Aunalytics Dashboards Deliver Insights and Actionable Business Opportunities to Mid-Market Banks and Credit Unions to Achieve Greater Visibility into Data, Strengthen Regional Market Position, and Compete More Effectively

Dashboards Augment Capabilities of Aunalytics Daybreak for Financial Services Cloud-Native Data Platform to Drive Customer Intelligence and Higher Strategic Value

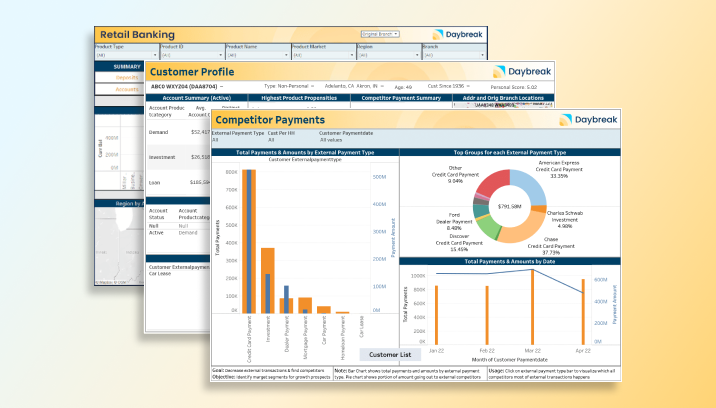

South Bend, IN (July 12, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today a new set of pre-built dashboards that augment the value delivered by the company’s DaybreakTM for Financial Services solution. The Daybreak dashboards are designed to deliver insights and actionable business results by revealing opportunities associated with customer, competitive, marketing, lending, and branch data and automatically presenting the data in a way that is easily understood, without any manual processes required.

Customer intelligence and personalized marketing in a digital world matters more than ever before, especially for mid-market banks that have traditionally relied on hometown, white glove service to win customers. With Aunalytics Daybreak for Financial Services, midsize financial institutions can target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. With the new Daybreak dashboards, mid-market banks and credit unions can achieve greater visibility into their data and identify more opportunities to strengthen their position in regional markets and compete more effectively.

The Daybreak for Financial Services cloud-native data platform integrates and cleanses data for accuracy and mines transactional data daily with AI-powered algorithms for customer intelligence and timely actionable insights that drive strategic value.

New Daybreak Dashboards include:

Customer Profile - This dashboard delivers an enriched profile of individual customers, powered by AI- insights that deliver intelligence on future customer growth beyond mere aggregations and reports of the past. The Customer Profile offers a 360-view of each customer including analysis of data integrated from multiple sources across the organization, and mined daily for timely fresh insights that can be acted upon. Banks can identify accounts that a customer has with competitors in order to make a more attractive offer to win their business and grow customer value. They can also determine the next best product offering for customers today, based upon their transactional behavior, and gain a deeper understanding of customers and the branches they use, beyond the origination branch.

Competitor Payments - Competitor Payments reveals insights for each customer, each competitor, and type of financial product. The dashboard tracks competitor payments by amount and how long they have been taking place so that a banker or credit union can determine when customers or members are likely to look for a new product, then create better offers as a result. Competitor Payments can drill down on credit cards, mortgages, auto loans, and investment products to identify a more competitive offer and use the segmented Customer List dashboard to target them. By using targeted competitive offers made to the right customers at the right time, banks can efficiently grow value from customers to increase net deposits.

Retail KPI - Retail KPI (key performance indicators) help banks to increase total deposits and accounts, and identify growth opportunities and potential. The dashboard delivers key performance metrics to retail leaders to understand the drivers of their account and deposit growth. It enables them to analyze deposits and balances over time and understand growth trends. It also provides data for overall institution performance, as well as detailed performance for each region, branch, market, product type and individual product to identify opportunities for growth and understand which branches are driving change.

Lending KPI - The Lending KPI dashboard delivers key performance metrics to lending leaders to understand the drivers of their loan and loan balance growth. It enables them to view trends over time for original loan amounts and outstanding loan balances. The dashboard provides data for overall institution lending performance and detailed performance of lending by branch, region, market, product type, and each product to uncover opportunities for growth and understand which products, team members, and branches are driving growth. The accompanying Lending Officer dashboard reveals performance insights by team member and shows loans closed and principle amounts over time.

Marketing KPI - This dashboard delivers key performance metrics to marketing leaders on campaign effectiveness to improve targeting and reduce account acquisition cost. It enables banks to target their institution’s marketing to reach the right customer at the right time with the right offer, making marketing operations more efficient and successful by using a data driven approach. Capabilities include:

- Track campaign performance by resulting deposits and new accounts

- Understand customer acquisition cost by region, branch and product type

- Assess account and balance growth by region, branch, and product type

- Understand new account demographics

Branch Reassignment - The Branch Reassignment dashboard delivers key information to business leaders to understand branch utilization and change over time based on where a customer originates and performs business. They can identify branch growth opportunities and areas where efficiencies can be improved, and view branch utilization to see customer banking patterns. With this, banks can determine which products to market at a particular branch and more precisely target those customers who are likely to need that product.

“Daybreak dashboards offer more than just reporting on the past. They connect the dots of relevant data and use predictive analytics to create a picture revealing intelligent insights that help financial institutions build smarter business strategies,” said Kyle Davis, Vice President of Daybreak, Aunalytics. “Designed to accelerate the value derived from AI-powered insights, Daybreak dashboards enable mid-market banks and credit unions to more clearly see the opportunities presented by their data and take action to increase net income and advance their competitive position.”

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Why Mid-Market Organizations Need Digital Transformation Solutions that Combine the Right Technology and Talent to Achieve Business Value

At Aunalytics, we know that an organization’s everyday data holds value, yet is a resource that often remains untapped. This is especially true for the mid-market—this market segment has been underserved and often lacks access to data management and analytics technologies and expertise. Our mission is to empower the mid-market with solutions that enable digital transformation so they can compete and stay relevant.

Digital transformation calls for mid-market companies to shift away from operational silos and work across the company to harness the power of data. This requires the integration of diverse technology across all functional business areas to enable convergence, promote a positive cultural change, drive customer value, and facilitate operational agility. Gartner’s report “Over 100 Data and Analytics Predictions Through 2025” asserts that by 2024, 75% of organizations will have established a centralized data and analytics center of excellence to support federated data and analytics initiatives and prevent enterprise failure. By 2023, organizations with shared companywide data management goals, including stewardship, governance, and semantics to enable inter-enterprise data sharing, will outperform those that don’t.

There is a recipe for successfully transforming massive amounts of corporate and third-party data created and used daily in your lines of business into a valuable asset. But to achieve business outcomes, organizations need to implement digital transformation solutions that include the right technologies/tools combined with the right talent.

The Right Tools and Technology

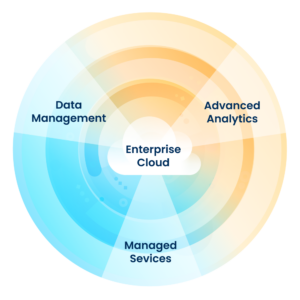

Mid-market companies generally do not currently have the tools needed to find value in their data through advanced analytics and AI. An enterprise data warehouse is only one piece of the puzzle. Successful mid-market digital transformation requires the appropriate storage and compute infrastructure, data management platform, and analytics software. It can be difficult to piece together each of these components into a single, unified system—it is expensive, time-consuming, and inefficient.

To solve this challenge, Aunalytics has developed a robust, cloud-native data platform built for universal data access, powerful analytics, and AI. Mid-market businesses benefit from using an end-to-end, cloud-based platform as it moves the burden of infrastructure procurement and maintenance to a third-party vendor in the data industry. An end-to-end platform is secure, reliable, and scalable while including the added benefit of being deployed and managed as a service. This is especially important for mid-market businesses because finding the right talent to execute digital transformation initiatives is extremely challenging in the current market.

The Right Talent and Expertise

Most IT departments do not currently have the skill sets needed for getting business value out of data. At the same time, for most mid-market companies, it does not make business sense to hire an entire division of highly compensated data experts to achieve digital transformation goals. Even if a mid-market company can find and hire these scarce resources—they were hard to come by even before the Talent War of 2022.

Aunalytics provides a team of experts who assist every step of the way. Mid-market businesses will have access to the right tools, resources, and support throughout our end-to-end process. Our team also includes industry experts who help businesses identify areas in which data can provide the most value, and guidance on how to work toward achieving these goals.

Aunalytics’ Digital Transformation Solution Gives Mid-Sized Businesses Answers

With Aunalytics, you get the technology and expertise required to complete the journey from data to actionable business results. This combination accelerates digital transformation, which allows businesses to realize the value of their investment quickly. By taking advantage of the experienced data professionals at Aunalytics, organizations can save time and avoid making costly mistakes while also maximizing the value currently hidden in their data.

What Mid-Market Companies Need for Data-Driven Success and How to Get It

What Mid-Market Companies Need for Data-Driven Success and How to Get It

Using your data as an asset to drive competitive business growth and achieve cost cutting operational efficiencies is imperative for a company to compete, survive, and thrive. Increasingly, data and analytics have become a primary driver of business strategy and the potential of data-driven business strategies is greater today than ever.

Related Content

Aunalytics Partners with Notre Dame’s iNDustry Labs to Help Facilitate Local Manufacturing Industry’s Digital Transformation Journey

Partnership Will Assist Manufacturing Organizations in Indiana’s South Bend-Elkhart Region to Effectively Compete in an Increasingly Digital and Global Marketplace Through Data-driven Analytics

The partnership will provide a cloud data and analytics platform to Notre Dame researchers and students working with iNDustry Labs business partners through the University’s Applied Analytics & Emerging Technology Lab (AETL), part of the Lucy Family Institute for Data & Society. The platform will enable the AETL team to work in a nimble data environment to gather insights and answer questions, driving value for partner businesses and offering students real-world scenarios to hone their skills. Through rapid prototyping, collaboration on algorithms and creation of data models, researchers and practitioners can work to create actionable insights.

More than a third of the SBE region's workforce is employed in manufacturing. Like other industry sectors, manufacturing companies are grappling with the costs associated with digital transformation to remain competitive in today’s data-driven era. The ability to aggregate siloed data from multiple sources, cleanse and organize data so that analytics can be applied to drive actionable insights, is critical to getting ahead. By achieving a 360-degree view of inventory and sales performance across different sales channels, manufacturing companies can perform the analysis needed to make better, more strategic decisions about how to move their businesses forward.

“This unique collaboration serves both the University’s mission and the needs of local industry partners,” said Rick Johnson, managing director of AETL. “It will greatly reduce the time needed to connect students and researchers with innovative companies, provide students with hands-on industry experience and help companies advance their business and attract new talent.”

The initiative is currently in its first phase, with a team of data scientists in place preparing the Aunalytics platform for University use. Once the platform is in place, contracted manufacturing companies can move into a pilot phase, where Notre Dame students will prepare their data - aggregating, cleansing, and organizing it - for analytics use.

“By providing our technology and services to this collaboration, we’re in a position to assist the SBE region’s industrial businesses in remaining competitive as data-driven insights become increasingly critical to standard business operations,” said Rich Carlton, president and CRO of Aunalytics. “We are very excited to be in partnership with the University, and to help facilitate the opportunities created when academic resources, enhancement of student skills, and industry growth intersect in support of a common goal.”

About iNDustry Labs

The University of Notre Dame’s iNDustry Labs forges innovative partnerships between the South Bend - Elkhart region’s industries and dedicated resources at the University to support a more prosperous region. An anchor of the South Bend-Elkhart region’s Labs for Industry Futures and Transformation (LIFT) Network, it was established through a $42.4 million grant awarded to Notre Dame in 2019 from Lilly Endowment, Inc.

About the Applied Analytics & Emerging Technology Lab

The Applied Analytics & Emerging Technology Lab (AETL), as part of the University of Notre Dame’s Lucy Family Institute for Data & Society, collaborates with iNDustry Labs to help accelerate economic and innovation impact in the South-Bend Elkhart region, achieving the goals of the LIFT Network. The AETL was in part made possible by a grant awarded to the University of Notre Dame in 2019 from Lilly Endowment Inc.

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Women’s Ability to Adapt and Persevere Leads to Success in the Tech Industry

By Katie Horvath, CMO, Aunalytics

As a woman who has spent the majority of my career in the tech industry, I am acutely aware of the importance of diverse representation. Historically, women have had to persevere through adversity and quickly adapt to change—skills needed to succeed in the tech industry. I have witnessed firsthand the importance of women’s contributions to the overall success of a tech organization. So when I received an email from McKinsey in my inbox today, I was happy to see this topic addressed. McKinsey reported that:

[C]ompanies across industries are boosting their efforts to increase the representation of women by focusing primarily on two targets: hiring them into entry-level roles and establishing parity in the C-suite. But our research has found that many organizations are missing the mark at a key moment: equitable advance in early promotion. Across all industries and roles, only 86 women are promoted to manager for every 100 men at the same level. In technical roles—specifically, engineering and product management—just 52 women are promoted to manager for every 100 men. As a result, women are leaving these technical fields in high numbers.

This inspired me to compare my experience with various tech companies across my career, spanning from the late 1990’s in Silicon Valley, to Redmond in the mid 2000’s, with work locations during my career on the East Coast and in the Midwest. While you might think that things are more conservative in “fly over land” of the Midwest—giving women in tech fewer opportunities than on the coasts—the horror stories of the “bro code” culture in the San Francisco Bay Area have dominated in more recent years and lack of support for women founders to find funding both on the west and east coasts is of high concern.

As CEO of a Midwest big data software company, I did not experience gender discrimination when it came to seeking funding from Midwest investors. We even completed our exit strategy in the middle of a global pandemic—acquisition by strategic investor, and today I am a C-suite executive at that strategic investor, leading high-tech in the Midwest. Out of my many experiences (and trust me, I’ve experienced the “good old boys club” and more), I truly believe that having women in leadership at the top is a key component of creating inclusive company culture. With women in roles empowered to build and create company culture, and hiring practices that include seeking men and women for front line roles, new hire roles (straight out of school), management, and executive roles, it breeds for inclusion at all ranks. Really, you need to work at all levels for people to see and believe that a workplace is “female friendly.” And then it builds upon itself. Women who want to work with other women in tech are attracted to the employer.

Key to this is having visible authentic leadership where team members can see women making personnel decisions, such as promotions into leadership roles for midlevel management. If the perception is that the “good old boys” are making career advancement decisions and company strategy decisions, then women are tokenized. Rather, to be equitably led by both men and women, the team needs to see both men and women empowered with this decision-making.

McKinsey reports that:

[E]ven today women earn about half of science and engineering degrees, but they comprise less than 20 percent of the people working in these fields—and the ones who do pursue this career path can often be the only person of their gender in a room. Without a doubt, retaining women in technical roles is crucial for organizations to reach gender parity not just at the top but also throughout the entire workforce. That cannot happen, however, if companies do not retain and advance women in tech roles—and see them as innovators—early in their careers. The task is not simple. It will require management commitment, as well as a systemic approach that includes equitable access to skill building, a structured process that debiases promotions, and a strong culture of support for women.

As with past years, this year, Aunalytics promoted many from the inside into leadership roles, and I am proud to look around and see women in numbers. Not just tokens, but women in numbers from entry level engineers, product and technical services managers, directors, vice presidents, and our C-suite is 50% woman led. I do not advocate for hiring a women just for the sake of diversity, but rather hiring the best person for the position. The fact that we have established a culture that attracts the best in the business, including the best women, is humbling. It’s the goal. You want to attract the best talent and hope that this opens doors for your company to benefit from diverse ideas, experiences, and opinions. This is what makes your products and services stronger. After all, if everyone came to the table with the same idea, creativity would be lacking and R&D stagnant.

At Aunalytics, we are in the business of data, including building AI to provide insights-as-a-service for industry applications, such as customer intelligence for financial services. McKinsey smartly points out that diverse teams can help de-bias the technologies that are ever-present and ever-expanding elements of modern life. Artificial intelligence, for example, has tremendous potential to help humans make fair and impartial choices, but only if the AI systems themselves are not embedded with human and societal biases. For our AI-powered financial services product, both women and men are leading roadmap decisions, driving development team velocity, managing sprints for delivery of new features, developing go to market strategies for new features, and leading our client success teams. Though our goal did not begin with making our AI diverse and inclusive, it is a great impact of the diverse team that we have assembled.

I have long been an advocate for encouraging girls into careers in math and science based upon finding career opportunity and success going down this path myself. We know that higher paid jobs continue to dwell in technology. For women, automation presents not only a myriad of opportunities, but also new challenges. Business is digitally transforming to the next age of technology and it is important for women to keep up. A smart worker looking for career advancement will embrace change and seek out job retraining programs, learning new skills and technologies such as those supporting business intelligence and automation. History has proven the resilience of women to persevere through hardship and adversity, multitask for efficiency, and quickly adapt to change. These exact skills are a recipe for success in business in the digitally transforming world. For women taking intentional steps to learn new technologies to drive business processes, leadership opportunity abounds.

Aunalytics Innovation Lab Accelerates Midsize Financial Institution Business Outcomes with AI Intelligence Services

Powerful Analytics/Intelligence Services and Experienced Data Science Team Provides Affordable Alternative to HyperCloud-based Solutions

South Bend, IN (April 12, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, today highlighted AI-powered Business Intelligence use cases built by the organization’s Innovation Lab. Established to provide deep insights to midsize financial services organizations lacking large AI budgets, the Aunalytics® Innovation Lab’s team of data scientists create and deploy Smart FeaturesTM (data-driven analytic insights) for companies seeking specific predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

Moving from reactive to proactive, predictive and prescriptive IT solutions are one of the key benefits of integrating a properly architected intelligence service enabled by machine learning, deep learning and artificial intelligence. For example, when a properly orchestrated AI/ML solution is in place, a bank can identify a customer purchase from the Home Depot (for example) and deliver predictive insights suggesting the customer may need a HELOC loan (Home Equity Line of Credit). Bank marketing is then able to take advantage of that information through predictive or proactive sales or marketing outreach. Because of the bottom-line impact this technology can have on midsize financial institutions competing against the Fortune 500, there is rapidly increasing demand for the technology nationwide.

The development of AI powered Smart Features for Aunalytics financial services customers is a top Innovation Lab priority. Smart Features are customized to leverage insights obtained from data-driven machine learning models. The Aunalytics service model includes a private analytics cloud as part of the end to end solution, so that customers can manage compute and storage costs associated with data analytics. Part of the customization is data mining transactional banking data and enriching it with the inclusion of algorithm-powered high value fields appended to customer records that reveal insights about a customer. Smart Features provide answers to pressing business questions in order to recommend next steps to take with a particular customer to deepen or extend the relationship, provide targeted sales strategies and marketing campaigns for better customer experiences that yield more profitable business outcomes.

By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments. Other Smart Features are aimed at providing actionable insights for operational efficiency, risk of loan default at time of application, customers at risk for crypto fraud, where to open or close bank branches, ways to minimize customer impact from new federal regulations regarding overdraft protection, and much more.

“Demand for intelligence services by financial services organizations is starting off strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “New functionality will support evolving compliance and security requirements and find opportunities in a financial institution’s own data. Instead of using national averages, we provide insights based on what is actually happening in a financial institution and enrich the data for predictive analytics. Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

Tweet this: .@Aunalytics AI Innovation Lab Supporting Small to Midsize Financial Service Providers with Advanced AI Intelligence Services

#Manufacturing #Recreationalvehicles #RV #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform members’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

IDEA Week 2022 Panel Discussion: Data-Driven Decision Making for Business

IDEA Week 2022 Panel Discussion:

Data-Driven Decision Making for Business: Using Advanced Analytics to Improve Productivity and Profitability

Embassy Suites by Hilton South Bend at Notre Dame, South Bend, IN

Aunalytics to Participate in IDEA Week Panel Discussion on Advanced Analytics in Business

Nitesh Chawla, PhD, Chief Product Officer at Aunalytics and David Cieslak, PhD, Chief Data Scientist at Aunalytics, will be participating in a panel entitled, “Data-Driven Decision Making for Business: Using Advanced Analytics to Improve Productivity and Profitability” during South Bend-Elkhart’s 2022 IDEA Week.

Real-time data collection is changing industry dramatically. The use of accurate and instantaneous data can help companies make better, faster decisions. The members of the panel will be discussing how their companies use predictive analytics to manage and optimize production, including key functions such as maintenance, quality, and planning.