Investment in Artificial Intelligence is Vital for Banks and Credit Unions

Has your bank or credit union made investments in artificial intelligence yet?

Advances in artificial intelligence (AI), and the promise it holds for the future, have been making news all year. And it’s no wonder that financial institutions are taking notice—a recent survey from the Economist Intelligence Unit found that 77% of bankers believe that unlocking value from AI will be the differentiator between winning and losing banks. Yet, many institutions are falling behind in AI maturity.

Despite its promise, making a large investment in artificial intelligence may seem risky to many midsized financial institutions. Hiring talent, developing a data management and analytics strategy, building a data platform, and creating AI models can be both time- and resource-intensive. Banks and credit unions want to ensure that the efforts spent to get an AI program off the ground will yield a high ROI, especially in times of economic uncertainty. Yet, failure to innovate and make progress toward digital transformation is not always an option in the highly competitive landscape.

Financial institutions find many uses for AI technologies

Thankfully, an investment in artificial intelligence can improve many processes across an institution. AI can optimize both time- and resource-intensive tasks, decrease risk, and increase revenue by improving the customer experience. For instance, by applying AI and machine learning algorithms to transactional data, banks and credit unions can gain insights into customers or members’ habits and preferences. Some use cases include:

- Detecting and preventing fraud

- Identifying loan default risk at the time of application

- Predicting customer churn

- Winning back business by discovering customer payments going to competitors, and subsequently making a more attractive offer

- Predicting the next best product for each customer then targeting them with the right product at the right time

- Calculating customer value scores in order to better allocate resources to target more valuable customers

Don’t get left behind

Large banks are already utilizing artificial intelligence use cases at scale. In a recent letter to shareholders, Jamie Dimon, Chief Executive Officer of JPMorgan Chase wrote, “Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success—the importance of implementing new technologies simply cannot be overstated.”

Because of this focus, his company has made tremendous investments in AI. They currently have over 300 AI use cases in production, and employ almost 3,000 people in data management, data science, and AI-research-related roles. This underscores how vital these new technologies are to success in the future.

Unfortunately, not every institution has access to talent and technology at the scale of JPMorgan Chase. That’s why Aunaytics has developed a cloud-based data and analytics platform to provide data management, advanced reporting, and predictive AI and machine learning solutions for midsized community banks and credit unions.

Daybreak for Financial Services allows institutions to learn more about their customers and members in order to provide a better overall experience—which in turn reduces risk, increases wallet share, and reduces expenses.

Microsoft will be ending patch support for Windows 10—what does that mean for you?

Preparations to end patch support for Windows 10, and eventually end of support entirely, have been in process for quite some time on Microsoft’s part. As far back as 2021, in an article by The Verge which talks about the then upcoming Windows 11, the author commented on the end of support date for Windows 10. The current version of Windows 10, 22H2, will be the final version of Windows 10, and all editions will continue to receive monthly security update releases through the end of support on October 14, 2025. This information applies to all of the following editions of Windows 10: Home, Pro, Pro Education, and Pro for Workstations

With the end of patch support for Windows 10, vulnerabilities will begin to appear, leaving your network more exposed than ever. The number of bad actors encrypting and stealing data can be overwhelming on the best of days and can cause massive issues and downtime for your company. Any hole in your cyber security could spell disaster for your company.

While it may seem like you have plenty of time to prepare, deadlines can quietly slip by, leaving your network and machines suddenly vulnerable because they are no longer receiving support or security patches. The rate of ransomware attacks remains high, with 66% of respondents across all industries indicating they had been hacked within the last year, says Sophos in their State of Ransomware 2023 report.

With a total of 36% respondents, Sophos also reported exploited vulnerabilities as the number one root cause of ransomware attacks within the last year. Knowing that 66% of companies surveyed in the last year were attacked by malicious actors, the number of ransomware attacks with the root cause of exploited vulnerabilities is quite large.

It’s hard to admit that your network may become unsafe at any point in time, but it’s necessary if you want to be prepared for when your Windows 10 network will no longer be supported. If you can keep track of those important dates, your cyber security should be on the right track. However, it can be a huge undertaking to efficiently manage patching or replace workstations in a timely manner.

With the right partner, you can stop worrying about missing important updates, especially as the end of patch support for Windows 10 is nearing. Aunalytics has a team of security experts, as well as technical support, with the ability to act as your Network Operations Center (NOC). Aunalytics also offers Co-Managed Patching-as-a-Service and many other ways to support the technology that keeps your business up and running. With the support of an experienced Managed IT Services partner, you can rest easy knowing that your cyber security is working hard to keep your data and network safe.

Why You Should Include an Analytics Platform in your Banking Software Arsenal

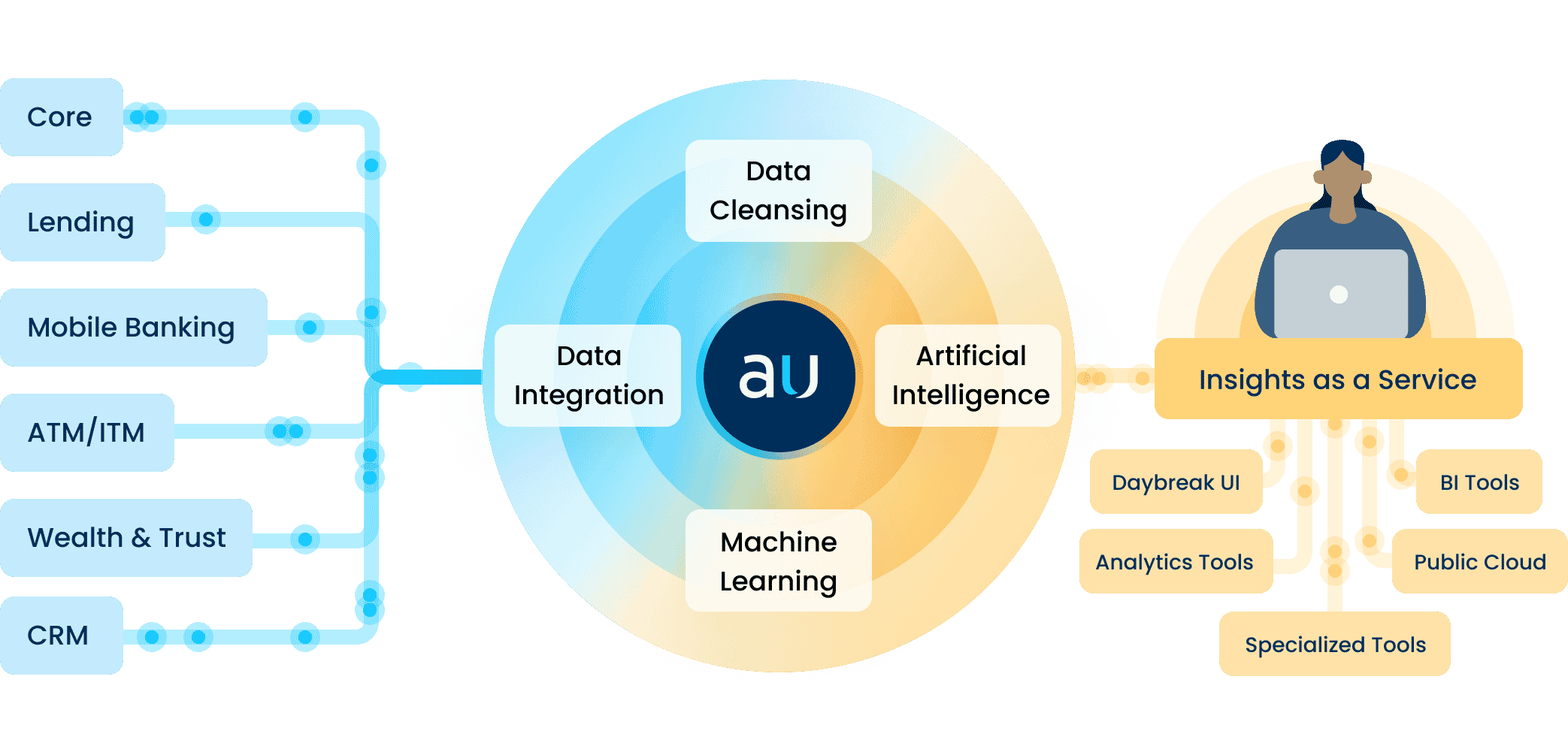

Banking software is vital to the success of all financial institutions. With an increasing focus on digital transformation, banks and credit unions amass a collection of platforms and software systems. Financial institutions not only rely on their banking core, but also CRM systems, online and mobile banking applications, loan management software, payment processing systems, and wealth management, risk, and compliance software, to name a few. Not only do these systems make banking more efficient, but they are collecting data that can be used to improve the business itself.

How can financial institutions best utilize their existing data? Thanks to their existing banking software, every institution holds valuable information about each customer or member that can be used to increase their lifetime value. PWC estimates that banks can generate a 70% return on initiatives targeting existing customers versus 10% when targeting new customers. Therefore, one of the best ways to use data to achieve better returns and higher margins is to focus on improving the customer or member experience.

Having access to an abundance of data points across various systems presents a tremendous opportunity to strengthen existing relationships—but it also poses a challenge. While each banking software system includes valuable information, it does not give the whole story. The problem for many institutions is that they have no way of getting a complete, 360-degree view of each individual from disparate software systems.

The Importance of an Analytics Platform

That is why a data and analytics platform is essential. An analytics platform can aggregate data from multiple systems, cleanse and organize that data into a 360-degree customer view, then apply artificial intelligence (AI) and machine learning algorithms to gain data-driven insights.

Once an analytics platform has been implemented, there are many customer intelligence use cases that can help banks and credit unions target the right customers, with the right offer, at the right time, including:

- Gaining transaction insights – Gaining access to transaction data, paired with AI and machine learning, gives great insights into consumer spending habits and preferences.

- Identifying competitor payments – By mining transactional data, financial institutions can discover customer payments going to competitors, then use that information to reach out to customers or members and win back business with a more attractive offer.

- Generating product recommendations – With access to data points from several software systems, machine learning and AI models can make predictions such as the next best product to offer for each customer.

- Predicting churn – AI algorithms identify trends in transactional data, and determine which customers are most likely to churn—so financial institutions can take actions to prevent it.

- Calculating Customer Lifetime Value – An analytics platform can calculate customer value scores based on a large number of relevant data points using AI and machine learning. Banks and credit unions can use this information to allocate resources toward targeting customers with higher customer lifetime value scores.

These are just a few of the ways banks and credit unions can implement insights from a data and analytics platform that mines data from across their organization’s many software systems. Once the platform is implemented, any number of use cases can be developed using AI and machine learning—getting the data collected, aggregated, updated, cleansed, and organized for analytics is one of the largest obstacles for organizations.

Thankfully, Aunalytics has developed a robust data and analytics platform called Daybreak for Financial Services. Daybreak provides all of these services and more to make sure your bank or credit union is making the most of its banking software data to reduce risk, optimize processes, increase revenue, and most importantly, improve the customer or member experience.

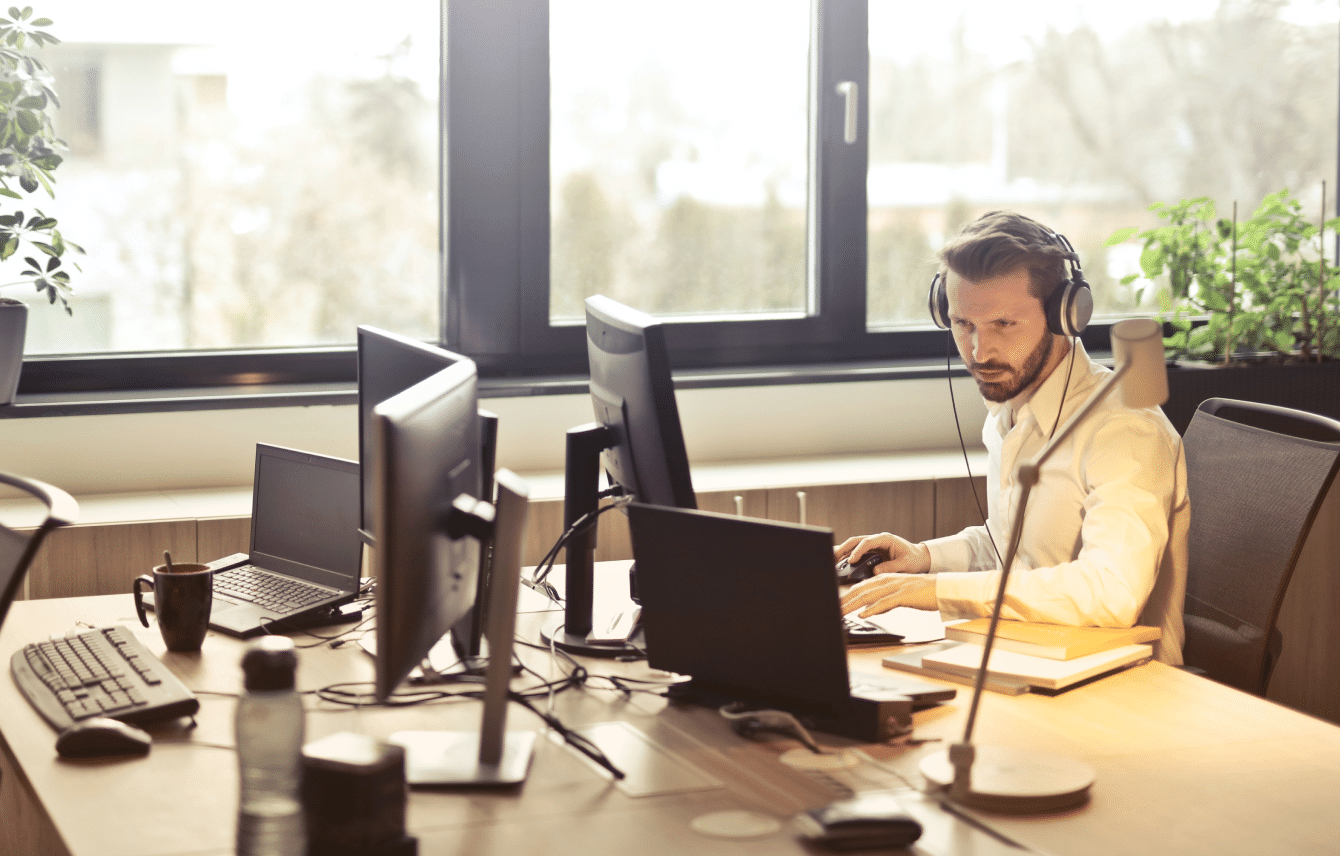

A Managed IT Services Partner Gives In-House IT Teams Much-Needed Support

Managing IT environments is a little bit like a box of chocolates—you never know what you’re going to be faced with on any given day. Regardless of the size of your business, your company still has a unique IT infrastructure that can be difficult to manage easily and efficiently. Those variabilities are where a beneficial relationship with an experienced managed IT services partner comes into play.

Partnering with a managed services provider gives you many advantages, including support and improvement for your security initiatives, increased efficiency in your everyday technology environment, and a happy partnership can lead to cost savings in the long run.

Let’s dive a little deeper into the advantages mentioned above:

- Improved security initiatives and better support – Business organizations are often targeted by bad actors due to not only the amount, but also due to the value of the data that can be gained from stealing your important information. By providing security services, an experienced partner can better protect and insulate your company from cyberthreats. Those security services could include constant vulnerability scanning, manning a Security Operations Center (SOC) when your team is too small or too spread out to do so, and even work with you on patch management.

- Increased efficiency – By reducing downtime in case of attack and bringing productivity back online as quickly as possible, a managed IT services partner helps keep your company up and running efficiently. In addition to keeping your company up and running from a security standpoint, a managed services partner can also help keep your data safe in case of disaster, system wipe, and more, allowing you to get back to doing what you do best as quickly as possible.

- Cost savings – By giving your company access to advanced cloud-based technology and a drove of experts right at their fingertips, you can reduce large capital expenditures and avoid hiring more expensive full-time employees (FTEs). Let the experts do the work for you, giving your team the ability to focus on your internal initiatives instead of attempting to defend your network while shorthanded.

Regardless of your needs, enlisting the help of a managed IT services partner can help ease the burden on your business in both the short- and long-term, allowing your team to focus on working toward the future of your company with experts at their sides, helping them every step of the way. Not only is it a burden off of your team’s shoulders, but it’s also a burden off of your shoulders. Knowing that your company is secured by both your team and a trusted managed services partner gives you the peace of mind that, no matter what happens, your company is safe from serious cyber threats.

From Backup & Disaster Recovery to Cloud Storage and Advanced Security, Aunalytics offers a wide variety of managed services products, all backed by our certified and talented technology experts. We are here to work with you through both your everyday needs and those moments when disaster strikes.

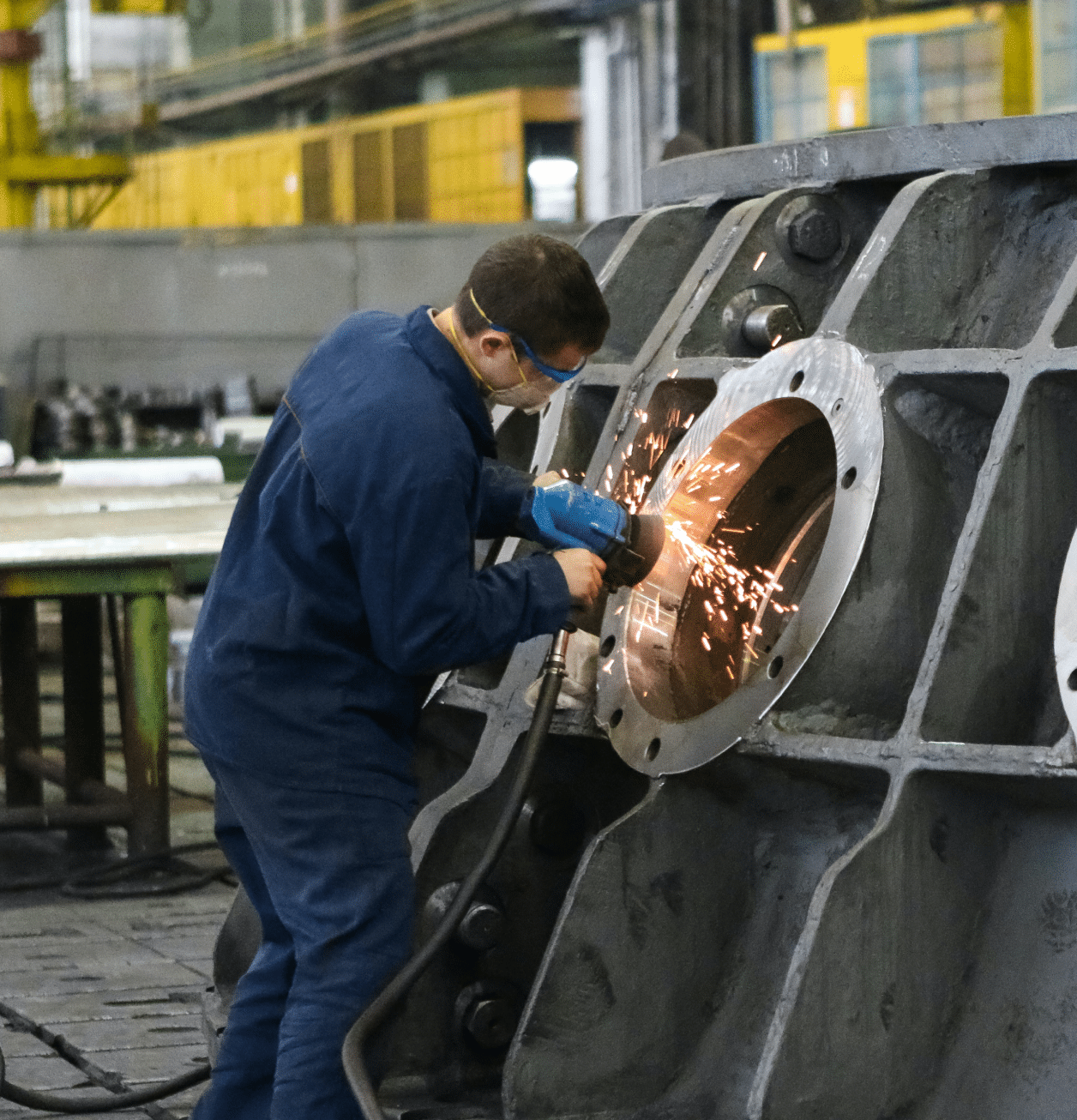

Defense Manufacturers Face Huge Risks from Malware

Manufacturers that work with the Department of Defense (DoD) are immune to attacks of any kind, right? Wrong. Like any industry, the companies that produce equipment and military systems are just as vulnerable to malware.

Malware is a blanket term used for any kind of software that is designed to cause harm to a digital environment like your office or factory spaces. It can damage devices, computer systems, and networks while bad actors ensure all business functions come to a screeching halt—frozen in place while your files are accessed, stolen, and possibly even sold. With such valuable, and often proprietary, information, defense manufacturers may be an even bigger target than others and can lead to a national security incident. What are some ways that malware can cause serious issues for defense manufacturers?

Disrupted Operations and Processes

The first issue is the most obvious—by using malware, hackers can access your network and put a halt to your internal processes.

Shutting down operations is a big deal for anyone, but when you work with the DoD, the delays and backups during equipment production and delivery of goods can lead to significant delays that impact military readiness.

Theft of Intellectual Property

In addition to being used to disrupt operations, malware can also be used to steal and encrypt or sell sensitive information connected to the development and production of equipment made for the DoD.

Bad actors can disrupt or shut down vital systems, encrypt your data, and openly steal your proprietary information in hopes you will pay them to restore it. It is exceptionally rare that a company receives all its data back after a ransomware attack and there is no way to guarantee the data wasn’t copied before being returned. Additionally, once you’ve paid the first ransom, it has become increasingly common for bad actors to charge additional ransoms before returning your data.

Due to the sensitive nature of the information, it can be used to sell competing products, sell counterfeits, and more, potentially giving an unfair advantage.

Compromised Security

You may have seen this coming. Theft of intellectual property often leads to every DoD manufacturer’s nightmare—especially where drones or other vital systems concerned—compromised security.

Since malware can be used to attack and enter the compromised security of a manufacturing company, including its networks, it allows attackers direct access to sensitive, and sometimes dangerous, equipment. You don’t want to give away your company’s ‘nuclear football’.

What now?

Thankfully you can make this an ‘if’ not a ‘when’ situation—there are ways that such attacks can be avoided and guarded against. In addition to the advanced security measures that are recommended, employee cybersecurity training must be implemented. It’s not enough to have good security—everyone with access to your company’s data must be able to recognize a bad actor when they see one.

Partnering with a Managed IT Services company that specializes in protecting against cybersecurity threats means you can focus on what you do best—helping the DoD protect our country. As one of the only FedRAMP certified companies in the Midwest, you can depend on Aunalytics to keep your sensitive data safe. Don’t settle for an out-of-the-box antivirus and nothing else. Ensure that your location and data are not only secure, but that they will remain that way—no matter what the threat landscape looks like.

The Truth About Artificial Intelligence in Business

Is the existence of Skynet imminent or is that simply a sci-fi trope? In this brief video, Dr. David Cieslak, Chief Data Scientist at Aunalytics, talks about the capabilities of Artificial Intelligence in business, some potential concerns with AI, and where the technology is headed in the future.

While there exists a broad range of applications for AI, in the business world, this technology has the potential to drastically change how we understand our customers and how we use our data to interact with them. Once created and trained with customer data, AI has the ability to quickly provide suggestions and insights that would otherwise be prohibitively difficult or even impossible to observe on your own.

For example, Aunalytics’ Daybreak for Financial Institutions platform uses a proprietary AI model that can predict when a customer or member is likely to churn, to suggest which product to promote based on what that specific person is most likely to buy, to identify where the best branch locations are, and more. These types of insights are hiding in your data, simply waiting to be uncovered. To learn more about the business applications of AI, you can view the extended interview here.

David Cieslak, PhD, is the Chief Data Scientist at Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors. Prior to Aunalytics, Cieslak was on staff at the University of Notre Dame as part of the research faculty where he contributed on high value grants with both the federal government and Fortune 500 companies. He has published numerous articles in highly regarded journals, conferences, and workshops on the topics of Machine Learning, Data Mining, Knowledge Discovery, Artificial Intelligence, and Grid Computing.

Do you have the tools and talent to set your organization up for analytics success?

Most business leaders would agree: data is a valuable asset. Having up-to-date, accurate data with which to make data-driven decisions currently gives organizations an edge, but eventually, this will become table stakes in most industries, simply to remain competitive. However, an up-front investment in a strong technical foundation and a shift to embrace analytics culture throughout the organization are required to achieve analytics success.

Unfortunately, there are many challenges to overcome when trying to bring siloed and dirty data from multiple sources across your business to a single place to be analyzed, including a lack of time and manpower, and the need for data points that don’t currently exist, to name a few. Using data analytics, it becomes possible to better optimize your business by discovering operational efficiencies, reducing costs, tracking customer trends across your organization, and making strategic decisions based on predictive data models. Is partnering with analytics experts the best choice for mid-sized institutions, or should you hire Full-Time Employees (FTEs) to build and manage your data?

There are multiple ways an analytics platform could be created—we’re going to look at two today.

Build it yourself

The first is choosing to create a custom data platform. While not a bad choice, it could take a FTE years to create your analytics platform—if it’s ever finished. An engineer hired to build a custom platform may leave you high and dry with no one to step in to help. Something like this could cost your business months—or even years—of lost money and productivity, leaving you with nothing to show for your platform building efforts.

Even if your data engineer remains with your business, there are other challenges you may encounter. It can be difficult for a single FTE to stay up to date on the newest technological advances and upgrades. Especially when that person is not only expected to clean and update information on thousands of data records, but also take care of system and software updates, keep up with changing trends in the analytics world, and more. A lack of manpower can also make tasks like finding trends in your data nearly impossible, as data processing may be far behind where your most recent and relevant business analytics can be found.

When it comes to advanced analytics, you would need to find and hire additional employees who are skilled in advanced data analytics, machine learning, and AI techniques, and ideally, familiar with your industry. This can be easier said than done. Data scientists, like many in the technology field, are in high demand, and may be difficult to find and hire in smaller geographical markets.

Work with a partner

A different option is working with a trusted technology partner who brings data analytics expertise straight to you. Partnering with an end-to-end provider often saves your company money while allowing someone else to take care of the nitty gritty that goes into creating reports, graphs, charts, and more. Additionally, you are guaranteed to have access to the team you need to build algorithms and find insights in your data. A partner will consistently provide you with the right tools, talent, and resources, while supporting you the entire way. But how could an Analytics as a Service partner help you find the true value of your data?

A good partner will be able to offer the required resources to achieve analytics success—a foundational data platform, automated data management, access to data experts, and data delivery methods such as relevant and actionable dashboards and reports. Imagine having a regular report, generated overnight, every night, for you to review first thing in the morning—without having to invest in many new FTEs and years of development time.

When looking for a data analytics partner, all the things above are important for creating a successful partnership that leads to analytics success. Aunalytics provides data processing and analytics help and would never expect you to go it alone. When you hire us, you hire data scientists, data engineers, and data analysts, reducing the need for multiple expensive FTEs. By having access to a team of data experts by your side, your business can find itself enabled to make better, faster, and smarter decisions based on consistent, real-time data.

Local and State Government Cyberattacks Prove that Security is a Necessity

Cyberattacks are a constant threat to organizations of all sizes. State and local governments are no different, having experienced significantly more cyberattacks than they did in previous years, and are at very high risk of bad actors slipping into their networks. To gain a better understanding of the current attack environment and track changes over time in ransomware trends, Aunalytics security partner Sophos commissioned an independent, vendor-agnostic survey of 5,600 IT professionals across multiple industries in mid-sized organizations across 31 countries. While it’s true cyber insurance has been playing a greater role in helping organizations improve their ability to recover from attacks, survey responses clearly indicate that ransomware poses a rising threat to government organizations.

Government Cyberattacks Increase From Previous Years

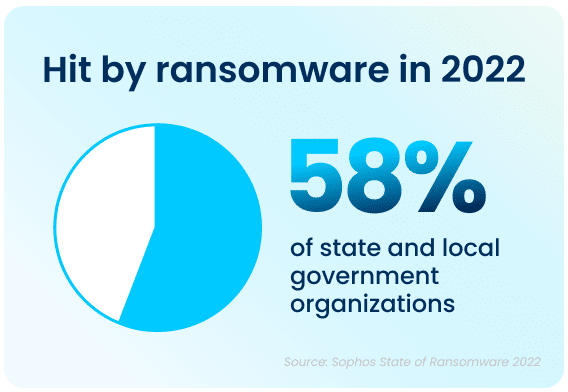

Ransomware attacks have increased significantly over the past year—58% of state and local government organizations surveyed were hit by an attack in 2021, up 70% from 2020. Bad actors are now considerably more capable of attacking organizations and executing harmful tactics at scale. The Ransomware-as-a-Service (RaaS) model is one cause of last year’s increased attacks, as the required skill level for bad actors to hamper the day-to-day operations of an organization has gone down significantly.

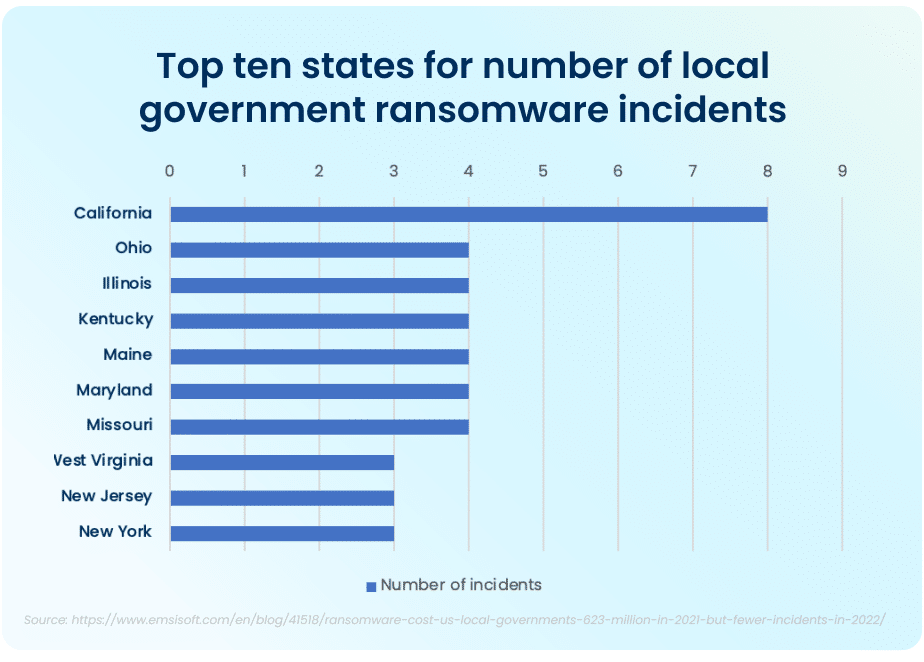

The top ten states that had to deal with the maximum amount of total ransomware attacks in the public sector in 2021 were California, who experienced the most attacks total, Ohio, Illinois, Kentucky, Maine, Maryland, and Missouri. While California took the lion’s share of attacks, with 8 major ransomware incidents, the other six states had four major incidents each.

FBI Cyber Division Survey Lists Examples of Ransomware Attacks

The Federal Bureau of Investigation (FBI) Cyber Division lists examples of several ransomware attacks that impacted state and local government organizations in their 2022 Private Industry Notification. This list contains evidence showing the impact these attacks can have on local communities.

For example, in January 2022, following a ransomware attack, a US county had to take all their systems offline and close all public locations in order to run an emergency response plan and restore all their data from backups. This action disabled all the cameras in the local county jail and deactivated automatic doors, resulting in severe safety concerns and a complete lockdown of the facility. A different county had their data—with residential and personal data—held ransom in an attack. When the ransom was not paid, all of the data was posted on the Dark Web in retaliation.

Rising Complexity of Ransomware Attacks

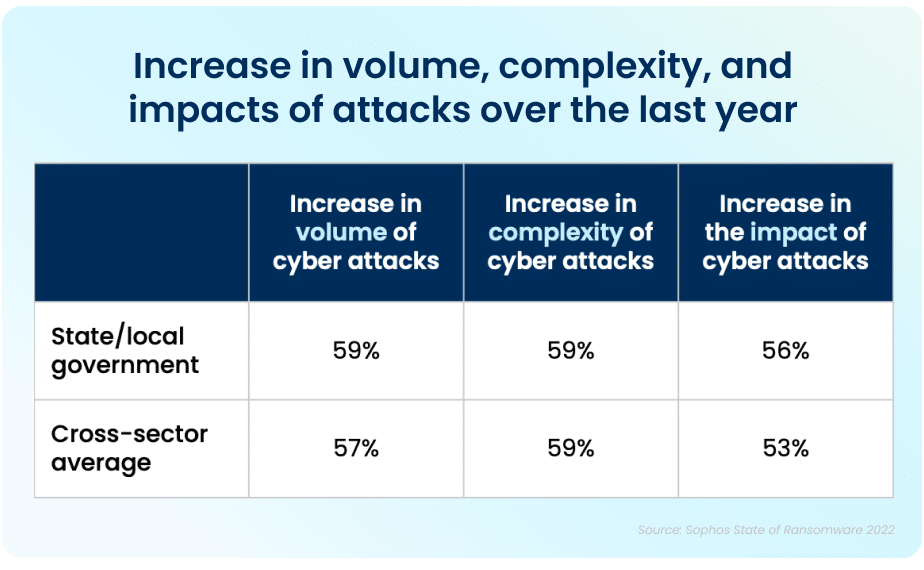

Apart from the rising prevalence of these attacks, the sheer complexity of each attack is also on an upwards trajectory. While the manufacturing and production industry reported the lowest rate of ransomware attacks, over half of all respondents reported their organization was injured by bad actors. The reality is that every organization is at high risk of cyberattack. In 2021, 59% percent of government organizations who experienced cyberattacks saw the complexity of the attacks increase, while a similar 59% saw an increase in the overall volume of cyberattacks.

Data Recovery Rates Are Improving

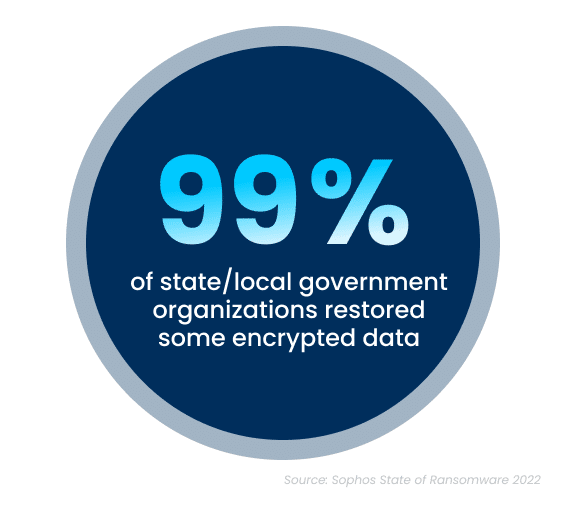

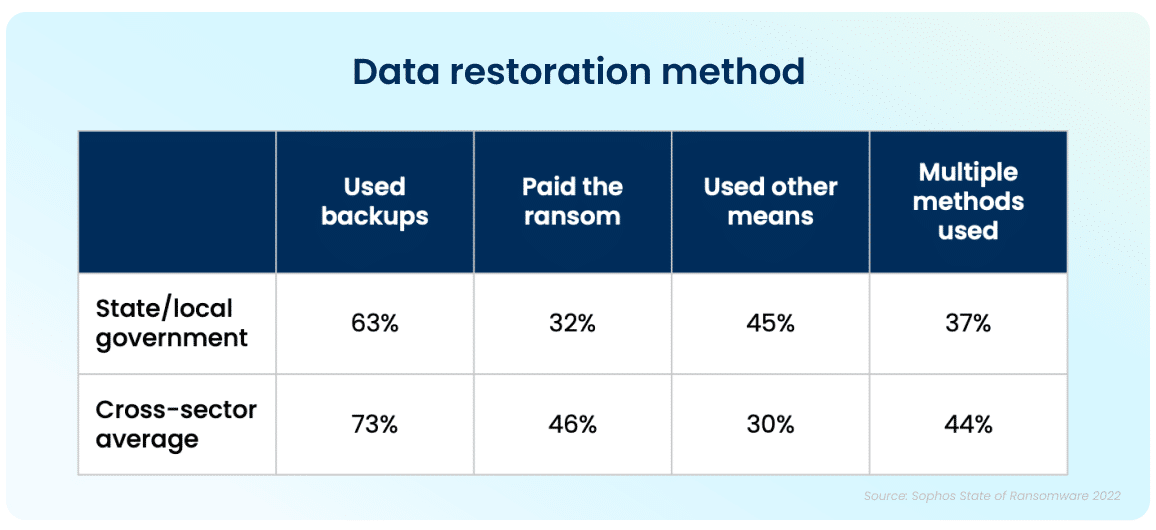

While the increase in cyberattacks paints a bleak picture, there is a silver lining to this dark cloud. Ninety-nine percent of government organizations were able to get at least some of their encrypted data back. The top method used to restore data was performed via existing backups, which were used by 63% of organizations whose data was encrypted in an attack. Unfortunately, despite the utilization of backups, 32% of the affected organizations still had to pay a ransom to ensure that more of their data was restored.

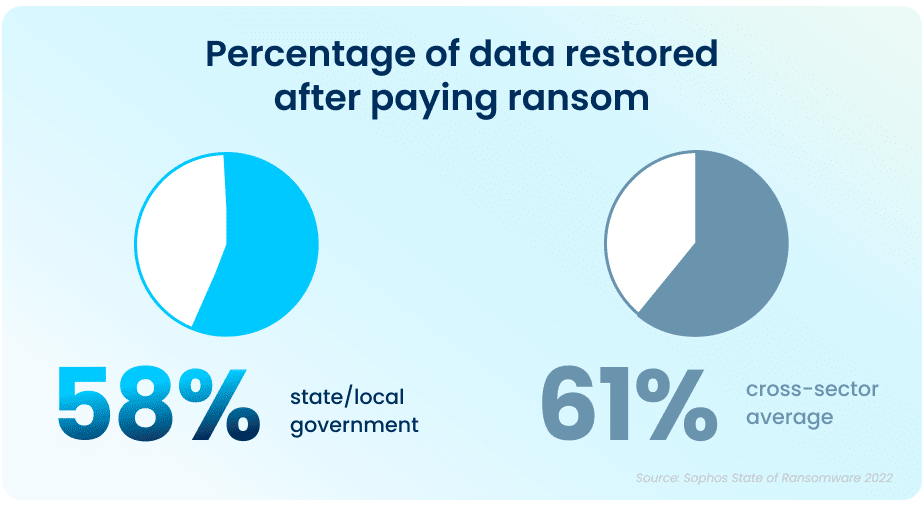

While paying a ransom typically allows organizations to get some data back, it is proving to be less effective than in years past. On average, in 2021, organizations that paid a ransom only got back 58% of their data, a considerable drop from 70% in 2020.

In April and June 2022, respectively, the states of North Carolina and Florida were the first states to prohibit state and local government organizations from paying ransoms to any bad actors. Arizona, Pennsylvania, Texas and New York are considering similar legislation. While the exact impact of this cannot be determined yet, this is expected to dissuade ransomware attacks on all organizations.

This highlights the importance of employing multiple methods to restore data—utilizing backups in particular can improve the speed of recovery and increase the amount of data that can be recovered in the event of an attack.

But It Doesn’t End There

The Sophos State of Ransomware In State and Local Government 2022 survey has revealed that ransomware continues to be an imminent threat for state and local government organizations. For many, choosing to work with an experienced partner with expertise in cybersecurity not only improves your chances of getting approved for the right amount of cyber insurance coverage, but can also ensure that companies see a higher return on investment, and improved ability to both prevent and mitigate attacks in the future. Aunalytics provides Disaster Recovery Services, which is further coupled with a comprehensive backup and archival strategy. This allows state and local government organizations like yours to remain confident so that you are prepared should you encounter a disaster event. We partner with industry leaders to replicate your critical infrastructure so you are prepared for anything.

When Was the Last Time You Checked on Your Internet Security?

Internet security—a combination of security measures put into place to protect any transaction or activity made over the internet—is one of the most necessary forms of security your business could possibly have.

Everything we do, every day, is virtually always online—even though we sit next to Deborah, we usually send her files through a document sharing program like SharePoint or Google Docs. We don’t walk over with a paper file and hand it to her often, if ever. When thinking of our daily interactions with the internet in corporate environments, it becomes more and more startling that many of us are not aware what our role in our company’s corporate security actually is. Some think it’s remembering to change your password, while others know there are specific steps you can take to better secure your network from the malicious creepy crawlies.

They're Everywhere

Security threats are as widely varied as the content on the internet and can include everything from the well-known malware and phishing to Wi-Fi threats, computer worms, and botnets.

How many people do you know that take their work devices with them to coffee shops for a change of pace? As safe and normal as this may seem, there are multiple kinds of Wi-Fi threats that can piggyback onto public Wi-Fi and open networks. The three most common types of Wi-Fi threats are Man-in-the-Middle (MitM), Rogue Networks, and Packet Sniffing.

Let’s break this down a little bit:

- Man-in-the-Middle (MitM) attacks are generally the most common type of Wi-Fi threat. In its most basic form, a MitM attack is when a bad actor is able to intercept and read messages between users who believe they are only speaking to each other privately, essentially eavesdropping on their conversation and any confidential information that is being shared.

- Rogue Networks are fake Wi-Fi networks that attackers set up to confuse users into giving hackers access to their devices. Rogue networks can easily masquerade as trusted networks, especially those at locations like your favorite bookstore or coffee shop. If you see a guest network, only use it if the network is secured and you need a password to log into the network. This can help ensure your computer and other tech is better protected and is less likely to end up on a rogue network.

- Packet Sniffing, sometimes known as Packet Analyzers, can monitor traffic on a network. This malicious attack can intercept data while it is being transmitted across your network and provide hackers with details on the data package’s contents. Using this method, bad actors can also introduce errors that can corrupt your system.

Wi-Fi threats aren’t the only internet threats to your corporate security. Botnets, a network of private computers that are infected with malicious software and often controlled by a single user, are most often used for denial-of-service (DoS) attacks, and sending out spam messages for users in your network. Similarly, a computer worm, a software that can copy itself multiple times, can spread across your network quickly, leaving mass destruction in its wake.

What Now?

With the threat of bad actors finding a hole in your network at any point in time, it’s impossible to ignore your cyber security. Risks are becoming higher as viruses and malware become increasingly complex, setting companies up for difficulties when navigating the process of recovering data, and further difficulties of finding easily obtainable cyber security insurance following a security event. Finding and utilizing a trusted partner can help you keep your network safe and consistently monitored with services like a 24/7/365 monitored Security Operations Center (SOC), help attaining industry security compliance requirements, and developing a Backup and Disaster Recovery (DR) plan for when the unexpected strikes.

Customer Intelligence Insights are Reliant on Accurate Data

It’s 10pm, do you know where your customer data is?

Jokes aside, is your data organized in a form that you can easily use, review, and make critical business decisions from? Or is disorganized data slowing down your decision-making and preventing your organization from utilizing customer intelligence to enhance the customer experience and grow your business?

Improved Enterprise Data Management Enables Customer Intelligence Analytics

In many organizations, heaps of data are coming in from multiple sources, into and out of multiple clouds and departments, with varying degrees of accuracy. This makes decision-making based on customer intelligence difficult. When your data is not cleansed, you may have multiple records for the same person, spread across your databases. It is essential for your digital maturity process to include optimizing enterprise data management—finding all disparate data, cleansing, and aggregating it, and creating a single, correct client record—your single source of truth.

With enterprise data management and a robust data analytics platform working together, your customer data and prospect lists become more reliable, you save money on marketing materials, and, with the right analytics platform, can more easily implement AI solutions to send the right offer to the right customer at the right time. An analytics platform can mean taking your client records and improving them, their data, and your ability to make data-driven decisions about your prospects’ and customers’ needs.

A Customer Intelligence Analytics Database, like Aunalytics’ Daybreak Analytics Database, not only provides daily insights, compiled overnight and ready for you first thing in the morning, but also gives you access to a robust data platform and actionable industry-relevant smart features to enable various analytics solutions, helping you create a strategy that will lead to positive outcomes for your customers. With a streamlined system for your organization to find, access, store, and manage your data, along with an analytics platform bringing data to your fingertips, you don’t have to worry about which version of a client record you will find today, which version of the client’s name is what she prefers to go by, or what the correct version of her address is.

A side-by-side approach with a technology partner is the best way to access tools like Artificial Intelligence (AI), machine learning (ML), predictive analytics, and a team of experts by your side to provide support and assist you every step of the way. Look for a provider who supports an end-to-end process, making sure you don’t get stuck in the middle and left hung out to dry when making your journey to better enterprise data management, analytics, and, ultimately, digital maturity.