Communication Federal Credit Union Leverages Data to Drive Higher Business Value with Aunalytics Daybreak for Financial Services

Communication Federal Credit Union Leverages Data to Drive Higher Business Value with Aunalytics Daybreak for Financial Services

Advanced Data Analytics Platform, Coupled with a Dedicated Side by Side Model, Accelerates Member-centric Decision Making

Fill out the form below to receive an email with a link to the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Related Content

Communication Federal Credit Union Leverages Data to Drive Higher Business Value with Aunalytics Daybreak for Financial Services - PDF

Communication Federal Credit Union Leverages Data to Drive Higher Business Value with Aunalytics Daybreak for Financial Services

Advanced Data Analytics Platform, Coupled with a Dedicated Side by Side Model, Accelerates Member-centric Decision Making

Related Content

Aunalytics VP Ryan Wilson to Present at Launch 2022, Providing Insights into How Credit Unions Can Strengthen Their Position in Regional Markets and Compete More Effectively Using Advanced Data Analytics

Leading Data Platform Provider Will Feature Aunalytics Daybreak for Financial Services at The Carolinas Credit Union League Event in February

South Bend, IN (January 31, 2022) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that the company’s Vice President, Client Relationships Ryan Wilson will present at LAUNCH 2002, hosted by The Carolinas Credit Union League in February. Wilson’s talk, How Advanced Data Analytics Enables Credit Unions to Strengthen Their Position in Regional Markets and Compete More Effectively, will take place on February 4 at 10:45 a.m. at the Sheraton Charlotte in Charlotte, North Carolina. Aunalytics will also showcase its advanced data analytics solution for credit unions at the event, February 3-4.

Aunalytics’ DaybreakTM for Financial Services offers credit unions the ability to gain member intelligence to grow their lifetime value, predict churn, determine which products to introduce to members and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean member intelligence and timely actionable insights that drive strategic value.

Using Aunalytics’ universal cloud-native data platform, predictive analytics, and AI/ML based Smart Features, credit unions have an effective and scalable way to leverage data for strategic business insights. Harnessing their data enables them to discover patterns, insights, trends, and usage strategies to help strengthen their position in regional markets and compete with large national banks. With Aunalytics’ member intelligence data model, they can deliver timely personalized messages to members, make data-driven product recommendations, measure campaign ROI, and grow net dollar retention.

“Credit unions and other midmarket financial institutions can sharpen their competitive edge by redefining the local experience and digitally transforming how they operate,” said Wilson. “The ability to target, discover and offer the right services to the right people, at the right time, improves member relationships, delivers new products and services through data-driven campaigns, and accelerates competitive advantage. We look forward to meeting members of The Carolinas Credit Union League and demonstrating how Daybreak can help them achieve their revenue goals in an increasingly digital, data-driven financial services environment.”

Tweet this: .@Aunalytics Aunalytics Vice President Ryan Wilson to Present at Launch 2022 #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

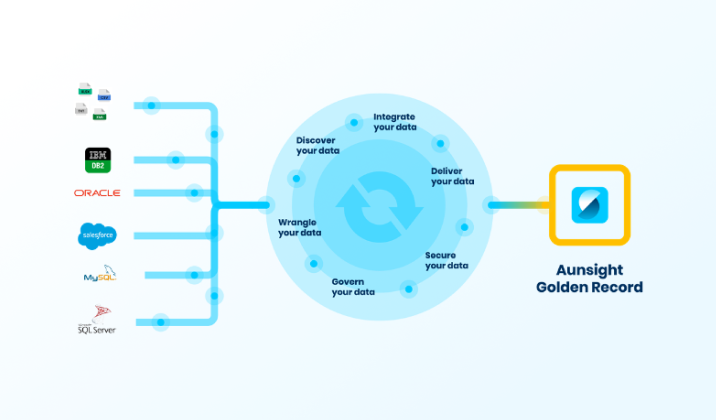

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform members’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

The ONE Conference 2022 - Illinois Bankers Association

The ONE Conference

Illinois Bankers Association

Embassy Suites, East Peoria, IL

Aunalytics to sponsor and present during the Bank Marketing track of the Illinois Bankers Association's The ONE Conference

Ryan Wilson, VP Client Relationships at Aunalytics, will be presenting a talk entitled “Using Advanced Data Analytics to Personalize Customer Intelligence and Achieve Competitive Advantage” at the Illinois Bankers Association’s The ONE Conference. Aunalytics, a sponsor of the event, will be demonstrating Daybreak™ for Financial Services at their exhibit booth. Daybreak enables community banks to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

LAUNCH 2022 - Carolinas Credit Union League

LAUNCH 2022

The Carolinas Credit Union League

Sheraton Charlotte, Charlotte, NC

Aunalytics to present and exhibit as a Takeoff Sponsor at LAUNCH 2022, powered by the Carolinas Credit Union League

Aunalytics is excited to attend LAUNCH 2022, powered by the Carolinas Credit Union League as a Takeoff Sponsor. Ryan Wilson, Vice President of Client Relationships, will be presenting a talk on advanced data analytics solutions, and the team will be demonstrating Daybreak™ for Financial Services at the Aunalytics exhibition booth. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

Digital Banking & Analytics Initiatives Top Banking Technology Predictions for 2022

Unfortunately, simply providing a mobile banking app is not enough in a world where customers demand personalized digital interactions. A banking institution must augment digital banking technology with customer intelligence and implement data-driven decision making through AI-enabled analytics. This is not a minor undertaking. It may require the bank to make a fundamental shift in the way it operates and the initiatives it prioritizes. Cultivating a data-driven culture is essential in meeting this goal. However, this can be challenging. Many mid-market financial institutions may not yet have the technology and talent needed to facilitate a data-driven culture. It requires data management and advanced analytics technology and expertise. Organizations need to take steps now in order to not only stay relevant—but to truly thrive—in this ever-evolving industry. Staying up-to-date on the latest technological trends is the first step in the process.

To learn more about the top technology trends in mid-market banking, and steps community banks and credit unions can take now in order to bridge the competitive gap, download our eBook, Top 5 Imperative 2022 Banking Technology Predictions for Mid-Market Financial Institutions.