Unlocking the Value of Data Analytics: What Mid-Market Companies Need to Understand

Unlocking the Value of Data Analytics: What Mid-Market Companies Need to Understand

Most mid-market companies make one mistake or another when investing in a data analytics platform, not understanding the many intricacies associated with preparing their data to get the best results. Some of the most common mistakes include:

Most mid-market companies make one mistake or another when investing in a data analytics platform, not understanding the many intricacies associated with preparing their data to get the best results. Some of the most common mistakes include:

- Not realizing they need to build pipelines to get the data from their multiple data sources to the analytics platform

- Tasking IT with implementing a data analytics solution, when the IT department does not have data science skillsets

- Basing analytics on data that is riddled with errors, incomplete, or stale, which compromises quality of decision-making due to the inaccuracy and tardiness of the underlying data.

- Relying on the reporting function of one data source and not taking into account data beyond that source for decision-making

- Using dashboards that provide insights into the past only, and not the future – a gap that needs to be bridged to compete with larger enterprises

It should also be noted that analytics requires massive storage and compute to mine data for actionable insights. Even in a cloud environment, which is less costly to maintain than on-premise servers, data analytics takes up a huge amount of compute to mine transactional data for AI-driven insights. Most data warehouses used by mid-market companies are not built for analytics, and their contracts with public cloud vendors for data storage often incur huge overage charges for compute spikes as millions of calculations are being completed for algorithms to converge for analytics results. Data analytics needs a cloud built for analytics. The mid-market should demand a built-in analytics cloud from an analytics solution, without a third-party public cloud contract to make it work (or attempt to host it in their regular institution data storage).

Industry Knowledge is Key

One of the most important aspects to understand is that there is no one-size-fits-all when it comes to data analytics. The value lies in industry specific data models, which must be built with algorithms using salient data points for a specific industry and appropriately weighted for that industry. For example, to build customer revenue in financial services, mining transactional banking data is important to reveal if a customer is doing business with competing financial institutions so that action can be taken to win this business over. In manufacturing, comparing product inventory at various channels and channel or retail sales locations is important for discerning sales performance and growth opportunities. In healthcare, mining insurance reimbursement claims for underpayments to recapture lost revenue requires comparisons of contracted amounts and fee schedules for multiple private insurance companies, plan coverages, and more. The true business value of analytics lies in industry specific data models and the data enrichment made possible by deep learning and the generation of actionable insights.

The Importance of Having the Right Expertise

This brings us to the requirement for data scientists and business analysts, which assist with achieving powerful and current actionable insights that lead to AI-driven decision-making and better business outcomes. Data scientists build algorithms to detect trends, patterns and predictions based upon the data, to position an enterprise for the future. Business analysts are industry specific and connect the dots between the data points relevant for answering business questions in that particular industry. They also help to design dashboards and other data visualizations to ensure that the insights generated answer questions important to that industry using industry-specific terminology, and analyze analytics results in the context of industry knowledge to reveal growth drivers and other opportunities for driving revenue. Typical IT departments do not have these skill sets.

Data Analytics Platform Requirements

Consider these questions when evaluating a data analytics platform:

- Which data sources are forming the basis for the insights: Is the analysis based upon only some of the data, leaving out important data sources? Do the analytics use the most important data points? Is too much data or the wrong data being used?

- How is the data cleansed for accuracy: To judge the accuracy of the insights, know what is being done to eliminate errors in the underlying data being analyzed. Garbage in leads to exponential garbage out when data is turned over to AI. Can the data be trusted?

- Which algorithms are being used to find insights: Is it a specialized or generic deep learning model? Is it optimized for the type of inquiry or result being sought? Is it tailored to a specific industry and weighted appropriately for that industry and the question posed? Can the results be trusted?

- Are the analytics results providing actionable insights such as how to grow revenue, improve efficiency or achieve other business outcomes? Are the results tied to solving business challenges, and not just AI for the sake of being cool?

Side-by-Side Approach

Most mid-market companies are not in the business of IT or data science. IT is a necessary administrative function for operating a business, but should not become the main focus of most non-tech mid-market companies. However, given the expertise needed to use and maintain most analytics solutions, and the cost of data expert professionals as FTEs, the cost of data management and analytics can quickly overtake mainline business COGS expenses. Given all the complexities and challenges associated with unlocking the true value of data analytics, a new approach is needed that mid-market businesses can afford, enabling them to leverage AI-driven analytics and more effectively compete.

Most mid-market companies are not in the business of IT or data science. IT is a necessary administrative function for operating a business, but should not become the main focus of most non-tech mid-market companies. However, given the expertise needed to use and maintain most analytics solutions, and the cost of data expert professionals as FTEs, the cost of data management and analytics can quickly overtake mainline business COGS expenses. Given all the complexities and challenges associated with unlocking the true value of data analytics, a new approach is needed that mid-market businesses can afford, enabling them to leverage AI-driven analytics and more effectively compete.

A side-by-side service model offers an alternative that goes beyond most tools and platforms on the market by providing a data platform with built-in data management and analytics, as well as access to human intelligence in data engineering, machine learning, and business analytics. Ideally it should operate as a cloud-based platform with a subscription service that places the burden of the data engineering expertise, technical tooling, and building and maintaining the infrastructure on the data management provider.

While many companies offer tools, and many consulting firms can provide guidance in choosing and implementing the tools, integration of all the tools and expertise in one end-to-end solution built for non-technical business users is key for digital transformation success for midmarket businesses.

Learn More

Nothing found.

Top 3 Actions for CIOs to Take Now in a Recession Economy - PDF

Top 3 Actions for CIOs to Take Now in a Recession Economy

The current economy poses a triple threat for business: persistent high inflation; scarce expensive talent; and global supply constraints. However, there are 3 actions CIOs should take to play offense to emerge from a recession on top.

Related Content

Nothing found.

Mid-Market Companies: Here’s How to Manage Your Data for the Best Business Outcomes

Mid-Market Companies: Here’s How to Manage Your Data for the Best Business Outcomes

To make data usable, you need data management. While some think of data management simply moving your data into a cloud or a data lake, it’s much more than this. True data management should focus on making data informative by correlating and integrating data from multiple disparate sources and systems across your organization, adding third-party sources and transactional data created in daily operations.

To make data usable, you need data management. While some think of data management simply moving your data into a cloud or a data lake, it’s much more than this. True data management should focus on making data informative by correlating and integrating data from multiple disparate sources and systems across your organization, adding third-party sources and transactional data created in daily operations.

Data management should also include:

- Cleansing the data to reduce errors

- Normalizing it so that aggregated information may be used for reporting, analytics, and better decision-making

- Governance for compliance with regulated industry and data privacy laws, and to ensure authorized access

- An audit trail of changes made to the data and which systems are using it

To read more, please fill out the form below:

Learn More

Mid-Market Companies: Here’s How to Manage Your Data for the Best Business Outcomes

Mid-Market Companies: Here’s How to Manage Your Data for the Best Business Outcomes

To make data usable, you need data management. While some think of data management simply moving your data into a cloud or a data lake, it’s much more than this. True data management should focus on making data informative by correlating and integrating data from multiple disparate sources and systems across your organization, adding third-party sources and transactional data created in daily operations.

To make data usable, you need data management. While some think of data management simply moving your data into a cloud or a data lake, it’s much more than this. True data management should focus on making data informative by correlating and integrating data from multiple disparate sources and systems across your organization, adding third-party sources and transactional data created in daily operations.

Data management should also include:

- Cleansing the data to reduce errors

- Normalizing it so that aggregated information may be used for reporting, analytics, and better decision-making

- Governance for compliance with regulated industry and data privacy laws, and to ensure authorized access

- An audit trail of changes made to the data and which systems are using it

Cost Concerns

It’s a big job, so it’s no surprise that enterprise-sized companies often have a financial advantage over the mid-market when it comes to data management. That’s because while enterprises likely have in-house teams with the necessary data management skillsets, it’s cost-prohibitive for most mid-market companies to invest in the technical talent needed for data engineering and management. Most mid-market companies do not have the data engineering expertise needed to use data management tools and technologies within their in-house IT team, or their IT team is too busy vigilantly keeping systems stable and secure—which should be IT’s primary and full-time focus.

Nearly half of IT professionals believe that data management is a significant barrier to digital transformation because digital processes and technologies such as the cloud are rapidly evolving and increasingly sophisticated. McKinsey & Company points out that the COVID-19 pandemic significantly accelerated these trends. This means successful data integration and management requires advanced data experts whose job is to stay current on quickly evolving data management technologies, which can be challenging for the mid-market to acquire. And even if you can find this talent, it often does not make financial sense for the mid-market to hire FTEs to obtain the skillsets needed for success.

Heavy Investment

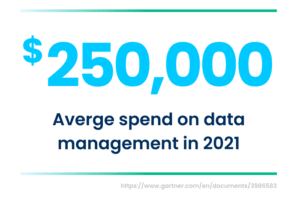

Nevertheless, finding an effective way to integrate data management is non-negotiable for organizations of any size. Our modern way of doing business includes multiple decentralized data sources and applications, often chosen by separate business units for what works best in their daily operations. This means that in order to get a complete picture of your business, data from multiple cloud sources, on premise sources and third party sources needs to be integrated to keep corporate information consistent across the organization and ensure that decision-making is based on an accurate complete picture of the business. Insights for Professionals found that in 2022, 62 percent of senior IT leaders and company executives surveyed plan to invest in data management, with three-quarters honing in on digital technology and data integration. Gartner reported that in 2021, each company’s average spend on data management tools was close to $250,000. Insights for Professionals results show that in 2022, 30% of IT experts intend to invest up to $500,000 on data management, with around one-quarter planning to spend even more.

Nevertheless, finding an effective way to integrate data management is non-negotiable for organizations of any size. Our modern way of doing business includes multiple decentralized data sources and applications, often chosen by separate business units for what works best in their daily operations. This means that in order to get a complete picture of your business, data from multiple cloud sources, on premise sources and third party sources needs to be integrated to keep corporate information consistent across the organization and ensure that decision-making is based on an accurate complete picture of the business. Insights for Professionals found that in 2022, 62 percent of senior IT leaders and company executives surveyed plan to invest in data management, with three-quarters honing in on digital technology and data integration. Gartner reported that in 2021, each company’s average spend on data management tools was close to $250,000. Insights for Professionals results show that in 2022, 30% of IT experts intend to invest up to $500,000 on data management, with around one-quarter planning to spend even more.

Looking ahead to 2024, Gartner also reports that cloud-native platforms will serve as the foundation for more than 75 percent of new digital workloads. This statistic is particularly meaningful for mid-market companies, where end-to-end solutions become a lifeline to leverage cloud technology efficiencies and advancements without the need for hiring in-house expert skill sets. The right end-to-end solution for the mid-market pairs the right combination of tools and technologies with access to the expert talent needed to achieve value and success. The right end to end solution includes everything so that mid-market companies need not spend years trying to piece together a solution out of countless possible tools and technologies. Building it just takes too much time and resources away from the primary business of most mid-market companies—and the mid-market does not have time to wait for this and thrive against competitive pressure from large enterprises.

By 2024, Gartner predicts that three quarters of organizations will have deployed multiple data hubs to drive data and analytics, since companies should only make decisions based on a complete picture of their data. But for mid-market companies with affordability concerns, few solutions meet the need for data management technology that enables companywide data integration as well as third-party data.

Solutions for the Mid-Market

Since mid-market firms that want to stay competitive can’t afford to fall behind enterprise-sized companies when it comes to data management, what can they do? Mid-market companies need technical experts to help build solutions, and research shows these solutions will be cloud-based. Insights for Professionals found that in 2022, close to two-thirds (63 percent) of senior IT leaders and company executives surveyed expect to invest in cloud infrastructure as a service. It makes sense over trying to maintain servers on-premise, recognizing that on-premise solutions have morphed into dinosaurs. According to Gartner, 85 percent of companies will have moved to a cloud-first approach by 2025.

Since mid-market firms that want to stay competitive can’t afford to fall behind enterprise-sized companies when it comes to data management, what can they do? Mid-market companies need technical experts to help build solutions, and research shows these solutions will be cloud-based. Insights for Professionals found that in 2022, close to two-thirds (63 percent) of senior IT leaders and company executives surveyed expect to invest in cloud infrastructure as a service. It makes sense over trying to maintain servers on-premise, recognizing that on-premise solutions have morphed into dinosaurs. According to Gartner, 85 percent of companies will have moved to a cloud-first approach by 2025.

Yet most hyper-scaler cloud service providers are priced for large enterprises, particularly to get the level of help that mid-market companies require. What’s more, many enterprise hyperscalers don’t offer data management, since their services focus only on migrating data to third-party cloud vendor platforms. Mid-market businesses need a hyperscaler capable of providing data management within a mid-market budget.

To ensure that important business decisions are not made based on inaccurate information, the mid-market needs an affordable data-cleansing solution.

Ideally, this means that data management would transform the data into decision-ready, analytics-ready status, including transactional data that sheds light on operations and customer behaviors. Gartner predicts that through 2024, half of organizations will adopt modern data quality solutions to better support digital business initiatives. To keep from falling behind, the mid-market must follow suit.

The Key to Consistency

In order to keep data consistent across the organization, another solution for the mid-market is to adopt master data management (MDM). MDM helps to ensure that if a customer’s contact information is updated through customer support, for example, then accounting and all other functional business units will receive the updated information. If data is kept in multiple siloes, operational efficiency decreases as employees spend time trying to track down data for reporting, analyzing, and determining which details are correct.

MDM technology has traditionally only been accessible to large enterprises due to its high cost, as most MDM platforms are a huge expense and implementation takes more than a year to achieve. These platforms typically also require highly skilled FTEs to use and maintain, which can be another cost consideration that rules out mid-market companies.

The answer to successful mid-market data management is to establish a side-by-side partnership with a data platform company to gain the benefits of working with experts and gain access to highly skilled technical resources to achieve true business value. By getting this help, you can devote your company’s time, resources, and innovation to your business and focus on what you do best.

Learn More

Nothing found.

Focusing on Business Outcomes Leads to Analytics Success

Most organizations today realize that their everyday data holds value, yet is a resource that often remains untapped. Community banks and credit unions in particular are beginning to see the necessity of investing in these initiatives to compete with large banks and fintechs. However, despite investment in technology solutions that enable advanced analytics, many organizations still fail to succeed in realizing the value. According to Gartner, through 2022, only 20% of analytic insights will actually deliver business outcomes. Why do so many of these projects fail? For many organizations, they lack a clear vision of success. Their success measures should not be to simply build a data warehouse or hire a data analyst. The success measures should center around specific business outcomes.

In the video clip below, Rich Carlton, President and Chief Revenue Officer at Aunalytics, talks about how the right combination of technology, data and analytics talent, and a focus on achieving specific business objectives leads to analytics success.

Aunalytics provides an end-to-end data and analytics solution, including the technology, talent and expertise to help organizations focus on achieving actionable business outcomes. This insights-as-a-service model removes the pressure of building up an analytics infrastructure so businesses can focus their energies on realizing the value in their data much sooner. To learn more about how Aunalytics empowers community banks and credit unions with the ability to turn their data into actionable insights, watch our webinar, “Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions.”

Aunalytics Selected for Inc. Magazine’s 5000 List of the Nation’s Fastest-growing Private Companies for Two Years in a Row

Leading Cloud Data Management & Analytics Company Demonstrates Continued Momentum With its Focus on Helping Mid-market Businesses Accelerate Their Digital Transformation

South Bend, IN (August 18, 2022) - Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, has been named by Inc. magazine as one of the nation’s fastest-growing private companies included in its annual Inc. 5000 list. This marks the second consecutive year that Aunalytics earned a spot on the prestigious ranking, representing a one-of-a-kind look at the most successful companies within the economy’s most dynamic segment—its independent businesses. Facebook, Chobani, Under Armour, Microsoft, Patagonia, and many other well-known names gained their first national exposure as honorees on the Inc. 5000.

“The accomplishment of building one of the fastest-growing companies in the U.S., in light of recent economic roadblocks, cannot be overstated,” said Scott Omelianuk, editor-in-chief of Inc. “Inc. is thrilled to honor the companies that have established themselves through innovation, hard work, and rising to the challenges of today.”

The companies on the 2022 Inc. 5000 have not only been successful, but have also demonstrated resilience amid supply chain woes, labor shortages, and the ongoing impact of Covid-19. Among the top 500, the average median three-year revenue growth rate soared to 2,144 percent. Together, those companies added more than 68,394 jobs over the past three years.

Aunalytics offers a robust, cloud-native platform built to deliver enterprise data management, powerful analytics, and AI-driven answers. From the onset, Aunalytics has been dedicated to empowering enterprise and mid-sized businesses located in secondary and tertiary markets, with advanced data management and analytics tools. Typically in these markets, the technical talent needed to use, maintain, and achieve value from the solution is scarce. Aunalytics provides its technology as a managed service paired with the expert talent needed to achieve ROI.

The analytics portion of the platform represents Aunalytics’ unique ability to unify all the elements necessary to process data and deliver AI end-to-end, from cloud infrastructure to data acquisition, organization, and machine learning models – all managed and run by Aunalytics as a secure managed service. Aunalytics continues to gain traction in industries such as financial services, healthcare, and manufacturing where companies are challenged with undertaking the digital transformation required to succeed in the modern world.

“We’re thrilled to be selected for the Inc. 5000 two years in a row – this truly demonstrates the accelerated growth Aunalytics has experienced as a result of providing advanced talent and tools that are typically not affordable for mid-market businesses,” said Rich Carlton, President of Aunalytics. “Our goal from the very beginning has been to address the midsize business sector and we remain committed to serving the best interests of our customers in this category because it is so critical for both innovation and the economy.”

Complete results of the Inc. 5000 can be found at www.inc.com/inc5000.

Tweet this: .@Aunalytics Selected for Inc. Magazine’s 5000 List of the Nation’s Fastest-growing Private Companies for Second Consecutive Year #Inc5000 #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Inc.

The world’s most trusted business-media brand, Inc. offers entrepreneurs the knowledge, tools, connections, and community to build great companies. Its award-winning multiplatform content reaches more than 50 million people each month across a variety of channels including websites, newsletters, social media, podcasts, and print. Its prestigious Inc. 5000 list, produced every year since 1982, analyzes company data to recognize the fastest-growing privately held businesses in the United States. The global recognition that comes with inclusion in the 5000 gives the founders of the best businesses an opportunity to engage with an exclusive community of their peers, and the credibility that helps them drive sales and recruit talent. The associated Inc. 5000 Conference & Gala is part of a highly acclaimed portfolio of bespoke events produced by Inc. For more information, visit www.inc.com.

For more information on the Inc. 5000 Conference & Gala, visit https://conference.inc.com/.

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Aunalytics Extends Its Presence in Greater Columbus Area

Leading Data Platform Provider Joins One Columbus Organization to Help Foster Economic Development in the 11-County Region, and Is a Featured Presenter at a Cybersecurity Forum in Sydney on August 19

South Bend, IN (August 17, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today its membership in One Columbus, the economic development organization for the 11-county Columbus, Ohio region. With an office in Bellefontaine, Aunalytics is committed to contributing its resources to foster the economic well-being of the broader Columbus region.

Working with local and state partners, One Columbus serves as the business location resource for companies across Central Ohio and around the world as they grow, innovate, and compete within the global economy. Its mission is to lead a comprehensive regional growth strategy that develops and attracts the world’s most competitive companies, grows a highly adaptive workforce, prepares its communities for the future, and inspires corporate, academic and public innovation throughout the greater Columbus area.

“As with other regions of the country, the organizations in the Greater Columbus area are interested in increasing their competitive advantage through digital transformation,” said Robert Lizotte, Ohio Local Market Leader for Aunalytics. “As a member of One Columbus, we look forward to demonstrating how this shift can be accomplished in a more secure and efficient way to drive a higher return on business initiatives.”

Aunalytics also announced that its Chief Security Officer, Kerry Vickers, will speak in Sydney, Ohio at the Sydney Shelby Chamber of Commerce cybersecurity forum, “Do You Have a Plan?” on August 19, at 8amET. Vickers is one of nine subject matter experts who will outline the threats and the measures that can be taken to mitigate cyber invasions which occur on a daily basis, to organizations large and small.

Tweet this: .@Aunalytics Extends Its Presence in Greater Columbus Area #Cybersecurity #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list two years in a row, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

1st Source Bank Focuses on Serving Customers with the Selection of Aunalytics Secure IT Managed Services

Company Gains Full Suite of IT Services as Infrastructure Shifts to the Cloud

South Bend, IN (August 2, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, today announced that South Bend, Indiana-based 1st Source Bank, is adopting Aunalytics Secure Managed IT Services so that it can quickly leverage cloud technology and also upgrade baseline infrastructure. Under the new arrangement, Aunalytics’ services will include data center infrastructure, server infrastructure, endpoint management, backup and disaster recovery (DR), and cybersecurity.

Established in 1863, 1st Source Bank assists its clients with building wealth and achieving financial security. The bank is a community financial services provider with community values and has held these same principles while providing outstanding customer service for more than 150 years. 1st Source operates across 81 branches in Indiana and Michigan and oversees a Specialty Finance Group that provides financing for aircraft, trucks, and construction equipment.

Prior to selecting Aunalytics, the organization conducted a thorough evaluation of its technology operations and decided to avoid locking the company into a hardware environment for another five-year period. The IT leadership chose to focus its IT resources on applications, data, and integration priorities of the business instead of continuing to support hardware internally. Additionally, the IT team at 1st Source Bank sought to deploy a near-term cloud option and expand upon its backup and DR options in order to build a more flexible and fully redundant computing environment.

Another draw on the bank’s IT staff was server management, which Aunalytics will also oversee. And with future plans to implement more advanced operational analytics, 1st Source Bank plans to start a full data management initiative, taking its data strategy to the next level.

“When it comes to IT infrastructure, there are several things that we need to maintain control over: The customer experience, data efficiency and innovation,” said Inder Koul, Chief Information Officer, 1st Source Bank. “Customers are intimately linked with their data so it must be closely guarded, and innovation will allow us to test new and compelling services that will provide a range of new and thoroughly secure services. With Aunalytics, there will be a 360-degree view of managed activities and greater context to deepen our relationships with customers.”

The Aunalytics Managed Services team provides ongoing support and security for 1st Source Bank servers, workstations, and networking equipment. The company provides 24/7/365 remote monitoring and management to mitigate the risk of valuable infrastructure becoming unavailable. Hardware and software are fully managed to proactively address any issues. The company's remote monitoring agent includes client-based interactive support, performance management, alerting, asset management and reporting, as well as on-site advisors to help mitigate any possible risks to the environment.

“Successful banks are flipping the script when it comes to IT management, bringing in managed IT and solution experts like Aunalytics to oversee an important range of tasks,” said Rich Carlton, President, Aunalytics. “By enhancing its IT processes with Aunalytics, 1st Source Bank will able to more efficiently and effectively service its clients. As a result, the bank’s customers will benefit from more sophisticated products and services in 2022 and beyond.”

Tweet this: 1st Source Bank Focuses on Infrastructure Modernization and Cloud Adoption with the Selection of @Aunalytics Secure IT Managed Services - https://www.aunalytics.com/category/pr/ #datacenter #datacenterinfrastructure #serverinfrastructure #endpointmanagement #backupanddisasterrecovery #DR #cybersecurity #Dataplatform #Dataintegration #Dataaccuracy #DigitalTransformation

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform members’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

AI Solutions Accelerate Business Outcomes for Midsize Financial Institutions

Midsize financial institutions make better decisions when they utilize AI solutions to discover insights in their data. By combining powerful analytics and intelligence services with an experienced data science team, organizations can gain access to an affordable alternative to HyperCloud-based AI solutions. The Aunalytics® Innovation Lab was established to fulfill the need for deep insights, catering to midsize financial services organizations lacking large AI budgets. This highly specialized team of data scientists produces data-driven analytic insights for companies seeking unique predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

To speed insights for financial services customers, the Innovation Lab has developed AI-powered Smart Features. Smart Features are customized to leverage insights obtained from data-driven machine learning models. By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments.

“Demand for intelligence services by financial services organizations is strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

As the financial services industry is one of the top consumers of business intelligence and analytics, these organizations are on the hunt for cutting-edge technology in their mission to identify customer preferences with regard to financial products as well as the need to better understand operational systems and conditions throughout the business. Data platform and predictive analytics solution providers like Aunalytics are the primary enablers behind many next-generation initiatives and are managing the lion’s share of this work for community banks and credit unions by extracting strategic insights, prioritizing market share, expanding products/services, and monitoring key performance indicators (KPIs) to maintain operational excellence. As a result, this has supported community financial institutions to better compete against national banks by strengthening the level of decision making, while empowering white glove service with powerful data analytics.