. The technology, combined with the technical talent necessary to fully utilize it, will help your organization achieve true value from your investment. End-to-end analytics solutions provide you with insights from your data so you can concentrate on critical business decisions. No longer do you have to worry about overages, licensing costs or other additional charges. Aunalytics has the answers to your business and IT questions.

The Aunalytics Data Platform is a robust, cloud-native data platform built for universal data access, powerful analytics, and AI. It includes the following components:

- Aunalytics Enterprise Cloud provides a highly redundant, secure, and scalable platform for hosting servers, data, analytics, and applications at any performance level.

- Aunsight Golden Record integrates and cleanses siloed data from disparate systems for a single source of accurate business information across your enterprise.

- Daybreak Analytics Database provides daily insights powered by Artificial Intelligence (AI) and Machine Learning (ML) driven analytics, industry intelligence, and smart features that enable a variety of analytics solutions and timely actionable insights that drive strategic value across your company.

This end-to-end platform enables your business to extract answers from your data without having to worry about additional charges that might break your budget. Our solutions are secure, reliable, and scalable, all according to your business’ needs. Aunalytics solutions seamlessly integrate and cleanse your valuable data for accuracy, ensuring data governance and employing Artificial Intelligence (AI) and Machine Learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

Using our solution, team members across your organization can reap the benefits of having an end-to-end analytics solution to make data-driven decisions. Company executives can view data cleansed into an accurate golden record that is streamed in real-time to enable better decision making for the entire organization. Your organization’s marketing team can have access to aggregated data that reveals a 360-degree view of your customer, including insights into customer behavior, that empowers them to run data-driven campaigns to the right customer, at the right time, with the right product. Your IT department can ensure that you are functioning at peak efficiency by analyzing the data collected to scale resources and identify potential roadblocks and bottlenecks. Those are just a few departments that would benefit—think about how powerful a real-time analytics solution could be across your entire organization.

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Fill out the form below to receive a link to the article.

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Cyber Insurance Continues to Skyrocket—Do You Have a Security Strategy in Place?

Cyber Insurance Continues to Skyrocket—Do You Have a Documentable Security Strategy in Place to Show You’re Prepared?

Cyber risk is a growing critical concern for organizations of all sizes and public entities globally, as we continue to rely on information technology and digital devices. But in the wake of steadily rising digital threats, cyber insurance is getting increasingly expensive—and difficult—for companies to procure.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Related Content

Cyber Insurance Continues to Skyrocket—Do You Have a Security Strategy in Place?

Cyber Insurance Continues to Skyrocket—Do You Have a Documentable Security Strategy in Place to Show You’re Prepared?

Cyber risk is a growing critical concern for organizations of all sizes and public entities globally, as we continue to rely on information technology and digital devices. But in the wake of steadily rising digital threats, cyber insurance is getting increasingly expensive—and difficult—for companies to procure.

Related Content

Nothing found.

Increasingly Difficult Security Requirements Complicate Cyber Insurance Renewal

Have you received a cyber insurance renewal notice with a shocking sticker price? With an ever-increasing number of security incidents involving data breaches, ransomware, phishing scams and more, the cyber insurance landscape has changed. It’s no longer possible to get premium discounts for implementing certain security controls—more is now required. And, without enhanced security measures, you may not get cyber insurance at all.

Threats evolve over time, meaning your security posture needs to evolve in order to not only remain operational, but also be compliant to qualify for most insurance policies.

Insurance companies are now requiring more precautionary measures than ever before due to the constant—and costly—increase of threats. Premiums are increasing and coverage is being denied even for companies that have no history of breaches or claims—cyber insurance renewal rates have increased by up to 200% over the past two years, even for companies who have not made any claims.

The average cost of a data breach has raised from a massive $3.86 million in 2020 to a staggering $4.24 million in 2022.

The Solution

With the risks of operating in an increasingly digital world, cyber insurance is essential for your business to function and remain protected in the event of an attack. Aunalytics’ Advanced Security experts have the talent and technology to audit your security and discuss precautionary measures an insurance company may want you to take before renewal. With a dedicated team, your business can avoid costly data breaches, ransomware, and get your security up to snuff.

Are you ready to assess your security before your company is the victim of a bad actor, costing you upward $4.24 million dollars? See if an audit by our security experts makes sense, and whether your insurance company has outright dictated (or hinted by their renewal questionnaires) new precautionary measures that they expect your enterprise to adopt to obtain coverage.