2022 Heartland Credit Union Association Convention & Annual Meeting

2022 Heartland Credit Union Association Convention & Annual Meeting

Sheraton Kansas City Hotel at Crown Center, Kansas City, MO

Aunalytics is a Keynote Speaker Sponsor at the Heartland CU Association Convention & Annual Meeting

Aunalytics is excited to attend the 2022 Heartland Credit Union Association Convention & Annual Meeting as a Keynote Speaker Sponsor. Aunalytics will be demonstrating Daybreak™ for Financial Services at Booth 225. Daybreak enables credit unions to more effectively identify and deliver new services and solutions to their members so they can better compete with large national financial institutions.

4 Questions Mid-market Companies Should Ask Themselves About Data Protection

4 Questions Mid-market Companies Should Ask Themselves About Data Protection

How safe is cloud security, which now often relies on “zero trust” security principles based on a user’s location rather than user credentials? While some worry that cloud security is less reliable than on-premise security, that’s not actually the case, particularly for mid-market businesses. The fact is that your data is actually more secure in a remote data center managed by security experts than by your in-house IT team.

You may feel a false sense of security by having your IT department guard your servers in a closet — but this strategy is extremely risky when it comes to data protection. It’s not standard for mid-market IT departments to possess expert skills in cloud security and data security, which are needed to properly safeguard data. Many mid-market companies, particularly those not in highly regulated industries, do not currently have Security Operations Centers.

To read more, please fill out the form below:

Enterprise Cloud Solutions Allow Businesses to Scale and Thrive

Paul Delory, Senior Director Analyst at Gartner says, “Cloud adoption accelerated rapidly during the pandemic and will accelerate further in the years to come.” There are several new advancements in the global IT infrastructure that have made deployment easier, which enables use cases which were previously considered to be unfeasible.

To get the most out of cloud storage, however, you need to find a cloud computing solution that fits your company’s needs. An enterprise cloud solution is a natural progression for any organization that has outgrown an onsite, physical server. A switch to a cloud computing solution can be compared to switching from everyone in an organization from owning a basic car to everyone in your organization carpooling in an efficient high-performance vehicle. Everyone gets to pool the resource and share it, but can also maintain their individuality.

A customer does not need to buy a physical or cloud server—instead they buy CPU, RAM, and storage components to satisfy their data and computational needs. These solutions often have scalability factored in, and, as you have greater needs as you grow, cloud providers are able to open more CPU, RAM, and storage as needed. For any organization, this option is significantly more feasible than having to buy double or triple the CPU and RAM for a physical server that they have on site. Our Enterprise Cloud offers server space in a shared environment that partitions a particular user’s CPU and RAM needs, alongside other user’s CPU and RAM needs, into a single, larger, combined CPU provisioning—and a single, larger, combined RAM bucket that are both Enterprise-level.

Aunalytics has high performance infrastructure solutions that provide scalable platforms for all your needs—including hosting servers, data, and applications at any performance level you’ll need. With this elastic infrastructure, we can support your ever-expanding needs and ensure your business is able to leverage the most robust cloud computing environment. Our hosting solutions are backed by our expertise in data, analytics, machine learning, and more.

To ensure the highest level of reliability, we host our Enterprise Cloud solution through multiple geographically diverse company-owned data centers, which provides you with a highly redundant and scalable platform. This cloud solution is intended to keep your data extremely safe and accessible and is scalable to handle any level of I/O intensive workloads.

Access to a strong cloud computing and storage solutions enable you to experience true efficiency as you manage, run, and secure applications across multiple devices. To increase your business’s agility, and meet your needs and your clients’ expectations, consider using a cloud computing solution and leverage the benefits of a consistent infrastructure with the ability to dynamically adjust to your requirements.

4 Questions Mid-market Companies Should Ask Themselves About Data Protection

4 Questions Mid-market Companies Should Ask Themselves About Data Protection

How safe is cloud security, which now often relies on “zero trust” security principles based on a user’s location rather than user credentials? While some worry that cloud security is less reliable than on-premise security, that’s not actually the case, particularly for mid-market businesses. The fact is that your data is actually more secure in a remote data center managed by security experts than by your in-house IT team.

You may feel a false sense of security by having your IT department guard your servers in a closet — but this strategy is extremely risky when it comes to data protection. It’s not standard for mid-market IT departments to possess expert skills in cloud security and data security, which are needed to properly safeguard data. Many mid-market companies, particularly those not in highly regulated industries, do not currently have Security Operations Centers.

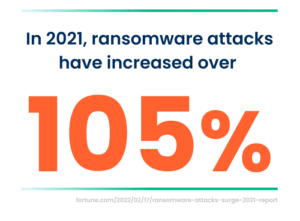

What’s more, it came to light at the end of 2021 that cyber-insurance renewals are becoming at times prohibitively expensive for all industries due to the exponential increase in cyber-attacks seen last year. The only way for mid-market companies in all industries to lower cyber-insurance premiums and ensure coverage is to implement enhanced data security measures.

Since data protection has become the most prevalent challenge in the cybersecurity market, it’s no surprise to see that according to Insights for Professionals, data protection is the main focus in 2022 for 85 percent of businesses surveyed; 37 percent plan to invest up to $500,000 on data protection in 2022, and 31 percent plan to invest more than $500,000 on data protection over the next 18 months. McKinsey also reports that 85 percent of midsize enterprises plan to boost their IT security spend until 2023.

All-Time High Cybercrime

McKinsey reports that there are multiple motivations for these attacks, headed by the fact that pandemic-weary companies have become ripe for security vulnerabilities. Also, as advancing digitization continues to drive connectivity and employees now log in from anywhere — including unsecured home networks — it makes life easier for ransomware hackers. The traditional smash and grab approach is now being replaced with bad actors “dwelling” undetected within victims’ environments, which gives cybercriminals the lay of the land in understanding where the highest value information resides before selling it to the highest bidder.

Another motivation for the continued attacks is their success: as more companies are forced to pay ransoms, hackers are further incentivized to build on their well-paid victories and continue innovating on this lucrative threat. Specific sectors are particularly at risk; keep in mind that in the U.S., supply-chain attacks rose 42 percent in Q1 of 2021, victimizing as many as 7 million people, while McKinsey shared that “security threats against industrial control systems and operational technology more than tripled in 2020.” The war in Ukraine has taught us lessons about attacks compromising infrastructure, utilities and government that can debilitate nations and be weaponized.

Paying Up

These massive numbers can seem overwhelming, and can also make it difficult to tell how much a ransomware attack can affect an individual company. To give you some perspective, consider these stats:

- NPR reported that Colonial Pipeline paid a $4.4 million ransom after the company shut down operations.

- CNBC reported that global meat producer JBS paid ransomware hackers $11 million.

- Insider reported that global insurance provider CNA Financial forked over a reported mind-blowing $40 million post-cyber-attack.

- The Washington Post reported that a ransomware attack on U.S. software provider Kaseya targeted the firm’s remote-computer-management tool and endangered up to 2,000 companies globally.

These costs are also just the tip of the iceberg for the companies victimized by ransomware hackers. Additional costs of such an attack include everything from paying third parties (like legal, PR, and negotiation firms), not to mention the opportunity costs of having executives, staff, and teams disconnected from their day-to-day roles for weeks or months to deal with the attack’s aftermath. Perhaps the biggest unaccounted-for expense is the resulting lost revenue.

Ask These 4 Questions

What can mid-market companies do in the face of these threats to their data’s safety? They should focus on strategies that address ransomware prevention, preparation, response, and recovery. Since this is an ongoing journey, threats continue to evolve and improve — so it’s critical to keep up to date with new threats of increasing sophistication, while being ready with cybersecurity strategies and best practices. The goal is to continue to build cyber maturity that creates a resilient approach. You may not be able to stop attacks from occurring, but when they do, they won’t have the same impact if you’ve prepared in this way.

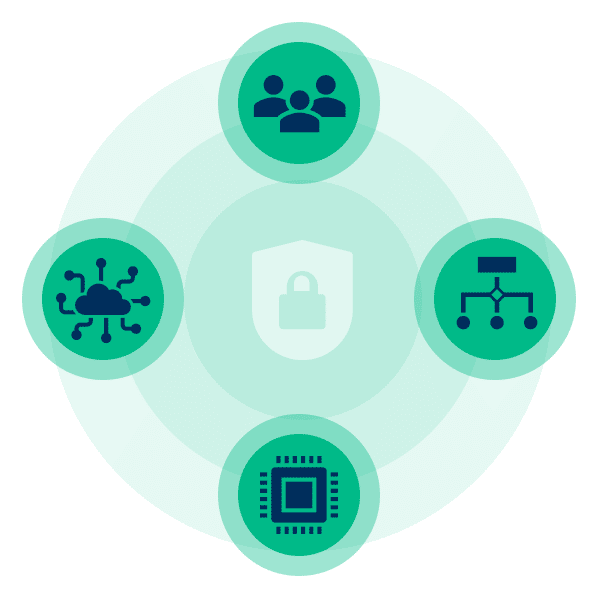

As a starting point, these are four questions that every mid-market company should ask itself to determine the organization’s readiness for data defense:

- When it comes to our people, do we have security focused IT leadership, trained cloud security experts, and data security experts?

- When it comes to our process, do we have defined IT security processes for proactively managing the security posture of our environments?

- When it comes to our technology, are we 100 percent confident in our security tech and our ability to actively monitor and detect threats around the clock?

- When it comes to our cloud architecture, are we confident that it allows for scalability without sacrificing security assurances?

If the answer is “no” or “I don’t know” to any of these questions, it is time to get your house in order — you are at risk. To stay alive, compete, and drive value, mid-market companies should shift their focus to data analytics, data management, security, and compliance. This requires a cloud-based data center, a cloud-native data management platform, and cloud-native analytics. Ensuring the right infrastructure to maximize the capabilities of data centers — and how they are able to manage and store data — is crucial to effective mid-market digital transformation.

Learn More

Nothing found.

Focusing on Business Outcomes Leads to Analytics Success

Most organizations today realize that their everyday data holds value, yet is a resource that often remains untapped. Community banks and credit unions in particular are beginning to see the necessity of investing in these initiatives to compete with large banks and fintechs. However, despite investment in technology solutions that enable advanced analytics, many organizations still fail to succeed in realizing the value. According to Gartner, through 2022, only 20% of analytic insights will actually deliver business outcomes. Why do so many of these projects fail? For many organizations, they lack a clear vision of success. Their success measures should not be to simply build a data warehouse or hire a data analyst. The success measures should center around specific business outcomes.

In the video clip below, Rich Carlton, President and Chief Revenue Officer at Aunalytics, talks about how the right combination of technology, data and analytics talent, and a focus on achieving specific business objectives leads to analytics success.

Aunalytics provides an end-to-end data and analytics solution, including the technology, talent and expertise to help organizations focus on achieving actionable business outcomes. This insights-as-a-service model removes the pressure of building up an analytics infrastructure so businesses can focus their energies on realizing the value in their data much sooner. To learn more about how Aunalytics empowers community banks and credit unions with the ability to turn their data into actionable insights, watch our webinar, “Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions.”

Aunalytics Selected for Inc. Magazine’s 5000 List of the Nation’s Fastest-growing Private Companies for Two Years in a Row

Leading Cloud Data Management & Analytics Company Demonstrates Continued Momentum With its Focus on Helping Mid-market Businesses Accelerate Their Digital Transformation

South Bend, IN (August 18, 2022) - Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, has been named by Inc. magazine as one of the nation’s fastest-growing private companies included in its annual Inc. 5000 list. This marks the second consecutive year that Aunalytics earned a spot on the prestigious ranking, representing a one-of-a-kind look at the most successful companies within the economy’s most dynamic segment—its independent businesses. Facebook, Chobani, Under Armour, Microsoft, Patagonia, and many other well-known names gained their first national exposure as honorees on the Inc. 5000.

“The accomplishment of building one of the fastest-growing companies in the U.S., in light of recent economic roadblocks, cannot be overstated,” said Scott Omelianuk, editor-in-chief of Inc. “Inc. is thrilled to honor the companies that have established themselves through innovation, hard work, and rising to the challenges of today.”

The companies on the 2022 Inc. 5000 have not only been successful, but have also demonstrated resilience amid supply chain woes, labor shortages, and the ongoing impact of Covid-19. Among the top 500, the average median three-year revenue growth rate soared to 2,144 percent. Together, those companies added more than 68,394 jobs over the past three years.

Aunalytics offers a robust, cloud-native platform built to deliver enterprise data management, powerful analytics, and AI-driven answers. From the onset, Aunalytics has been dedicated to empowering enterprise and mid-sized businesses located in secondary and tertiary markets, with advanced data management and analytics tools. Typically in these markets, the technical talent needed to use, maintain, and achieve value from the solution is scarce. Aunalytics provides its technology as a managed service paired with the expert talent needed to achieve ROI.

The analytics portion of the platform represents Aunalytics’ unique ability to unify all the elements necessary to process data and deliver AI end-to-end, from cloud infrastructure to data acquisition, organization, and machine learning models – all managed and run by Aunalytics as a secure managed service. Aunalytics continues to gain traction in industries such as financial services, healthcare, and manufacturing where companies are challenged with undertaking the digital transformation required to succeed in the modern world.

“We’re thrilled to be selected for the Inc. 5000 two years in a row – this truly demonstrates the accelerated growth Aunalytics has experienced as a result of providing advanced talent and tools that are typically not affordable for mid-market businesses,” said Rich Carlton, President of Aunalytics. “Our goal from the very beginning has been to address the midsize business sector and we remain committed to serving the best interests of our customers in this category because it is so critical for both innovation and the economy.”

Complete results of the Inc. 5000 can be found at www.inc.com/inc5000.

Tweet this: .@Aunalytics Selected for Inc. Magazine’s 5000 List of the Nation’s Fastest-growing Private Companies for Second Consecutive Year #Inc5000 #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Inc.

The world’s most trusted business-media brand, Inc. offers entrepreneurs the knowledge, tools, connections, and community to build great companies. Its award-winning multiplatform content reaches more than 50 million people each month across a variety of channels including websites, newsletters, social media, podcasts, and print. Its prestigious Inc. 5000 list, produced every year since 1982, analyzes company data to recognize the fastest-growing privately held businesses in the United States. The global recognition that comes with inclusion in the 5000 gives the founders of the best businesses an opportunity to engage with an exclusive community of their peers, and the credibility that helps them drive sales and recruit talent. The associated Inc. 5000 Conference & Gala is part of a highly acclaimed portfolio of bespoke events produced by Inc. For more information, visit www.inc.com.

For more information on the Inc. 5000 Conference & Gala, visit https://conference.inc.com/.

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Aunalytics Extends Its Presence in Greater Columbus Area

Leading Data Platform Provider Joins One Columbus Organization to Help Foster Economic Development in the 11-County Region, and Is a Featured Presenter at a Cybersecurity Forum in Sydney on August 19

South Bend, IN (August 17, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today its membership in One Columbus, the economic development organization for the 11-county Columbus, Ohio region. With an office in Bellefontaine, Aunalytics is committed to contributing its resources to foster the economic well-being of the broader Columbus region.

Working with local and state partners, One Columbus serves as the business location resource for companies across Central Ohio and around the world as they grow, innovate, and compete within the global economy. Its mission is to lead a comprehensive regional growth strategy that develops and attracts the world’s most competitive companies, grows a highly adaptive workforce, prepares its communities for the future, and inspires corporate, academic and public innovation throughout the greater Columbus area.

“As with other regions of the country, the organizations in the Greater Columbus area are interested in increasing their competitive advantage through digital transformation,” said Robert Lizotte, Ohio Local Market Leader for Aunalytics. “As a member of One Columbus, we look forward to demonstrating how this shift can be accomplished in a more secure and efficient way to drive a higher return on business initiatives.”

Aunalytics also announced that its Chief Security Officer, Kerry Vickers, will speak in Sydney, Ohio at the Sydney Shelby Chamber of Commerce cybersecurity forum, “Do You Have a Plan?” on August 19, at 8amET. Vickers is one of nine subject matter experts who will outline the threats and the measures that can be taken to mitigate cyber invasions which occur on a daily basis, to organizations large and small.

Tweet this: .@Aunalytics Extends Its Presence in Greater Columbus Area #Cybersecurity #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list two years in a row, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Backup vs Disaster Recovery: What’s the Difference?

Your data is vital for your business to function. Often, companies are not completely confident in what should be a part of their Business Continuity Plan (BCP), and do not understand that they need both data backup and disaster recovery to re-operationalize the business to be covered for outages and disasters.

Backup

Disaster Recovery

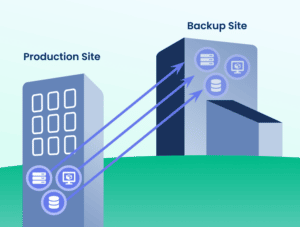

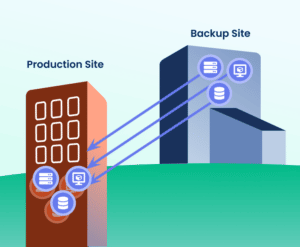

Disaster recovery services are designed to bring a business back online after a failure at the primary business site. Disaster recovery includes steps to operationalize the data back-ups, and bring back online networks and systems should an attack or outage occur. With a disaster recovery solution in place your organization’s data and the functioning of your IT systems are restored. An all-encompassing Disaster Recovery plan restores business functions and minimizes losses and downtimes. It includes server level and site level restoration. You may have to invest in an entire secondary IT infrastructure unless you have a Disaster Recovery as a Service (DRaaS) provider.

Business Continuity Plan

A Business Continuity Plan should include both backup procedures so that you protect your business from data loss, and disaster recovery plans to restore networks, systems and data after failure at your primary business site. For IT resiliency, your plan should include: active monitoring and assessment of IT hazards; resiliency risk assessment including potential consequences; risk and mitigation strategies; understanding of business relevance of the assets to understand business drivers and classify assets in terms of business criticality; and setting IT resilience priorities. Recovery plans should be drilled and tested regularly.

Aunalytics Backup and Disaster Recovery services will give your organization the peace of mind that, no matter what circumstances come, a trusted partner will have your back. You will not have to worry about data loss or theft, as backing up your on-premises data to the cloud will allow your company to have a business continuity plan in place to save critical business information, and you will have experts on hand to help your IT team restore networks, systems and data after a disaster.