ICBA Live 2024

ICBA Live 2024

Independent Community Bankers of America

Orlando World Center Marriott, Orlando, FL

Aunalytics to exhibit at ICBA LIVE, presented by Independent Community Bankers of America

Aunalytics is excited to attend ICBA LIVE 2024, powered by the Independent Community Bankers of America. Representatives from Aunalytics will be exhibiting at booth #241 and talking to attendees about our how our customer intelligence solution enables banks to increase deposits and more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

Fintech Meetup 2024

Fintech Meetup 2024

The Venetian, Las Vegas, NV

Aunalytics to attend the 2024 Fintech Meetup in Las Vegas

Aunalytics is excited to attend the 2024 Fintech Meetup in Las Vegas, Nevada. Aunalytics will be meeting with attendees and giving demos at booth SC1 on how financial institutions can use AI-driven insights to improve customer and member engagement and increase wallet share. Event attendees can learn more about the Daybreak™ for Financial Services solution which enables community banks and credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

LAUNCH 2024 - The Carolinas Credit Union League

LAUNCH 2024

The Carolinas Credit Union League

Embassy Suites by Hilton Charlotte Concord, Concord, NC

Aunalytics to present and exhibit as an Ignition Sponsor at LAUNCH 2024, powered by the Carolinas Credit Union League

Aunalytics is excited to attend LAUNCH 2024, powered by the Carolinas Credit Union League as an Ignition Sponsor. Brad Thien of Aunalytics will be speaking on how credit unions can use AI-driven insights to improve member engagement and increase wallet share. Event attendees can learn more about the Daybreak™ for Financial Services solution at the Aunalytics exhibit booth—Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

Becoming More Customer-Centric—How Community Banks and Credit Unions Can Cultivate This Mindset and Act on It

Personal, white glove service has always been a competitive advantage for community banks and credit unions. Therefore, a customer-centric mindset is vital. While a customer may be just another number at a large, national bank, community-based financial organizations can get to know people on a more personal level—and they may in turn feel a larger sense of connection and loyalty to a bank or credit union that has a history within the community.

But, as banking moves to be more digitally-focused, a familiar, friendly face at the bank counter is not enough, especially as younger generations embrace the convenience of online and mobile banking. Customer touch points are increasingly digital—which isn’t necessarily a bad thing. Financial institutions now have a wealth of data about each individual. Large, national banks are already using this to their advantage.

Many large financial institutions have invested billions in technology, including data and AI-based solutions that allow them to fully embrace customer centricity in their business practice. This allows them to foster relationships based heavily on digital interactions.

But without ample resources that can be focused on developing data-backed solutions, how can a smaller, community-based institution compete?

Adopting a Customer-First Mindset

While a focus on the customer or member is the bread and butter of most community banks and credit unions, there is always room for improvement. While customer centricity is a sought after ideal, only about 9% of organizations have achieved this goal. This can make it a competitive differentiator for organizations who manage to fully embrace this mindset. To become a truly customer-centric organization, it’s not enough to provide a high level of customer service. It requires customer centricity to be embedded in the organization’s DNA and across all functional areas of the financial institution.

A customer’s interaction with an organization goes beyond the tellers at the branch, or a mobile app’s user interface (though these are each vitally important elements!) There are some questions to consider when evaluating whether an organization is truly putting the customer first:

- Are your products and services what your customers really want and need?

- Are recommendations and advice being tailored to each unique individual?

- Are customers experiencing seamless interactions across all touchpoints?

- Are you using direct feedback and data to inform decision-making?

- Are you able to provide customers with “unexpected value,” beyond what they would normally expect from their financial institution?

In order to reach these lofty goals, organizations must first get buy-in across the organization and actively work to shift goals and mindsets.

Embracing The Power of Data and AI

Once a bank or credit union has determined that it is on its way to cultivating a customer-centric mindset, it is time to start taking action. One of the most powerful ways to become more customer-centric is to rely on insights from data. But the first step is to organize data into a 360-degree view of each customer—breaking down data silos in order to capture the entire customer journey.

Once data has been aggregated, cleansed, and organized around each customer, it can be used to make data-driven decisions, personalize the customer journey, and increase the effectiveness of marketing campaigns, and optimize operations. With the power of AI and predictive analytics, organizations can:

- Enhance digital interactions with chatbots;

- Enact offer relevant product suggestions;

- Determine which customers or members are most likely to churn;

- Identify potential new customers who look the most like their current best customers;

- Optimize loyalty programs to increase customer satisfaction; and more.

Where To Start?

If all of this sounds like a lofty goal, that is because it is. This undertaking can be a huge challenge for most midsized banks and credit unions. In many cases, it could take several months—or even years—to get to this point. That is why many organizations are looking outside their own walls to work with experienced partners to guide them through the process along with pre-built technology solutions that can reduce the time to implementation.

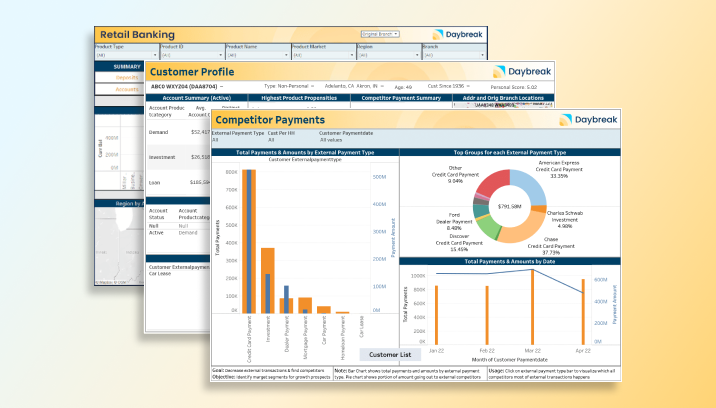

To meet the unique challenges of community banks and credit unions, Aunalytics has developed the Daybreak Analytics Database—an end-to-end data and analytics platform using AI and machine learning to enrich a bank or credit union’s existing data and create a customer-centric view. This ultimately allows midsized financial institutions to more effectively identify and deliver new services and solutions so they can increase wallet share and better compete with large financial institutions.

Investment in Artificial Intelligence is Vital for Banks and Credit Unions

Has your bank or credit union made investments in artificial intelligence yet?

Advances in artificial intelligence (AI), and the promise it holds for the future, have been making news all year. And it’s no wonder that financial institutions are taking notice—a recent survey from the Economist Intelligence Unit found that 77% of bankers believe that unlocking value from AI will be the differentiator between winning and losing banks. Yet, many institutions are falling behind in AI maturity.

Despite its promise, making a large investment in artificial intelligence may seem risky to many midsized financial institutions. Hiring talent, developing a data management and analytics strategy, building a data platform, and creating AI models can be both time- and resource-intensive. Banks and credit unions want to ensure that the efforts spent to get an AI program off the ground will yield a high ROI, especially in times of economic uncertainty. Yet, failure to innovate and make progress toward digital transformation is not always an option in the highly competitive landscape.

Financial institutions find many uses for AI technologies

Thankfully, an investment in artificial intelligence can improve many processes across an institution. AI can optimize both time- and resource-intensive tasks, decrease risk, and increase revenue by improving the customer experience. For instance, by applying AI and machine learning algorithms to transactional data, banks and credit unions can gain insights into customers or members’ habits and preferences. Some use cases include:

- Detecting and preventing fraud

- Identifying loan default risk at the time of application

- Predicting customer churn

- Winning back business by discovering customer payments going to competitors, and subsequently making a more attractive offer

- Predicting the next best product for each customer then targeting them with the right product at the right time

- Calculating customer value scores in order to better allocate resources to target more valuable customers

Don’t get left behind

Large banks are already utilizing artificial intelligence use cases at scale. In a recent letter to shareholders, Jamie Dimon, Chief Executive Officer of JPMorgan Chase wrote, “Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success—the importance of implementing new technologies simply cannot be overstated.”

Because of this focus, his company has made tremendous investments in AI. They currently have over 300 AI use cases in production, and employ almost 3,000 people in data management, data science, and AI-research-related roles. This underscores how vital these new technologies are to success in the future.

Unfortunately, not every institution has access to talent and technology at the scale of JPMorgan Chase. That’s why Aunaytics has developed a cloud-based data and analytics platform to provide data management, advanced reporting, and predictive AI and machine learning solutions for midsized community banks and credit unions.

Daybreak for Financial Services allows institutions to learn more about their customers and members in order to provide a better overall experience—which in turn reduces risk, increases wallet share, and reduces expenses.

The Truth About Artificial Intelligence in Business

Is the existence of Skynet imminent or is that simply a sci-fi trope? In this brief video, Dr. David Cieslak, Chief Data Scientist at Aunalytics, talks about the capabilities of Artificial Intelligence in business, some potential concerns with AI, and where the technology is headed in the future.

While there exists a broad range of applications for AI, in the business world, this technology has the potential to drastically change how we understand our customers and how we use our data to interact with them. Once created and trained with customer data, AI has the ability to quickly provide suggestions and insights that would otherwise be prohibitively difficult or even impossible to observe on your own.

For example, Aunalytics’ Daybreak for Financial Institutions platform uses a proprietary AI model that can predict when a customer or member is likely to churn, to suggest which product to promote based on what that specific person is most likely to buy, to identify where the best branch locations are, and more. These types of insights are hiding in your data, simply waiting to be uncovered. To learn more about the business applications of AI, you can view the extended interview here.

David Cieslak, PhD, is the Chief Data Scientist at Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors. Prior to Aunalytics, Cieslak was on staff at the University of Notre Dame as part of the research faculty where he contributed on high value grants with both the federal government and Fortune 500 companies. He has published numerous articles in highly regarded journals, conferences, and workshops on the topics of Machine Learning, Data Mining, Knowledge Discovery, Artificial Intelligence, and Grid Computing.

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

In this interview, David Cieslak, PhD, the Chief Data Scientist at Aunalytics, describes complex analytics concepts such as artificial intelligence, machine learning, and deep learning, and explains how they are useful for businesses today—and will continue to be in the future. David has been with Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors.

Fill out the form below to receive an email with a link to the interview.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

A Data Scientist's Thoughts on Artificial Intelligence, Business, and the Future

In this interview, David Cieslak, PhD, the Chief Data Scientist at Aunalytics, describes complex analytics concepts such as artificial intelligence, machine learning, and deep learning, and explains how they are useful for businesses today—and will continue to be in the future. David has been with Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors.

Related Content

Do you have the tools and talent to set your organization up for analytics success?

Most business leaders would agree: data is a valuable asset. Having up-to-date, accurate data with which to make data-driven decisions currently gives organizations an edge, but eventually, this will become table stakes in most industries, simply to remain competitive. However, an up-front investment in a strong technical foundation and a shift to embrace analytics culture throughout the organization are required to achieve analytics success.

Unfortunately, there are many challenges to overcome when trying to bring siloed and dirty data from multiple sources across your business to a single place to be analyzed, including a lack of time and manpower, and the need for data points that don’t currently exist, to name a few. Using data analytics, it becomes possible to better optimize your business by discovering operational efficiencies, reducing costs, tracking customer trends across your organization, and making strategic decisions based on predictive data models. Is partnering with analytics experts the best choice for mid-sized institutions, or should you hire Full-Time Employees (FTEs) to build and manage your data?

There are multiple ways an analytics platform could be created—we’re going to look at two today.

Build it yourself

The first is choosing to create a custom data platform. While not a bad choice, it could take a FTE years to create your analytics platform—if it’s ever finished. An engineer hired to build a custom platform may leave you high and dry with no one to step in to help. Something like this could cost your business months—or even years—of lost money and productivity, leaving you with nothing to show for your platform building efforts.

Even if your data engineer remains with your business, there are other challenges you may encounter. It can be difficult for a single FTE to stay up to date on the newest technological advances and upgrades. Especially when that person is not only expected to clean and update information on thousands of data records, but also take care of system and software updates, keep up with changing trends in the analytics world, and more. A lack of manpower can also make tasks like finding trends in your data nearly impossible, as data processing may be far behind where your most recent and relevant business analytics can be found.

When it comes to advanced analytics, you would need to find and hire additional employees who are skilled in advanced data analytics, machine learning, and AI techniques, and ideally, familiar with your industry. This can be easier said than done. Data scientists, like many in the technology field, are in high demand, and may be difficult to find and hire in smaller geographical markets.

Work with a partner

A different option is working with a trusted technology partner who brings data analytics expertise straight to you. Partnering with an end-to-end provider often saves your company money while allowing someone else to take care of the nitty gritty that goes into creating reports, graphs, charts, and more. Additionally, you are guaranteed to have access to the team you need to build algorithms and find insights in your data. A partner will consistently provide you with the right tools, talent, and resources, while supporting you the entire way. But how could an Analytics as a Service partner help you find the true value of your data?

A good partner will be able to offer the required resources to achieve analytics success—a foundational data platform, automated data management, access to data experts, and data delivery methods such as relevant and actionable dashboards and reports. Imagine having a regular report, generated overnight, every night, for you to review first thing in the morning—without having to invest in many new FTEs and years of development time.

When looking for a data analytics partner, all the things above are important for creating a successful partnership that leads to analytics success. Aunalytics provides data processing and analytics help and would never expect you to go it alone. When you hire us, you hire data scientists, data engineers, and data analysts, reducing the need for multiple expensive FTEs. By having access to a team of data experts by your side, your business can find itself enabled to make better, faster, and smarter decisions based on consistent, real-time data.

ACCELERATE 23 - Minnesota Credit Union League

ACCELERATE 23 - Minnesota Credit Union League

Radisson Blu MOA, Bloomington, MN

Aunalytics to attend ACCELERATE 23 as a Silver Sponsor

Aunalytics is excited to attend the Minnesota Credit Union League’s annual conference, ACCELERATE 23 in Bloomington, MN. Representatives from Aunalytics will be speaking with attendees and presenting the Daybreak™ for Financial Services solution at their exhibit booth. Daybreak enables credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks through AI and advanced analytics. Financial institutions can use these AI-driven insights to improve customer and member engagement and increase wallet share.