The Value of Data Visualization

In this brief video, Dr. David Cieslak, Chief Data Scientist at Aunalytics, discusses the value that data visualization brings to data analytics. Whether you’re using a simple tool such as Excel or a BI software such as Tableau, creating a visual representation of your data allows it to be consumed by a much broader and less technical audience. Whether you’re a marketing specialist, a loan officer, or a bank president, a well-designed and up-to-date dashboard greatly improves your ability to understand and work with your data in a way that lists and spreadsheets can’t.

Aunalytics’ Daybreak Dashboards for Financial Institutions offer a variety of data visualization options such as the Customer Profile dashboard, which provides a 360-degree view of each customer, the Lending KPI dashboard, which provides overall and detailed lending performance across your organization, and the Marketing KPI dashboard, which allows for targeted campaigns to reach the right customer at the right time with the right product. With Aunalytics, you get the technology and the expertise required to turn your disparate data into easily understandable insights through the Daybreak Dashboards.

David Cieslak, PhD, is the Chief Data Scientist at Aunalytics since its inception and leads its Innovation Lab in the development and delivery of complex algorithms designed to solve business problems in the manufacturing/supply chain, financial, healthcare, and media sectors. Prior to Aunalytics, Cieslak was on staff at the University of Notre Dame as part of the research faculty where he contributed on high value grants with both the federal government and Fortune 500 companies. He has published numerous articles in highly regarded journals, conferences, and workshops on the topics of Machine Learning, Data Mining, Knowledge Discovery, Artificial Intelligence, and Grid Computing.

How An End-to-End Analytics Solution Helps You Avoid Hidden Costs

As the new year approaches, digital transformation should be at the top of every mid-market organization’s to-do list. As organizations begin to understand the value of business analytics for their daily operations, the need for an end-to-end analytics solution becomes evident. Yet, many companies struggle to obtain the right analytics solutions to fit their specific needs.

Unfortunately, the analytics solution market can be difficult to navigate. Since building an analytics tool in-house is incredibly time-consuming and very costly, many mid-market companies would be better served by working with a solution provider who can provide both the tools and talent necessary to achieve their business goals.

Digital Transformation Roadblocks

One major roadblock in the pursuit of digital evolution is determining how much an analytics solution is going to cost. Analytics solutions are complex, and when an analytics company gives a quote, they often fail to mention additional add-ons their solution needs to be functional. For instance, charges for a third-party cloud to host your analytics solution and individual charges for connectors that allow your disparate data sources to flow into the solution are the most common up-charges.

Your organization could get stuck with unexpected licensing fees or overage charges from a third-party cloud provider. Worse yet, you may end up piecing together various technologies, while lacking the adequate technical talent to keep the solution functioning and show actionable results. To achieve value from your investment, it is vital to look for a partner that can provide you with a solution where extra charges do not come into play. Budgets are an integral part of the decision-making process when it comes time to choose a solution provider.

With hidden costs, figuring out how a particular solution is going to fit into your budget becomes increasingly difficult. The most effective solution is opting for a partner who can provide your company with an end-to-end analytics solution.

Why Mid-Market Organizations Need End-to-End Analytics Solutions

To compete with larger institutions, mid-market organizations need to leverage their existing local data to gain insights to better serve their clients. An end-to-end solution ensures you do not end up with a solution your team cannot utilize to achieve your business goals and thrive in an increasingly competitive market.

It is a known fact that mid-market businesses struggle with retaining talent for data management, IT, security, and advanced analytics. Opting for an end-to-end solution gives you access to a team of experts who will always be by your side, assisting you every step of the way.

With Aunalytics, you get the technology and the expertise required to complete your journey from disparate data to actionable business results. Using our platform, your entire organization can reap the benefits of having a reliable and robust data platform.

Aunalytics Provides a Complete, End-to-End Analytics Solution for Mid-Sized Organizations

Aunalytics offers an end-to-end analytics solution that includes the right technology paired with experts who work by your side to help you accomplish your business goals. The technology, combined with the technical talent necessary to fully utilize it, will help your organization achieve true value from your investment. End-to-end analytics solutions provide you with insights from your data so you can concentrate on critical business decisions. No longer do you have to worry about overages, licensing costs or other additional charges. Aunalytics has the answers to your business and IT questions.

The Aunalytics Data Platform is a robust, cloud-native data platform built for universal data access, powerful analytics, and AI. It includes the following components:

- Aunalytics Enterprise Cloud provides a highly redundant, secure, and scalable platform for hosting servers, data, analytics, and applications at any performance level.

- Aunsight Golden Record integrates and cleanses siloed data from disparate systems for a single source of accurate business information across your enterprise.

- Daybreak Analytics Database provides daily insights powered by Artificial Intelligence (AI) and Machine Learning (ML) driven analytics, industry intelligence, and smart features that enable a variety of analytics solutions and timely actionable insights that drive strategic value across your company.

This end-to-end platform enables your business to extract answers from your data without having to worry about additional charges that might break your budget. Our solutions are secure, reliable, and scalable, all according to your business’ needs. Aunalytics solutions seamlessly integrate and cleanse your valuable data for accuracy, ensuring data governance and employing Artificial Intelligence (AI) and Machine Learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

Using our solution, team members across your organization can reap the benefits of having an end-to-end analytics solution to make data-driven decisions. Company executives can view data cleansed into an accurate golden record that is streamed in real-time to enable better decision making for the entire organization. Your organization’s marketing team can have access to aggregated data that reveals a 360-degree view of your customer, including insights into customer behavior, that empowers them to run data-driven campaigns to the right customer, at the right time, with the right product. Your IT department can ensure that you are functioning at peak efficiency by analyzing the data collected to scale resources and identify potential roadblocks and bottlenecks. Those are just a few departments that would benefit—think about how powerful a real-time analytics solution could be across your entire organization.

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Fill out the form below to receive a link to the article.

Related Content

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Accelerating Midsize Financial Institution Business Outcomes with AI Intelligence as a Service

Many financial institutions have struggled to efficiently and consistently use AI technologies for strategic and operational purposes. To meet this need, the Aunalytics® Innovation Lab was established to provide deep insights to midsize financial services organizations lacking large AI budgets. This combination of powerful analytics and intelligence services with an experienced data science team allows organizations to gain access to an affordable alternative to HyperCloud-based AI solutions.

Related Content

Daybreak Allows Financial Institutions to Increase Wallet Share with Competitor Payment Smart Feature

In the competitive financial services landscape, increasing revenue through new customer acquisition alone is a challenge. According to the Harvard Business Review, it can be anywhere from five to 25 times more expensive to acquire a new customer than to retain an existing one. While new customer acquisition is important, retention and expansion of existing relationships should be a high priority—especially during economic downturns when reducing costs is imperative. A recent report by Bain & Company states, “In financial services, a 5% increase in customer retention produces more than a 25% increase in profit. Why? Return customers tend to buy more from a company over time.” Therefore, it makes sense for community banks and credit unions to focus on retention and increasing wallet share of existing customers.

Winning Back Business by Identifying Competitor Payments

Many community bank customers and credit union members utilize multiple financial institutions for various products. They may have a checking or savings account at their local bank or credit union, but an IRA account at a large, national investment firm, or a loan through another financial institution. By identifying which customers have external accounts and which products they may have through other institutions, community banks and credit unions can take steps to win back that business and increase wallet share of their existing customers and members. Daybreak‘s Competitor Payments Smart Feature mines transactional data and uses AI algorithms to flag external products with competing financial institutions on all active customers/members. These insights can be used to make more attractive targeted offers to win back business.

Watch the video below to see how banks and credit unions can utilize Daybreak’s Competitor Payments insights to win back business from competing institutions:

In addition to providing the ability to discover competitor payment insights in transactional data, Daybreak allows community banks and credit unions to compete with large financial institutions by…

- Understanding customers,

- Optimizing processes, and

- Revealing actionable insights.

See how Daybreak Customer Intelligence for Financial Institutions is the customer data platform that makes it easier for community banks and credit unions to gain actionable insights and achieve positive business outcomes.

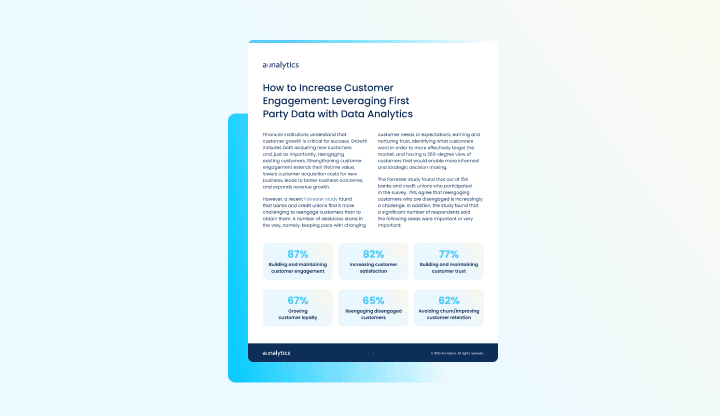

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

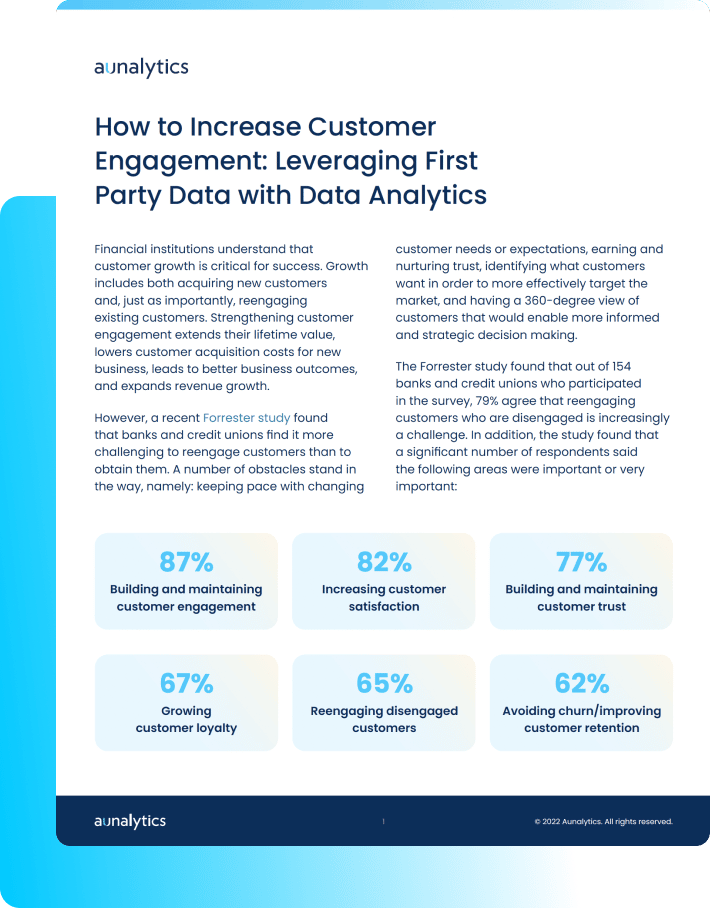

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

How to Increase Customer Engagement: Leveraging First Party Data with Data Analytics

Financial institutions understand that customer growth is critical for success—both acquiring new customers and, just as importantly, reengaging existing customers. Strengthening customer engagement extends their lifetime value, lowers customer acquisition costs for new business, leads to better business outcomes, and expands revenue growth. Using the data that you already have in-house, coupled with data analytics and predictive modeling, will drive smarter marketing campaigns that increase customer engagement.

Related Content

Aunalytics to Feature Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at Financial Services Events in November and December

Leading Data Management and Analytics Provider Will Showcase How AI-Powered Analytics Can Increase Business Wins with Real-Time Customer Insights and Highly Personalized Interactions

South Bend, IN (November 1, 2022) - Aunalytics, a leading data management and analytics company delivering Insights-as-a-Service for mid-market businesses, announced today its participation at three financial services events in November and December. The company will showcase its DaybreakTM for Financial Services advanced data analytics solution and demonstrate how midmarket banks and credit unions can use artificial intelligence (AI)-powered data analytics to increase business wins and compete more effectively.

November and December events include:

- Ohio Bankers League Annual Meeting, November 2-3

- The Financial Brand Forum 2022, November 14-16

- Annual CUSO Conference, December 1-4

Daybreak for Financial Services enables midsize financial institutions to gain customer intelligence and grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“It is critical now more than ever that mid-market banks and credit unions take action based on real-time insights that deliver a 360-degree view of customers or members so they can be nimbler and pivot their strategies as the market shifts course,” said Katie Horvath, Chief Marketing Officer of Aunalytics. “Aunalytics solutions offer this granular level of insights as a service at speed to inform banking strategies. Using Aunalytics Daybreak for Financial Services, mid-market banks and credit unions can now deploy advanced analytics to more highly personalize their interactions with customers and members. It enables them to target-market more efficiently with the right product offering at the right time, and win business away from competitors to increase revenue. We look forward to meeting with bankers and credit unions in the coming months, and demonstrating how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Tweet this: .@Aunalytics to Feature Its Advanced Data Analytics Solution for Mid-market Banks and Credit Unions at Financial Services Events in November and December #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation

About Aunalytics

Aunalytics is a leading data management and analytics company delivering Insights-as-a-Service for mid-sized businesses and enterprises. Selected for the prestigious Inc. 5000 list for two consecutive years as one of the nation’s fastest growing companies, Aunalytics offers managed IT services and managed analytics services, private cloud services, and a private cloud-native data platform for data management and analytics. The platform is built for universal data access, advanced analytics and AI – unifying distributed data silos into a single source of truth for highly accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI for accurate mission-critical insights. To solve the talent gap that so many mid-sized businesses and enterprises located in secondary markets face, Aunalytics’ side-by-side digital transformation model provides the technical talent needed for data management and analytics success in addition to its innovative technologies and tools. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Does Your Mid-Market Firm Have the Right Talent to Maximize Its Data Tech Investments?

Does Your Mid-Market Firm Have the Right Talent to Maximize Its Data Tech Investments?

Investing in digital transformation technologies can be a waste of money if your company forgets one important point. That point is, no matter how cutting edge the tech or tool may be, people are needed with specific technical expertise in order to derive true business value from these investments.

Unlike large enterprises, mid-market companies often try to find this expertise in their IT manager, hoping a jack-of-all-trades approach will take care of it. This is an unfortunate mistake, since it would require the IT manager to have unusual command over a long laundry list of duties, from data integration, ingestion, and preparation to data security, regulatory compliance, data science, and building pipelines of data ready for executive reporting from multiple cloud and on-premises environments. This is not just a tall order for a mid-market IT manager to pull off, but likely an impossible one.

To read more, please fill out the form below:

Featured Content

Nothing found.