2022 CULytics Day

2022 CULytics Day

Aunalytics to showcase Daybreak at 2022 CULytics Day

Aunalytics is pleased to sponsor 2022 CULytics Day, and will be hosting a virtual booth. Aunalytics has developed Daybreak™ for Financial Services, a cloud-native data platform that enables users to focus on critical business outcomes. Daybreak seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs AI and machine learning to glean intelligence from transactional data.

CBAO 48th Annual Convention

CBAO 48th Annual Convention

Hilton Columbus at Easton, Columbus, OH

Aunalytics is proud to be a Golf Lunch Sponsor and Exhibitor at the CBAO 48th Annual Convention

Aunalytics is excited to exhibit at the 2022 Community Bankers of Ohio 48th Annual Convention and serve as Lunch Sponsor at the Annual Golf Outing at Delaware Golf Club. Aunalytics will be demonstrating Daybreak™ for Financial Services, a cloud-native data platform which enables midsized banks to focus on critical business outcomes and make data-driven business decisions in order to compete with large financial institutions.

2022 OBL Bankers Cup

2022 OBL Bankers Cup

Jefferson Country Club, Blacklick, OH

Aunalytics excited to sponsor the 2022 OBL Bankers Cup Golf & Cornhole Tournament

Aunalytics is excited to sponsor the Ohio Bankers League’s 2022 OBL Cup Golf & Cornhole Tournament. Aunalytics has developed Daybreak™ for Financial Services, a cloud-native data platform, to enable community banks to focus on critical business outcomes and make data-driven business decisions in order to compete with large financial institutions. Aunalytics also offers a complete suite of security and managed IT services to proactively protect and maintain organizations’ technologies, allowing staff to work without interruptions.

1st Source Bank Focuses on Serving Customers with the Selection of Aunalytics Secure IT Managed Services

Company Gains Full Suite of IT Services as Infrastructure Shifts to the Cloud

South Bend, IN (August 2, 2022) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for mid-market businesses, today announced that South Bend, Indiana-based 1st Source Bank, is adopting Aunalytics Secure Managed IT Services so that it can quickly leverage cloud technology and also upgrade baseline infrastructure. Under the new arrangement, Aunalytics’ services will include data center infrastructure, server infrastructure, endpoint management, backup and disaster recovery (DR), and cybersecurity.

Established in 1863, 1st Source Bank assists its clients with building wealth and achieving financial security. The bank is a community financial services provider with community values and has held these same principles while providing outstanding customer service for more than 150 years. 1st Source operates across 81 branches in Indiana and Michigan and oversees a Specialty Finance Group that provides financing for aircraft, trucks, and construction equipment.

Prior to selecting Aunalytics, the organization conducted a thorough evaluation of its technology operations and decided to avoid locking the company into a hardware environment for another five-year period. The IT leadership chose to focus its IT resources on applications, data, and integration priorities of the business instead of continuing to support hardware internally. Additionally, the IT team at 1st Source Bank sought to deploy a near-term cloud option and expand upon its backup and DR options in order to build a more flexible and fully redundant computing environment.

Another draw on the bank’s IT staff was server management, which Aunalytics will also oversee. And with future plans to implement more advanced operational analytics, 1st Source Bank plans to start a full data management initiative, taking its data strategy to the next level.

“When it comes to IT infrastructure, there are several things that we need to maintain control over: The customer experience, data efficiency and innovation,” said Inder Koul, Chief Information Officer, 1st Source Bank. “Customers are intimately linked with their data so it must be closely guarded, and innovation will allow us to test new and compelling services that will provide a range of new and thoroughly secure services. With Aunalytics, there will be a 360-degree view of managed activities and greater context to deepen our relationships with customers.”

The Aunalytics Managed Services team provides ongoing support and security for 1st Source Bank servers, workstations, and networking equipment. The company provides 24/7/365 remote monitoring and management to mitigate the risk of valuable infrastructure becoming unavailable. Hardware and software are fully managed to proactively address any issues. The company's remote monitoring agent includes client-based interactive support, performance management, alerting, asset management and reporting, as well as on-site advisors to help mitigate any possible risks to the environment.

“Successful banks are flipping the script when it comes to IT management, bringing in managed IT and solution experts like Aunalytics to oversee an important range of tasks,” said Rich Carlton, President, Aunalytics. “By enhancing its IT processes with Aunalytics, 1st Source Bank will able to more efficiently and effectively service its clients. As a result, the bank’s customers will benefit from more sophisticated products and services in 2022 and beyond.”

Tweet this: 1st Source Bank Focuses on Infrastructure Modernization and Cloud Adoption with the Selection of @Aunalytics Secure IT Managed Services - https://www.aunalytics.com/category/pr/ #datacenter #datacenterinfrastructure #serverinfrastructure #endpointmanagement #backupanddisasterrecovery #DR #cybersecurity #Dataplatform #Dataintegration #Dataaccuracy #DigitalTransformation

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform members’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

AI Solutions Accelerate Business Outcomes for Midsize Financial Institutions

Midsize financial institutions make better decisions when they utilize AI solutions to discover insights in their data. By combining powerful analytics and intelligence services with an experienced data science team, organizations can gain access to an affordable alternative to HyperCloud-based AI solutions. The Aunalytics® Innovation Lab was established to fulfill the need for deep insights, catering to midsize financial services organizations lacking large AI budgets. This highly specialized team of data scientists produces data-driven analytic insights for companies seeking unique predictive functionality to solve mission critical business challenges.

According to a recent Deloitte survey of IT and line-of-business executives, “86% of financial services AI adopters say that AI will be very or critically important to the success of their business over the next two years. While the banking sector has long been technology-dependent and data-intensive, new data-enabled AI technology has the capability to drive innovation further and faster than ever before. AI can help improve efficiency, enable a growth agenda, boost differentiation, manage risk and regulatory needs, and positively influence customer experience.”

To speed insights for financial services customers, the Innovation Lab has developed AI-powered Smart Features. Smart Features are customized to leverage insights obtained from data-driven machine learning models. By providing extensive data science expertise to answer industry and client specific business questions, Aunalytics is showcasing the promise of data-driven intelligence for midmarket financial services. As a result, these organizations can better understand a particular customer, product or service viability through comparison to other customers and/or data. Whether there is an interest in knowing if a customer is likely to select a new financial product, her potential as a long-term customer, or any other number of questions, the Aunalytics Innovation Lab team of data scientists and financial industry business analysts are experienced and committed to answering these questions based on years of experience with other small to midsize financial establishments.

“Demand for intelligence services by financial services organizations is strong in 2022. Therefore, we are building in a number of new Smart Features to enhance system capabilities,” said David Cieslak, Chief Data Scientist. “Our goal is to enable mid-market financial institutions, such as community banks and credit unions, to use data in a powerful way to enhance their personalized services to better compete against Fortune 500 banks.”

As the financial services industry is one of the top consumers of business intelligence and analytics, these organizations are on the hunt for cutting-edge technology in their mission to identify customer preferences with regard to financial products as well as the need to better understand operational systems and conditions throughout the business. Data platform and predictive analytics solution providers like Aunalytics are the primary enablers behind many next-generation initiatives and are managing the lion’s share of this work for community banks and credit unions by extracting strategic insights, prioritizing market share, expanding products/services, and monitoring key performance indicators (KPIs) to maintain operational excellence. As a result, this has supported community financial institutions to better compete against national banks by strengthening the level of decision making, while empowering white glove service with powerful data analytics.

The Key to Data-Driven Success for Mid-Market Companies Starts Here

The Key to Data-Driven Success for Mid-Market Companies Starts Here

To read more, please fill out the form below:

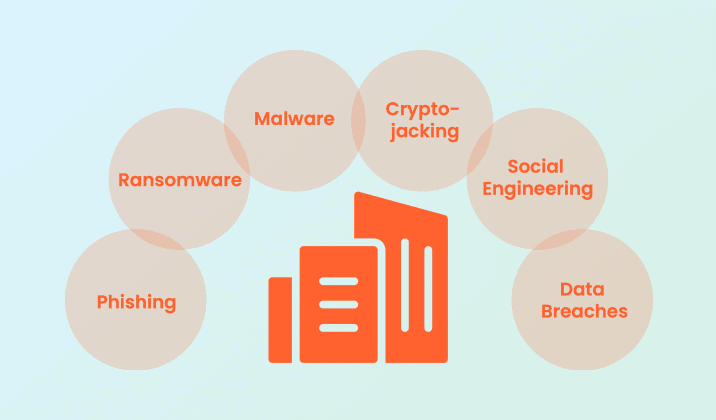

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.

Fill out the form below to receive a link to the article.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

Lowering Cybersecurity Insurance Premiums with Managed Security Services - PDF

Lowering Cybersecurity Insurance Premiums with Managed Security Services

Midmarket organizations face the threat of cyberattacks that put every organization at great risk. As a result, a greater number of IT professionals are turning to managed security services to lower cybersecurity insurance premiums.