Cornerstone League: ELEVATE Leadership Summit

2023 ELEVATE Credit Union Leadership Summit

OMNI Hotels & Resorts Oklahoma City, Oklahoma City, OK

Aunalytics Is Proud to Be a Silver Sponsor at the 2023 ELEVATE Leadership Conference

Aunalytics is excited to attend the Cornerstone League’s ELEVATE Leadership Summit. Aunalytics is participating as a Breakfast Sponsor and our team is excited to demonstrate Daybreak™ for Financial Services at exhibition booth #401. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can increase deposits and better compete with large national banks.

2023 CULytics Day

2023 CULytics Day

Aunalytics to showcase Daybreak at 2023 CULytics Day

Aunalytics is pleased to be a Gold Sponsor of 2023 CULytics Day, where we will be sharing information on how AI can be used to help credit unions discover insights in their data and gain a more complete view of their members. Aunalytics’ cloud-native data platform, Daybreak™ for Financial Services, enables users to focus on critical business outcomes. Daybreak seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs AI and machine learning to glean intelligence from transactional data.

CBAO 49th Annual Convention

CBAO 49th Annual Convention

Glass City Center, Toledo, OH

Aunalytics Attending the CBAO 49th Annual Convention

Aunalytics is excited to exhibit at booth #519 during the 2023 Community Bankers of Ohio 49th Annual Convention in Toledo, OH. Representatives from Aunalytics will be educating attendees on how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. Event attendees can also learn more about the Daybreak™ for Financial Services solution which enables community banks to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

Organizations Shift to Cloud-Based Analytics and IT Platforms

The growth rates of cloud-based IT solutions in the areas of analytics and artificial intelligence have been substantial in recent years. The increasing volume of data and the need for faster, more accurate insights have driven organizations to adopt cloud-based analytics solutions at a rapid pace. This has resulted in the growth of cloud-based data warehousing, business intelligence, and big data analytics solutions.

Similarly, the growth of artificial intelligence has been driven by the cloud, as it allows organizations to access powerful AI algorithms and training data without having to invest in expensive hardware. The cloud has also made it possible for organizations to scale AI solutions quickly and easily, leading to an increase in the adoption of cloud-based machine learning and deep learning solutions. These trends are expected to continue as organizations look to leverage the power of AI and analytics to gain a competitive edge in the market.

This growth in cloud-based analytics and AI has been driven by the larger business adoption of cloud IT because of its numerous benefits such as increased flexibility, scalability, and cost savings. Cloud technology allows companies to access their data and applications from anywhere, reducing the need for physical infrastructure and freeing up resources for other areas of the business. This shift towards cloud computing has also improved disaster recovery and business continuity, as data can be stored and accessed remotely. Additionally, with the rise of cloud-based solutions, businesses have been able to access advanced technologies and services without having to invest in expensive hardware and software. This has resulted in increased competitiveness, innovation and better overall business performance.

APIs add efficiency and flexibility to cloud environments

The power behind the most widely adopted cloud platforms are APIs (Application Programming Interfaces), which play a crucial role as they allow different software systems to communicate with each other and access data from the cloud. This has enabled organizations to build custom solutions and integrate disparate systems seamlessly, making the use of cloud technology much more efficient and flexible.

APIs also allow for automation and streamlining of processes, reducing manual errors and freeing up time for more valuable tasks. APIs make it possible to add new functionality and services to existing systems, allowing for continuous improvement and innovation. In essence, APIs provide a bridge between the cloud and an organization’s systems, enabling organizations to harness the full potential of cloud computing and drive digital transformation.

Analytics moves to the cloud

In terms of business outcomes, cloud-based analytics allow businesses to access and process large amounts of data in real-time, regardless of the size or location of their operations. This enables organizations to make informed decisions quickly and respond to changing market conditions with agility. Secondly, these solutions are much more cost-effective, as businesses only pay for what they use and do not have to invest in expensive hardware or IT infrastructure. The cloud provides businesses with access to a wide range of advanced analytics tools and technologies, enabling them to gain insights from their data in new and innovative ways. These solutions are highly secure and reliable when they are managed by experienced cloud service providers who ensure that data is protected and the solution is always available. Overall, they are considered to be a better choice for businesses because of their scalability, flexibility, cost-effectiveness, and secure approach to data analysis.

Likewise, cloud-based AI or AI as a Service (AIaaS) provides organizations with access to deep insights without having to invest in expensive experts or the necessary hardware and software to implement such solutions. This makes it easier for organizations to deploy and scale AI solutions as they only pay for what they use and do not have to invest in maintaining their own infrastructure. Furthermore, these solutions are more flexible and can be customized to meet specific business requirements, enabling organizations to generate valuable insights that help them to differentiate from their competitors. Finally, cloud-based AI makes it possible for organizations to collaborate and share AI models, allowing them to leverage the collective expertise of their partners, customers, and employees to create better solutions. In short, it is a high-value choice for businesses as it provides a more accessible, scalable, affordable, and collaborative approach to artificial intelligence.

Moving to the cloud accelerates digital transformation

Leading research and advisory firm Gartner reported that “Cloud migration is not stopping, IaaS will naturally continue to grow as businesses accelerate IT modernization initiatives to minimize risk and optimize costs. Moving operations to the cloud also reduces capital expenditures by extending cash outlays over a subscription term, a key benefit in an environment where cash may be critical to maintain operations.”

Aunalytics provides a highly redundant and scalable cloud infrastructure that enables midsized businesses to reap the benefits of the cloud at a reasonable cost. The Aunalytics Cloud provides a wide range of solutions—including cloud storage, backup and disaster recovery, application hosting, advanced analytics, and AI. Moving from on-premises computing to a cloud environment is a key step in an organization’s digital transformation.

Investment in Artificial Intelligence is Vital for Banks and Credit Unions

Has your bank or credit union made investments in artificial intelligence yet?

Advances in artificial intelligence (AI), and the promise it holds for the future, have been making news all year. And it’s no wonder that financial institutions are taking notice—a recent survey from the Economist Intelligence Unit found that 77% of bankers believe that unlocking value from AI will be the differentiator between winning and losing banks. Yet, many institutions are falling behind in AI maturity.

Despite its promise, making a large investment in artificial intelligence may seem risky to many midsized financial institutions. Hiring talent, developing a data management and analytics strategy, building a data platform, and creating AI models can be both time- and resource-intensive. Banks and credit unions want to ensure that the efforts spent to get an AI program off the ground will yield a high ROI, especially in times of economic uncertainty. Yet, failure to innovate and make progress toward digital transformation is not always an option in the highly competitive landscape.

Financial institutions find many uses for AI technologies

Thankfully, an investment in artificial intelligence can improve many processes across an institution. AI can optimize both time- and resource-intensive tasks, decrease risk, and increase revenue by improving the customer experience. For instance, by applying AI and machine learning algorithms to transactional data, banks and credit unions can gain insights into customers or members’ habits and preferences. Some use cases include:

- Detecting and preventing fraud

- Identifying loan default risk at the time of application

- Predicting customer churn

- Winning back business by discovering customer payments going to competitors, and subsequently making a more attractive offer

- Predicting the next best product for each customer then targeting them with the right product at the right time

- Calculating customer value scores in order to better allocate resources to target more valuable customers

Don’t get left behind

Large banks are already utilizing artificial intelligence use cases at scale. In a recent letter to shareholders, Jamie Dimon, Chief Executive Officer of JPMorgan Chase wrote, “Artificial intelligence (AI) is an extraordinary and groundbreaking technology. AI and the raw material that feeds it, data, will be critical to our company’s future success—the importance of implementing new technologies simply cannot be overstated.”

Because of this focus, his company has made tremendous investments in AI. They currently have over 300 AI use cases in production, and employ almost 3,000 people in data management, data science, and AI-research-related roles. This underscores how vital these new technologies are to success in the future.

Unfortunately, not every institution has access to talent and technology at the scale of JPMorgan Chase. That’s why Aunaytics has developed a cloud-based data and analytics platform to provide data management, advanced reporting, and predictive AI and machine learning solutions for midsized community banks and credit unions.

Daybreak for Financial Services allows institutions to learn more about their customers and members in order to provide a better overall experience—which in turn reduces risk, increases wallet share, and reduces expenses.

2023 IBA/OBL Annual Convention

2023 IBA/OBL Annual Convention

Fairmont Chicago - Millennium Park, Chicago, IL

Ryan Wilson of Aunalytics Speaking at 2023 IBA/OBL Annual Convention

Aunalytics is pleased to announce that Ryan Wilson, VP, Client Relationships at Aunalytics, was chosen to present at the 2023 IBA/OBL Annual Convention in Chicago, IL. His presentation is entitled, “How to Win Wallet Share while Cutting Costs in Operations”. This presentation will examine how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. He will also share how Aunalytics empowers banks through our Daybreak™ for Financial Services solution, which enables community banks to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

Why You Should Include an Analytics Platform in your Banking Software Arsenal

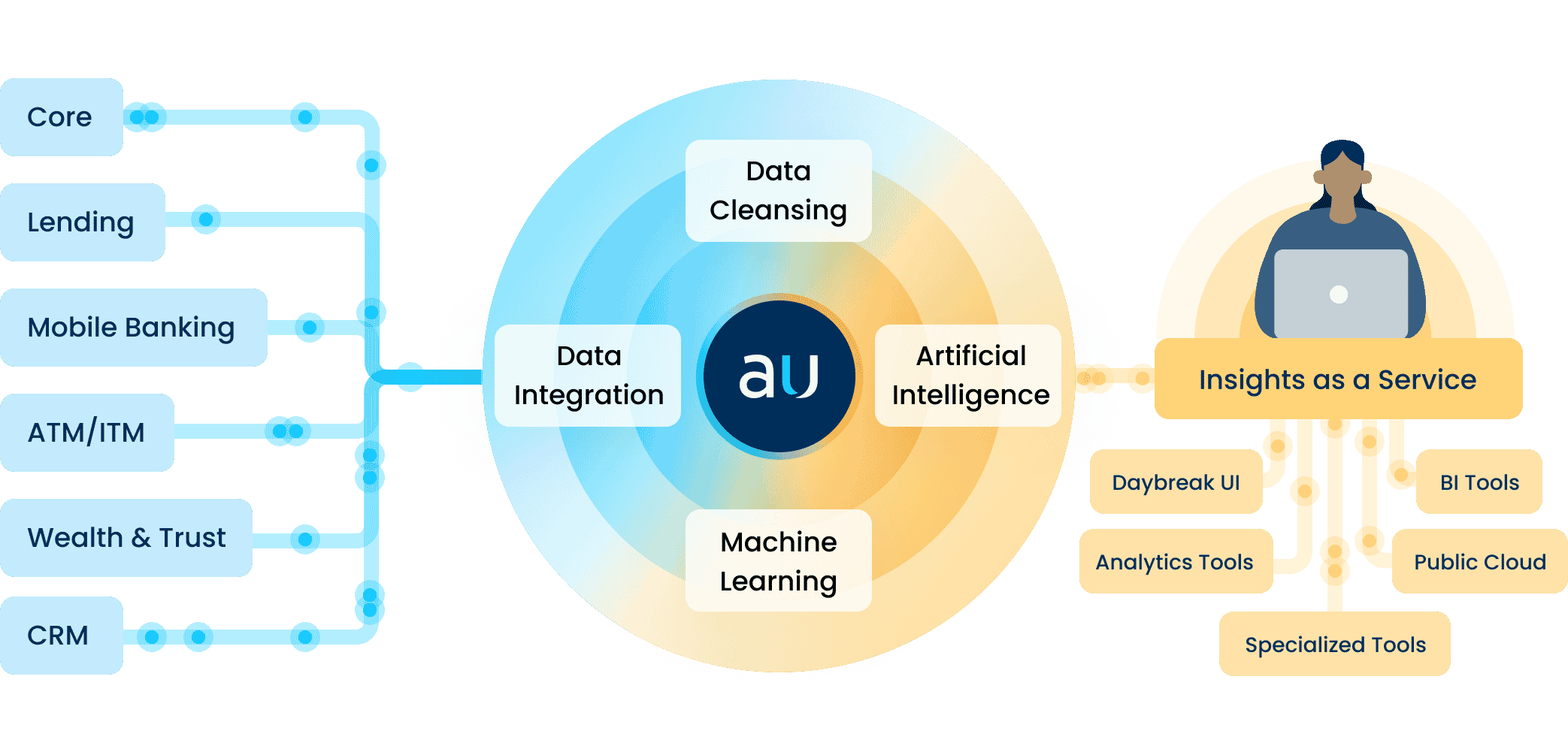

Banking software is vital to the success of all financial institutions. With an increasing focus on digital transformation, banks and credit unions amass a collection of platforms and software systems. Financial institutions not only rely on their banking core, but also CRM systems, online and mobile banking applications, loan management software, payment processing systems, and wealth management, risk, and compliance software, to name a few. Not only do these systems make banking more efficient, but they are collecting data that can be used to improve the business itself.

How can financial institutions best utilize their existing data? Thanks to their existing banking software, every institution holds valuable information about each customer or member that can be used to increase their lifetime value. PWC estimates that banks can generate a 70% return on initiatives targeting existing customers versus 10% when targeting new customers. Therefore, one of the best ways to use data to achieve better returns and higher margins is to focus on improving the customer or member experience.

Having access to an abundance of data points across various systems presents a tremendous opportunity to strengthen existing relationships—but it also poses a challenge. While each banking software system includes valuable information, it does not give the whole story. The problem for many institutions is that they have no way of getting a complete, 360-degree view of each individual from disparate software systems.

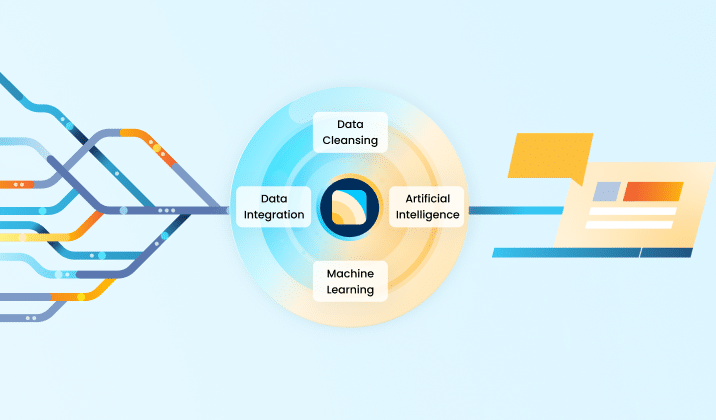

The Importance of an Analytics Platform

That is why a data and analytics platform is essential. An analytics platform can aggregate data from multiple systems, cleanse and organize that data into a 360-degree customer view, then apply artificial intelligence (AI) and machine learning algorithms to gain data-driven insights.

Once an analytics platform has been implemented, there are many customer intelligence use cases that can help banks and credit unions target the right customers, with the right offer, at the right time, including:

- Gaining transaction insights – Gaining access to transaction data, paired with AI and machine learning, gives great insights into consumer spending habits and preferences.

- Identifying competitor payments – By mining transactional data, financial institutions can discover customer payments going to competitors, then use that information to reach out to customers or members and win back business with a more attractive offer.

- Generating product recommendations – With access to data points from several software systems, machine learning and AI models can make predictions such as the next best product to offer for each customer.

- Predicting churn – AI algorithms identify trends in transactional data, and determine which customers are most likely to churn—so financial institutions can take actions to prevent it.

- Calculating Customer Lifetime Value – An analytics platform can calculate customer value scores based on a large number of relevant data points using AI and machine learning. Banks and credit unions can use this information to allocate resources toward targeting customers with higher customer lifetime value scores.

These are just a few of the ways banks and credit unions can implement insights from a data and analytics platform that mines data from across their organization’s many software systems. Once the platform is implemented, any number of use cases can be developed using AI and machine learning—getting the data collected, aggregated, updated, cleansed, and organized for analytics is one of the largest obstacles for organizations.

Thankfully, Aunalytics has developed a robust data and analytics platform called Daybreak for Financial Services. Daybreak provides all of these services and more to make sure your bank or credit union is making the most of its banking software data to reduce risk, optimize processes, increase revenue, and most importantly, improve the customer or member experience.

Indiana Bankers Association Mega Conference 2023

Indiana Bankers Association Mega Conference 2023

Indiana Convention Center, Indianapolis, IN

Aunalytics is excited to attend the 2023 IBA Mega Conference

Aunalytics is pleased to attend the 2023 Indiana Bankers Association Mega Conference. Aunalytics will be meeting with attendees and giving demos at booth #107. Representatives from Aunalytics will be educating attendees on how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. Event attendees can also learn more about the Daybreak™ for Financial Services solution which enables community banks to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

2023 MBA Perry Schools of Banking

MBA Perry Schools of Banking

Kellogg Center, East Lansing, MI

Drew Conley of Aunalytics Speaking at 2023 MBA Perry School of Banking

Aunalytics is pleased to announce that Drew Conley, Daybreak Relationship Manager at Aunalytics, was chosen to present at Michigan Bankers Association’s Perry Schools of Banking. His presentation is entitled, “How to Win Wallet Share while Cutting Costs in Operations”. This presentation will examine how financial institutions can use AI-driven insights to improve customer engagement and increase wallet share. He will also share how Aunalytics empowers banks through our Daybreak™ for Financial Services solution, which enables community banks and credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.

2023 Wisconsin Credit Union League Convention & Expo

2023 Wisconsin Credit Union League Convention & Expo

Kalahari Resort & Convention Center, Wisconsin Dells, WI

Aunalytics to attend the 2023 Wisconsin Credit Union League Convention & Expo

Aunalytics is pleased to attend 2023 Wisconsin Credit Union League Convention & Expo. Aunalytics will be meeting with attendees and giving demos at booth #320. Representatives from Aunalytics will be educating attendees on how financial institutions can use AI-driven insights to improve customer and member engagement and increase wallet share. Event attendees can also learn more about the Daybreak™ for Financial Services solution which enables credit unions to more effectively identify and deliver new services and solutions so they can better compete with large national banks.