Michigan Bank Management and Directors Conference 2021

Michigan Bankers Association Bank Management and Directors Conference

The Westin Book Cadillac, Detroit, MI

Aunalytics Participates as a Silver Sponsor at the Michigan Bankers Association's Bank Management and Directors Conference

Aunalytics will be attending the Michigan Bankers Association’s Bank Management and Directors Conference as a Silver Sponsor, and will be demonstrating Daybreak™ for Financial Services at booth #3 in the exhibition hall. Daybreak enables community banks to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

Daybreak's Predictive Smart Features Add Additional Value for Credit Unions

Is your credit union in a position to hire experienced data scientists who will develop predictive algorithms to enrich your member relationships? With Aunalytics, you can take advantage an entire team of data science talent. Our customer intelligence data platform, Daybreak™ for Financial Services, includes industry relevant Smart Features™ —high value data fields created by our Innovation Lab using advanced AI to provide high-impact insights.

Watch the video below to learn more about how Smart Features provide additional value for credit unions.

Minnesota Credit Union Network Accelerate 2021 Annual Conference

ACCELERATE 21 Annual Conference

Minnesota Credit Union Network

Radisson Blu MOA, Bloomington, MN

Aunalytics to demonstrate Daybreak platform as a Silver Sponsor at ACCELERATE 21, the MnCUN's annual conference

Aunalytics is excited to attend the Minnesota Credit Union Network’s ACCELERATE 21 annual conference as a Silver Sponsor, and will be demonstrating Daybreak™ for Financial Services at booth #22 in the exhibition hall. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

2021 Indiana Bankers Association Banking on Women Conference

2021 Indiana Bankers Association Banking on Women Conference

Sheraton Indianapolis Hotel at Keystone Crossing, Indianapolis, IN

Aunalytics to Attend the 2021 IBA Banking on Women Conference

Aunalytics is pleased to attend the Banking on Women Conference in Indianapolis as a Ruby Sponsor. In addition to connecting with women bankers from across the state and listening to empowering speakers, Aunalytics will be demonstrating Daybreak™ for Financial Services, which uncovers customer insights from transactional data using machine learning and AI, and is tailored to the financial services industry.

California and Nevada Credit Union Leagues REACH 2021

REACH 2021

California and Nevada Credit Union Leagues

JW Marriott Desert Springs Resort, Palm Desert, CA

Aunalytics President Rich Carlton to Speak at the California and Nevada Credit Union League’s REACH 2021

Rich Carlton will be featured as a REACHtalk speaker at the California Nevada Credit Union League’s REACH 2021, November 1-4. Carlton’s talk, Leverage Your Data with Advanced Analytics to Personalize Customer Intelligence and Achieve Competitive Advantage, will take place on November 3, 2021 at 11:45. Aunalytics will also be demonstrating Daybreak™ for Financial Services at booth #1000 in the exhibition hall. Daybreak enables credit unions to more effectively identify and deliver new services and solutions for their members so they can better compete with large national banks.

Aunalytics President Rich Carlton to Speak at the California and Nevada Credit Union League’s REACH 2021

Carlton’s REACHtalk Will Offer Insights into Leveraging Data with Advanced Analytics to Personalize Customer Intelligence and Achieve Competitive Advantage

Leading Data Platform Provider Will Feature Aunalytics Daybreak for Financial Services in November at Industry Events Attended by California, Nevada, Indiana, and Minnesota Bankers and Credit Unions

South Bend, IN (October 25, 2021) – Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, announced today that the company’s president, Rich Carlton, will be featured as a REACHtalk speaker at the California Nevada Credit Union League’s REACH 2021, November 1-4. Carlton’s talk, Leverage Your Data with Advanced Analytics to Personalize Customer Intelligence and Achieve Competitive Advantage, will take place on November 3, 2021 at 11:45. REACH 2021 will be held at the JW Marriott Desert Springs Resort & Spa. Aunalytics will also feature its advanced data analytics solution for midmarket community banks at three industry events attended by bankers and credit unions from California, Nevada, Indiana, and Minnesota in November.

Aunalytics’ DaybreakTM for Financial Services offers midsize banks and credit unions the ability to gain customer intelligence to grow their lifetime value, predict churn, determine which products to introduce to customers and when, based upon deep learning models that are informed by data. Built from the ground up, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Midmarket financial institutions can thrive by redefining the local experience and digitally transforming how they operate,” said Carlton. “The ability to target, discover and offer the right services to the right people, at the right time, improves customer relationships, delivers new products and services through data-driven campaigns, and accelerates competitive advantage. We look forward to meeting with bankers and credit unions from California, Nevada, Indiana, and Minnesota and showing how Daybreak for Financial Services can help them strengthen their position in regional markets and compete more effectively.”

Aunalytics will demonstrate Daybreak for Financial Services at:

- California Nevada Credit Union League’s REACH 2021, November 1-4

- Indiana Bankers Association Banking on Women Conference, November 3-4

- Minnesota Credit Union Network ACCELERATE21 Annual Conference, November 18-19

Tweet this: .@Aunalytics President Rich Carlton to Speak at the California Nevada Credit Union League’s REACH 2021 #FinancialServices #Banks #CreditUnions #Dataplatform #DataAnalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Named a Digital Innovator by analyst firm Intellyx, and selected for the prestigious Inc. 5000 list, Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at http://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

Think your financial institution is immune to ransomware? Think again.

Many organizations in the financial services sector don’t expect to be hit by ransomware. In the recent State of Ransomware in Financial Services 2021 survey by Sophos, 119 financial services respondents indicated that their organizations were not hit by any ransomware attacks in the past year, and they do not expect to be hit by them in the future either.

The respondents mentioned that their confidence relied on the following beliefs:

- They are not targets for ransomware

- They possess cybersecurity insurance against ransomware

- They have air-gapped backups to restore any lost data

- They work with specialist cybersecurity companies which run full Security Operations Centers (SOC)

- They have anti-ransomware technology in place

- They have trained IT security staff who can hinder ransomware attacks

It’s not all good news. Some results are cause for concern. Many financial services respondents that don’t expect to be hit (61%) are putting their faith in approaches that don’t offer any protection from ransomware.

- 41% cited cybersecurity insurance against ransomware. Insurance helps cover the cost of dealing with an attack, but doesn’t stop the attack itself.

- 42% cited air-gapped backups. While backups are valuable tools for restoring data post attack, they don’t stop you getting hit.

While many organizations believe they have the correct safeguards in place to mitigate ransomware attacks, 11% believe that they are not a target of ransomware at all. Sadly, this is not true. No organization is safe. So, what are financial institutions to do?

While advanced and automated technologies are essential elements of an effective anti-ransomware defense, stopping hands-on attackers also requires human monitoring and intervention by skilled professionals. Whether in-house staff or outsourced pros, human experts are uniquely able to identify some of the tell-tale signs that ransomware attackers have you in their sights. It is strongly recommended that all organizations build up their human expertise in the face of the ongoing ransomware threat.

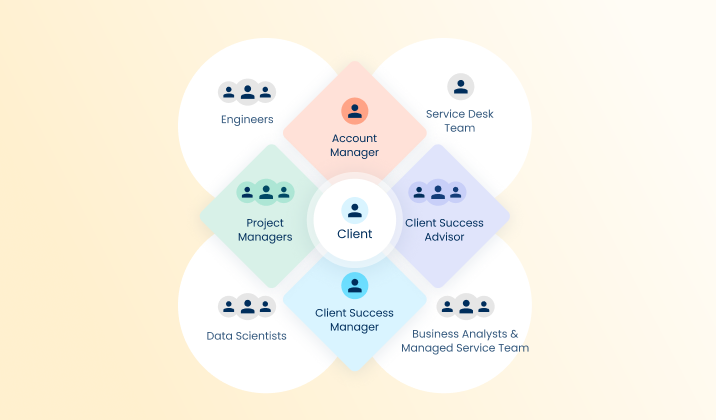

Credit Unions Realize Business Outcomes Sooner by Utilizing Aunalytics' Expertise

Aunalytics speeds time to value for credit unions looking to dive into analytics. By offering a well-rounded team including technology experts—such as data engineers and data scientists—and subject matter experts with experience in the financial services industry, Aunalytics is able to implement our Daybreak solution quickly and get credit unions actionable business answers using machine learning and AI.

Watch the video below to learn more about how our team gets credit unions the answers they need faster.