2021 Illinois Credit Union League Annual Convention

Illinois Credit Union League Annual Convention

Chicago Hilton, Chicago, IL

Aunalytics presents Daybreak at Illinois Credit Union League Annual Convention

Aunalytics will be demonstrating Daybreak™ for Financial Services at the Illinois Credit Union League Annual Convention in Chicago, IL. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

2021 Iowa Bankers Association Technology Conference

Iowa Bankers Association Technology Conference

Airport Holiday Inn, Des Moines, IA

Aunalytics is excited to demo Daybreak at the Iowa Bankers Association TECH21 Technology Conference

Aunalytics will be demonstrating Daybreak™ for Financial Services at the Iowa Bankers Association Technology Conference in Des Moines, IA. Daybreak enables community banks to more effectively identify and deliver new services and solutions to their customers by utilizing machine learning and AI so they can better compete with large national banks.

2021 Indiana Bankers Association Mega Conference

Indiana Bankers Association Mega Conference

Indiana Convention Center, Indianapolis, IN

Aunalytics proud to present Daybreak as a Gold Sponsor at 2021 IBA Mega Conference

Aunalytics will showcase its Daybreak™ for Financial Services cloud-native data platform as a Gold Sponsor at the 2021 Indiana Bankers Association Mega Conference. Daybreak seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs AI and machine learning to glean customer intelligence from transactional data and timely actionable insights that drive strategic value.

Illinois Bankers Association 2021 BankTech Conference

Illinois Bankers Association BankTech Conference

Chicago Marriott Southwest, Burr Ridge, IL

Rich Carlton, Aunalytics President & CRO, to present "How to Leverage Your Data to Win Against National Banks" at IBA BankTech Conference

Rich Carton of Aunalytics will be presenting “How to Leverage Your Data to Win Against National Banks” during the Innovator’s Showcase of the Illinois Bankers Association BankTech Conference. Aunalytics is also excited to demonstrate the Daybreak™ for Financial Services cloud-native data platform that enables users to focus on critical business outcomes. Daybreak seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs AI and machine learning to glean customer intelligence from transactional data and timely actionable insights that drive strategic value.

What is a Product Propensity Report?

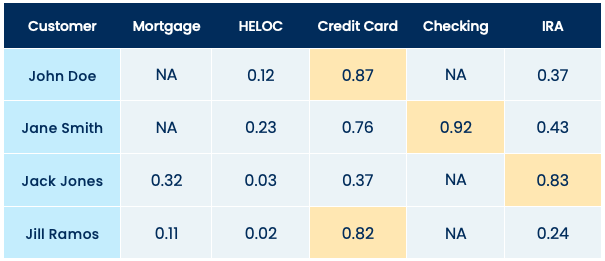

Cultivating a long-term customer relationship requires intelligent marketing efforts based on a solid understanding of the types of products a particular customer or group of customers would most likely be interested in based on their past behavior. Aunalytics has nearly a decade’s worth of experience assisting our clients with data analysis projects and now offers the fruits of that experience as the Product Propensity Report Framework for our Daybreak™ Analytic Database subscribers. The Product Propensity Report Framework (PPRF) provides a customized dataset with an individualized analysis of every customer’s propensity for new financial services products by type. Think of it like a PivotTable in Excel with a row for every customer and columns representing each of the products your institution offers with a propensity score showing the likelihood that customer might opt for that product.

The preceding example is purely illustrative since every Product Propensity Report is customized to the types of products and services offered by our clients, but it shows the general structure of how such a report might look like for a client offering five different products. In this example, customers receive a decimal score (0-1) for each product, or an indication that the customer already has that product (NA). In this example, we can see that Jane Smith is predicted to be very likely to open a checking account or possibly a credit card account, whereas John Doe and Jill Ramos will likely open a credit card account, and Jack Jones will most likely be interested in a retirement account.

Aunalytics generates these Product Propensity Reports for clients based on a machine learning algorithm that learns about new accounts opened from your organization’s historical data. This algorithm digs into data about transactions and current product utilization to construct a model that can identify future customers’ propensities based on patterns in this data. The output of this model is tailored uniquely to your organization’s product offerings and trained on your organization’s data in order to provide you with reporting that gives you a deeper glimpse into what your customers are after and how best to tailor your outreach to connect those customers with the products and services they are most interested in.

Aunalytics Gains Significant Momentum in Q2 2021 with 40% Increase in Quarter over Quarter Growth of Analytic Data Platform Deployments

Award Winning Data Platform Provider Achieves Key Milestones and Expands Reach as it Delivers Universal Data Access and Advanced Analytics to Drive Digital Transformation for Customers

South Bend, IN (September 22, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, continued to demonstrate exceptional growth and momentum during the second quarter of 2021. Deployment of the Aunalytics Daybreak™ analytic database providing customer intelligence for the financial services industry increased 40%. Further, late in the quarter, the company launched a new tiered data model that reduces implementation time by 50% to place actionable revenue growth insights in the hands of its financial services clients faster. It is anticipated that implementations will continue to accelerate with this advancement. The company also announces a 25% increase in new clients in its enterprise cloud and managed services business lines.

The global big data and analytics market is expected to grow at a CAGR of 10% in the forecast period of 2021-2026, reaching $450 billion by 2026. Organizations have started to capitalize on big data by generating and leveraging key insights, strategies, and business decisions to provide better customer experiences, improve efficiency, and remain competitive by gaining answers to critical questions in nearly every functional aspect of their business.

Aunalytics offers a robust, cloud-native data platform built to enable universal data access, powerful analytics, and AI-driven answers. Customers can turn data into answers with the secure, reliable, and scalable data platform deployed and managed by technology and data experts as a service. The platform represents Aunalytics’ unique ability to unify all the elements necessary to process data and deliver AI end-to-end, from cloud infrastructure to data acquisition, organization, and machine learning models – all managed and run by Aunalytics as a secure managed service. And, while typically large enterprises are in a better position to afford advanced database and analytics technology, Aunalytics pairs its platform with access to its team’s expertise to help mid-market companies compete with enterprise players.

Significant milestones Aunalytics achieved in Q2 of this year include:

- Daybreak analytic database deployment 40% growth

- 25% new customer growth in cloud and managed services business lines

- The company announced that its Aunalytics® Cloud solution has achieved Federal Risk and Authorization Management Program (FedRAMP) Ready status and is actively working toward FedRAMP certification.

- The introduction of a new tiered data model workflow added to Daybreak 3.0 for faster implementation resulting in customers receiving answers faster. Implementation time has been reduced by 50%.

- The introduction of new Churn Propensity Smart Feature™ added to Daybreak 3.0: a predictive model that analyzes customer transactional data for indicators that a customer is likely to churn so that financial institutions can take action before losing customers.

- The introduction of new Product Propensity Smart Feature added to Daybreak 3.0: a machine learning powered customized dataset for each customer’s propensity for new financial services products by type modeled on customer behaviors prior to opening new accounts to better cultivate long-term customer relationships with intelligent marketing.

- The introduction of new Risk Scoring for Loan Default at Time of Application Smart Feature added to Daybreak 3.0: a machine learning powered data model to reduce lending risk based upon an institution’s historical loan defaults that identifies risk of a particular loan application at the time of underwriting.

- Aunalytics Accelerates Insights-as-a-Service Offering Through Ohio Expansion - The integration of Ohio-based managed services provider NetGain and Aunalytics in February 2021 has allowed the company to expand its footprint in the state and extended its solution portfolio, including Aunsight™ Golden Record and the Daybreak Analytic Database, to new customers in the region.

- Introduction of the Alliance Partner Program to Accelerate Adoption of its Cloud Native Data Analytics Platform and Capitalize on the Multi-Billion Dollar Market Opportunity. The Alliance Partner Program was developed to give ISVs and technology partners the dedicated resources and support to ensure success and drive new recurring revenue opportunities and long-term value for clients.

- New partnerships

- Aunalytics and AC3 Announce a Strategic Partnership that Empowers Oncology Practice Groups to Modernize Their Businesses Through Advanced Analytics and Valuable Business Insights

- Aunalytics and Stonebridge Consulting Announce Strategic Partnership to Deliver Data Accuracy and Advanced Data Management Solutions for the Oil and Gas Industry.

Kelly Jones, former president and chief operations officer of NetGain Information Systems (acquired by Aunalytics in February 2021) and now vice president of Integration Services at Aunalytics, was recognized as one of CRN’s 2021 Women of the Channel as well as one of CRN’s Power 60 Solution Providers.

- Aunalytics was named one of CRN’s Coolest Business Analytics Companies of the 2021 Big Data 100, a list of vendors that CRN says “solution providers should know in the big data business.”

“We’re extremely pleased with our continued momentum and the milestones achieved in the second quarter of this year,” said Rich Carlton, President and CRO of Aunalytics. “It demonstrates how businesses are eager to leverage their data for competitive gain, and yet midsize companies are often out-teched by larger rivals with bigger budgets for advanced data analytics tools and talent. We remain committed to providing the ability to quickly and accurately answer our customers’ important IT and business questions to help drive growth and improve the bottom line as we continue to expand our position as a leading data platform provider.”

Tweet this: .@Aunalytics Gains Significant Momentum in Q2 2021 with 40% Increase in Quarter over Quarter Growth of Analytic Data Platform Deployments #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its Daybreak™ industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

CULytics Solutions Showcase - The Best of Data Analytics Solutions

CULytics Solutions Showcase (Virtual)

The Best of Data Analytics Solutions

Aunalytics to showcase Daybreak and present case study at the virtual CULytics Solutions Showcase

Aunalytics will be hosting a virtual booth at the CULytics Solutions Showcase, as well as demonstrating the Daybreak™ for Financial Services cloud-native data platform that enables users to focus on critical business outcomes. Daybreak seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs AI and machine learning to glean customer intelligence from transactional data and timely actionable insights that drive strategic value.

In addition, Ben Smith, Vice President, Business Intelligence of Communication Federal Credit Union will discuss how Daybreak enabled CFCU to gain and leverage daily cleaned data delivered seamlessly in a dynamic environment without the investment in required cloud infrastructure, software, and people such as data engineers, data scientists, and day to day support. The credit union is now leveraging this data to accomplish high effort projects at greater speed and efficiency, such as implementing a complex membership branch reassignment using several weighted elements to truly distribute its members to the most appropriate market.

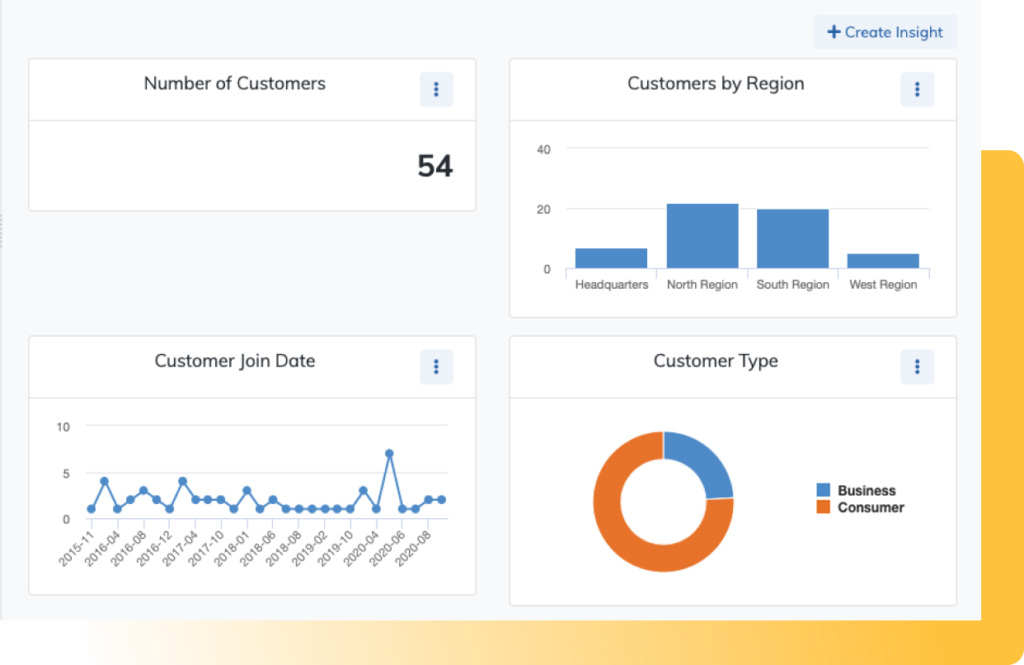

Visualize Data-Driven Answers with Daybreak Insights

Insights are a valuable way to share stories about data with other members of your organization. The Daybreak Insights dashboard enables you to build a custom dashboard for saved queries, and then share that dashboard with other Daybreak users on your team. Insights can also be saved as downloadable graphics for inclusion in other documents or slideshows to accelerate and automate data-driven presentations.

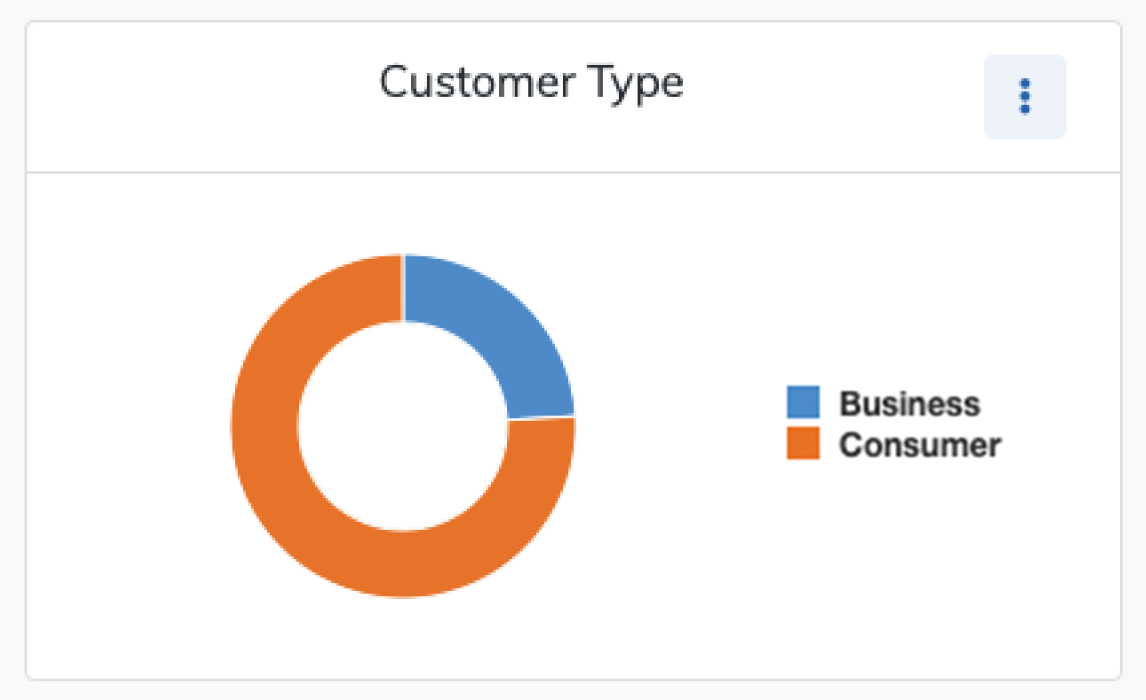

Figure 1: Daybreak Insight showing the proportion of business vs. consumer customers

Figure 2: Daybreak Insight showing the number of customers joining over time

Daybreak Insights are easy to create. Simply click the “Insights” tab to add an Insight. Daybreak supports different kinds of charts to display different kinds of data, like timeseries line charts, column or donut charts, or summary metrics to display simple calculations based on fields. Each type of Insight has its own settings that can be configured to control how the charts are drawn. The value of each axis or segment can be simple counts of records, or aggregations based on arithmetical or statistical operations like sums, minimums, maximums, or averages.

Insights are one of the many ways Aunalytics provides data-driven answers to your most important business and IT questions.

Aunalytics to Present on Natural Language Interface Synthesis of SQL Database Queries at The 2021 European Conference on Machine Learning and Practice of Knowledge Discovery

Leading Data Platform Provider to Showcase New NL2SQL System with Natural Language Interface for Deployment on Enterprise Data Marts in the Banking Sector

SOUTH BEND, Ind., Sept. 13, 2021 – Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will present a new paper to be showcased at the ECML-PKDD 2021 Virtual Event, taking place online, September 13-17. During the event, David Cieslak, Chief Data Scientist for Aunalytics, will discuss the use of natural language interface synthesis of SQL database queries leveraging the company’s new NL2SQL System.

Natural language interface integration with database environments is a growing field that enables end users to interact with relational databases without technical database skills. These interfaces solve the problem of synthesizing SQL queries based on natural language input from the user. There are considerable research interests around the topic but there are few systems to date that are deployed on top of active enterprise data marts.

At ECML-PKDD 2021, Aunalytics will introduce the NL2SQL system and present on data simulations that provide adaptive feedback for continuous model advancement. The architecture of the NL2SQL is built on WikiSQL data and research conducted by the data science team at Aunalytics. The company supports multiple scenarios using a unique table expansion process. The data simulation and the feedback loop help the model continuously adjust to linguistic variation introduced by the domain specific knowledge.

“We are excited to explore this emerging area with the professionals attending ECML-PKDD 2021,” said David Cieslak, Chief Data Scientist, Aunalytics. “Advancements in natural language integration with today’s most widely deployed data marts is expected to improve business outcomes for financial institutions seeking next-level business intelligence.”

The ECML-PKDD 2021 event is the premier European machine learning and data mining conference, building upon more than 19 years of successful events and conferences held across Europe.

Tweet this: .@Aunalytics to Present on Natural Language Interface Synthesis of SQL Database Queries at The 2021 European Conference on Machine Learning and Practice of Knowledge Discovery #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its Daybreak™ industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com