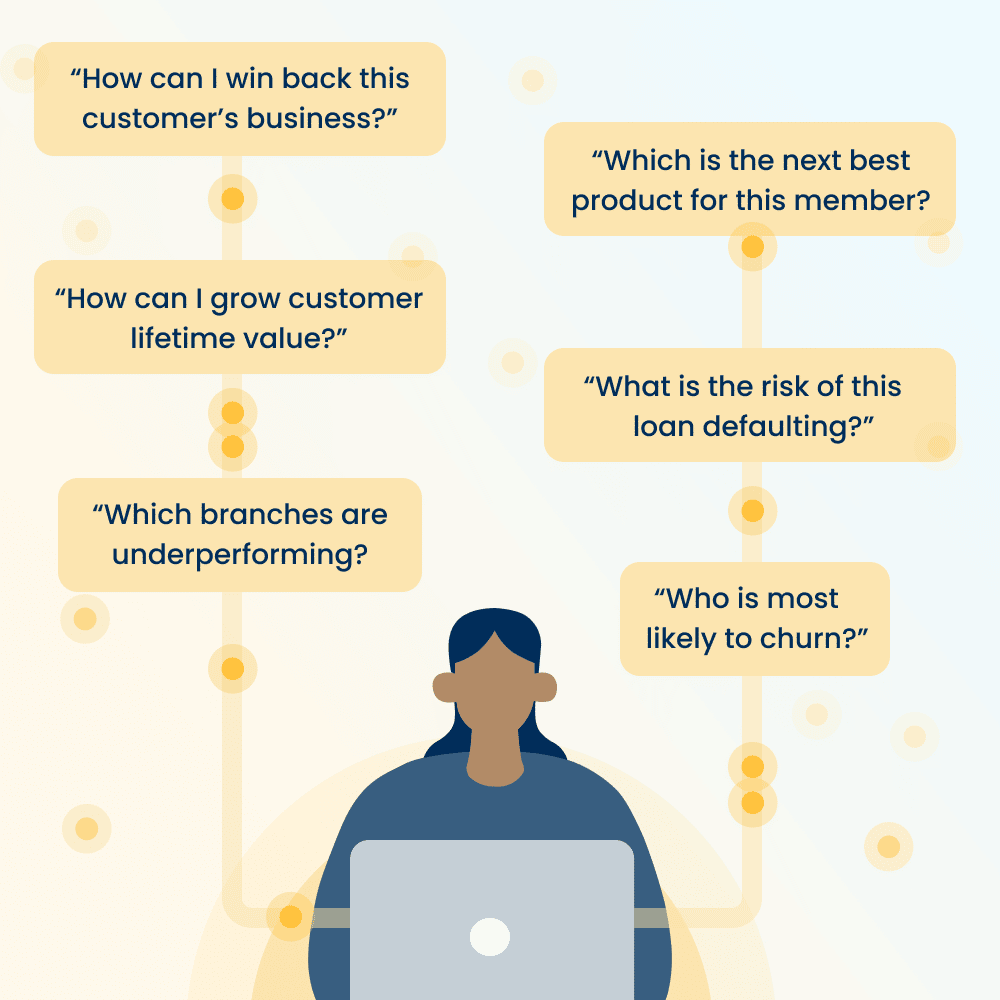

Your most important questions, answered.

Daybreak™ Customer Intelligence Analytics Database provides daily insights powered by a robust data platform, financial industry intelligence, and actionable smart features that enable a variety of analytics solutions across your bank or credit union.

Why Daybreak?

Daybreak allows community banks and credit unions to compete with larger financial institutions by giving them the ability to use data to better understand customers or members, optimize processes, and discover actionable insights to gain a competitive advantage.

Daybreak Smart Features

Get answers to industry-relevant questions with analytics. Smart Features™ are high value data fields created by our Innovation Lab using advanced AI to provide high-impact insights.

Grow customer value, increase sales efficiencies, and improve the customer experience. Daybreak’s Upsell/Cross-Sell Smart Feature uses AI propensity models to give you insights that allow your team to personalize offers and target members or customers with the right product at the right time.

Effectively target market to individuals within a household and increase household revenue and services. Daybreak’s Householding Smart Feature associates disparate accounts within the same household so your team can more effectively target household members and reduce marketing waste such as duplicate mailers to the same household.

Enhance the customer experience by personalizing services to customers based on their behavior. Daybreak’s Transactions Insights Smart Feature uses AI algorithms to mine transactional data daily for fresh insights so your team can build better relationships with your customers and members.

Increase revenue, retain business, and enhance customer and member relationships. Daybreak’s Competitor Payments Smart Feature mines transactional data and uses AI algorithms to flag external products with competing financial institutions on all active customers/members. Your team can use these insights to make more attractive targeted offers to win back business.

Create more operational efficiencies by managing costs, promoting branch profitability, improving staffing, and planning for future branches. The Branch Re-Assignment Smart Feature assigns customers and members to a branch based on location usage and individual product mix so your team can make decisions that will allow for better engagement.

Increase wallet share of existing members and customers by identifying which products an individual is most likely to purchase at a particular point in time. The Next Best Product Smart Feature uses AI models based on key demographics, tenure, product mix, and transactional behaviors for each customer or member to make data-backed product recommendations. This Smart Feature allows your team to improve marketing efficiencies and maximize campaign ROI.

Predict which customers or members are most likely to churn so your team can proactively market to at-risk customers and take actions to prevent churn. The Customer Churn Smart Feature uses an algorithm to detect decreases in deposits, loan payoffs, upcoming loan maturity dates, and other factors indicating propensity for a customer to leave your financial institution.

Increase revenue and better serve your customers and members by discovering their current income, and reduce risk and loan loss by identifying decreases in monthly income due to job loss. The Derived Income Smart Feature uses an algorithm to classify an income series based on ACH transaction data.

Enhance customer and community relations by identifying companies in your community to target for new relationships, and reduce churn by identifying the customers or members at your institution with deposit relationships with companies you know are struggling to succeed. The Derived Employer Smart Feature utilizes ACH transactions to classify an income series and identify a customer or member’s employer.

Identify customers likely to default on a loan at the time of loan application with AI-powered predictions. The Loan Default Smart Feature uses transactional data to detect behaviors indicative of loan default risk so your team can make more informed lending decisions.

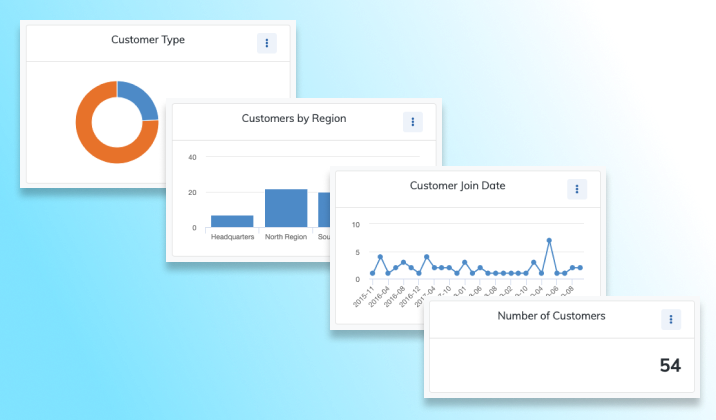

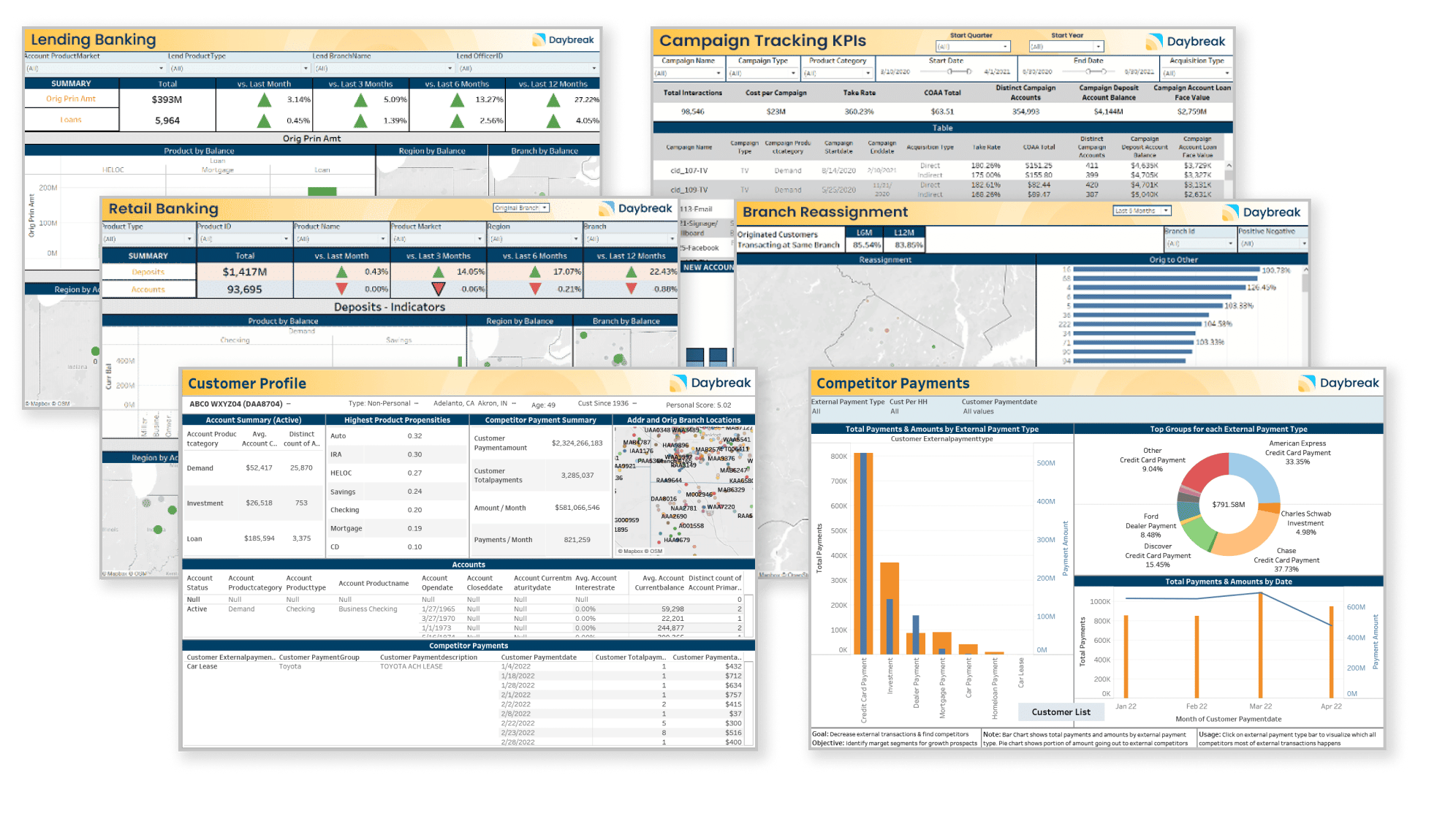

Discover Insights with Daybreak Dashboards

Find opportunities in your data and act on them. Daybreak’s pre-built dashboards can be easily shared across your organization, and give your team actionable insights that provide real business value.

Daybreak Dashboards for Financial Institutions

- Customer Profile Dashboard

- Competitor Payments Dashboard

- Retail Banking KPIs Dashboard

- Lending Banking KPIs Dashboard

- Branch Re-Assignment Dashboard

- Marketing KPIs Dashboard

One platform. Answers for everyone.

Our data analytics platform provides insights to transform your data into actionable business information relevant to financial institutions.

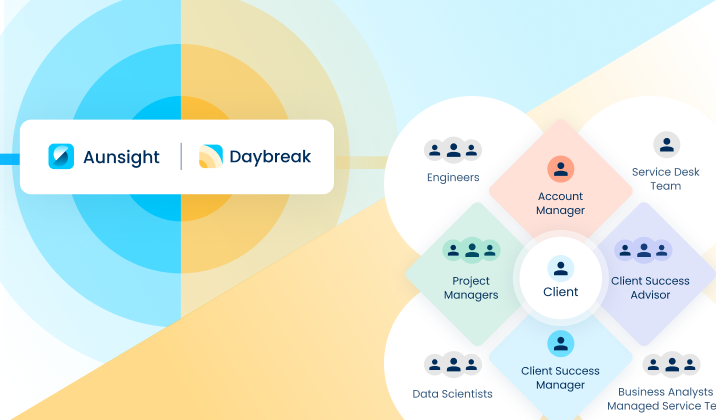

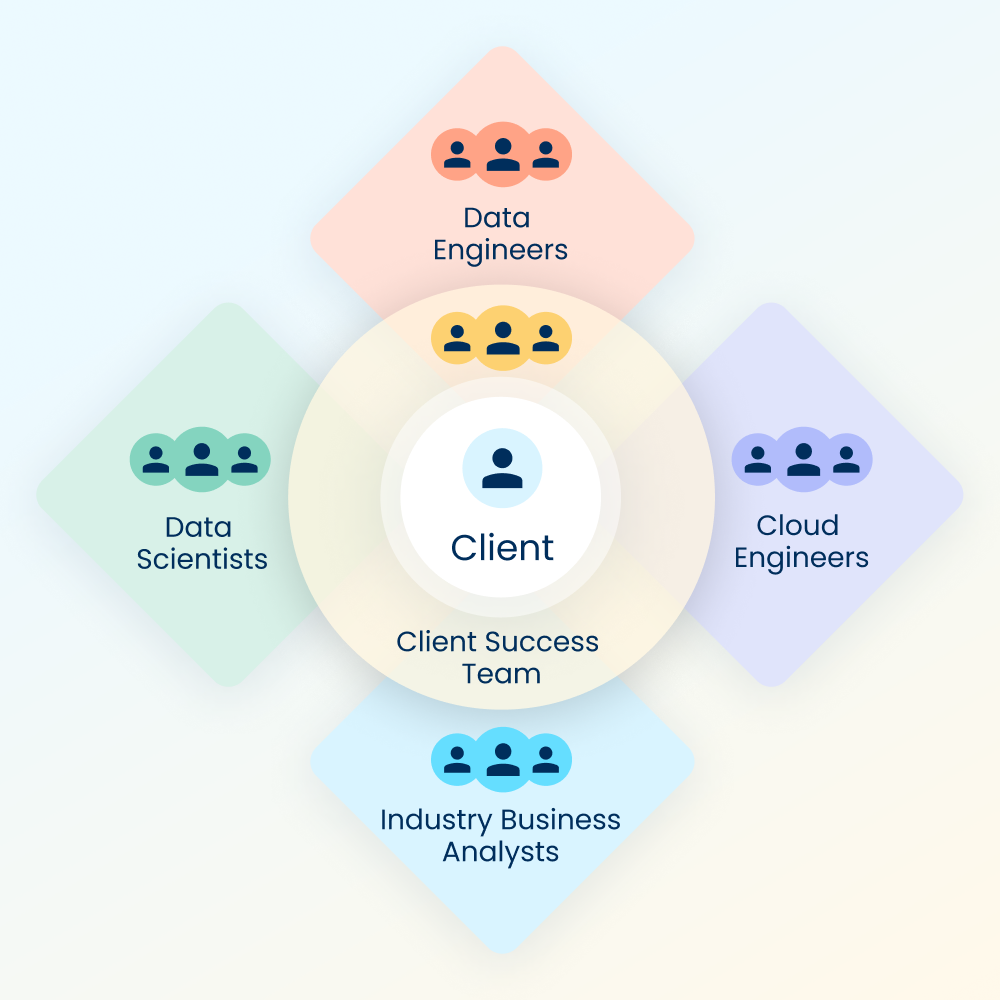

Technology Plus a Team of Experts

Our talented team of data scientists, engineers, and analysts are here to help.

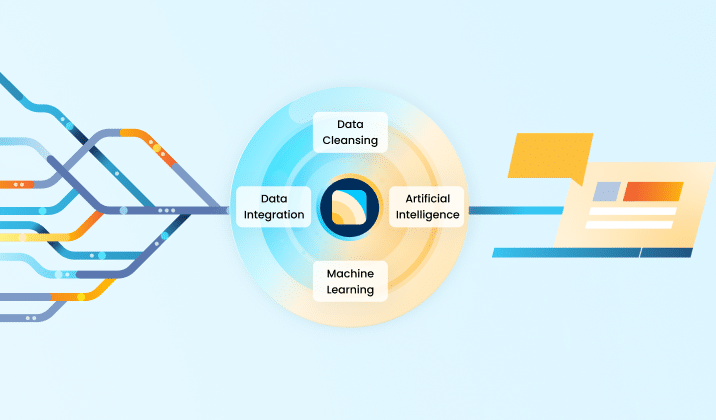

In the current market, it can be difficult for midsized financial institutions to hire the technical talent for advanced analytics. With Aunalytics by your side, we provide a team of experts who will assist you every step of the way. You will have access to the right tools, resources, and support throughout our end-to-end process. Integrate, enrich and utilize data marts with our team beside you to get better answers. Be ready for your AI, machine learning, and predictive analytics journey with the right foundation.

Data Integration & Preparation

Integrated, cleaned data updated daily.

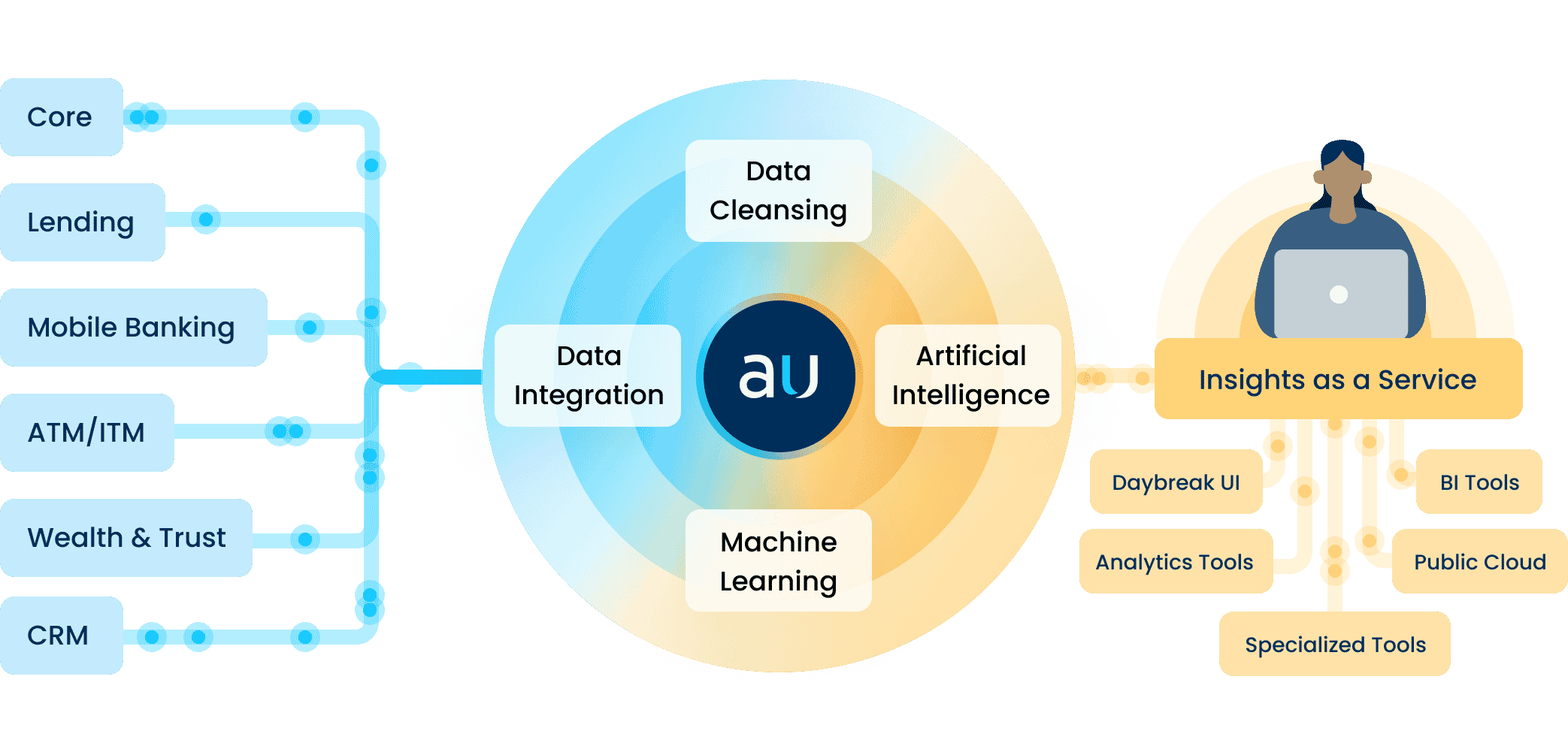

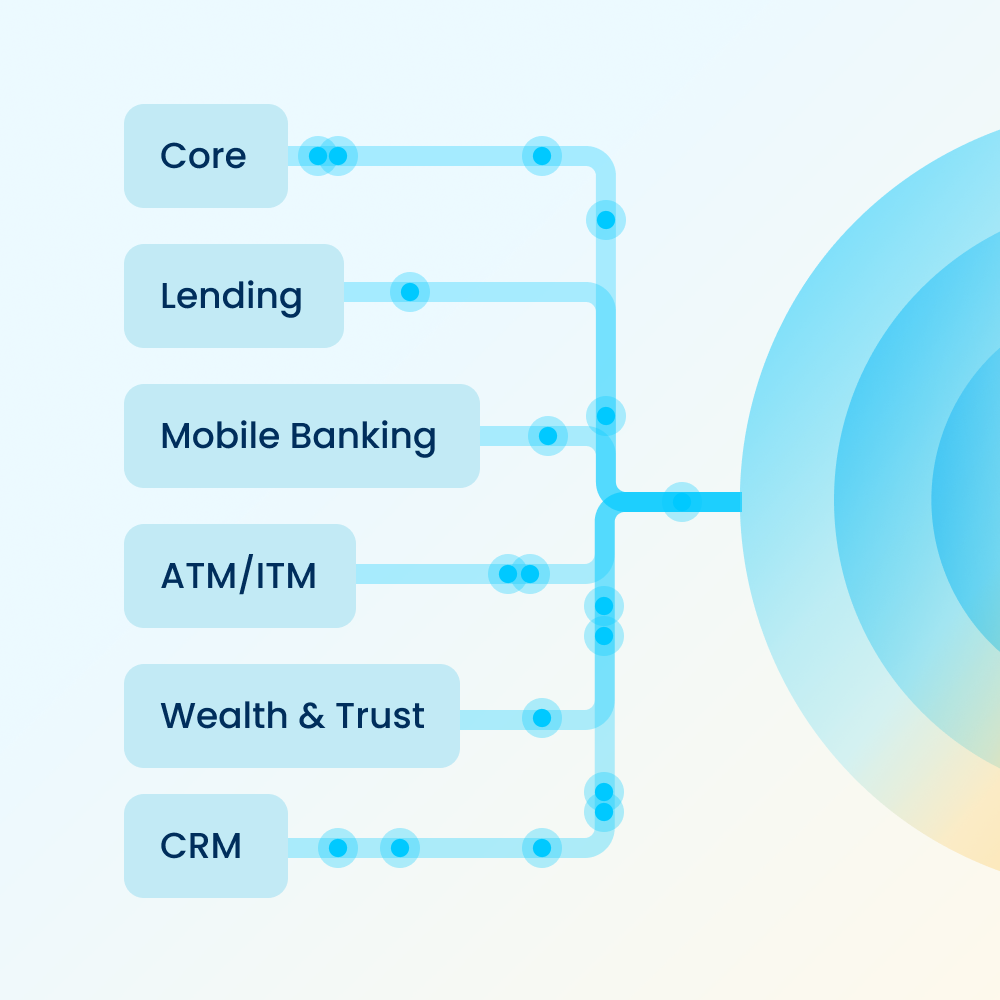

Daybreak integrates and cleanses data from disparate sources across your financial institution, so that analytics are based upon a complete picture of accurate information. We can integrate your transactional data, core data, data from other internal line of business applications, and even third party data. The entire process is automated so you get updated data on a daily basis.

Insights as a Service

Get answers to industry-relevant questions with analytics.

AI-powered Smart Features™, created by data scientists in our Innovation Lab, mine the data to add knowledge beyond basic statistics and aggregations—giving you real, actionable insights from your data. With Daybreak, you can measure marketing campaign effectiveness. You can achieve targeted cross-selling using product propensity models to offer the right product to the right customer at the right time. You can quickly assess KPIs such as branch profitability and make data driven decisions for where to open new locations. These are just a few examples of insights our Smart Features provide—and we are continually developing new Smart Features to answer your biggest questions.

Actionable Business Results

We partner with your team to provide real business value.

We help you find opportunities in your data so you can act on them. As your valued partner, we measure our success on our clients’ business outcomes—not implementation milestones. Daybreak provides the technology to mine your data and reveal actionable business insights, while the Aunalytics team works with you every step of the way, from implementation to delivery. With Daybreak’s AI-powered insights, you can take your personalized, white glove services to a whole new level by anticipating customer needs and providing a better overall experience.

Daybreak Features

Insights as a Service

Data-backed answers to your most pressing questions as the sun rises. With Daybreak, you receive the data insights you need quickly, consistently, and securely every day. We convert rich, transactional data about your customers into actionable insights using our predictive models, so you can quickly understand the landscape and make informed decisions that advance your strategic business priorities.

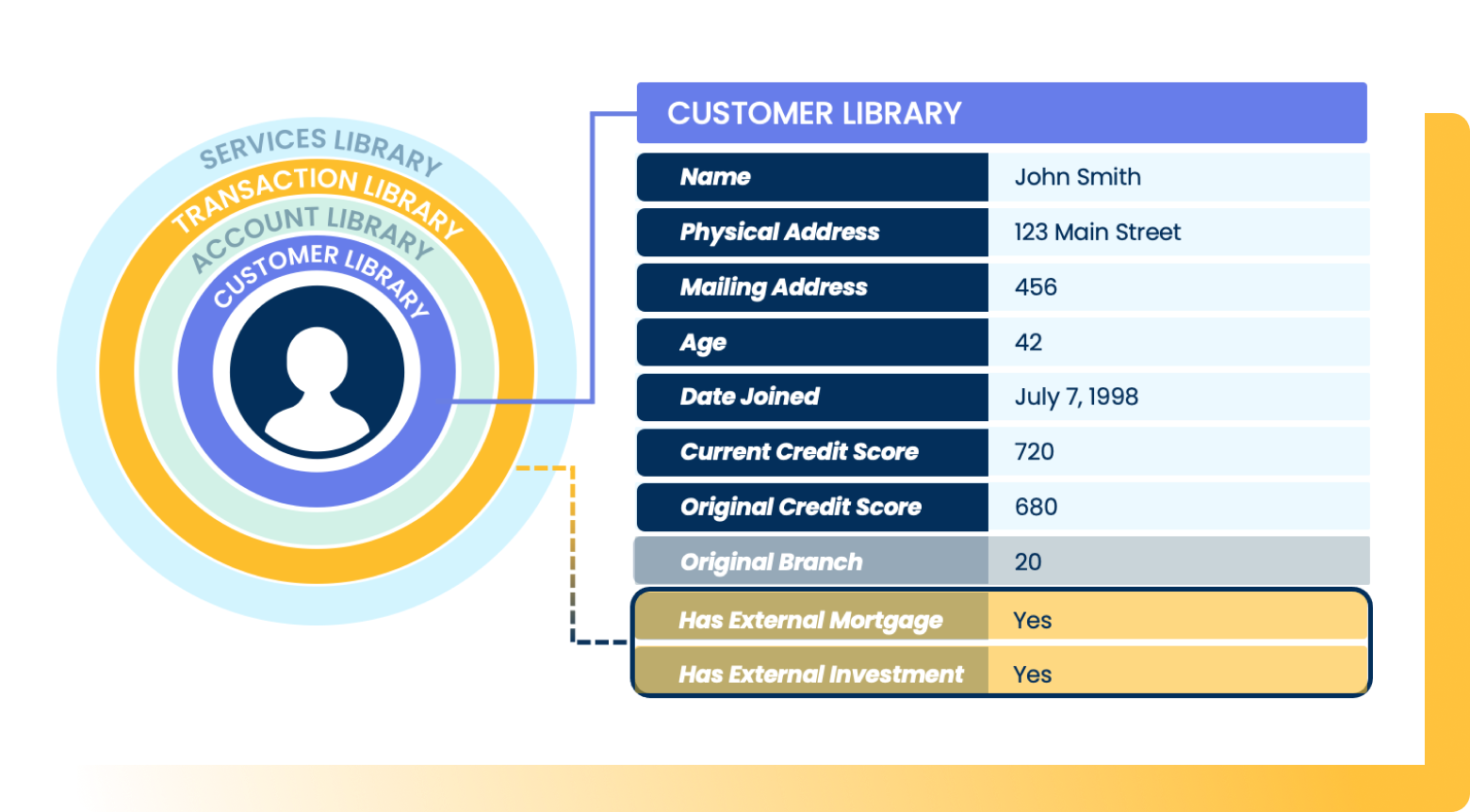

Industry Intelligent Analytics Database

Libraries of data are integrated, cleansed, and enriched by third party sources, then organized into industry-specific data models. Daybreak mines your disparate data sources—transactional banking core data, lending, mobile banking, ATM/ITM, wealth and trust, CRM, and more—to give you a 360-degree view of your customers or members and reveal deep customer insights.

Aunsight™ Data Platform

Provides cloud-native advanced analytics, computing, and data warehouse storage infrastructure and software. The data accuracy feature provides automated data management including data profiling, auto-mapping, and ingestion.

Ingestion & Cleansing

The Daybreak platform is a secure, fully agnostic data management and analytics platform, with the ability to ingest structured, semi-structured, and unstructured data from anywhere that data resides—including cloud-hosted and 3rd party data sources—and clean and organize it for accurate reporting and advanced data analytics.

Smart Features™

AI-powered Smart Features™, created by our data scientists in our Innovation Lab, mine and enrich your integrated data to add knowledge beyond basic statistics and aggregations—giving you real, actionable insights from your data to answer industry and functional questions.

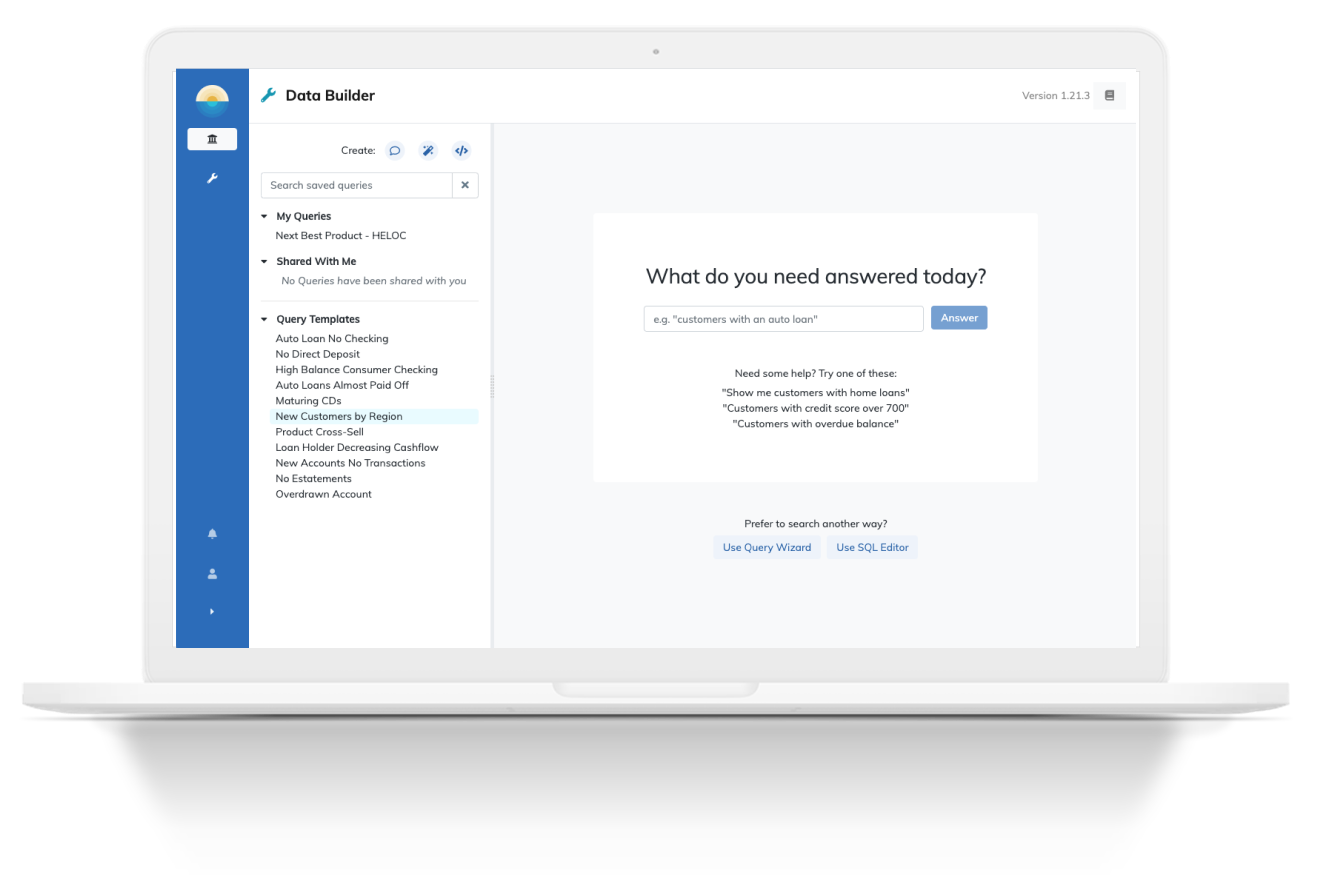

Data Explorer Query Tool

Daybreak provides multiple ways for both technical and non-technical users the ability to ask questions of their data, and then save and share queries for future use. The Data Builder allows users of all experience levels to generate ad-hoc SQL queries, while Natural Language Answers™ allows non-technical business users to search using natural language to find answers in minutes. In addition, Daybreak generates AI-powered query recommendations, delivering other insights the user might find valuable.

Connectors & App Integrations

View your insights and analytics results in our intuitive UI, or replicate them forward to your own dashboards, tools and applications. We have integrations and connectors to a large number of banking cores, business applications, CRMs, and reporting and visualization tools, and are able to add additional app integrations as the need arises.

Intuitive UI & Dashboard Suite

Daybreak’s intuitive UI lets users of all experience levels browse and query the data to find answers to their most important questions. Daybreak includes a pre-built dashboard suite populated with metrics that are relevant to banks and credit unions and allow them to discover actionable insights that provide real business value.

"Aunalytics client service is top notch. There is a dedicated full scale team to take care of our needs and that is much appreciated. There is a strong push for innovation and high value features."

Ben Smith

VP Business Intelligence, Communication Federal Credit Union

"Daybreak has broken down our data silos and given stakeholders across the organization access to insights they have never had before. We are limited only by our own imagination in terms of the types of insights we can uncover."

John Kamin

EVP and Chief Information Officer, Provident Bank

These financial institutions have answers:

Daybreak Resources

Do you have questions about how to use Daybreak? Find answers in the Daybreak User Guide.

Questions around Daybreak Customer Intelligence Analytics Platform? Let's get them answered.

Looking for more information? Want to schedule a demo? Let us know and a relationship manager will be in touch to answer your questions.