The Key to Data-Driven Success for Mid-Market Companies Starts Here

The Key to Data-Driven Success for Mid-Market Companies Starts Here

To read more, please fill out the form below:

Learn More

Aunalytics Managed IT Services Safeguard Local Government Against Disruptive Weather, Cyber, and Pandemic Events

As a primarily rural area, the county is in short supply of experienced technology professionals available to assist with IT management. As a result, the decision was made to contract with a skilled managed IT services provider with regional operations. This has evolved into what is today a strategic relationship with Aunalytics where the IT services and solution provider is integrated both horizontally and vertically to oversee nearly all aspects of the county’s IT operations. This includes oversight of applications, as well as servers, storage, endpoint devices, security, networking, and data protection to ensure business continuity.

This partnership has been particularly beneficial as Logan County has faced a series of challenging events:

- A powerful storm damaged the county’s courthouse, resulting in a complete closure and relocation of court staff and systems. The IT and business recovery experts at Aunalytics helped to set up transitional offices, upgrade servers, desktops and laptops to enable remote access to all required information stores, allowing the court to proceed with operations. Once repairs to the courthouse were complete, relocation support back to the building began and re-orchestration of all IT infrastructure was completed by the Aunalytics’ IT services and support team.

- In early 2021, the Jobs and Family Services Office was also severely damaged after the weight of ice and snow collapsed the roof, necessitating evacuation to a temporary facility. As with the damaged courthouse, the managed IT services team coordinated with a rented facility prior to occupancy and wired the location for operations, minimizing downtime and facilitating the quick re-opening of the temporary office location in order to return services to the community.

- The past 12 months have also seen a recurring stream of cyberattacks, where Aunalytics has defended the county’s sensitive data and systems from downtime. However, in one instance, a server at the sheriff’s headquarters was struck by an attack, resulting in a printer issue. The attack occurred on a Friday when Aunalytics took immediate action and rectified the printer issue over the weekend, returning it to proper operation by Monday morning.

- Adding to the challenges, the COVID-19 pandemic began in March of 2020, causing a number of IT issues as county employees worked remotely, exposing a large number of computing endpoints in the form of laptops, desktops, printers and other network-connected devices outside of the county walls. Aunalytics assisted by improving virtual private network (VPN) services for much higher traffic volumes than usual and managed these systems so that county employees could re-establish their work environments from home where they would be protected against the contagious and, in some cases, deadly virus.

Measuring Success

The county measures the success of its outsourced IT operations by looking at uptime and risk mitigation. Aunalytics has provided an IT services foundation that reduces the number of internal employee hours allocated to IT management and monitoring. Aunalytics enables Logan County staff to work remotely in a much more efficient and reliable manner than otherwise possible. Furthermore, both the security and disaster recovery capabilities implemented have been exceptional, guarding the county against serious downtime for many years.

According to Jack Reser, Auditor of Logan County, “The causes of downtime in a distributed IT infrastructure can be innumerable and the county has definitely had its share of events putting its services at risk. However, Aunalytics has been a reliable IT services partner, quickly responding to our challenges and with expertise that ensures we are returned to the people’s business without delay. Aunalytics has been a steadfast IT partner that we plan to work with closely in 2022 and beyond.”

Learn more about how Aunalytics Managed IT Services have benefitted the Logan County government by downloading the full case study.

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

Lowering Cybersecurity Insurance Premiums with Managed Security Services - PDF

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.

Related Content

Nothing found.

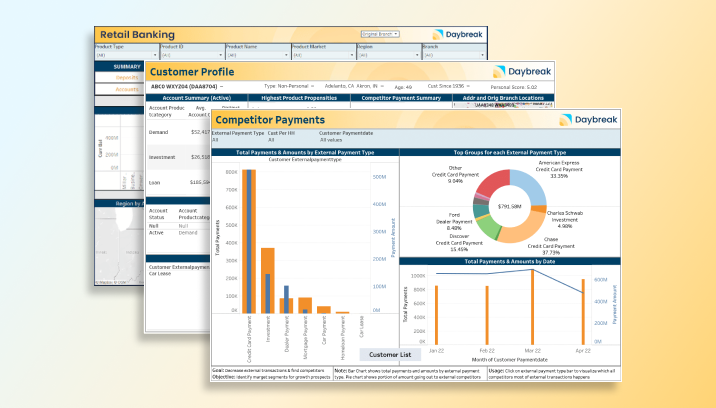

Aunalytics Dashboards Deliver Insights and Actionable Business Opportunities to Mid-Market Banks and Credit Unions to Achieve Greater Visibility into Data, Strengthen Regional Market Position, and Compete More Effectively

Dashboards Augment Capabilities of Aunalytics Daybreak for Financial Services Cloud-Native Data Platform to Drive Customer Intelligence and Higher Strategic Value

South Bend, IN (July 12, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today a new set of pre-built dashboards that augment the value delivered by the company’s DaybreakTM for Financial Services solution. The Daybreak dashboards are designed to deliver insights and actionable business results by revealing opportunities associated with customer, competitive, marketing, lending, and branch data and automatically presenting the data in a way that is easily understood, without any manual processes required.

Customer intelligence and personalized marketing in a digital world matters more than ever before, especially for mid-market banks that have traditionally relied on hometown, white glove service to win customers. With Aunalytics Daybreak for Financial Services, midsize financial institutions can target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. With the new Daybreak dashboards, mid-market banks and credit unions can achieve greater visibility into their data and identify more opportunities to strengthen their position in regional markets and compete more effectively.

The Daybreak for Financial Services cloud-native data platform integrates and cleanses data for accuracy and mines transactional data daily with AI-powered algorithms for customer intelligence and timely actionable insights that drive strategic value.

New Daybreak Dashboards include:

Customer Profile - This dashboard delivers an enriched profile of individual customers, powered by AI- insights that deliver intelligence on future customer growth beyond mere aggregations and reports of the past. The Customer Profile offers a 360-view of each customer including analysis of data integrated from multiple sources across the organization, and mined daily for timely fresh insights that can be acted upon. Banks can identify accounts that a customer has with competitors in order to make a more attractive offer to win their business and grow customer value. They can also determine the next best product offering for customers today, based upon their transactional behavior, and gain a deeper understanding of customers and the branches they use, beyond the origination branch.

Competitor Payments - Competitor Payments reveals insights for each customer, each competitor, and type of financial product. The dashboard tracks competitor payments by amount and how long they have been taking place so that a banker or credit union can determine when customers or members are likely to look for a new product, then create better offers as a result. Competitor Payments can drill down on credit cards, mortgages, auto loans, and investment products to identify a more competitive offer and use the segmented Customer List dashboard to target them. By using targeted competitive offers made to the right customers at the right time, banks can efficiently grow value from customers to increase net deposits.

Retail KPI - Retail KPI (key performance indicators) help banks to increase total deposits and accounts, and identify growth opportunities and potential. The dashboard delivers key performance metrics to retail leaders to understand the drivers of their account and deposit growth. It enables them to analyze deposits and balances over time and understand growth trends. It also provides data for overall institution performance, as well as detailed performance for each region, branch, market, product type and individual product to identify opportunities for growth and understand which branches are driving change.

Lending KPI - The Lending KPI dashboard delivers key performance metrics to lending leaders to understand the drivers of their loan and loan balance growth. It enables them to view trends over time for original loan amounts and outstanding loan balances. The dashboard provides data for overall institution lending performance and detailed performance of lending by branch, region, market, product type, and each product to uncover opportunities for growth and understand which products, team members, and branches are driving growth. The accompanying Lending Officer dashboard reveals performance insights by team member and shows loans closed and principle amounts over time.

Marketing KPI - This dashboard delivers key performance metrics to marketing leaders on campaign effectiveness to improve targeting and reduce account acquisition cost. It enables banks to target their institution’s marketing to reach the right customer at the right time with the right offer, making marketing operations more efficient and successful by using a data driven approach. Capabilities include:

- Track campaign performance by resulting deposits and new accounts

- Understand customer acquisition cost by region, branch and product type

- Assess account and balance growth by region, branch, and product type

- Understand new account demographics

Branch Reassignment - The Branch Reassignment dashboard delivers key information to business leaders to understand branch utilization and change over time based on where a customer originates and performs business. They can identify branch growth opportunities and areas where efficiencies can be improved, and view branch utilization to see customer banking patterns. With this, banks can determine which products to market at a particular branch and more precisely target those customers who are likely to need that product.

“Daybreak dashboards offer more than just reporting on the past. They connect the dots of relevant data and use predictive analytics to create a picture revealing intelligent insights that help financial institutions build smarter business strategies,” said Kyle Davis, Vice President of Daybreak, Aunalytics. “Designed to accelerate the value derived from AI-powered insights, Daybreak dashboards enable mid-market banks and credit unions to more clearly see the opportunities presented by their data and take action to increase net income and advance their competitive position.”

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com