Smart Features

Get answers to industry-relevant questions with analytics. Smart Features™ are high value data fields created by our Innovation Lab using advanced AI to provide high-impact insights.

Your data, enriched with industry-relevant answers

Despite having large amounts of data, organizations frequently struggle to get actionable answers out of it. Daybreak solves this problem by analyzing your data for what is relevant and enriching your data with high-value insights gleaned from AI powered data analytics. This allows your team to move from reactive to proactive to achieve data driven business results.

Your data, enriched with industry-relevant answers

Despite having large amounts of data, organizations frequently struggle to get actionable answers out of it. Daybreak solves this problem by analyzing your data for what is relevant and enriching your data with high-value insights gleaned from AI powered data analytics. This allows your team to move from reactive to proactive to achieve data driven business results.

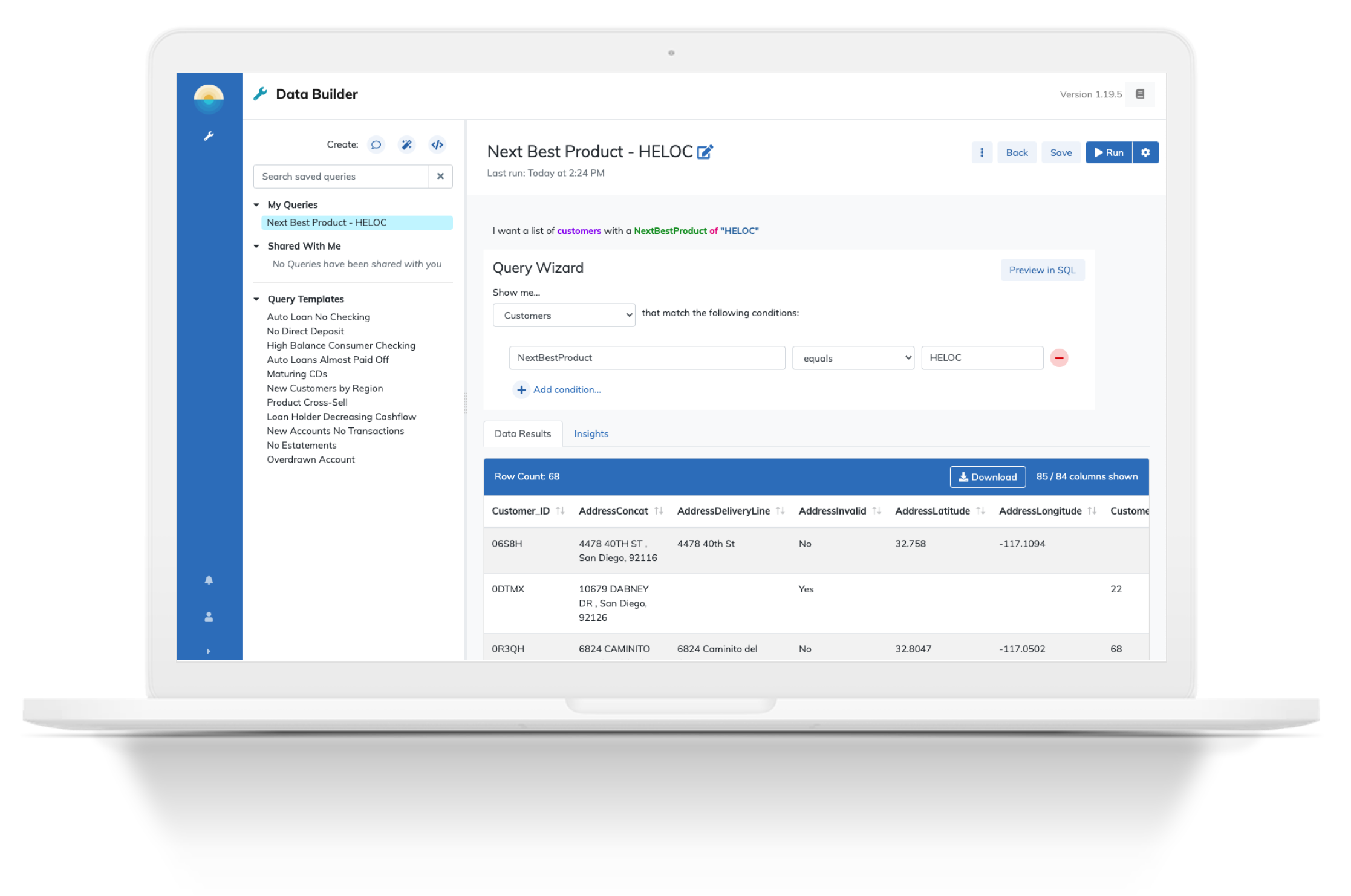

Smart Feature Enrichment

Daybreak integrates, cleans, and merges fields and records from disparate sources into a golden record. Then, AI powered Smart Features mine the data to add knowledge beyond basic statistics and aggregations.

Examples of Daybreak Smart Features

Upsell / Cross-Sell

Grow customer value, increase sales efficiencies, and improve the customer experience. Daybreak’s Upsell/Cross-Sell Smart Feature uses AI propensity models to give you insights that allow your team to personalize offers and target members or customers with the right product at the right time.

Householding

Effectively target market to individuals within a household and increase household revenue and services. Daybreak’s Householding Smart Feature associates disparate accounts within the same household so your team can more effectively target household members and reduce marketing waste such as duplicate mailers to the same household.

Transactions Insights

Enhance the customer experience by personalizing services to customers based on their behavior. Daybreak’s Transactions Insights Smart Feature uses AI algorithms to mine transactional data daily for fresh insights so your team can build better relationships with your customers and members.

Competitor Payments

Increase revenue, retain business, and enhance customer and member relationships. Daybreak’s Competitor Payments Smart Feature mines transactional data and uses AI algorithms to flag external products with competing financial institutions on all active customers/members. Your team can use these insights to make more attractive targeted offers to win back business.

Branch Re-Assignment

Create more operational efficiencies by managing costs, promoting branch profitability, improving staffing, and planning for future branches. The Branch Re-Assignment Smart Feature assigns customers and members to a branch based on location usage and individual product mix so your team can make decisions that will allow for better engagement.

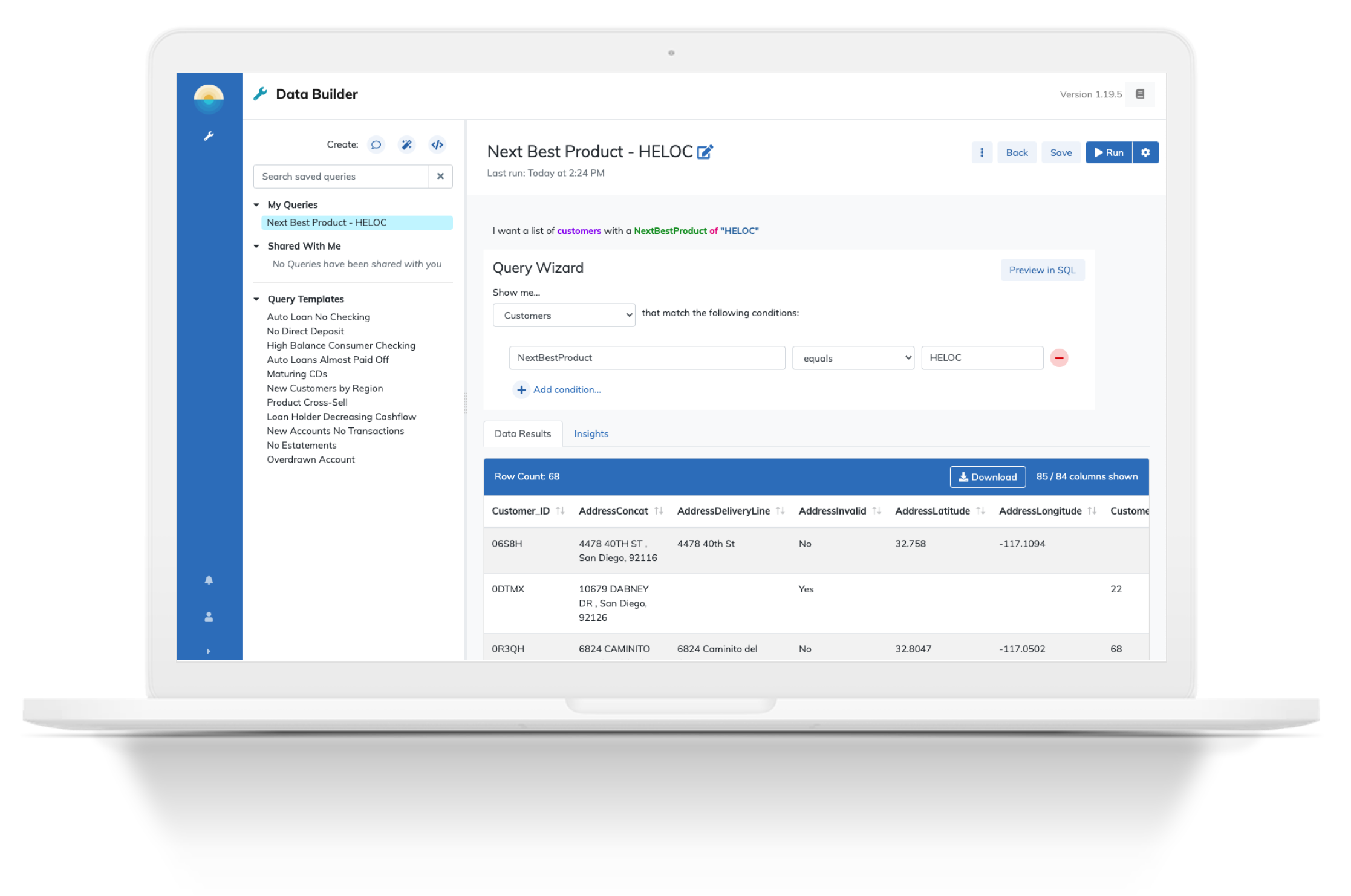

Next Best Product

Increase wallet share of existing members and customers by identifying which products an individual is most likely to purchase at a particular point in time. The Next Best Product Smart Feature uses AI models based on key demographics, tenure, product mix, and transactional behaviors for each customer or member to make data-backed product recommendations. This Smart Feature allows your team to improve marketing efficiencies and maximize campaign ROI.

Derived Employer

Enhance customer and community relations by identifying companies in your community to target for new relationships, and reduce churn by identifying the customers or members at your institution with deposit relationships with companies you know are struggling to succeed. The Derived Employer Smart Feature utilizes ACH transactions to classify an income series and identify a customer or member’s employer.

Derived Income

Increase revenue and better serve your customers and members by discovering their current income, and reduce risk and loan loss by identifying decreases in monthly income due to job loss. The Derived Income Smart Feature uses an algorithm to classify an income series based on ACH transaction data.

Customer Churn Prediction

Predict which customers or members are most likely to churn so your team can proactively market to at-risk customers and take actions to prevent churn. The Customer Churn Smart Feature uses an algorithm to detect decreases in deposits, loan payoffs, upcoming loan maturity dates, and other factors indicating propensity for a customer to leave your financial institution.

Loan Default Prediction

Identify customers likely to default on a loan at the time of loan application with AI-powered predictions. The Loan Default Smart Feature uses transactional data to detect behaviors indicative of loan default risk so your team can make more informed lending decisions.

Smart Features give you actionable insights

Customer Insight

Action

Customer has a checking account which was opened in 1998, but does not have other products with us

Reach out to thank this customer for being a loyal member for over 20 years.

Send special offers to entice this customer to open additional accounts such as savings, credit card, etc.

Member has outside investment & mortgage accounts

Use external account information including amount of monthly payment and duration of external relationship to offer member competitive mortgage to gain new business.

Reach out to the member to explain why your white glove personalized service is a better fit than the big brokerage firm for investment accounts.

Customer has improved his credit score and is now in the excellent range

See if this customer is interested in a Home Equity loan and let him know that he qualifies for low interest rates.

Member is most likely to open a Money Market account or a CD

Contact this member personally to encourage her to open a CD or Money Market account.

Do not market a Home Equity loan at this time.

Customer regularly uses bill pay, but hasn’t logged into mobile banking in over a year

Send this customer correspondence to introduce new mobile banking features to improve customer engagement and reduce risk of churn.

Member signed up at branch 65, but mainly uses branch 16

Evaluate the true profitability of branches.