Aunalytics Dashboards Deliver Insights and Actionable Business Opportunities to Mid-Market Banks and Credit Unions to Achieve Greater Visibility into Data, Strengthen Regional Market Position, and Compete More Effectively

Dashboards Augment Capabilities of Aunalytics Daybreak for Financial Services Cloud-Native Data Platform to Drive Customer Intelligence and Higher Strategic Value

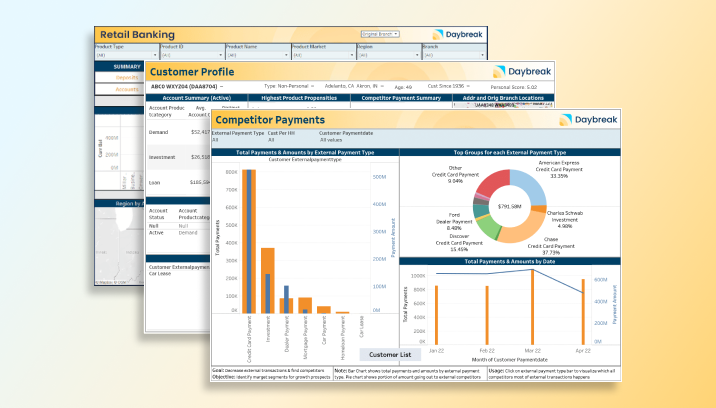

South Bend, IN (July 12, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, announced today a new set of pre-built dashboards that augment the value delivered by the company’s DaybreakTM for Financial Services solution. The Daybreak dashboards are designed to deliver insights and actionable business results by revealing opportunities associated with customer, competitive, marketing, lending, and branch data and automatically presenting the data in a way that is easily understood, without any manual processes required.

Customer intelligence and personalized marketing in a digital world matters more than ever before, especially for mid-market banks that have traditionally relied on hometown, white glove service to win customers. With Aunalytics Daybreak for Financial Services, midsize financial institutions can target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. With the new Daybreak dashboards, mid-market banks and credit unions can achieve greater visibility into their data and identify more opportunities to strengthen their position in regional markets and compete more effectively.

The Daybreak for Financial Services cloud-native data platform integrates and cleanses data for accuracy and mines transactional data daily with AI-powered algorithms for customer intelligence and timely actionable insights that drive strategic value.

New Daybreak Dashboards include:

Customer Profile - This dashboard delivers an enriched profile of individual customers, powered by AI- insights that deliver intelligence on future customer growth beyond mere aggregations and reports of the past. The Customer Profile offers a 360-view of each customer including analysis of data integrated from multiple sources across the organization, and mined daily for timely fresh insights that can be acted upon. Banks can identify accounts that a customer has with competitors in order to make a more attractive offer to win their business and grow customer value. They can also determine the next best product offering for customers today, based upon their transactional behavior, and gain a deeper understanding of customers and the branches they use, beyond the origination branch.

Competitor Payments - Competitor Payments reveals insights for each customer, each competitor, and type of financial product. The dashboard tracks competitor payments by amount and how long they have been taking place so that a banker or credit union can determine when customers or members are likely to look for a new product, then create better offers as a result. Competitor Payments can drill down on credit cards, mortgages, auto loans, and investment products to identify a more competitive offer and use the segmented Customer List dashboard to target them. By using targeted competitive offers made to the right customers at the right time, banks can efficiently grow value from customers to increase net deposits.

Retail KPI - Retail KPI (key performance indicators) help banks to increase total deposits and accounts, and identify growth opportunities and potential. The dashboard delivers key performance metrics to retail leaders to understand the drivers of their account and deposit growth. It enables them to analyze deposits and balances over time and understand growth trends. It also provides data for overall institution performance, as well as detailed performance for each region, branch, market, product type and individual product to identify opportunities for growth and understand which branches are driving change.

Lending KPI - The Lending KPI dashboard delivers key performance metrics to lending leaders to understand the drivers of their loan and loan balance growth. It enables them to view trends over time for original loan amounts and outstanding loan balances. The dashboard provides data for overall institution lending performance and detailed performance of lending by branch, region, market, product type, and each product to uncover opportunities for growth and understand which products, team members, and branches are driving growth. The accompanying Lending Officer dashboard reveals performance insights by team member and shows loans closed and principle amounts over time.

Marketing KPI - This dashboard delivers key performance metrics to marketing leaders on campaign effectiveness to improve targeting and reduce account acquisition cost. It enables banks to target their institution’s marketing to reach the right customer at the right time with the right offer, making marketing operations more efficient and successful by using a data driven approach. Capabilities include:

- Track campaign performance by resulting deposits and new accounts

- Understand customer acquisition cost by region, branch and product type

- Assess account and balance growth by region, branch, and product type

- Understand new account demographics

Branch Reassignment - The Branch Reassignment dashboard delivers key information to business leaders to understand branch utilization and change over time based on where a customer originates and performs business. They can identify branch growth opportunities and areas where efficiencies can be improved, and view branch utilization to see customer banking patterns. With this, banks can determine which products to market at a particular branch and more precisely target those customers who are likely to need that product.

“Daybreak dashboards offer more than just reporting on the past. They connect the dots of relevant data and use predictive analytics to create a picture revealing intelligent insights that help financial institutions build smarter business strategies,” said Kyle Davis, Vice President of Daybreak, Aunalytics. “Designed to accelerate the value derived from AI-powered insights, Daybreak dashboards enable mid-market banks and credit unions to more clearly see the opportunities presented by their data and take action to increase net income and advance their competitive position.”

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

How to Assess True Branch Profitability in Mid-Market Banking - PDF

How to Assess True Branch Profitability in Mid-Market Banking

Branch profitability calculations are critically important for branch planning. Traditionally, the branch where a customer opens an account receives credit for that customer’s business. But it’s not always that simple. Learn how analyzing the right data can lead to more accurate results.

Why Mid-Market Organizations Need Digital Transformation Solutions that Combine the Right Technology and Talent to Achieve Business Value

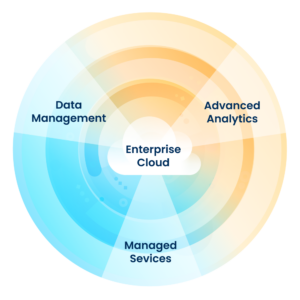

At Aunalytics, we know that an organization’s everyday data holds value, yet is a resource that often remains untapped. This is especially true for the mid-market—this market segment has been underserved and often lacks access to data management and analytics technologies and expertise. Our mission is to empower the mid-market with solutions that enable digital transformation so they can compete and stay relevant.

Digital transformation calls for mid-market companies to shift away from operational silos and work across the company to harness the power of data. This requires the integration of diverse technology across all functional business areas to enable convergence, promote a positive cultural change, drive customer value, and facilitate operational agility. Gartner’s report “Over 100 Data and Analytics Predictions Through 2025” asserts that by 2024, 75% of organizations will have established a centralized data and analytics center of excellence to support federated data and analytics initiatives and prevent enterprise failure. By 2023, organizations with shared companywide data management goals, including stewardship, governance, and semantics to enable inter-enterprise data sharing, will outperform those that don’t.

There is a recipe for successfully transforming massive amounts of corporate and third-party data created and used daily in your lines of business into a valuable asset. But to achieve business outcomes, organizations need to implement digital transformation solutions that include the right technologies/tools combined with the right talent.

The Right Tools and Technology

Mid-market companies generally do not currently have the tools needed to find value in their data through advanced analytics and AI. An enterprise data warehouse is only one piece of the puzzle. Successful mid-market digital transformation requires the appropriate storage and compute infrastructure, data management platform, and analytics software. It can be difficult to piece together each of these components into a single, unified system—it is expensive, time-consuming, and inefficient.

To solve this challenge, Aunalytics has developed a robust, cloud-native data platform built for universal data access, powerful analytics, and AI. Mid-market businesses benefit from using an end-to-end, cloud-based platform as it moves the burden of infrastructure procurement and maintenance to a third-party vendor in the data industry. An end-to-end platform is secure, reliable, and scalable while including the added benefit of being deployed and managed as a service. This is especially important for mid-market businesses because finding the right talent to execute digital transformation initiatives is extremely challenging in the current market.

The Right Talent and Expertise

Most IT departments do not currently have the skill sets needed for getting business value out of data. At the same time, for most mid-market companies, it does not make business sense to hire an entire division of highly compensated data experts to achieve digital transformation goals. Even if a mid-market company can find and hire these scarce resources—they were hard to come by even before the Talent War of 2022.

Establishing a side-by-side partnership with a data platform company is the key to gaining the benefits of working with experts including cloud engineers, data engineers, security experts, data scientists and other highly skilled technical resources to achieve true business value. By getting expert help, you can devote your company’s time, resources, and innovation to your business and focus on what you do best.

Establishing a side-by-side partnership with a data platform company is the key to gaining the benefits of working with experts including cloud engineers, data engineers, security experts, data scientists and other highly skilled technical resources to achieve true business value. By getting expert help, you can devote your company’s time, resources, and innovation to your business and focus on what you do best.

Aunalytics provides a team of experts who assist every step of the way. Mid-market businesses will have access to the right tools, resources, and support throughout our end-to-end process. Our team also includes industry experts who help businesses identify areas in which data can provide the most value, and guidance on how to work toward achieving these goals.

Aunalytics’ Digital Transformation Solution Gives Mid-Sized Businesses Answers

With Aunalytics, you get the technology and expertise required to complete the journey from data to actionable business results. This combination accelerates digital transformation, which allows businesses to realize the value of their investment quickly. By taking advantage of the experienced data professionals at Aunalytics, organizations can save time and avoid making costly mistakes while also maximizing the value currently hidden in their data.

eBook: What Mid-Market Companies Need for Data-Driven Success and How to Get It

What Mid-Market Companies Need for Data-Driven Success and How to Get It

Using your data as an asset to drive competitive business growth and achieve cost cutting operational efficiencies is imperative for a company to compete, survive, and thrive. Increasingly, data and analytics have become a primary driver of business strategy and the potential of data-driven business strategies is greater today than ever.

Fill out the form below to receive an email with a link to the eBook.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

What Mid-Market Companies Need for Data-Driven Success and How to Get It

What Mid-Market Companies Need for Data-Driven Success and How to Get It

Using your data as an asset to drive competitive business growth and achieve cost cutting operational efficiencies is imperative for a company to compete, survive, and thrive. Increasingly, data and analytics have become a primary driver of business strategy and the potential of data-driven business strategies is greater today than ever.

Daybreak is a Customer Data Platform Encompassing Ingestion to AI for an End-to-End Analytics Solution

As technology advances and AI and advanced analytics are becoming mainstream, consumers have grown to expect a more personalized experience from their bank or credit union. This is especially important for midsized community financial institutions as they rely on their white-glove service to compete against large national banks. Having a customer data platform that not only integrates, aggregates, and cleans customer-centric data, but also makes it easy to gather actionable insights using AI and machine learning is essential. Gartner reports that by 2024, 75% of organizations will have deployed multiple data hubs to drive mission-critical data and analytics sharing and governance. While this is a high priority initiative for many organizations, community banks and credit unions frequently don’t know where to start, or get stuck trying to piece together various tools to build a customer data and analytics solution on their own. Now, there is a better answer.

As technology advances and AI and advanced analytics are becoming mainstream, consumers have grown to expect a more personalized experience from their bank or credit union. This is especially important for midsized community financial institutions as they rely on their white-glove service to compete against large national banks. Having a customer data platform that not only integrates, aggregates, and cleans customer-centric data, but also makes it easy to gather actionable insights using AI and machine learning is essential. Gartner reports that by 2024, 75% of organizations will have deployed multiple data hubs to drive mission-critical data and analytics sharing and governance. While this is a high priority initiative for many organizations, community banks and credit unions frequently don’t know where to start, or get stuck trying to piece together various tools to build a customer data and analytics solution on their own. Now, there is a better answer.

Daybreak is an end-to-end data and analytics solution, providing daily insights powered by a robust data platform, financial industry intelligence, and AI-powered insights. In the current market, it can be difficult for midsized financial institutions to hire the technical talent for complex data management and advanced analytics. Aunalytics provides clients with the right tools, resources, and support throughout our end-to-end process. The right foundation is essential for a successful AI, machine learning, and predictive analytics journey.

Watch the video below to see why an end-to-end customer data platform is the ideal solution for community banks and credit unions:

Daybreak allows community banks and credit unions to compete with large financial institutions by…

- Understanding customers,

- Optimizing processes, and

- Revealing actionable insights.

See how Daybreak Customer Intelligence for Financial Institutions is the customer data platform that makes it easier for community banks and credit unions to gain actionable insights and achieve positive business outcomes.

Webinar: Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions

Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions

Aunalytics CMO Katie Horvath explains how midsized banks and credit unions can enhance the customer or member experience by becoming more data-driven. Employing these strategies can lead to increased revenue, lower expenses, and increased operational efficiencies.

Fill out the form below to receive an email with a link to the webinar.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions

Enhance Customer Experience and Increase Market Share with AI-Driven Personalized Interactions

Aunalytics CMO Katie Horvath explains how midsized banks and credit unions can enhance the customer or member experience by becoming more data-driven. Employing these strategies can lead to increased revenue, lower expenses, and increased operational efficiencies.