eBook: Top 5 Imperative 2022 Banking Technology Predictions for Mid-Market Financial Institutions

Top 5 Imperative 2022 Banking Technology Predictions for Mid-Market Financial Institutions

As we move away from the initial shock to our economy caused by the global pandemic, and continue to feel its ripple effects in the supply chain, the jobs market, and price increases in nearly every sector, 2022 reveals that time is of the essence for new leaders to emerge in mid-market banking with smart technology investments.

Fill out the form below to receive the eBook.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

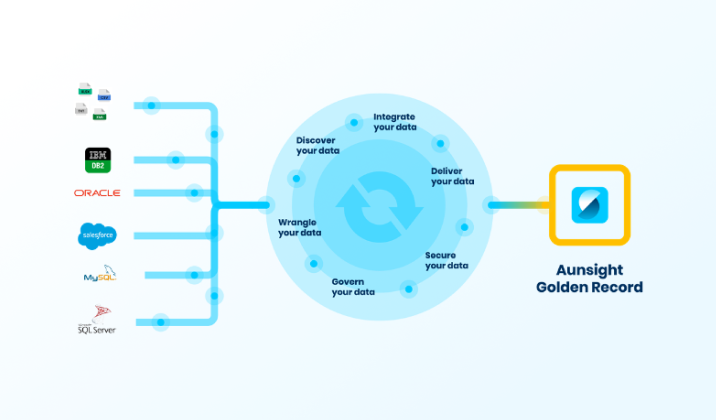

Global Insurance Company Utilizes Aunsight Golden Record Platform to Integrate and Clean Data from Multiple Sources in Real-Time

Global Insurance Company Utilizes Aunsight Golden Record Platform to Integrate and Clean Data from Multiple Sources in Real-Time

A major global insurance company was creating a new customer-facing portal and needed a solution to deliver synchronization of data updates from the portal to its backend insurance policy and analytical systems.

Fill out the form below to receive the use case.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

Data Analytics Helps Midsize Financial Institutions Thrive

It is unlikely that midsize and community banks will “out tech” large banks and fin-techs on their own. However, with the right partners, they have an opportunity to thrive by redefining the local experience and digitally transforming how they operate. Using the right data analytics, they can leverage their local knowledge with personalized customer intelligence to regain competitive advantage.

Customer Intelligence within Reach

Aunalytics’ Daybreak™ for Financial Services offers the ability to target, discover and offer the right services to the right people, at the right time. Built from the ground up for midsize community banks and credit unions, Daybreak for Financial Services is a cloud-native data platform with advanced analytics that empowers users to focus on critical business outcomes. The solution cleanses data for accuracy, ensures data governance across the organization, and employs AI and machine learning (ML) driven analytics to glean customer intelligence and insights from volumes of transactional data created in the business and updated daily. With daily insights powered by the Aunalytics cloud-native data platform, industry intelligence, and smart features that enable a variety of analytics solutions for fast, easy access to credible data, users can find the answers to such questions as:

- Which current customers that have a loan but not a deposit account?

- Who has a mortgage or wealth account with one of my competitors?

- Which customers with a credit score above 700 are most likely to open a HELOC?

- Which loans were modified from the previous day?

- Who are current members with a HELOC that are utilizing less than 25% of their line of credit?

Harnessing their data with Daybreak enables community banks and credit unions to discover patterns, insights, trends, and usage strategies helps to strengthen their position in regional markets and compete with large national banks. With Aunalytics’ customer intelligence data model, they are enabled to deliver timely personalized messages to customers, make data-driven product recommendations, measure campaign ROI, and grow net dollar retention.

Catalyst University 2022

Catalyst University 2022

Radisson Kalamazoo, Kalamazoo, MI

Aunalytics to Attend 2022 Catalyst University

Aunalytics is excited to once again attend Southwest Michigan First’s Catalyst University 2022 in Kalamazoo, MI. Aunalytics is participating as a speaker sponsor this year, and is pleased to present Chip Heath, best-selling co-author and professor at Stanford Graduate School of Business, teaching courses on business strategy and organizations. He will be speaking about how to translate numbers into things our brains can comprehend and use to tell compelling stories.

Aunsight Golden Record creates a single source of truth for credit union data

Credit unions have a great deal of data spread across various systems. However, it is impossible to create a centralized, accurate and up-to-date record of all of this data manually. Aunsight™ Golden Record automates this process by aggregating, cleansing, and merging data into a single source of truth so credit unions have access to an accurate record of their data in one place.

Watch the video below to learn more about how Aunsight Golden Record, along with the expertise of the Aunalytics team, can help credit unions quickly and painlessly take charge of their data: