Aunalytics to Showcase Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at August Financial Services Events

Leading Data Platform Provider Will Feature Its Aunalytics Daybreak for Financial Services and How Data-driven Marketing Can Help Win Business and Strengthen their Position in Regional Markets

South Bend, IN (August 9, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today its participation at three financial services events in August. The company will showcase its DaybreakTM for Financial Services advanced data analytics solution and demonstrate how midmarket banks and credit unions can use artificial intelligence (AI)-powered data analytics to increase business wins and compete more effectively.

August events include:

- Community Bankers Association of Ohio Annual Conference, August 9-11

- CULytics Day 2022, August 22

- Jack Henry Annual Conference, August 29-September 1

Daybreak for Financial Services enables midsize financial institutions to gain customer intelligence and grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Personalized marketing in a digital world matters more than ever before, especially for midmarket banks and credit unions that have traditionally relied upon hometown, white glove service to win customers,” said Katie Horvath, Chief Marketing Officer of Aunalytics. “Using Aunalytics Daybreak for Financial Services, mid-market banks and credit unions can now deploy advanced analytics to more highly personalize their interactions with customers and members. It enables them to target-market more efficiently with the right product offering at the right time, and win business away from competitors to increase revenue. We look forward to meeting with bankers and credit unions in August, and demonstrating how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Tweet this: .@Aunalytics to Showcase Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at August Financial Services Events #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Timing is Everything in Delivering Data-Driven Insights for Bankers

Many banks and credit unions have set their sights upon initiatives that would allow their teams to make informed, data-driven decisions to improve their business. But when it comes to delivering data-driven insights, timing is everything. Currently, too many mid-sized credit unions and banks rely upon reporting modules from their banking cores for trying to understand business performance and making business decisions. The problem with doing this is two-fold.

First, core reporting only shows you what happened in the past. It does not give you predictive insights for acting now or in the future. As we know, market conditions can rapidly change. Looking back on what worked for your institution three months ago may be informative on past performance, but it is of limited value in deciding what to do next. Your analysis is limited to a review of the past, and then guesswork for what to do today. This is a business review, not data analytics.

Second, by the time that most financial institutions get their core reports, it is months later. This means that if you are basing decision-making on analysis of the core reports, you are making decisions based upon stale data. As we know, market conditions can rapidly change. For example, if you are looking back 3-6 months, you may likely see strong mortgage lending performance. But as we know, with climbing interest rates and inflation, mortgages are not the hot product that they were six months ago. If you decided to double-down on marketing and sales campaigns for achieving new mortgage loans, you would not have the return on this investment that you might have had six months ago. The core report data is stale and does not reflect the market changes.

Timing is Crucial

For this reason, it is critical that your team be enabled to act based upon fresh data. This allows your team to be nimble and pivot strategy as the market changes. The change in the mortgage lending business is an obvious one, given changes by the Fed in interest rates. But what about subtle changes in the market? What about changes for each of your members or customers individually in their life circumstances and behaviors? Having information on what was relevant to a customer three months ago does little to help you act today.

For this reason, it is critical that your team be enabled to act based upon fresh data. This allows your team to be nimble and pivot strategy as the market changes. The change in the mortgage lending business is an obvious one, given changes by the Fed in interest rates. But what about subtle changes in the market? What about changes for each of your members or customers individually in their life circumstances and behaviors? Having information on what was relevant to a customer three months ago does little to help you act today.

For example, when a member changes jobs you have a window of opportunity to market an IRA product before the member likely settles into a new 401(k). If you market the IRA to the member three months later, she likely has rolled over into the new 401(k) and you missed your opportunity. Yet if you had a data analytics solution that provided daily insights, such as a change in the income stream pattern by amount or timing of payroll deposits, this could alert you to a change in employment status as it is happening. This gives your team the ability to sell an investment product when the opportunity is ripe.

Delivering Fresh Data-Driven Insights

Only predictive data analytics can deliver daily insights at scale for all of your customers or members. By detecting trends and patterns revealing growth drivers through predictive analytics, your team can be nimble and positioned for informed decision-making. This leads to doing more of what is working and less of what is not effective in growing operating income and customer loyalty.

2022 Jack Henry Connect

2022 Jack Henry Connect

San Diego Convention Center, San Diego, CA

Aunalytics participates as a Beverage Break Sponsor at 2022 Jack Henry Connect

Aunalytics is excited to attend the 2022 Jack Henry Connect and sponsor the beverage break. Aunalytics will be demonstrating Daybreak™ for Financial Services at their booth. Daybreak enables community banks and credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

2022 CULytics Day

2022 CULytics Day

Aunalytics to showcase Daybreak at 2022 CULytics Day

Aunalytics is pleased to sponsor 2022 CULytics Day, and will be hosting a virtual booth. Aunalytics has developed Daybreak™ for Financial Services, a cloud-native data platform that enables users to focus on critical business outcomes. Daybreak seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs AI and machine learning to glean intelligence from transactional data.

CBAO 48th Annual Convention

CBAO 48th Annual Convention

Hilton Columbus at Easton, Columbus, OH

Aunalytics is proud to be a Golf Lunch Sponsor and Exhibitor at the CBAO 48th Annual Convention

Aunalytics is excited to exhibit at the 2022 Community Bankers of Ohio 48th Annual Convention and serve as Lunch Sponsor at the Annual Golf Outing at Delaware Golf Club. Aunalytics will be demonstrating Daybreak™ for Financial Services, a cloud-native data platform which enables midsized banks to focus on critical business outcomes and make data-driven business decisions in order to compete with large financial institutions.

2022 OBL Bankers Cup

2022 OBL Bankers Cup

Jefferson Country Club, Blacklick, OH

Aunalytics excited to sponsor the 2022 OBL Bankers Cup Golf & Cornhole Tournament

Aunalytics is excited to sponsor the Ohio Bankers League’s 2022 OBL Cup Golf & Cornhole Tournament. Aunalytics has developed Daybreak™ for Financial Services, a cloud-native data platform, to enable community banks to focus on critical business outcomes and make data-driven business decisions in order to compete with large financial institutions. Aunalytics also offers a complete suite of security and managed IT services to proactively protect and maintain organizations’ technologies, allowing staff to work without interruptions.

AI Solutions Accelerate Business Outcomes for Midsize Financial Institutions

Midsize financial institutions make better decisions when they utilize AI solutions to discover insights in their data. By combining powerful analytics and intelligence services with an experienced data science team, organizations can gain access to an affordable alternative to HyperCloud-based AI solutions. The Aunalytics® Innovation Lab was established to fulfill the need for deep insights, catering to midsize financial services organizations lacking large AI budgets. This highly specialized team of data scientists produces data-driven analytic insights for companies seeking unique predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

To speed insights for financial services customers, the Innovation Lab has developed AI-powered Smart Features. Smart Features are customized to leverage insights obtained from data-driven machine learning models. By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments.

“Demand for intelligence services by financial services organizations is strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

As the financial services industry is one of the top consumers of business intelligence and analytics, these organizations are on the hunt for cutting-edge technology in their mission to identify customer preferences with regard to financial products as well as the need to better understand operational systems and conditions throughout the business. Data platform and predictive analytics solution providers like Aunalytics are the primary enablers behind many next-generation initiatives and are managing the lion’s share of this work for community banks and credit unions by extracting strategic insights, prioritizing market share, expanding products/services, and monitoring key performance indicators (KPIs) to maintain operational excellence. As a result, this has supported community financial institutions to better compete against national banks by strengthening the level of decision making, while empowering white glove service with powerful data analytics.

Aunalytics Dashboards Deliver Insights and Actionable Business Opportunities to Mid-Market Banks and Credit Unions to Achieve Greater Visibility into Data, Strengthen Regional Market Position, and Compete More Effectively

Dashboards Augment Capabilities of Aunalytics Daybreak for Financial Services Cloud-Native Data Platform to Drive Customer Intelligence and Higher Strategic Value

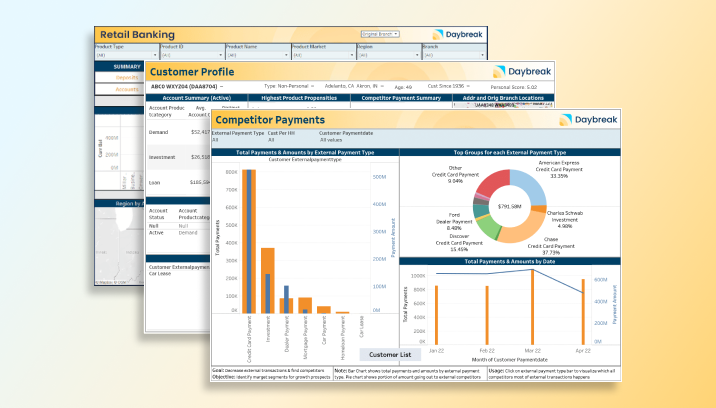

South Bend, IN (July 12, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today a new set of pre-built dashboards that augment the value delivered by the company’s DaybreakTM for Financial Services solution. The Daybreak dashboards are designed to deliver insights and actionable business results by revealing opportunities associated with customer, competitive, marketing, lending, and branch data and automatically presenting the data in a way that is easily understood, without any manual processes required.

Customer intelligence and personalized marketing in a digital world matters more than ever before, especially for mid-market banks that have traditionally relied on hometown, white glove service to win customers. With Aunalytics Daybreak for Financial Services, midsize financial institutions can target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. With the new Daybreak dashboards, mid-market banks and credit unions can achieve greater visibility into their data and identify more opportunities to strengthen their position in regional markets and compete more effectively.

The Daybreak for Financial Services cloud-native data platform integrates and cleanses data for accuracy and mines transactional data daily with AI-powered algorithms for customer intelligence and timely actionable insights that drive strategic value.

New Daybreak Dashboards include:

Customer Profile - This dashboard delivers an enriched profile of individual customers, powered by AI- insights that deliver intelligence on future customer growth beyond mere aggregations and reports of the past. The Customer Profile offers a 360-view of each customer including analysis of data integrated from multiple sources across the organization, and mined daily for timely fresh insights that can be acted upon. Banks can identify accounts that a customer has with competitors in order to make a more attractive offer to win their business and grow customer value. They can also determine the next best product offering for customers today, based upon their transactional behavior, and gain a deeper understanding of customers and the branches they use, beyond the origination branch.

Competitor Payments - Competitor Payments reveals insights for each customer, each competitor, and type of financial product. The dashboard tracks competitor payments by amount and how long they have been taking place so that a banker or credit union can determine when customers or members are likely to look for a new product, then create better offers as a result. Competitor Payments can drill down on credit cards, mortgages, auto loans, and investment products to identify a more competitive offer and use the segmented Customer List dashboard to target them. By using targeted competitive offers made to the right customers at the right time, banks can efficiently grow value from customers to increase net deposits.

Retail KPI - Retail KPI (key performance indicators) help banks to increase total deposits and accounts, and identify growth opportunities and potential. The dashboard delivers key performance metrics to retail leaders to understand the drivers of their account and deposit growth. It enables them to analyze deposits and balances over time and understand growth trends. It also provides data for overall institution performance, as well as detailed performance for each region, branch, market, product type and individual product to identify opportunities for growth and understand which branches are driving change.

Lending KPI - The Lending KPI dashboard delivers key performance metrics to lending leaders to understand the drivers of their loan and loan balance growth. It enables them to view trends over time for original loan amounts and outstanding loan balances. The dashboard provides data for overall institution lending performance and detailed performance of lending by branch, region, market, product type, and each product to uncover opportunities for growth and understand which products, team members, and branches are driving growth. The accompanying Lending Officer dashboard reveals performance insights by team member and shows loans closed and principle amounts over time.

Marketing KPI - This dashboard delivers key performance metrics to marketing leaders on campaign effectiveness to improve targeting and reduce account acquisition cost. It enables banks to target their institution’s marketing to reach the right customer at the right time with the right offer, making marketing operations more efficient and successful by using a data driven approach. Capabilities include:

- Track campaign performance by resulting deposits and new accounts

- Understand customer acquisition cost by region, branch and product type

- Assess account and balance growth by region, branch, and product type

- Understand new account demographics

Branch Reassignment - The Branch Reassignment dashboard delivers key information to business leaders to understand branch utilization and change over time based on where a customer originates and performs business. They can identify branch growth opportunities and areas where efficiencies can be improved, and view branch utilization to see customer banking patterns. With this, banks can determine which products to market at a particular branch and more precisely target those customers who are likely to need that product.

“Daybreak dashboards offer more than just reporting on the past. They connect the dots of relevant data and use predictive analytics to create a picture revealing intelligent insights that help financial institutions build smarter business strategies,” said Kyle Davis, Vice President of Daybreak, Aunalytics. “Designed to accelerate the value derived from AI-powered insights, Daybreak dashboards enable mid-market banks and credit unions to more clearly see the opportunities presented by their data and take action to increase net income and advance their competitive position.”

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com