Investment in Artificial Intelligence is Vital for Banks and Credit Unions

Has your bank or credit union made investments in artificial intelligence yet?

Advances in artificial intelligence (AI), and the promise it holds for the future, have been making news all year. And it’s no wonder that financial institutions are taking notice—a recent survey from the Economist Intelligence Unit found that 77% of bankers believe that unlocking value from AI will be the differentiator between winning and losing banks. Yet, many institutions are falling behind in AI maturity.

Despite its promise, making a large investment in artificial intelligence may seem risky to many midsized financial institutions. Hiring talent, developing a data management and analytics strategy, building a data platform, and creating AI models can be both time- and resource-intensive. Banks and credit unions want to ensure that the efforts spent to get an AI program off the ground will yield a high ROI, especially in times of economic uncertainty. Yet, failure to innovate and make progress toward digital transformation is not always an option in the highly competitive landscape.

Financial institutions find many uses for AI technologies

Thankfully, an investment in artificial intelligence can improve many processes across an institution. AI can optimize both time- and resource-intensive tasks, decrease risk, and increase revenue by improving the customer experience. For instance, by applying AI and machine learning algorithms to transactional data, banks and credit unions can gain insights into customers or members’ habits and preferences. Some use cases include:

- Detecting and preventing fraud

- Identifying loan default risk at the time of application

- Predicting customer churn

- Winning back business by discovering customer payments going to competitors, and subsequently making a more attractive offer

- Predicting the next best product for each customer then targeting them with the right product at the right time

- Calculating customer value scores in order to better allocate resources to target more valuable customers

Don’t get left behind

Large banks are already utilizing artificial intelligence use cases at scale. In a recent letter to shareholders, Jamie Dimon, Chief Executive Officer of JPMorgan Chase wrote, “Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success—the importance of implementing new technologies simply cannot be overstated.”

Because of this focus, his company has made tremendous investments in AI. They currently have over 300 AI use cases in production, and employ almost 3,000 people in data management, data science, and AI-research-related roles. This underscores how vital these new technologies are to success in the future.

Unfortunately, not every institution has access to talent and technology at the scale of JPMorgan Chase. That’s why Aunaytics has developed a cloud-based data and analytics platform to provide data management, advanced reporting, and predictive AI and machine learning solutions for midsized community banks and credit unions.

Daybreak for Financial Services allows institutions to learn more about their customers and members in order to provide a better overall experience—which in turn reduces risk, increases wallet share, and reduces expenses.

Why You Should Include an Analytics Platform in your Banking Software Arsenal

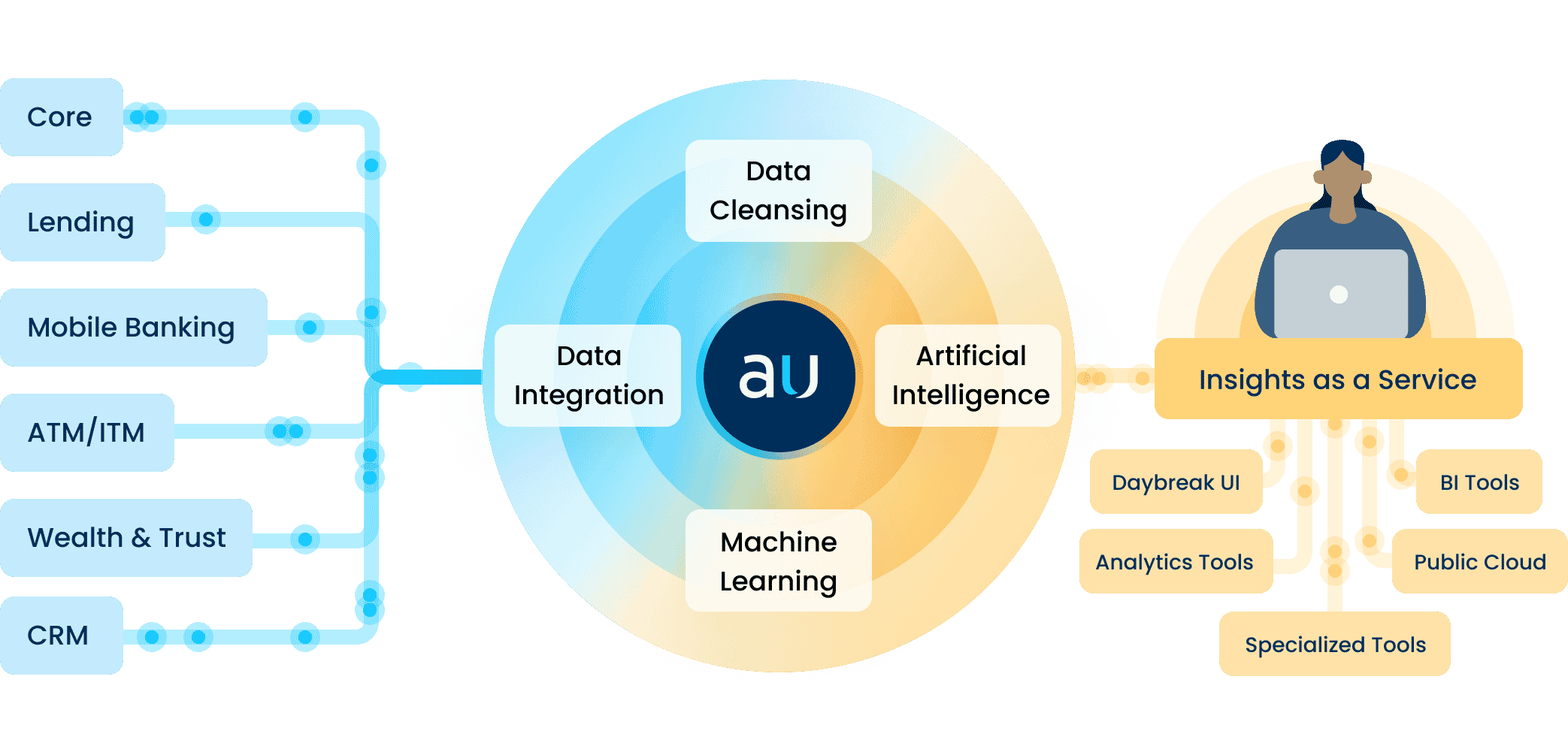

Banking software is vital to the success of all financial institutions. With an increasing focus on digital transformation, banks and credit unions amass a collection of platforms and software systems. Financial institutions not only rely on their banking core, but also CRM systems, online and mobile banking applications, loan management software, payment processing systems, and wealth management, risk, and compliance software, to name a few. Not only do these systems make banking more efficient, but they are collecting data that can be used to improve the business itself.

How can financial institutions best utilize their existing data? Thanks to their existing banking software, every institution holds valuable information about each customer or member that can be used to increase their lifetime value. PWC estimates that banks can generate a 70% return on initiatives targeting existing customers versus 10% when targeting new customers. Therefore, one of the best ways to use data to achieve better returns and higher margins is to focus on improving the customer or member experience.

Having access to an abundance of data points across various systems presents a tremendous opportunity to strengthen existing relationships—but it also poses a challenge. While each banking software system includes valuable information, it does not give the whole story. The problem for many institutions is that they have no way of getting a complete, 360-degree view of each individual from disparate software systems.

The Importance of an Analytics Platform

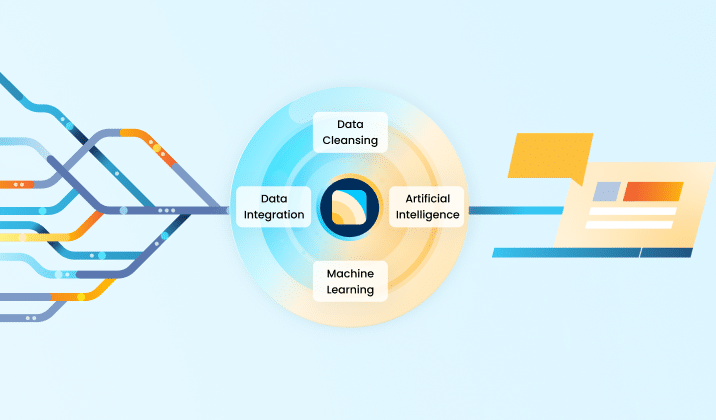

That is why a data and analytics platform is essential. An analytics platform can aggregate data from multiple systems, cleanse and organize that data into a 360-degree customer view, then apply artificial intelligence (AI) and machine learning algorithms to gain data-driven insights.

Once an analytics platform has been implemented, there are many customer intelligence use cases that can help banks and credit unions target the right customers, with the right offer, at the right time, including:

- Gaining transaction insights – Gaining access to transaction data, paired with AI and machine learning, gives great insights into consumer spending habits and preferences.

- Identifying competitor payments – By mining transactional data, financial institutions can discover customer payments going to competitors, then use that information to reach out to customers or members and win back business with a more attractive offer.

- Generating product recommendations – With access to data points from several software systems, machine learning and AI models can make predictions such as the next best product to offer for each customer.

- Predicting churn – AI algorithms identify trends in transactional data, and determine which customers are most likely to churn—so financial institutions can take actions to prevent it.

- Calculating Customer Lifetime Value – An analytics platform can calculate customer value scores based on a large number of relevant data points using AI and machine learning. Banks and credit unions can use this information to allocate resources toward targeting customers with higher customer lifetime value scores.

These are just a few of the ways banks and credit unions can implement insights from a data and analytics platform that mines data from across their organization’s many software systems. Once the platform is implemented, any number of use cases can be developed using AI and machine learning—getting the data collected, aggregated, updated, cleansed, and organized for analytics is one of the largest obstacles for organizations.

Thankfully, Aunalytics has developed a robust data and analytics platform called Daybreak for Financial Services. Daybreak provides all of these services and more to make sure your bank or credit union is making the most of its banking software data to reduce risk, optimize processes, increase revenue, and most importantly, improve the customer or member experience.

The Truth About Artificial Intelligence in Business

Is the existence of Skynet imminent or is that simply a sci-fi trope? In this brief video, Dr. David Cieslak, Chief Data Scientist at Aunalytics, talks about the capabilities of Artificial Intelligence in business, some potential concerns with AI, and where the technology is headed in the future.

While there exists a broad range of applications for AI, in the business world, this technology has the potential to drastically change how we understand our customers and how we use our data to interact with them. Once created and trained with customer data, AI has the ability to quickly provide suggestions and insights that would otherwise be prohibitively difficult or even impossible to observe on your own.

For example, Aunalytics’ Daybreak for Financial Institutions platform uses a proprietary AI model that can predict when a customer or member is likely to churn, to suggest which product to promote based on what that specific person is most likely to buy, to identify where the best branch locations are, and more. These types of insights are hiding in your data, simply waiting to be uncovered. To learn more about the business applications of AI, you can view the extended interview here.

David Cieslak, PhD, is the Chief Data Scientist at Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors. Prior to Aunalytics, Cieslak was on staff at the University of Notre Dame as part of the research faculty where he contributed on high value grants with both the federal government and Fortune 500 companies. He has published numerous articles in highly regarded journals, conferences, and workshops on the topics of Machine Learning, Data Mining, Knowledge Discovery, Artificial Intelligence, and Grid Computing.

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

In this interview, David Cieslak, PhD, the Chief Data Scientist at Aunalytics, describes complex analytics concepts such as artificial intelligence, machine learning, and deep learning, and explains how they are useful for businesses today—and will continue to be in the future. David has been with Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors.

Fill out the form below to receive an email with a link to the interview.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

In this interview, David Cieslak, PhD, the Chief Data Scientist at Aunalytics, describes complex analytics concepts such as artificial intelligence, machine learning, and deep learning, and explains how they are useful for businesses today—and will continue to be in the future. David has been with Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors.

Do you have the tools and talent to set your organization up for analytics success?

Most business leaders would agree: data is a valuable asset. Having up-to-date, accurate data with which to make data-driven decisions currently gives organizations an edge, but eventually, this will become table stakes in most industries, simply to remain competitive. However, an up-front investment in a strong technical foundation and a shift to embrace analytics culture throughout the organization are required to achieve analytics success.

Unfortunately, there are many challenges to overcome when trying to bring siloed and dirty data from multiple sources across your business to a single place to be analyzed, including a lack of time and manpower, and the need for data points that don’t currently exist, to name a few. Using data analytics, it becomes possible to better optimize your business by discovering operational efficiencies, reducing costs, tracking customer trends across your organization, and making strategic decisions based on predictive data models. Is partnering with analytics experts the best choice for mid-sized institutions, or should you hire Full-Time Employees (FTEs) to build and manage your data?

There are multiple ways an analytics platform could be created—we’re going to look at two today.

Build it yourself

The first is choosing to create a custom data platform. While not a bad choice, it could take a FTE years to create your analytics platform—if it’s ever finished. An engineer hired to build a custom platform may leave you high and dry with no one to step in to help. Something like this could cost your business months—or even years—of lost money and productivity, leaving you with nothing to show for your platform building efforts.

Even if your data engineer remains with your business, there are other challenges you may encounter. It can be difficult for a single FTE to stay up to date on the newest technological advances and upgrades. Especially when that person is not only expected to clean and update information on thousands of data records, but also take care of system and software updates, keep up with changing trends in the analytics world, and more. A lack of manpower can also make tasks like finding trends in your data nearly impossible, as data processing may be far behind where your most recent and relevant business analytics can be found.

When it comes to advanced analytics, you would need to find and hire additional employees who are skilled in advanced data analytics, machine learning, and AI techniques, and ideally, familiar with your industry. This can be easier said than done. Data scientists, like many in the technology field, are in high demand, and may be difficult to find and hire in smaller geographical markets.

Work with a partner

A different option is working with a trusted technology partner who brings data analytics expertise straight to you. Partnering with an end-to-end provider often saves your company money while allowing someone else to take care of the nitty gritty that goes into creating reports, graphs, charts, and more. Additionally, you are guaranteed to have access to the team you need to build algorithms and find insights in your data. A partner will consistently provide you with the right tools, talent, and resources, while supporting you the entire way. But how could an Analytics as a Service partner help you find the true value of your data?

A good partner will be able to offer the required resources to achieve analytics success—a foundational data platform, automated data management, access to data experts, and data delivery methods such as relevant and actionable dashboards and reports. Imagine having a regular report, generated overnight, every night, for you to review first thing in the morning—without having to invest in many new FTEs and years of development time.

When looking for a data analytics partner, all the things above are important for creating a successful partnership that leads to analytics success. Aunalytics provides data processing and analytics help and would never expect you to go it alone. When you hire us, you hire data scientists, data engineers, and data analysts, reducing the need for multiple expensive FTEs. By having access to a team of data experts by your side, your business can find itself enabled to make better, faster, and smarter decisions based on consistent, real-time data.

How State and Local Governments Can Use Technology to Overcome Economic Challenges

How State and Local Governments Can Use Technology to Overcome Economic Challenges

At present, state and local governments are confronted with significant challenges stemming from the current state of the economy. This includes a decrease in tax revenues, sustained high inflation, and a shortage of proficient IT personnel, who are vital to their day-to-day operations. Industry experts consider technology as an effective solution to address inadequacies during challenging economic periods.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Government Resources

Nothing found.

How State and Local Governments Can Use Technology to Overcome Economic Challenges

How State and Local Governments Can Use Technology to Overcome Economic Challenges

At present, state and local governments are confronted with significant challenges stemming from the current state of the economy. This includes a decrease in tax revenues, sustained high inflation, and a shortage of proficient IT personnel, who are vital to their day-to-day operations. Industry experts consider technology as an effective solution to address inadequacies during challenging economic periods.

Overcome Hiring and Talent Challenges to Get Ahead of the Competition in 2023

Overcome Hiring and Talent Challenges to Get Ahead of the Competition in 2023

Hiring and retaining staff is going to be the most difficult task facing CFOs for much of 2023. This is particularly true for IT departments. In today’s economy, highly skilled IT and data experts are a scarce and expensive resource. The mid-market organization requires another option that provides access to the right tools, resources, and support.