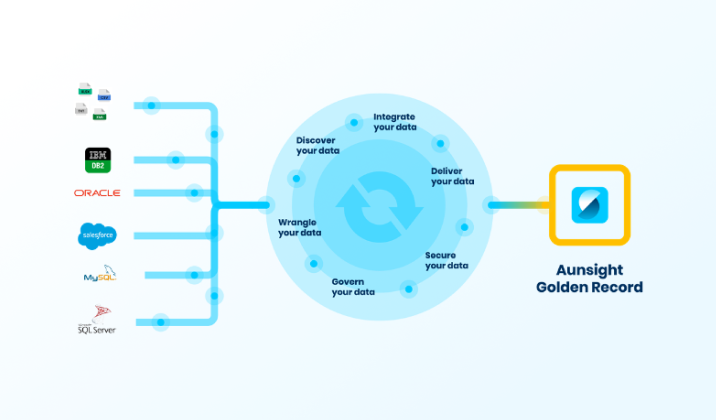

Aunsight Golden Record creates a single source of truth for credit union data

Credit unions have a great deal of data spread across various systems. However, it is impossible to create a centralized, accurate and up-to-date record of all of this data manually. Aunsight™ Golden Record automates this process by aggregating, cleansing, and merging data into a single source of truth so credit unions have access to an accurate record of their data in one place.

Watch the video below to learn more about how Aunsight Golden Record, along with the expertise of the Aunalytics team, can help credit unions quickly and painlessly take charge of their data:

Aunalytics Cites Cybersecurity Best Practices for Financial Services as Attacks Rise 118% in 2021

Secure Managed Services Provider Protects Community Banks and Credit Unions as Cybercriminals Double Down on Efforts to Breach Financial Data, Compromise Accounts, and Profit Illegally

South Bend, IN (December 14, 2021) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, today announced several cybersecurity best practices for financial services firms, including community banks and credit unions. This guidance follows new data showing hackers will continue to strike these organizations with increasing sophistication, targeting the high value data held by these organizations.

For the past six years, the finance sector has been ranked number one as the most cyberattacked industry. In 2020, attacks against banks and other financial institutions climbed an incredible 238% followed by a further impressive 118% increase in 2021. One example includes Europe-based Carbanak and Cobalt malware campaigns which targeted more than 100 financial institutions in more than 40 countries during five years, yielding criminal profits of more than a billion Euros.

According to the 2021 Modern Bank Heists 4.0 survey, the most common types of attacks hitting the financial services sector in 2020 and 2021 included server attacks, data theft and ransomware cases. It was also found that 57% of surveyed financial institutions revealed an increase in wire transfer fraud, 54% had experienced destructive attacks, 41% had suffered brokerage account take-overs, 51% experienced attacks on target market strategy data, 38% suffered attacks originating from hackers accessing trusted supply chain partners to gain entry into the bank, and 41% had become victim to manipulated timestamps resulting in fund theft.

Increasing the challenge for financial institutions is the fact that the current unemployment rate for IT security professionals is approximately 0%. The scarcity of highly skilled security professionals is compounded by the huge volume of emerging threats. As a result, financial institutions are struggling to keep up with the ever-increasing threat landscape. Digitalization in commerce is driving the need for continuously adapting and evolving skills and knowledge for IT security.

Best Practices for the Defense Against Cyber Threats

As a specialist in secure managed services, the experts at Aunalytics have reviewed the top actions necessary to secure IT, administrative, and environments touching the consumer in the financial services space to prioritize the most important areas that should be considered when securing these businesses against a cyberattack. The following best practices include:

- Continuously updating security technology and protocols as threats evolve and adapt. This means deploying a dedicated full-time security team – not an overworked IT department handling system stability and help desk, while also trying to keep abreast of the latest security threats and technologies, piecing together security tools as a solution. This is not a solution.

- Employment of 24/7/365 monitoring with remote remediation to quickly stop attacks in their tracks.

- Monitoring endpoint devices to stop attacks before they hit networks. User devices are the most likely entry point for attackers to compromise a financial institution due to the high propensity for innocent user error opening doors.

- Monitoring cloud security including application use across the financial institution to be on the lookout for atypical user behavior signaling an attack.

- Monitoring email and Office 365 using tools specially designed to thwart attacks on these platforms, such as expertly recognizing and removing phishing scams before employees have an opportunity to unleash horrible consequences with a rogue mistaken click.

- Having a dedicated security team and SOC, or hire an expert outside managed security services firm that embeds tools, technology and 24/7/365 monitoring to serve as an SOC. This is a must for financial institutions.

- Pushing frequent patches so that user devices are equipped with the latest security protections.

- Adopting deep learning or AI monitoring, mitigation and context investigation that can more quickly identify threats.

- Encrypting data so that it is not compromised even if a breach occurs.

- Using multi-factor authentication to protect against unauthorized access.

- Instructing employees and customers to only access bank data in a secure location over a non-public Internet connection.

- Training employees on cybersecurity threats quarterly.

- Developing a solid business recovery plan for when an attack occurs.

“The challenge with cyber threats is daunting because they can enter the business environment from any number of areas, making comprehensive, multi-layer security strategies and implementations a must,” said Katie Horvath, CMO, Aunalytics. “However, by implementing this recommended regiment of protections, organizations can significantly reduce the risk of a successful attack, safeguarding client data and the organization’s long-term viability.”

Tweet this: .@Aunalytics cites cybersecurity best practices for financial services as attacks rise 118% in 2021 #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Citizens Federal Simplifies IT with Managed Services by Aunalytics

Citizens Federal Simplifies IT with Managed Services by Aunalytics

Ohio Savings & Loan Automates and Improves IT Efficiency with

Comprehensive Managed Services Suite by Regional Technology Leader

Fill out the form below to receive the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

Daybreak's built-in data connectors and integrations speed insights for financial institutions

Got data? There’s a Daybreak connector for that! Our customer intelligence data platform, Daybreak™ for Financial Services, has built-in connectors for the financial services industry so credit unions and banks can put an end to siloed, disparate data. Daybreak connects to most relevant data sources, including core, lending, wealth, CRMs, and mobile banking. Whether structured or unstructured, on-prem or in the cloud, Daybreak can handle all types of data and sources.

In addition, Daybreak can feed cleaned, updated data to other systems you may be using, including BI platforms or analytics tools, through pre-built integrations. Watch the video below to learn more about Daybreak’s connectors and integrations.

Aunalytics Vice President of Client Relationships Ryan Wilson to Speak at the Missouri Executive Management Conference; Wilson’s Talk Will Offer Insights into Leveraging Data to Compete Against National Banks

Advanced Data Platform Provider Will Feature Aunalytics Daybreak for Financial Services in December as a Diamond Sponsor of the Missouri conference, as a Silver Sponsor of the Michigan Bank Management and Directors Conference, and at the Annual CUSO Conference

South Bend, IN (November 23, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that its Vice President of Client Relationships, Ryan Wilson, will be featured as a speaker at the Missouri Executive Management Conference, December 1-3, 2021. Wilson’s presentation, How to Leverage Your Data to Win Against National Banks, will take place on December 2. Aunalytics is a Diamond Sponsor of the conference, which will be held at the Ritz Carlton Hotel in St. Louis.

Aunalytics will feature its advanced data analytics solution for midmarket community banks at the Missouri conference, as well as at two additional financial events:

- Michigan Bank Management and Directors Conference, December 1-3, 2021. Aunalytics will participate as a Silver Sponsor of the Michigan conference, which will be held at the Westin Book Cadillac hotel in Detroit.

- Annual CUSO (Credit Union Service Organization) Conference, December 2-5, 2021 at the TradeWinds Island Grand Resort, St. Petersburg, Florida.

Aunalytics’ DaybreakTM for Financial Services offers midsize banks and credit unions the ability to gain customer intelligence to grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

With daily insights powered by the Aunalytics cloud-native data platform, industry intelligence, and smart features that enable a variety of analytics solutions for fast, easy access to credible data, financial services users can find the answers to such questions as:

- Which customers with a credit score above 700 are most likely to buy a HELOC?

- Who are my current members with a HELOC that are utilizing less than 25% of their line of credit?

- Who are my current customers that have a loan and not a deposit account?

- Who has a mortgage or wealth account with one of my competitors?

- Which loans were modified from the previous day?

“Financial institutions have a massive amount of data that is typically siloed across the organization, making it difficult and time consuming to aggregate and integrate for higher business value,” said Ryan Wilson, Vice President of Client Relationships, Aunalytics. “Aunalytics Daybreak for Financial Services enables them to harness the power of their data to gain valuable insights and better target and deliver new services and solutions for their customers so they are better positioned to compete with national banks. We look forward to meeting with bankers in Missouri and Michigan, in addition to credit union service organizations, and showing how our advanced data analytics solution can help them intelligently anticipate customer needs and deliver the right products and services at the right time to increase their competitive advantage.”

Tweet this: .@Aunalytics Vice President of Client Relationships Ryan Wilson to Speak at the Missouri Executive Management Conference #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at http://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

2021 Annual CUSO (Credit Union Service Organization) Conference

Annual CUSO Conference

TradeWinds Island Grand Resort, St. Petersburg, FL

Aunalytics to attend the 2021 Annual CUSO (Credit Union Service Organization) Conference

Aunalytics will be attending the Annual CUSO (Credit Union Service Organization) Conference, where they will be demonstrating Daybreak™ for Financial Services. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

Missouri Executive Management Conference 2021

Missouri Executive Management Conference

Ritz Carlton, St. Louis, MO

Aunalytics to present talk, How to Leverage Your Data to Win Against National Banks, at the Missouri Executive Management Conference

Aunalytics is a Diamond Sponsor of the Missouri Bankers Association’s Executive Management Conference. Ryan Wilson, Vice President of Client Relationships at Aunalytics, will be a featured speaker, giving the presentation How to Leverage Your Data to Win Against National Banks, which takes place on December 2. In addition, Aunalytics will be demonstrating Daybreak™ for Financial Services at booth #10 in the exhibition hall. Daybreak enables community banks to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.