Women’s Ability to Adapt and Persevere Leads to Success in the Tech Industry

By Katie Horvath, CMO, Aunalytics

As a woman who has spent the majority of my career in the tech industry, I am acutely aware of the importance of diverse representation. Historically, women have had to persevere through adversity and quickly adapt to change—skills needed to succeed in the tech industry. I have witnessed firsthand the importance of women’s contributions to the overall success of a tech organization. So when I received an email from McKinsey in my inbox today, I was happy to see this topic addressed. McKinsey reported that:

[C]ompanies across industries are boosting their efforts to increase the representation of women by focusing primarily on two targets: hiring them into entry-level roles and establishing parity in the C-suite. But our research has found that many organizations are missing the mark at a key moment: equitable advance in early promotion. Across all industries and roles, only 86 women are promoted to manager for every 100 men at the same level. In technical roles—specifically, engineering and product management—just 52 women are promoted to manager for every 100 men. As a result, women are leaving these technical fields in high numbers.

This inspired me to compare my experience with various tech companies across my career, spanning from the late 1990’s in Silicon Valley, to Redmond in the mid 2000’s, with work locations during my career on the East Coast and in the Midwest. While you might think that things are more conservative in “fly over land” of the Midwest—giving women in tech fewer opportunities than on the coasts—the horror stories of the “bro code” culture in the San Francisco Bay Area have dominated in more recent years and lack of support for women founders to find funding both on the west and east coasts is of high concern.

As CEO of a Midwest big data software company, I did not experience gender discrimination when it came to seeking funding from Midwest investors. We even completed our exit strategy in the middle of a global pandemic—acquisition by strategic investor, and today I am a C-suite executive at that strategic investor, leading high-tech in the Midwest. Out of my many experiences (and trust me, I’ve experienced the “good old boys club” and more), I truly believe that having women in leadership at the top is a key component of creating inclusive company culture. With women in roles empowered to build and create company culture, and hiring practices that include seeking men and women for front line roles, new hire roles (straight out of school), management, and executive roles, it breeds for inclusion at all ranks. Really, you need to work at all levels for people to see and believe that a workplace is “female friendly.” And then it builds upon itself. Women who want to work with other women in tech are attracted to the employer.

Key to this is having visible authentic leadership where team members can see women making personnel decisions, such as promotions into leadership roles for midlevel management. If the perception is that the “good old boys” are making career advancement decisions and company strategy decisions, then women are tokenized. Rather, to be equitably led by both men and women, the team needs to see both men and women empowered with this decision-making.

McKinsey reports that:

[E]ven today women earn about half of science and engineering degrees, but they comprise less than 20 percent of the people working in these fields—and the ones who do pursue this career path can often be the only person of their gender in a room. Without a doubt, retaining women in technical roles is crucial for organizations to reach gender parity not just at the top but also throughout the entire workforce. That cannot happen, however, if companies do not retain and advance women in tech roles—and see them as innovators—early in their careers. The task is not simple. It will require management commitment, as well as a systemic approach that includes equitable access to skill building, a structured process that debiases promotions, and a strong culture of support for women.

As with past years, this year, Aunalytics promoted many from the inside into leadership roles, and I am proud to look around and see women in numbers. Not just tokens, but women in numbers from entry level engineers, product and technical services managers, directors, vice presidents, and our C-suite is 50% woman led. I do not advocate for hiring a women just for the sake of diversity, but rather hiring the best person for the position. The fact that we have established a culture that attracts the best in the business, including the best women, is humbling. It’s the goal. You want to attract the best talent and hope that this opens doors for your company to benefit from diverse ideas, experiences, and opinions. This is what makes your products and services stronger. After all, if everyone came to the table with the same idea, creativity would be lacking and R&D stagnant.

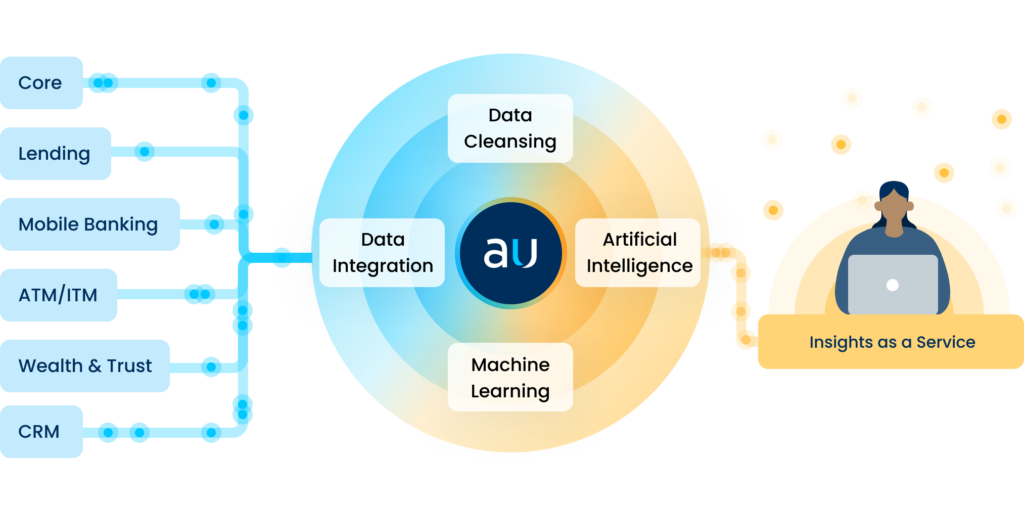

At Aunalytics, we are in the business of data, including building AI to provide insights-as-a-service for industry applications, such as customer intelligence for financial services. McKinsey smartly points out that diverse teams can help de-bias the technologies that are ever-present and ever-expanding elements of modern life. Artificial intelligence, for example, has tremendous potential to help humans make fair and impartial choices, but only if the AI systems themselves are not embedded with human and societal biases. For our AI-powered financial services product, both women and men are leading roadmap decisions, driving development team velocity, managing sprints for delivery of new features, developing go to market strategies for new features, and leading our client success teams. Though our goal did not begin with making our AI diverse and inclusive, it is a great impact of the diverse team that we have assembled.

I have long been an advocate for encouraging girls into careers in math and science based upon finding career opportunity and success going down this path myself. We know that higher paid jobs continue to dwell in technology. For women, automation presents not only a myriad of opportunities, but also new challenges. Business is digitally transforming to the next age of technology and it is important for women to keep up. A smart worker looking for career advancement will embrace change and seek out job retraining programs, learning new skills and technologies such as those supporting business intelligence and automation. History has proven the resilience of women to persevere through hardship and adversity, multitask for efficiency, and quickly adapt to change. These exact skills are a recipe for success in business in the digitally transforming world. For women taking intentional steps to learn new technologies to drive business processes, leadership opportunity abounds.

Oil & Gas Company Achieves Total Data Management Solution with EnerHub Powered by Aunsight Golden Record

Any business in an industry with large amounts of data knows that properly managing data across the entire organization can be a colossal, if not nearly impossible, task. That is why many choose to implement a third-party data management solution to streamline the process of integration, cleansing, and governance.

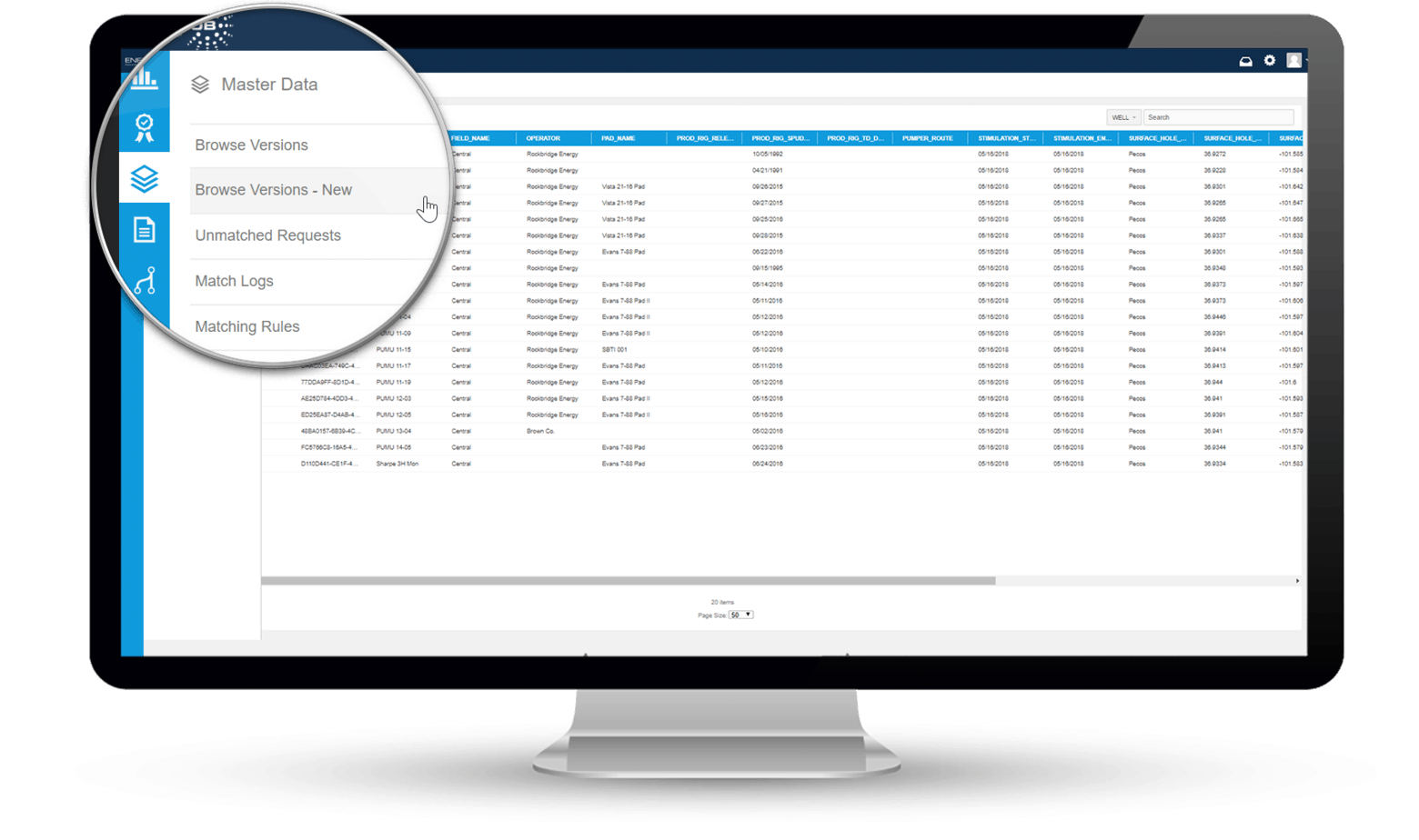

One oil & gas company faced a huge data problem impacting business operations: inconsistent data in common well attributes across multiple operational systems. To solve this challenge, the company had previously selected a Master Data Management (MDM) tool from a well-known oil and gas software vendor.

However, once up and running, the company soon realized that the software complicated and actually worked cross-purpose to its business processes instead of streamlining data. They experienced labor-intensive data maintenance, lack of summary-level views of the data, and a poor overall user experience.

Less than a year after their original MDM implementation, the oil & gas operator decided to cut its losses and find a solution that aligned with its original vision: an easy-to-use, “super-intuitive” tool with the flexibility to adapt to its culture, workflows, and user needs. The company spent nearly a year evaluating and comparing data management tools and selected EnerHub™️ Powered by Aunsight™️ Golden Record.

“Aunalytics technology exposes and remediates issues caused by siloed and inconsistent data that otherwise would cost an oil & gas company millions of dollars annually in lost productivity and missed opportunities,” says William Cummings, Vice President of EnerHub at Stonebridge Consulting. “With Aunalytics technology, Stonebridge quickly and easily builds and manages specialized well production data models and EnerHub customers find the technology easy-to-use.”

By implementing EnerHub Powered by Aunsight Golden Record, the oil & gas company now has the total data management solution they originally envisioned. Learn about the benefits of the Aunsight Golden Record technology by downloading the full case study.

Analytics Database Platform Powers Customer Insights and Positive Outcomes for Community Bank

Data experts at Aunalytics took a three-pronged approach to solve Horizon Bank’s business challenges using the Daybreak for Financial Services analytics database platform. The first move was to get the data right by converging disparate repositories, and organizing the information for ingestion in the proper application area. Horizon Bank leverages Daybreak’s robust, cloud-native platform to convert data into answers in support of a wide range of business intelligence applications. Daybreak allows Horizon’s executives to view system-wide data from all business units, cleansing and verifying records to provide enriched data for accurate, data-driven decision making. The aggregated data delivers a 360-degree view of customer information including behavioral data, from which the platform’s proprietary AI technology and deep learning models developed by Aunalytics data scientists glean actionable customer intelligence insights.

Deploying the Daybreak analytics platform has taken Horizon Bank and its 74 locations to the next level of services and support for customers, making it the preferred financial partner with compelling advantages over larger, competitive establishments. Learn more about the challenges Horizon faced to implement a data analytics platform, and how Daybreak helped them overcome those challenges by downloading the full case study.

Managed IT Services and Data Recovery Offerings from Aunalytics Solve Emergency IT Challenges for EMI

Managing business-critical IT environments is a time-consuming process that many times can require specialists with the experience to deliver the highest performing infrastructure possible. EMI has seen this first-hand over the past several years as the company has had to recover from destroyed network infrastructure caused by a catastrophic lightning strike, a disruptive cyberattack involving ransomware with the encryption of important company information, and the need to reconfigure its computing endpoints quickly because of the occurrence of Covid-19 to accommodate “work from home” environments for its team.

Aunalytics provides a broad range of managed IT solutions, including network, server management, and PC management, as well as Office 365, data recovery and business continuity support. EMI employed several services which have helped to positively transform the company’s operations.

The side-by-side support model employed by Aunalytics has been an especially impactful benefit of this partnership. “While there are many important services provided, perhaps the most widely used and important for EMI is the 24×7 help desk which is essentially an IT department on demand,” said Tom Kiefer, CFO for EMI. “Whether it’s an employee who accidentally deleted a file or a catastrophic lightning strike, the team behind the Aunalytics Ohio help desk has been insightful and fast to act, allowing our employees to remain online and productive.”

Read the full case study to see how EMI further benefitted from the managed IT and data recovery services provided by Aunalytics Ohio.

Automating Data Management Significantly Improves Efficiency for an Oncology Business Intelligence Platform

The Aunalytics Daybreak™ data platform improves the performance of technology solutions by automating data management, ingestion, and cleansing to provide a single source of truth that is updated daily. AC3, an oncology business intelligence company, experienced this efficiency upgrade firsthand.

Therefore, AC3 decided to look for more efficient ways to take charge of data and better prepare it for reporting and analytics. The company selected the Daybreak platform to aggregate data from siloed systems and lay the foundation for their solution that enables healthcare practice groups to avoid manually building billing systems and avoid costly data errors. Aunalytics provides features that enable analytic solutions like fee schedule generation and the ability to build master records of accurate patient data. The platform cleanses data for accuracy and governance and transforms disparate data into a golden record for a single source of truth ready for analytics and reporting.

To learn more about how Daybreak has enriched the AC3 oncology solution, download the case study here.

Why Cybersecurity Should Be a Top Priority for Mid-market Businesses

At the same time, the number of cybersecurity attacks has increased to its highest levels ever. It has been reported that ransomware attacks increased over 90% in 2021. Ransomware has hit new levels of sophistication, with demands for payment skyrocketing into the tens of millions. McKinsey reports that attacks are motivated by:

- Vulnerabilities posed by pandemic weary organizations and workers logging in from unsecured home networks

- Ever advancing connectivity driven by advancing digitization

- Threat actors are now “dwelling” undetected within victims’ environments (instead of using a smash and grab approach) to better understand where the highest value data and information lives and then selling that to the highest bidder

- More companies have been forced to pay ransoms to regain control of their networks and data, so hackers are further incentivized to innovate on this lucrative threat

Companies need to ensure they remain resilient by focusing on ransomware prevention, preparation, response, and recovery strategies. This is a journey—threats continue to evolve and staying ready means staying up to date with new threats of increasing sophistication, cyber security strategies, and best practices. Over time, increasing cyber maturity creates a resilient environment where attacks may still occur but do not have the same impact they would otherwise.

Mid-market businesses need expert skills in cloud security and data security, which is not standard in mid-market IT department skillsets. Keeping servers in a closet guarded by your IT department is extremely risky for data protection. With constantly looming cyber threats, organizations should make cybersecurity best practices a top business priority—and Aunalytics is here to help.

Side-by-Side Client Success Model Empowers Bank's Analytics Initiative

Customers are increasingly demanding digital banking experiences, immediate results and responses to sales and service inquiries, and easy-to-use online platforms. While it is common for banks to invest in building mobile and online banking platforms, industry trailblazers are harnessing the power of data and analytics to drive revenue and smarten operations by gleaning better understanding of their customers for timely targeted cross selling opportunities, lower risk lending, and by cutting operational costs caused by ineffective duplicative customer outreach for sales and service.

So, where to start? The data analytics landscape has exploded over the past decade with an ever-growing list of products and services: literally thousands of tools exist to help business deploy and manage data lakes, ETL and ELT, machine learning, and business intelligence. With so many tools to piece together, how do business leaders find the best one or ones? How do you figure out the best combination of tools and use them to get business outcomes?

The truth is that many tools are built for data scientists, data engineers and other users with technical expertise. With most tools, if you do not have a data science department, your company is at risk of buying technologies that your team does not have the expertise to use and maintain. This turns digital transformation into a failed project without business outcomes instead of sparking data-driven revenue growth.

Yet most mid-sized financial institutions do not have teams of data scientists or data engineers and it does not make business sense to add these FTEs. Really, mid-market banking is stuck between a rock and a hard place in trying to compete with big banks and not get left in the dust of industry giants taking more market share by using data analytics to sweeten customer experiences. So how does the mid-market compete?

Side-by-Side Solution

A side-by-side client success model provides value that goes beyond most tools and platforms on the market by providing a data platform with built in data management and analytics, as well as access to human intelligence in data engineering, machine learning, and business analytics. While many companies offer tools, and many consulting firms can provide guidance in choosing and implementing the tools, integration of all the tools and expertise in one end-to-end solution built for non-technical business users is key for digital transformation success for mid-market businesses.

To learn how Aunalytics helps mid-market banks and credit unions achieve success in data analytics implementation and beyond through their side-by-side client success model, download the full case study here.

Insurance Company Discovers Solution to Data Management Challenges with Aunsight Golden Record

The insurance company initially selected a cloud-native data management solution provided by a company in Silicon Valley. They began a proof of concept project. However, the solution did not perform as planned. Despite being promoted as an out-of-the-box master data management solution, the product required users to write “glue code” to map and connect data sources to the platform. The insurance team soon realized that they would also be responsible for maintaining the glue code and connectors—the solution did not do this. They calculated that they would need to hire at least one more full time employee to do this work.

Further, the platform was built for a technical audience and was not intuitive to use. It required more training than originally thought. And because it was built for a highly technical audience, it limited who from the insurance company team would be skilled enough to use it. The technical skills required to use the platform meant that the burden would be on the IT department to fix data errors reported by business users, and respond to data query requests from the business, in addition to having to build and maintain connectors to data sources and govern and secure the data. This workflow would not be sustainable long-term.

Unsatisfied with the Silicon Valley solution, the global insurance company launched a second proof of concept project to try Aunsight™ Golden Record. Instead of merely integrating the data sources, the Aunsight Golden Record platform cleansed data, eliminated duplicate records, used ELT/ETL and other techniques to normalize data from the different data sources into a single automatically generated schema. To learn how Aunsight Golden Record resolved this company’s data management challenges, download the full insurance use case.

Financial institutions are frequently targeted in cyberattacks—here’s how to protect your bank or credit union

Attacks are increasingly sophisticated and cyber criminals continue to invest in new and complex criminal strategies and campaigns. Hackers in banking often take advantage of the interdependencies of financial institutions to service products such as credit cards and mortgages for other banks. From one bank breach, the cyber cartels jump to the partnered financial institution to steal its data as well.

In some types of cyberattacks, criminals make slight changes to data, which may not be immediately detectable. Because nothing is stolen at the time, users may not recognize the attack. However, once the criminals gain access to this data, they can manipulate algorithms in the system for their own financial gain. Timestamp manipulation is a newer strategy, whereby criminals have found that they are more likely to evade detection if they manipulate time for an otherwise valid transaction. Changing timestamps can alter the value of capital and trades. Because the parties to the transaction appear to be legitimate, this type of fraud is harder to detect.

Other criminals outright steal data for financial gain by selling it, hold data hostage for ransom profit, or pilfer intellectual property such as an organization’s competitive strategy and business plans to sell to interested parties. But the main goal in banking cyber-criminal activity is direct profit from a modern-day bank heist—stealing money from the bank.

Despite the increasing complexity of cyberattacks against financial institutions, there are some tools and best practices that banks and credit unions can use to protect themselves from these threats:

- Continuously update security technology and protocols as threats evolve and adapt with the help of a dedicated full-time security team.

- Employ 24/7/365 monitoring with remote remediation to quickly stop attacks in their tracks

- Monitor endpoint devices to stop attacks before they hit networks.

- Monitor cloud security including application use across the financial institution.

- Monitor email and Office 365 using tools specially designed to thwart attacks on these platforms, such as proactively recognizing and removing phishing scams.

- Have a dedicated security team and SOC, or hire an expert outside managed security services firm that embeds tools, technology and 24/7/365 monitoring to serve as your SOC.

- Push frequent patches so that user devices are equipped with the latest security protections.

- Adopt deep learning or AI monitoring, mitigation and context investigation that can more quickly identify threats.

- Encrypt data so that it is not compromised even if a breach occurs.

- Use multi-factor authentication to protect against unauthorized access.

- Instruct employees and customers to only access bank data in a secure location over a non-public Internet connection.

- Train employees on cybersecurity threats quarterly.

- Develop a solid business recovery plan for when an attack occurs.

Learn more about how Aunalytics Advanced Security helps protect financial institutions, and businesses in other highly regulated industries, from cyberattacks.

Marketing pitfalls can damage customer relationships—here's how to avoid them

While the main goal of marketing is to gain new customers or increase spend from existing customers, at times, marketing effort can do more harm than good. Unfortunately, a marketing campaign could not only fail to entice customers, but certain pitfalls could actively damage customer relationships. Fortunately, there are ways to avoid them. Below are three major mistakes that marketers are prone to making.

#1 Duplicate Mailers

This leaves you to focus on the wasted paper and postage instead of the product or service being marketed. And if the company sending the mailer knew more about the target customer, perhaps the target is someone who does not respond well to snail mail and doesn’t like it. Mailed promotional materials go straight into the recycling bin without even entering houses in many households. This type of waste would be avoided by intel on channel preference of prospects.

When you receive duplicate mailings from a company that you do not do business with currently, it can be viewed as a sign that the customer experience would lack attention to detail, personalization and efficiency. This is a turnoff. That company is likely to be put on a mental list of those you do not want to do business with – period.

If a company that you are doing business with sends multiple duplicative mailers to your home, this can be even worse. In this digital world, many businesses ask customer profile questions including preferred contact method. If you opt in for electronic communications and e-bills, sending a mailer shows that the company is either not listening to its customers or the company is not communicating well within its internal teams. You took the time to complete the profile, yet the business can’t be bothered with using your input. Did anyone read your form fill results? Again, this shows lack of personalized customer experience, inefficiency and lack of cohesiveness in operations. As a current customer, you feel even more devalued than the business that does not have a relationship with you.

Sometimes the duplicate mailings are sent to your name using slight variations of your address, such as “Street” versus “St.” If the business cleaned up its mailing list and recognized that this is the same location, it would save on operational costs and make the company look smarter.

#2 Marketing Products to Customers Who Just Bought Them

A second frustration is receiving a mailer from a company that you currently do business with asking you to purchase products or services that you already have purchased from them. For example, a bank sends a mailer to open a HELOC account or a credit card account when you already have that product from that bank. Is the bank carpet bombing mailings to everyone? How wasteful. Is it that the bank does not care enough about you as a customer to take the time to realize which products you already have with them?

The misdirected marketing may cause customers to begin to think that they should place their business with a bank that cares about their business enough to know which accounts a customer has with them. Really, the relationship would be better if the bank stopped trying to engage its customers than continue to do so with communications that miss the mark.

#3 Bad Timing

A third pet peeve with marketing is when the offers are untimely. For example, if you just refinanced your mortgage with your bank, the bank should not send you a mailer 10 days later for a refinancing opportunity. Yes, customers appreciate notification of interest rates becoming more favorable. But given that you just paid closing costs (or folded them into your loan), refinancing 10 days later is not likely. Instead, you run the risk that the customer sees even better terms being offered and feels dissatisfied with his new product or even mad. From the customer’s perspective, if the bank had told him to wait 10 days, he’d have better terms. Marketing can do better on timing.

Marketing should not damage customer relations.

The Digital Data Challenge

Many businesses have a plethora of data that is typically siloed across many systems throughout the organization. Aggregating and integrating this data for marketing purposes is a major challenge that can be difficult and time-consuming, if not nearly impossible.

Hyper-personalized services that factor in intelligence about a customer holistically should form the core of customer relationships. To achieve this goal, businesses can integrate their disparate data architecture across lines of business and functions to create a 360-degree view of customers and allow for targeted marketing based upon data.

New and advanced data analytics powered by artificial intelligence (AI) are available today that enable customer intelligence to drive marketing. Aggregate your data and ensure that it is cleansed to remove duplicate customer lists for mailings. AI-powered analytics recognizes when people with different names are part of the same household to further eliminate duplicate mailings.

Harness the power of your data to personalize a customer’s experience with your company and not only avoid these pitfalls, but enable smarter targeted marketing.