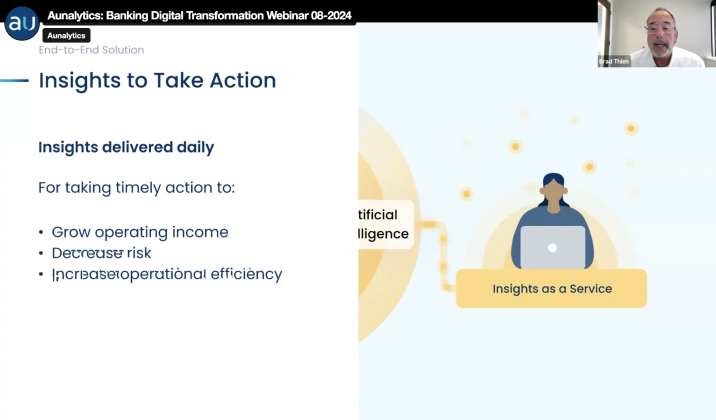

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Fill out the form below to receive a link to the article.

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Daybreak Allows Financial Institutions to Increase Wallet Share with Competitor Payment Smart Feature

In the competitive financial services landscape, increasing revenue through new customer acquisition alone is a challenge. According to the Harvard Business Review, it can be anywhere from five to 25 times more expensive to acquire a new customer than to retain an existing one. While new customer acquisition is important, retention and expansion of existing relationships should be a high priority—especially during economic downturns when reducing costs is imperative. A recent report by Bain & Company states, “In financial services, a 5% increase in customer retention produces more than a 25% increase in profit. Why? Return customers tend to buy more from a company over time.” Therefore, it makes sense for community banks and credit unions to focus on retention and increasing wallet share of existing customers.

Winning Back Business by Identifying Competitor Payments

Many community bank customers and credit union members utilize multiple financial institutions for various products. They may have a checking or savings account at their local bank or credit union, but an IRA account at a large, national investment firm, or a loan through another financial institution. By identifying which customers have external accounts and which products they may have through other institutions, community banks and credit unions can take steps to win back that business and increase wallet share of their existing customers and members. Daybreak‘s Competitor Payments Smart Feature mines transactional data and uses AI algorithms to flag external products with competing financial institutions on all active customers/members. These insights can be used to make more attractive targeted offers to win back business.

Watch the video below to see how banks and credit unions can utilize Daybreak’s Competitor Payments insights to win back business from competing institutions:

In addition to providing the ability to discover competitor payment insights in transactional data, Daybreak allows community banks and credit unions to compete with large financial institutions by…

- Understanding customers,

- Optimizing processes, and

- Revealing actionable insights.

See how Daybreak Customer Intelligence for Financial Institutions is the customer data platform that makes it easier for community banks and credit unions to gain actionable insights and achieve positive business outcomes.

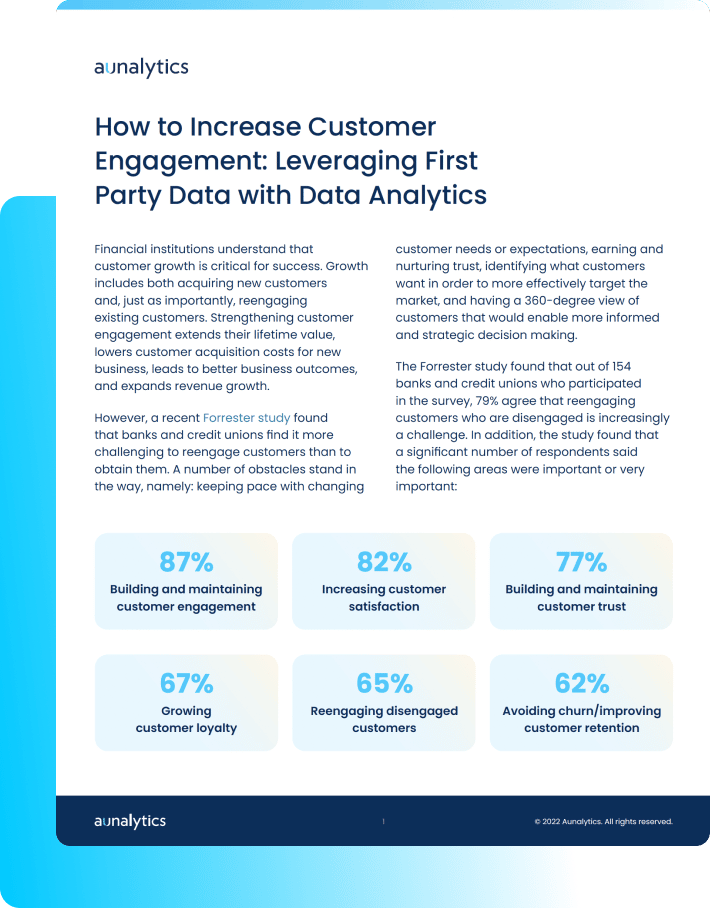

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

2022 Annual CUSO Conference

2022 Annual CUSO Conference

TradeWinds Island Grand Resort, St. Petersburg, FL

Aunalytics to attend the 2021 Annual CUSO (Credit Union Service Organization) Conference

Aunalytics will be attending the Annual CUSO (Credit Union Service Organization) Conference as a lunch sponsor. Aunalytics has developed Daybreak™ for Financial Services, which enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

The Financial Brand Forum 2022

The Financial Brand Forum 2022

ARIA Hotel & Casino, Las Vegas, NV

Aunalytics to Attend the The Financial Brand Forum 2022 as a Gold Sponsor

Aunalytics is thrilled to attend the The Financial Brand Forum 2022 in Las Vegas, Nevada as a Gold Sponsor. Join Aunalytics at booth #413, where representatives will be demonstrating Daybreak™ for Financial Services, a cloud-native data platform which enables financial institutions to focus on critical business outcomes and make data-driven business decisions. Daybreak enables a variety of use cases through AI-driven insights, such as reducing customer churn, increasing wallet share, and optimizing branch allocation decision-making.

2022 Ohio Bankers League Annual Meeting

2022 Ohio Bankers League Annual Meeting

Hyatt Regency, Columbus OH

Aunalytics Excited to Attend the 2022 OBL Annual Meeting as a Reception Sponsor

Aunalytics is excited to attend the 2022 Ohio Bankers League (OBL) Annual Meeting as a Reception Sponsor. Aunalytics will be demonstrating Daybreak™ for Financial Services, a cloud-native data platform which enables community banks to focus on critical business outcomes and make data-driven business decisions in order to compete with large financial institutions.