Insurance Company Discovers Solution to Data Management Challenges with Aunsight Golden Record

A major global insurance company was creating a new customer-facing portal and needed a data management solution to deliver synchronization of data updates from the portal to its backend insurance policy and analytical systems. Customers would start using the web portal to update information, such as contact information, and the insurance company desired a solution to automatically communicate the data entries and changes to other company systems. The goal was for the most up to date customer data to be available for use in the line of business applications across the company and to ensure that data would remain consistent across ten separate systems for over two million customers cross the globe.

A major global insurance company was creating a new customer-facing portal and needed a data management solution to deliver synchronization of data updates from the portal to its backend insurance policy and analytical systems. Customers would start using the web portal to update information, such as contact information, and the insurance company desired a solution to automatically communicate the data entries and changes to other company systems. The goal was for the most up to date customer data to be available for use in the line of business applications across the company and to ensure that data would remain consistent across ten separate systems for over two million customers cross the globe.

The insurance company initially selected a cloud-native data management solution provided by a company in Silicon Valley. They began a proof of concept project. However, the solution did not perform as planned. Despite being promoted as an out-of-the-box master data management solution, the product required users to write “glue code” to map and connect data sources to the platform. The insurance team soon realized that they would also be responsible for maintaining the glue code and connectors—the solution did not do this. They calculated that they would need to hire at least one more full time employee to do this work.

Further, the platform was built for a technical audience and was not intuitive to use. It required more training than originally thought. And because it was built for a highly technical audience, it limited who from the insurance company team would be skilled enough to use it. The technical skills required to use the platform meant that the burden would be on the IT department to fix data errors reported by business users, and respond to data query requests from the business, in addition to having to build and maintain connectors to data sources and govern and secure the data. This workflow would not be sustainable long-term.

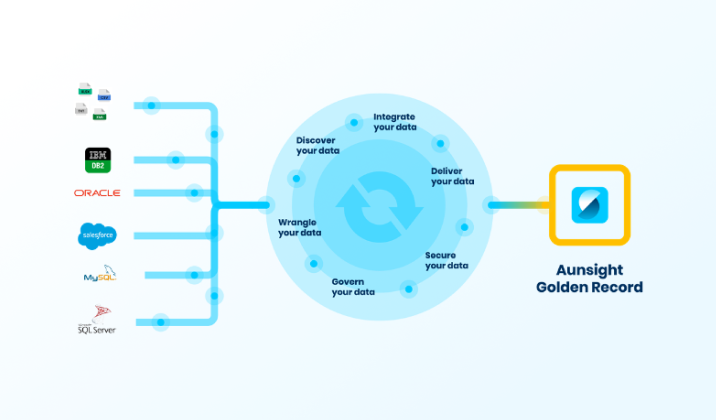

Unsatisfied with the Silicon Valley solution, the global insurance company launched a second proof of concept project to try Aunsight™ Golden Record. Instead of merely integrating the data sources, the Aunsight Golden Record platform cleansed data, eliminated duplicate records, used ELT/ETL and other techniques to normalize data from the different data sources into a single automatically generated schema. To learn how Aunsight Golden Record resolved this company’s data management challenges, download the full insurance use case.

Global Insurance Company Utilizes Aunsight Golden Record Platform to Integrate and Clean Data from Multiple Sources in Real-Time

Global Insurance Company Utilizes Aunsight Golden Record Platform to Integrate and Clean Data from Multiple Sources in Real-Time

A major global insurance company was creating a new customer-facing portal and needed a solution to deliver synchronization of data updates from the portal to its backend insurance policy and analytical systems.

Fill out the form below to receive the use case.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Catalyst University 2022

Catalyst University 2022

Radisson Kalamazoo, Kalamazoo, MI

Aunalytics to Attend 2022 Catalyst University

Aunalytics is excited to once again attend Southwest Michigan First’s Catalyst University 2022 in Kalamazoo, MI. Aunalytics is participating as a speaker sponsor this year, and is pleased to present Chip Heath, best-selling co-author and professor at Stanford Graduate School of Business, teaching courses on business strategy and organizations. He will be speaking about how to translate numbers into things our brains can comprehend and use to tell compelling stories.

Aunsight Golden Record creates a single source of truth for credit union data

Credit unions have a great deal of data spread across various systems. However, it is impossible to create a centralized, accurate and up-to-date record of all of this data manually. Aunsight™ Golden Record automates this process by aggregating, cleansing, and merging data into a single source of truth so credit unions have access to an accurate record of their data in one place.

Watch the video below to learn more about how Aunsight Golden Record, along with the expertise of the Aunalytics team, can help credit unions quickly and painlessly take charge of their data:

What is the 1-10-100 rule of data quality?

The 1-10-100 Rule pertains to the cost of bad quality. As digital transformation is becoming more and more prevalent and necessary for businesses, data across a company is integral to operations, executive decision-making, strategy, execution, and providing outstanding customer service. Yet, many enterprises are plagued by having data that is completely riddled with errors, duplicate records containing different information for the same human customer, different spellings for names, different addresses, more than one account for the same vendor (where pricing is not consistent), inconsistent information about a customer’s lifetime value or purchasing history, and reports and dashboards are often not trusted because the data underlying the display is not trusted. By its very nature, business operations often include manual data entry and errors are inherent.

The true cost to an organization of trying to conduct operations and make decisions based upon data riddled with errors is tough to calculate. That’s why G. Loabovitz and Y. Chang set out to conduct a study of enterprises to measure the cost of bad data quality. The 1-10-100 Rule was born from this research.

In data quality, the cost of verifying a record as it is entered is $1 per record. The cost of remediation to fix errors after they are created is $10 per record. The cost of inaction is $100 per record per year.

In data quality, the cost of verifying a record as it is entered is $1 per record. The cost of remediation to fix errors after they are created is $10 per record. The cost of inaction is $100 per record per year.

The Harvard Business Review reveals that on average, 47% of newly created records contain errors significant enough to impact operations.

If we combine the 1-10-100 Rule, using $100 per record for failing to fix data errors, with the Harvard Business Review statistic on the volume of such errors typical for an organization, the cost of poor data quality adds up rapidly. For an enterprise having 1,000,000 records, 470,000 have errors each costing the enterprise $100 per year in opportunity cost, operational cost, etc. This costs the enterprise $47,000,000 per year. Had the enterprise cleansed the data, the data clean-up effort would have cost $4,700,000 and had the records been verified upon entry, the cost would have been $470,000. Inherit in business services are errors caused by human manual data entry. Even with humans eyeballing records as they are entered, errors escape. This is why investing in an automated data management platform with built-in data quality provides a huge cost savings to an organization. Our solution, Aunsight Golden Record, can help organizations mitigate these data issues by automating data integration and cleansing.

Failure to follow Data Privacy Compliance requirements can be costly. How can you prepare your business?

GDPR, CCPA and the newly coming CPRA (which goes into effect 1/1/2023) require intense data management, or the cost of non-compliance can rise to $1000 per record. These data privacy laws pertain broadly to personal information of consumers including:

- Account and login information

- GPS and other location data

- Social security numbers

- Health information

- Drivers license and passport information

- Genetic and biometric data

- Mail, email, and text message content

- Personal communications

- Financial account information

- Browsing history, search history, or online behavior

- Information about race, ethnicity, religion, union membership, sex life, or sexual orientation

CPRA requires businesses to inform consumers how long they will retain data (for each category of data) and the criteria used to determine that time period of what is “reasonably necessary.” Basically, you have to be prepared to justify the data collection, processing, and retention and tie it directly to a legitimate business purpose.

Now prohibited is “sharing” data (beyond buying and selling it), which is defined as: sharing, renting, releasing, disclosing, disseminating, making available, transferring or otherwise communicating orally, in writing, or by electronic of other means, a consumer’s personal information by the business to a third party for cross-context behavioral advertising, whether or not for monetary or other valuable consideration, including transactions between a business and a third party for the benefit of a business in which no money is exchanged. Arguably, this covers a business working with a marketing firm and sharing data with the agency about leads or prospects to employ cross-content behavioral advertising in a campaign.

Companies now need to be able to inform the consumer what type of data they have about customers, what business purposes it is used for, and retention periods. This information allows them to meet the expanded consumer rights given by the CPRA, including deleting data, limiting types of use for certain types of data, correcting data errors across the organization in every location where it lives, automating and executing data retention policies, and to be ready for auditing. While it is an ethical ruleset that has now been put in place, with Data Privacy Compliance active, companies now have to consider possible non-compliance costs in addition to operational and opportunity costs as well.

As a result of these requirements, companies are now in need of a data management system with built-in data governance to stay in compliance. These data management platforms must be capable of identifying, on a data field-by-data-field basis, where the data originates, each and every change made to the data, and each downstream user of the data (databases, apps, analytics, queries, extracts, dashboards). Without automated data management and governance, it will be humanly impossible to manually find this information by the deadlines required. You need to be able to automatically replicate changes made to the data to all locations where the data resides throughout your organization to make consumer directed corrections and deletions within the time limits prescribed.

Critical Success Factors for Data Accuracy Platforms

The data accuracy market is currently undergoing a paradigm shift from complex, monolithic, on-premise solutions to nimble, lightweight, cloud-first solutions. As the production of data accelerates, the costs associated with maintaining bad data will grow exponentially and companies will no longer have the luxury of putting data quality concerns on the shelf to be dealt with “tomorrow.”

When analyzing major critical success factors for data accuracy platforms in this rapidly evolving market, four are critically important to evaluate in every buyer’s journey. Simply put, these are: Installation, Business Adoption, Return on Investment and BI and Analytics.

Installation

When executing against corporate data strategies, it is imperative to show measured progress quickly. Complex installations that require cross-functional technical teams and invasive changes to your infrastructure will prevent data governance leaders from demonstrating tangible results within a reasonable time frame. That is why it is critical that next-gen data accuracy platforms be easy to install.

Business Adoption & Use

Many of the data accuracy solutions available on the market today are packed with so many complicated configuration options and features that they require extensive technical training in order to be used properly. When the barrier to adoption and use is so high, showing results fast is nearly impossible. That is why it is critical that data accuracy solutions be easy to adopt and use.

Return on Investment

The ability to demonstrate ROI quickly is a critical enabler for securing executive buy-in and garnering organizational support for an enterprise data governance program. In addition to being easy to install, adopt, and use, next-gen data accuracy solutions must also make it easy to track progress against your enterprise data governance goals.

Business Intelligence & Analytics

At the end of the day, a data accuracy program will be judged on the extent to which it can enable powerful analytics capabilities across the organization. Having clean data is one thing. Leveraging that data to gain competitive advantage through actionable insights is another. Data accuracy platforms must be capable of preparing data for processing by best-in-class machine learning and data analytics engines.

Look for solutions that offer data profiling, data enrichment and master data management tools and that can aggregate and cleanse data across highly disparate data sources and organize it for consumption by analytics engines both inside and outside the data warehouse.

Aunalytics CMO Katie Horvath to Participate as a Panelist at Traverse Connect’s Economic Summit 2021

Horvath to Address Data Analytics and Cybersecurity at Annual Event that Looks Ahead at the Emerging Business Climate and Highlights Trends, Economic Issues, and Expert Knowledge

South Bend, IN (November 2, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, is pleased to announce that Katie Horvath, chief marketing officer for Aunalytics, has been invited to participate as a panelist at Economic Summit 2021 on November 2, 2021 in Traverse City, hosted by Traverse Connect. The annual summit will highlight trends, speak to issues affecting the economy, and share knowledge from economic experts to support organizations’ efforts to thrive in today’s challenging business climate.

Horvath will participate in the summit’s Economic Outlook Luncheon panel, which will address the economic outlook for the Traverse City region. She will specifically talk about the current state of cybersecurity and how it is impacting business insurance. For the past six years, the finance sector has ranked #1 as the most cyberattacked industry, with cyber criminals continuing to double down efforts to breach financial data, compromise accounts, and profit from this industry with increasingly sophisticated attacks and campaigns. Horvath will also discuss how imperative data analytics has become for regional financial institutions and healthcare providers with the current business climate.

The panel will also include Jeff Korzenik, managing director and chief investment strategist for Fifth Third Investment Management Group; Jamie Gallagher, president and chief executive officer for Faber-Castell USA; and Stacie Kwaiser, chief operating officer for Rehmann.

“I’m honored to participate in this year’s Economic Summit in light of the dynamic work and economic challenges and opportunities that exist at every level in our environment today,” said Horvath. “It has never been more important to gather information, exchange ideas, and explore possibilities. I look forward to being a part of the Economic Outlook panel and discussing very important issues, such as the importance of cybersecurity and banking, that impact our economic health and well-being.”

The Economic Summit will be held at the Grand Traverse Resort & Spa, and feature a Business Showcase highlighting 20 businesses in the Grand Traverse region. Aunalytics is pleased to be a sponsor of this year’s Economic Summit.

About Katie Horvath

Katie Horvath is Chief Marketing Officer for Aunalytics, Inc. She has been recognized by the United States Congress with a leadership award for innovative business models in healthcare for her work in rural oncology care with Munson Medical Center. Horvath is one of the newest members appointed by the Governor to the Michigan Women’s Commission. She serves on the Advisory Board for Industrial & Operations Engineering at the University of Michigan School of Engineering, and the Michigan Artificial Intelligence Advisory Board through the Center for Automotive Research. Horvath is a mentor and advisor for 20Fathoms tech incubator in Traverse City and a regular speaker at the National Cancer Prevention Caucus and Workshop on Capitol Hill and a member of the Forbes Communication Council.

Tweet this: .@Aunalytics CMO Katie Horvath to Participate as a Panelist at Traverse Connect’s Economic Summit 2021 #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com