Why You Should Include an Analytics Platform in your Banking Software Arsenal

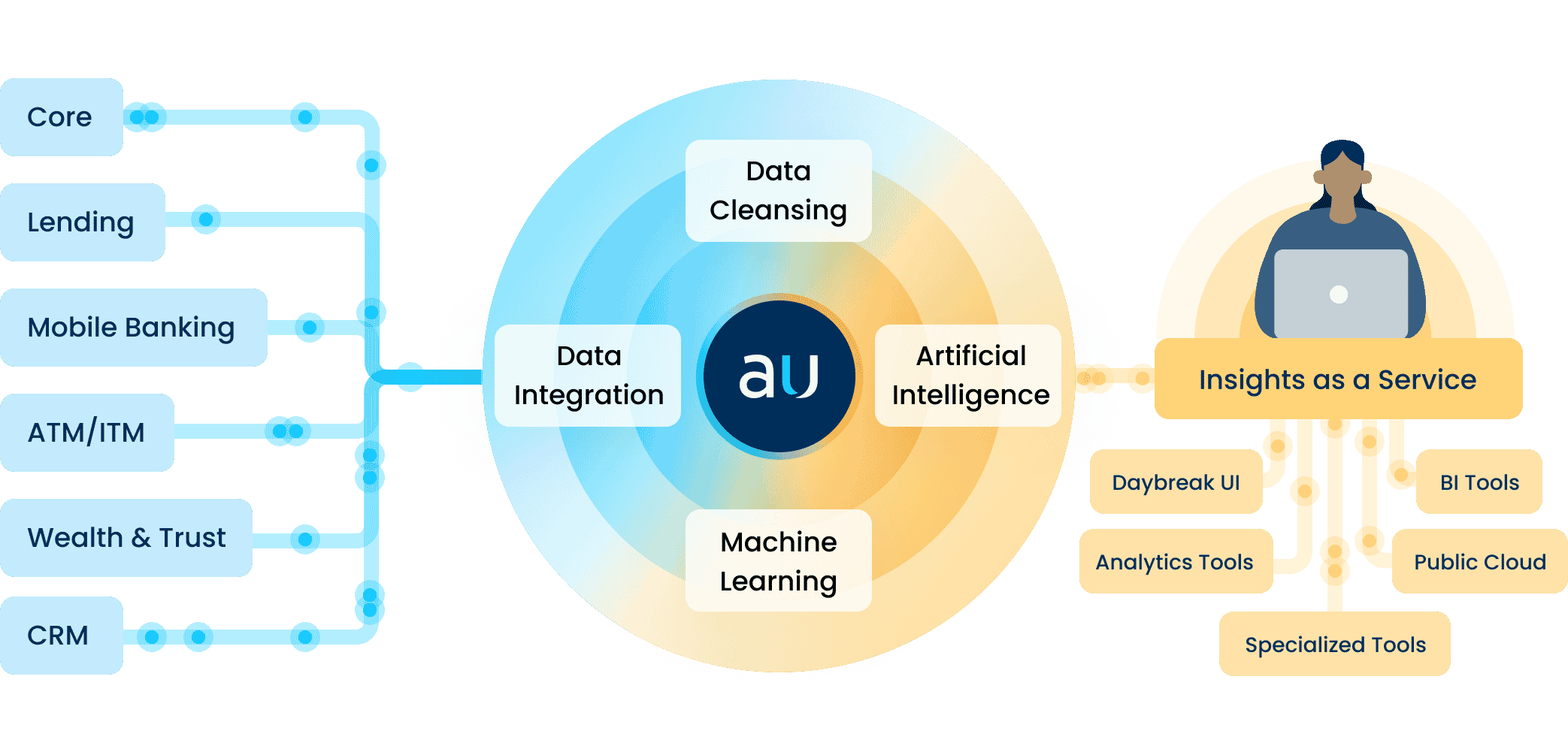

Banking software is vital to the success of all financial institutions. With an increasing focus on digital transformation, banks and credit unions amass a collection of platforms and software systems. Financial institutions not only rely on their banking core, but also CRM systems, online and mobile banking applications, loan management software, payment processing systems, and wealth management, risk, and compliance software, to name a few. Not only do these systems make banking more efficient, but they are collecting data that can be used to improve the business itself.

How can financial institutions best utilize their existing data? Thanks to their existing banking software, every institution holds valuable information about each customer or member that can be used to increase their lifetime value. PWC estimates that banks can generate a 70% return on initiatives targeting existing customers versus 10% when targeting new customers. Therefore, one of the best ways to use data to achieve better returns and higher margins is to focus on improving the customer or member experience.

Having access to an abundance of data points across various systems presents a tremendous opportunity to strengthen existing relationships—but it also poses a challenge. While each banking software system includes valuable information, it does not give the whole story. The problem for many institutions is that they have no way of getting a complete, 360-degree view of each individual from disparate software systems.

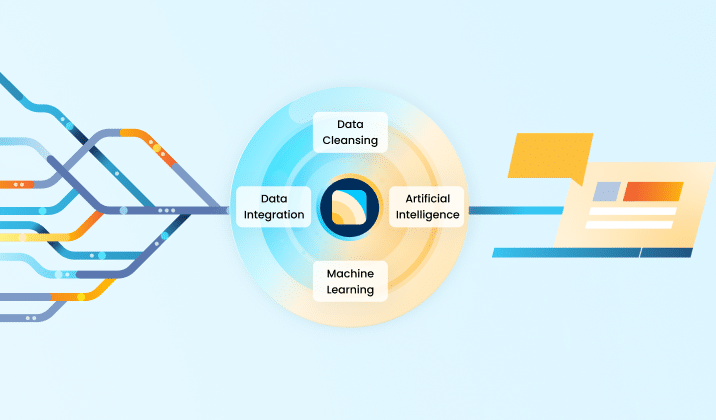

The Importance of an Analytics Platform

That is why a data and analytics platform is essential. An analytics platform can aggregate data from multiple systems, cleanse and organize that data into a 360-degree customer view, then apply artificial intelligence (AI) and machine learning algorithms to gain data-driven insights.

Once an analytics platform has been implemented, there are many customer intelligence use cases that can help banks and credit unions target the right customers, with the right offer, at the right time, including:

- Gaining transaction insights – Gaining access to transaction data, paired with AI and machine learning, gives great insights into consumer spending habits and preferences.

- Identifying competitor payments – By mining transactional data, financial institutions can discover customer payments going to competitors, then use that information to reach out to customers or members and win back business with a more attractive offer.

- Generating product recommendations – With access to data points from several software systems, machine learning and AI models can make predictions such as the next best product to offer for each customer.

- Predicting churn – AI algorithms identify trends in transactional data, and determine which customers are most likely to churn—so financial institutions can take actions to prevent it.

- Calculating Customer Lifetime Value – An analytics platform can calculate customer value scores based on a large number of relevant data points using AI and machine learning. Banks and credit unions can use this information to allocate resources toward targeting customers with higher customer lifetime value scores.

These are just a few of the ways banks and credit unions can implement insights from a data and analytics platform that mines data from across their organization’s many software systems. Once the platform is implemented, any number of use cases can be developed using AI and machine learning—getting the data collected, aggregated, updated, cleansed, and organized for analytics is one of the largest obstacles for organizations.

Thankfully, Aunalytics has developed a robust data and analytics platform called Daybreak for Financial Services. Daybreak provides all of these services and more to make sure your bank or credit union is making the most of its banking software data to reduce risk, optimize processes, increase revenue, and most importantly, improve the customer or member experience.

A Managed IT Services Partner Gives In-House IT Teams Much-Needed Support

Managing IT environments is a little bit like a box of chocolates—you never know what you’re going to be faced with on any given day. Regardless of the size of your business, your company still has a unique IT infrastructure that can be difficult to manage easily and efficiently. Those variabilities are where a beneficial relationship with an experienced managed IT services partner comes into play.

Partnering with a managed services provider gives you many advantages, including support and improvement for your security initiatives, increased efficiency in your everyday technology environment, and a happy partnership can lead to cost savings in the long run.

Let’s dive a little deeper into the advantages mentioned above:

- Improved security initiatives and better support – Business organizations are often targeted by bad actors due to not only the amount, but also due to the value of the data that can be gained from stealing your important information. By providing security services, an experienced partner can better protect and insulate your company from cyberthreats. Those security services could include constant vulnerability scanning, manning a Security Operations Center (SOC) when your team is too small or too spread out to do so, and even work with you on patch management.

- Increased efficiency – By reducing downtime in case of attack and bringing productivity back online as quickly as possible, a managed IT services partner helps keep your company up and running efficiently. In addition to keeping your company up and running from a security standpoint, a managed services partner can also help keep your data safe in case of disaster, system wipe, and more, allowing you to get back to doing what you do best as quickly as possible.

- Cost savings – By giving your company access to advanced cloud-based technology and a drove of experts right at their fingertips, you can reduce large capital expenditures and avoid hiring more expensive full-time employees (FTEs). Let the experts do the work for you, giving your team the ability to focus on your internal initiatives instead of attempting to defend your network while shorthanded.

Regardless of your needs, enlisting the help of a managed IT services partner can help ease the burden on your business in both the short- and long-term, allowing your team to focus on working toward the future of your company with experts at their sides, helping them every step of the way. Not only is it a burden off of your team’s shoulders, but it’s also a burden off of your shoulders. Knowing that your company is secured by both your team and a trusted managed services partner gives you the peace of mind that, no matter what happens, your company is safe from serious cyber threats.

From Backup & Disaster Recovery to Cloud Storage and Advanced Security, Aunalytics offers a wide variety of managed services products, all backed by our certified and talented technology experts. We are here to work with you through both your everyday needs and those moments when disaster strikes.

Indiana Bankers Association Mega Conference 2023

Indiana Bankers Association Mega Conference 2023

Indiana Convention Center, Indianapolis, IN

Aunalytics is excited to attend the 2023 IBA Mega Conference

Aunalytics is pleased to attend the 2023 Indiana Bankers Association Mega Conference. Aunalytics will be meeting with attendees and giving demos at booth #107. Representatives from Aunalytics will be educating attendees on how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. Event attendees can also learn more about the Daybreak™ for Financial Services solution which enables community banks to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

2023 MBA Perry Schools of Banking

MBA Perry Schools of Banking

Kellogg Center, East Lansing, MI

Drew Conley of Aunalytics Speaking at 2023 MBA Perry School of Banking

Aunalytics is pleased to announce that Drew Conley, Daybreak Relationship Manager at Aunalytics, was chosen to present at Michigan Bankers Association’s Perry Schools of Banking. His presentation is entitled, “How to Win Wallet Share while Cutting Costs in Operations”. This presentation will examine how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. He will also share how Aunalytics empowers banks through our Daybreak™ for Financial Services solution, which enables community banks and credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

2023 Wisconsin Credit Union League Convention & Expo

2023 Wisconsin Credit Union League Convention & Expo

Kalahari Resort & Convention Center, Wisconsin Dells, WI

Aunalytics to attend the 2023 Wisconsin Credit Union League Convention & Expo

Aunalytics is pleased to attend 2023 Wisconsin Credit Union League Convention & Expo. Aunalytics will be meeting with attendees and giving demos at booth #320. Representatives from Aunalytics will be educating attendees on how financial institutions can use AI-driven insights to improve customer and member engagement and increase wallet share. Event attendees can also learn more about the Daybreak™ for Financial Services solution which enables credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

Defense Manufacturers Face Huge Risks from Malware

Manufacturers that work with the Department of Defense (DoD) are immune to attacks of any kind, right? Wrong. Like any industry, the companies that produce equipment and military systems are just as vulnerable to malware.

Malware is a blanket term used for any kind of software that is designed to cause harm to a digital environment like your office or factory spaces. It can damage devices, computer systems, and networks while bad actors ensure all business functions come to a screeching halt—frozen in place while your files are accessed, stolen, and possibly even sold. With such valuable, and often proprietary, information, defense manufacturers may be an even bigger target than others and can lead to a national security incident. What are some ways that malware can cause serious issues for defense manufacturers?

Disrupted Operations and Processes

The first issue is the most obvious—by using malware, hackers can access your network and put a halt to your internal processes.

Shutting down operations is a big deal for anyone, but when you work with the DoD, the delays and backups during equipment production and delivery of goods can lead to significant delays that impact military readiness.

Theft of Intellectual Property

In addition to being used to disrupt operations, malware can also be used to steal and encrypt or sell sensitive information connected to the development and production of equipment made for the DoD.

Bad actors can disrupt or shut down vital systems, encrypt your data, and openly steal your proprietary information in hopes you will pay them to restore it. It is exceptionally rare that a company receives all its data back after a ransomware attack and there is no way to guarantee the data wasn’t copied before being returned. Additionally, once you’ve paid the first ransom, it has become increasingly common for bad actors to charge additional ransoms before returning your data.

Due to the sensitive nature of the information, it can be used to sell competing products, sell counterfeits, and more, potentially giving an unfair advantage.

Compromised Security

You may have seen this coming. Theft of intellectual property often leads to every DoD manufacturer’s nightmare—especially where drones or other vital systems concerned—compromised security.

Since malware can be used to attack and enter the compromised security of a manufacturing company, including its networks, it allows attackers direct access to sensitive, and sometimes dangerous, equipment. You don’t want to give away your company’s ‘nuclear football’.

What now?

Thankfully you can make this an ‘if’ not a ‘when’ situation—there are ways that such attacks can be avoided and guarded against. In addition to the advanced security measures that are recommended, employee cybersecurity training must be implemented. It’s not enough to have good security—everyone with access to your company’s data must be able to recognize a bad actor when they see one.

Partnering with a Managed IT Services company that specializes in protecting against cybersecurity threats means you can focus on what you do best—helping the DoD protect our country. As one of the only FedRAMP certified companies in the Midwest, you can depend on Aunalytics to keep your sensitive data safe. Don’t settle for an out-of-the-box antivirus and nothing else. Ensure that your location and data are not only secure, but that they will remain that way—no matter what the threat landscape looks like.

The Truth About Artificial Intelligence in Business

Is the existence of Skynet imminent or is that simply a sci-fi trope? In this brief video, Dr. David Cieslak, Chief Data Scientist at Aunalytics, talks about the capabilities of Artificial Intelligence in business, some potential concerns with AI, and where the technology is headed in the future.

While there exists a broad range of applications for AI, in the business world, this technology has the potential to drastically change how we understand our customers and how we use our data to interact with them. Once created and trained with customer data, AI has the ability to quickly provide suggestions and insights that would otherwise be prohibitively difficult or even impossible to observe on your own.

For example, Aunalytics’ Daybreak for Financial Institutions platform uses a proprietary AI model that can predict when a customer or member is likely to churn, to suggest which product to promote based on what that specific person is most likely to buy, to identify where the best branch locations are, and more. These types of insights are hiding in your data, simply waiting to be uncovered. To learn more about the business applications of AI, you can view the extended interview here.

David Cieslak, PhD, is the Chief Data Scientist at Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors. Prior to Aunalytics, Cieslak was on staff at the University of Notre Dame as part of the research faculty where he contributed on high value grants with both the federal government and Fortune 500 companies. He has published numerous articles in highly regarded journals, conferences, and workshops on the topics of Machine Learning, Data Mining, Knowledge Discovery, Artificial Intelligence, and Grid Computing.

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

In this interview, David Cieslak, PhD, the Chief Data Scientist at Aunalytics, describes complex analytics concepts such as artificial intelligence, machine learning, and deep learning, and explains how they are useful for businesses today—and will continue to be in the future. David has been with Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors.

Fill out the form below to receive an email with a link to the interview.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

In this interview, David Cieslak, PhD, the Chief Data Scientist at Aunalytics, describes complex analytics concepts such as artificial intelligence, machine learning, and deep learning, and explains how they are useful for businesses today—and will continue to be in the future. David has been with Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors.