2022 NJBankers Spring Golf Outing

NJBankers Spring Golf Outing

Glen Ridge Country Club, Glen Ridge, NJ

Aunalytics to attend NJBankers Spring Golf Outing

Aunalytics is excited to sponsor a foursome at the 2022 NJBankers Spring Golf Outing at Glen Ridge Country Club. Aunalytics’ Daybreak™ solution enables banks to use transactional data to more effectively identify and deliver new services and solutions for their customers.

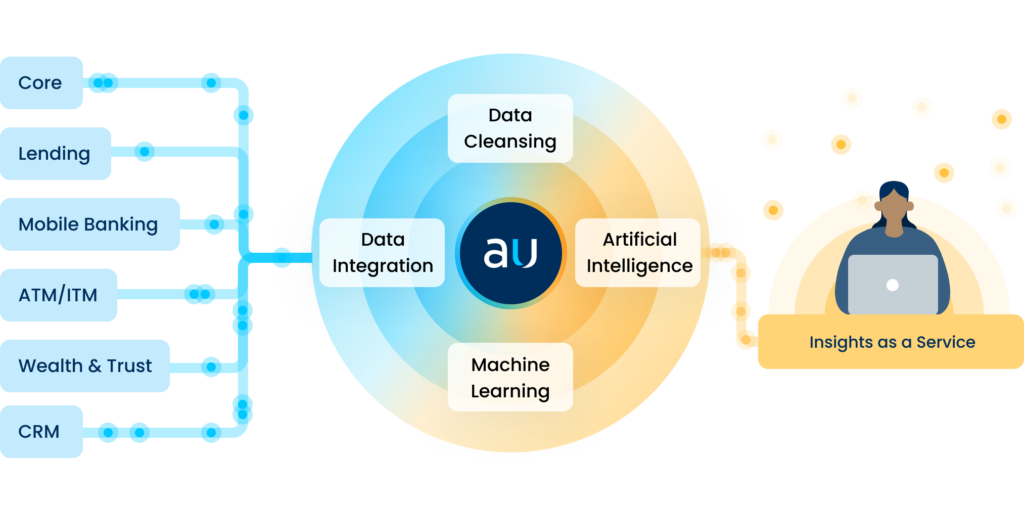

Analytics Database Platform Powers Customer Insights and Positive Outcomes for Community Bank

Data experts at Aunalytics took a three-pronged approach to solve Horizon Bank’s business challenges using the Daybreak for Financial Services analytics database platform. The first move was to get the data right by converging disparate repositories, and organizing the information for ingestion in the proper application area. Horizon Bank leverages Daybreak’s robust, cloud-native platform to convert data into answers in support of a wide range of business intelligence applications. Daybreak allows Horizon’s executives to view system-wide data from all business units, cleansing and verifying records to provide enriched data for accurate, data-driven decision making. The aggregated data delivers a 360-degree view of customer information including behavioral data, from which the platform’s proprietary AI technology and deep learning models developed by Aunalytics data scientists glean actionable customer intelligence insights.

Deploying the Daybreak analytics platform has taken Horizon Bank and its 74 locations to the next level of services and support for customers, making it the preferred financial partner with compelling advantages over larger, competitive establishments. Learn more about the challenges Horizon faced to implement a data analytics platform, and how Daybreak helped them overcome those challenges by downloading the full case study.

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The allure of investing early in the “next big thing” has led to increased interest in crypto investment. As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big loss. As a bank or credit union, here’s what you need to know to protect your institution.

Fill out the form below to receive the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions - PDF

The Visible and Invisible Risks of Cryptocurrency for Banks and Credit Unions

The allure of investing early in the “next big thing” has led to increased interest in crypto investment. As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big lose. As a bank or credit union, here’s what you need to know to protect your institution.

Related Content

Aunalytics Innovation Lab Accelerates Midsize Financial Institution Business Outcomes with AI Intelligence Services

Powerful Analytics/Intelligence Services and Experienced Data Science Team Provides Affordable Alternative to HyperCloud-based Solutions

South Bend, IN (April 12, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, today highlighted AI-powered Business Intelligence use cases built by the organization’s Innovation Lab. Established to provide deep insights to midsize financial services organizations lacking large AI budgets, the Aunalytics® Innovation Lab’s team of data scientists create and deploy Smart FeaturesTM (data-driven analytic insights) for companies seeking specific predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

Moving from reactive to proactive, predictive and prescriptive IT solutions are one of the key benefits of integrating a properly architected intelligence service enabled by machine learning, deep learning and artificial intelligence. For example, when a properly orchestrated AI/ML solution is in place, a bank can identify a customer purchase from the Home Depot (for example) and deliver predictive insights suggesting the customer may need a HELOC loan (Home Equity Line of Credit). Bank marketing is then able to take advantage of that information through predictive or proactive sales or marketing outreach. Because of the bottom-line impact this technology can have on midsize financial institutions competing against the Fortune 500, there is rapidly increasing demand for the technology nationwide.

The development of AI powered Smart Features for Aunalytics financial services customers is a top Innovation Lab priority. Smart Features are customized to leverage insights obtained from data-driven machine learning models. The Aunalytics service model includes a private analytics cloud as part of the end to end solution, so that customers can manage compute and storage costs associated with data analytics. Part of the customization is data mining transactional banking data and enriching it with the inclusion of algorithm-powered high value fields appended to customer records that reveal insights about a customer. Smart Features provide answers to pressing business questions in order to recommend next steps to take with a particular customer to deepen or extend the relationship, provide targeted sales strategies and marketing campaigns for better customer experiences that yield more profitable business outcomes.

By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments. Other Smart Features are aimed at providing actionable insights for operational efficiency, risk of loan default at time of application, customers at risk for crypto fraud, where to open or close bank branches, ways to minimize customer impact from new federal regulations regarding overdraft protection, and much more.

“Demand for intelligence services by financial services organizations is starting off strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “New functionality will support evolving compliance and security requirements and find opportunities in a financial institution’s own data. Instead of using national averages, we provide insights based on what is actually happening in a financial institution and enrich the data for predictive analytics. Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

Tweet this: .@Aunalytics AI Innovation Lab Supporting Small to Midsize Financial Service Providers with Advanced AI Intelligence Services

#Manufacturing #Recreationalvehicles #RV #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform members’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Michiana Hematology Oncology Named an IDC Future of Intelligence Award Winner

Oncology practice digitally transforms and simplifies healthcare business complexities with state-of-the-art technology from AC3 and Aunalytics

South Bend, IN (March 31, 2022) – Michiana Hematology Oncology, which delivers world-class cancer care to local communities, has been named an IDC Future of Intelligence winner based on its use of AC3’s oncology practice intelligence platform, powered by Aunalytics’ advanced data management platform and revenue cycle analytics. The award program acknowledges organizations that have demonstrated outstanding capabilities related to increasing enterprise intelligence and as a result, improved business outcomes.

IDC commends those with forward thinking initiatives that span across four key capabilities of enterprise intelligence – Ability to Synthesize Information, Capacity to Learn, Delivery of Insights at Scale, and Data Culture – and those who excel in any one of these four areas. Michiana Hematology Oncology (MHO) was named a winner in the Capacity to Learn category and will be recognized at an awards ceremony in May 2022.

MHO implemented AC3’s oncology practice intelligence platform, powered by Aunalytics’ advanced data management platform and revenue cycle analytics, to digitally transform and simplify healthcare business complexities. Oncology care often involves multiple providers, treatments and newly emerging drugs that are added to patient care as cancer science continually advances. The billing process is particularly complicated and often riddled with cumbersome manual processes. The alliance between AC3 and Aunalytics offers MHO advanced analytics and valuable business insights to improve operations and collect revenue in an accurate and timely manner. This is key to driving the overall health of an oncology practice.

Using AC3’s oncology intelligence solutions with advanced analytics from Aunalytics, MHO understands its business more quickly, makes better decisions that are data driven, and achieves greater results, such as getting new leadership up to speed quickly based on a more accurate picture. In addition, the practice can manage cash flow more efficiently with visibility into ever changing data, with a clear picture of its actual allowed rate is vs. billed rate. As a result, MHO gains a keener view of the true health of the practice, based on data accuracy - more data is collected, and collected more precisely.

“Michiana Hematology Oncology demonstrated that enterprise intelligence can help achieve operational efficiencies regardless of the size and the industry of an organization. MHO strives to deliver the best care to its patients across the Midwest region while reducing the administrative burden on its employees,” said Chandana Gopal, Research Director, Future of Intelligence at IDC. “The organization is recognized as a winner in the Capacity to Learn category because it implemented initiatives that were continuously improved and fostered collaboration between its administrative team, clinical staff, and other entities that ultimately improve patient care."

To learn more about IDC’s Future of Enterprise Awards Program, visit here.

About Michiana Hematology Oncology

Established in 1968, Michiana Hematology Oncology is the largest cancer care organization of its kind in northern Indiana, with offices in Crown Point, Chesterton, Elkhart, Hobart, Mishawaka, Plymouth, Valparaiso and Westville. The organization consists of 11 Medical Oncologists, three Radiation Oncologists and four Advanced Practice nurses who provide integrated and comprehensive medical and radiation oncology services for patients throughout the region. For more information, visit www.TheHeartOfCancerCare.com.

About AC3

AC3’s practice intelligence platform digitally transforms oncology practices into modern and sustainable operations that reduce the overall cost of care. Through its oncology data model which unites practice management, healthcare data and innovative technology intelligence into a single environment, AC3 delivers full transparency and automated actionable insights to simplify workflows, increase efficiency, and secure revenue integrity. Guided by a dedicated side-by-side client success team, AC3 simplifies oncology business complexities empowering practices to spend more time on what matters – fighting cancer. To learn more, visit https://ac3health.com/

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Aunalytics President Rich Carlton to Deliver Keynote Address at Virtual Fintech Conference, and CMO Katie Horvath to Present at Bankers Education Summit in April

Leading Data Platform Provider Will Demonstrate Aunalytics Daybreak for Financial Services at National and Statewide Industry Events Attended by Bankers and Credit Unions

South Bend, IN (March 30, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that President Rich Carlton will deliver a keynote address at the Washington Bankers Association Virtual Fintech Conference on April 20, and participate in a panel at the conference on April 21. Aunalytics Chief Marketing Officer Katie Horvath will also present in April, at the Michigan Bankers Association Bankers Education Summit and Trade Show. Both Carlton and Horvath will discuss how mid-market bankers and credit unions can increase market share with AI-driven personalized interactions with customers and members.

Aunalytics will participate in multiple industry events in April, showcasing DaybreakTM for Financial Services, an advanced data analytics solution for community banks and credit unions:

- Ohio Bankers League Security & Technology Conference, April 6-8

- FIS Emerald, April 11-13

- Michigan Bankers Association BEST (Bankers Education Summit & Trade Show) Conference, April 12-14

- Cornerstone League IMPACT 2022: Annual Meeting & Council Forum, April 20-22 (Texas, Arkansas, Oklahoma credit unions)

- Washington Bankers Association Virtual Fintech Conference, April 20-21

- Minnesota Credit Union Network ACCELERATE 22 Annual Conference, April 21-22

Daybreak for Financial Services enables midsize financial institutions to gain customer intelligence and grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Midmarket financial institutions can thrive by redefining the local experience and digitally transforming how they operate,” said Horvath. “The ability to target, discover and offer the right services to the right people, at the right time, improves customer relationships, delivers new products and services through data-driven campaigns, and accelerates competitive advantage. Consumers demand digital experiences and view personalization as the default standard for engagement. Personalized marketing in a digital world matters more than ever before, especially for midmarket banks that have traditionally relied upon hometown, white glove service to win customers. Using Aunalytics Daybreak for Financial Services, midsize banks can now benefit from the advanced analytics that their large national counterparts have employed, to make personalized interactions data driven. This enables mid-market financial institutions to target-market more efficiently, reach high-value customers with the right product offering, and win business away from competitors to expand value. We look forward to meeting with bankers and credit unions at a variety of industry events in April and demonstrating how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Tweet this: .@Aunalytics Aunalytics President to Deliver Keynote at Fintech Conference & CMO to Present at Bankers Education Summit in April #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

MnCUN ACCELERATE 22

ACCELERATE 22

Minnesota Credit Union Network

Radisson Blu MOA, Bloomington, MN

Aunalytics to sponsor keynote speaker at Minnesota Credit Union Network's ACCELERATE 22 event

Aunalytics is excited to sponsor the keynote speaker at Minnesota Credit Union Network’s ACCELERATE 22 annual conference. Aunalytics will be demonstrating Daybreak™ for Financial Services at the Aunalytics exhibition booth. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

2022 Washington Bankers Association Virtual Fintech Conference

2022 Washington Bankers Association Virtual Fintech Conference

Aunalytics to give keynote presentation at the 2022 Washington Bankers Association Virtual Fintech Conference

Rich Carlton, President and Chief Revenue Officer at Aunalytics, will be presenting a keynote presentation at the 2022 Washington Bankers Association Virtual Fintech Conference entitled Enhance the Customer Experience and Increase Market Share with AI-Driven Personalized Interactions. He will also be participating in roundtable discussions. Aunalytics has developed Daybreak™ for Financial Services, a cloud-native data platform, that enables banks to focus on critical business outcomes and make data-driven business decisions.