Aunalytics to Showcase Daybreak for Financial Services at August Industry Events Attended by Illinois, Indiana, Ohio, and Tennessee Bankers

Leading Data Platform Provider Will Demonstrate Its Advanced Analytics Solution Designed to Help Community and Midsize Banks Compete Against National Financial Institutions

South Bend, IN (August 3, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will feature its advanced analytics solution for midsize and community banks at four industry events attended by bankers from Illinois, Indiana, Ohio, and Tennessee in August. Aunalytics DaybreakTM for Financial Services enables bankers to more effectively identify and deliver new services and solutions for their customers so they can better compete with large national banks.

Aunalytics will demonstrate Daybreak for Financial Services at:

- Community Bankers Association of Ohio Annual Convention, August 10-12

- Illinois Bankers Association Annual Conference (virtual), August 11-14

- Indiana Bankers Association Convention, August 15-17

- Tennessee Credit Union League Annual Convention & Expo, August 18-20

Aunalytics’ Daybreak for Financial Services offers the ability to target, discover and offer the right services to the right people, at the right time. The solution empowers mid-market financial institutions with advanced analytics and valuable business insights to improve customer relationships, strategically deliver new products and services through data-driven campaigns, and increase competitive advantage with Aunalytics’ side-by-side digital transformation model.

Built from the ground up for midsize and community banks, Daybreak for Financial Services is a cloud-native data platform that enables users to focus on critical business outcomes. The solution seamlessly integrates and cleanses data for accuracy, ensures data governance, and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and timely actionable insights that drive strategic value.

“Massive amounts of siloed data are difficult to integrate and present a real challenge to midsize and community banks that want to get a better foothold against their larger counterparts,” said Rich Carlton, President, Aunalytics. “Daybreak for Financial Services mines transactional bank data every day to deliver timely insights, such as which product is a customer most likely to purchase next. This enables mid-market banks to more efficiently target and deliver new services and solutions for their customers so they can compete with national banks. We look forward to meeting with bankers from Illinois, Indiana, Ohio, and Tennessee, and demonstrating how Daybreak helps them anticipate customer needs to deliver the right products and services at the right time to gain a critical edge.”

Tweet this: .@Aunalytics to Showcase Daybreak for Financial Services at August Industry Events Attended by Illinois, Indiana, Ohio, and Tennessee Bankers #Dataplatform #Dataanalytics #Dataintegration #Dataaccuracy #AdvancedAnalytics #ArtificialIntelligence #AI #Masterdatamanagement #MDM #DataScientist #MachineLearning #ML #DigitalTransformation #FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Denise Nelson

The Ventana Group for Aunalytics

(925) 858-5198

dnelson@theventanagroup.com

How to Identify Which of Your Banking Customers are at Risk for Crypto Scams

The allure of investing early in the “next big thing” has led to interest in investing in cryptocurrency. Cryptocurrency is a type of digital or virtual money that exists in electronic form (no printed dollars or coins). As a new industry, it is highly unregulated compared to other types of investments and banking. While there is potential for a big win, there is strong potential for a big loss.

Crypto Buyer Profile

Crypto investors tend to be younger adults. They decide to put money into a crypto currency investment with the idea that the currency will gain value over time. When compared to current low and no interest checking and savings accounts rates, where money will not grow in a conventional banking account, crypto provides the promise of potential growth.

People use cryptocurrency for quick payments, to avoid transaction fees that regular banks charge, or because it offers some anonymity. It is typically exchanged person to person online (such as over a phone or computer) without an intermediary like a bank. This means that there is often no one to turn to if there is a problem with the exchange.

Crypto Risks

While some crypto investment opportunities may be speculative long term plays, unfortunately unscrupulous scammers have been attracted to the emerging industry. Investors may find their investment to be worth nothing and the value stolen by a scammer. New crypto currency brands emerge often and many consumers do not know which are legitimate. Because crypto currency is stored in a digital wallet, it is at risk from hackers stealing it. Because there is no banking intermediary, there is no one to turn to if there is fraud.

Crypto currencies are not backed by the government. So, if you store your crypto with a third party company that disappears or is hacked and your money is stolen, there is little to no recourse and the government has no obligation to help you get your money back.

Unlike with credit card purchases, returns and refunds are often not possible for purchases made with crypto because the unregulated industry does not offer these protections as standard.

Crypto currency values change rapidly and constantly. Value is based upon supply and demand. Unlike many investments that may fall in value but typically regain value over time, crypto is less stable. A purchase of $1000 could fall to a value of $100 in minutes. Conversely, it could rise to a value of $10,000 in minutes. But then it could change again – even while you are trying to cash out on your gain while up, it could result in a loss due to the value changing again before the transaction is complete.

How can you protect your banking customers from crypto fraud?

DaybreakTM for Financial Institutions was built specifically for mid-market banks and credit unions to get business outcomes using analytics. Daybreak can mine your transactional data to determine which of your customers has money leaving or entering your bank from a crypto currency company. This will give you an actionable list of customers for outreach and education on risks. If enriched with a listing of crypto companies known to be fraudulent, targeted outreach may be done by you to save your customers from fraud. Further, after explaining the risks of crypto and educating your customers, you may be able to offer an alternative investment opportunity to keep your customers safe and their dollars in your bank.

2021 Missouri Bankers Association Annual Convention

Missouri Bankers Association Annual Convention & Trade Show

Chateau on the Lake Resort Spa & Convention Center, Branson, MO

Aunalytics is attending the 2021 MBA Annual Convention as a Gold Sponsor

Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will join the upcoming Missouri Bankers Association Annual Convention as a Gold Sponsor, July 13-16 in Branson, MO. Aunalytics will feature its Daybreak™ for Financial Services solution with advanced analytics that enable bankers to more effectively identify and deliver new services and solutions for their customers for greater competitive advantage.

What are Smart Features?

Machine learning is a leading component of today’s business landscape, but even many forward-looking business leaders in the mid-market have difficulty developing a strategy to leverage these cutting edge techniques for their business. At Aunalytics, our mission is to improve the lives and businesses of others through technology, and we believe that what many organizations need to succeed in today’s climate is access to machine learning technology to enhance the ability to make data driven-decisions from complex data sources.

Imagine having the ability to look at a particular customer and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our products is this customer most likely to choose next?

- How likely is this customer to default or become past due on an invoice?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics’ Innovation Lab data scientists have combed through data from our clients in industries like financial services, healthcare, retail, and manufacturing and have developed proprietary machine learning techniques based on a solid understanding of the data commonly collected by businesses in these sectors.

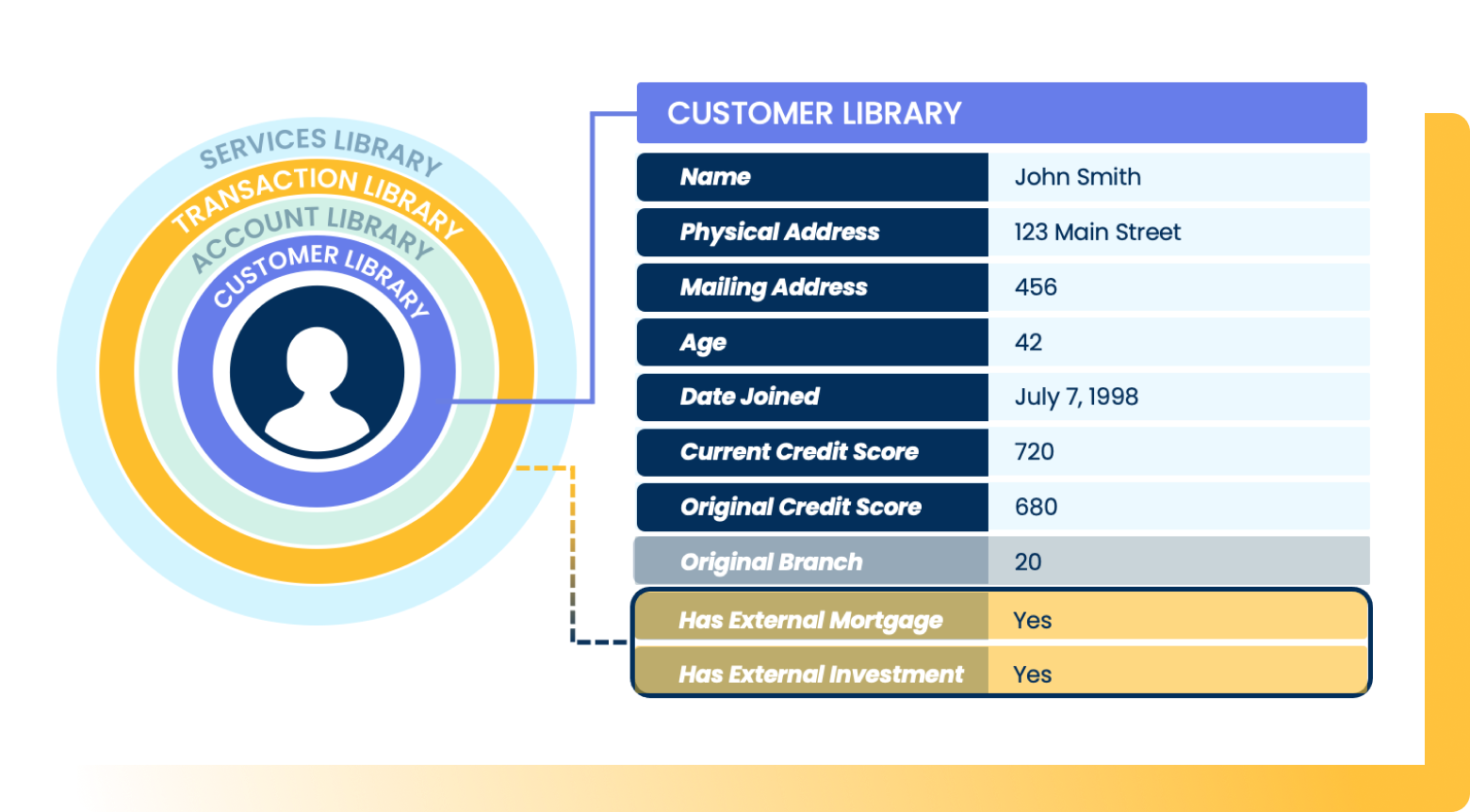

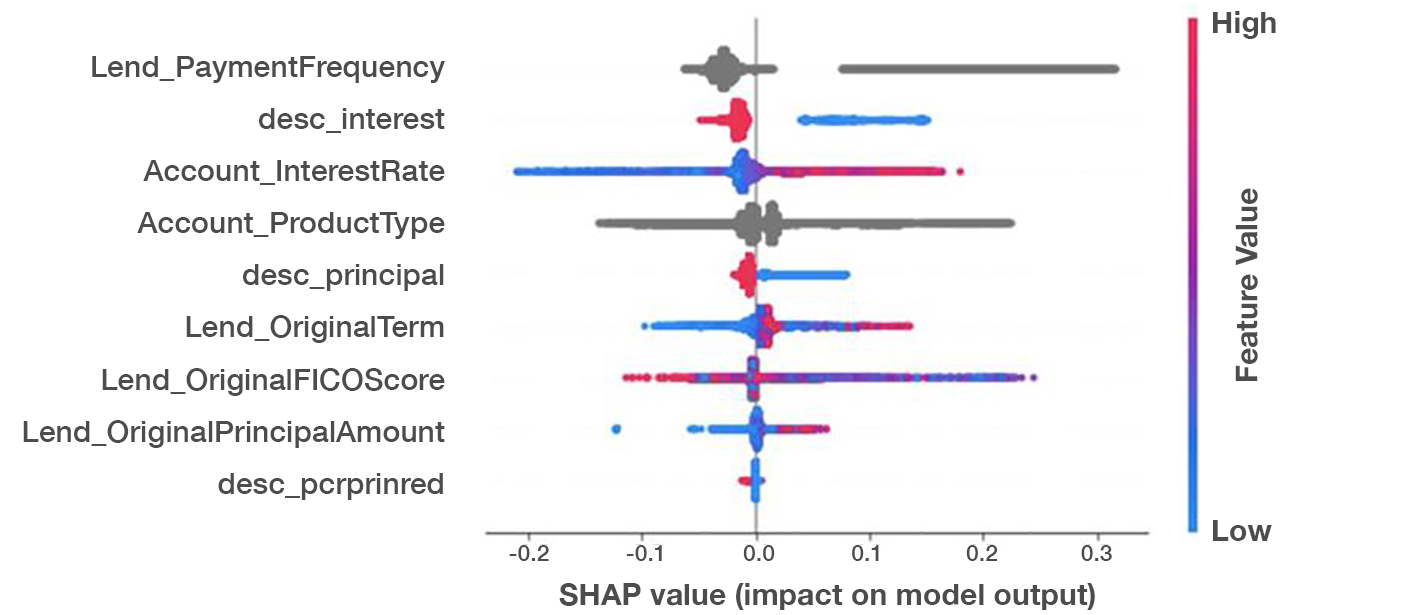

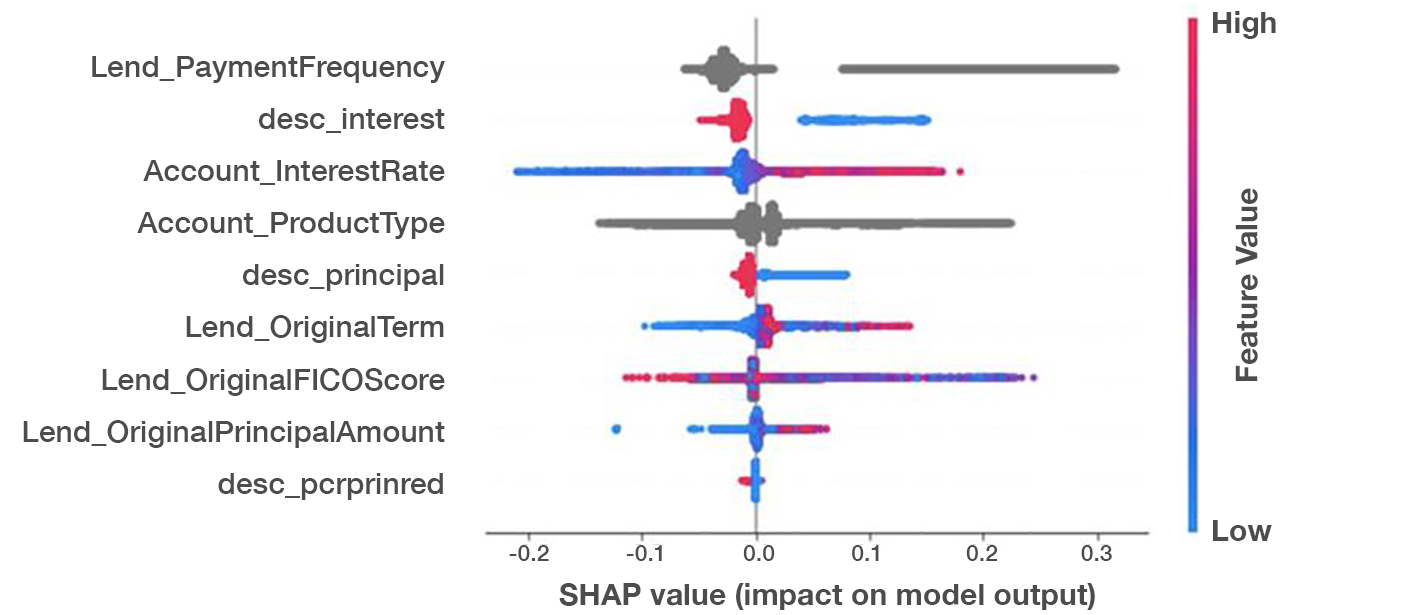

A SHAP (Shapley Additive Explanations) value chart for a remarkably accurate loan default risk model we developed shows which features have the highest impact on risk prediction.

From this, we append insights gleaned from machine learning to data models. We add high value fields to customer records to reveal insights about a customer learned from our algorithms. Smart Features provide answers to pressing business questions to recommend next steps to take with a particular customer to deepen relationships, provide targeted land and expand sales strategies, provide targeted marketing campaigns for better customer experiences, and yield business outcomes.

Machine learning techniques enable more accurate models of risk, propensity, and customer churn because they represent a more complex model of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Smart Features are one way that Aunalytics provides value to our clients by lending our extensive data science expertise to client-specific questions. Through these machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with businesses in your industry.

How to Assess True Branch Profitability in Mid-Market Banking

How to Assess True Branch Profitability in Mid-Market Banking

Branch profitability calculations are critically important for branch planning. Traditionally, the branch where a customer opens an account receives credit for that customer’s business. But it’s not always that simple. Learn how analyzing the right data can lead to more accurate results.

Fill out the form below to receive a link to the white paper.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

Mid-Market Bank Achieves Targeted Marketing Success

Mid-Market Bank Achieves Targeted Marketing Success

Customers are increasingly demanding digital banking experiences, immediate results and responses to sales and service inquiries, and easy-to-use online platforms. While it is common for banks to invest in building mobile and online banking platforms, industry trailblazers are now harnessing the power of data and analytics to drive revenue and smarten operations.

Fill out the form below to receive the case study.

Aunalytics is a data platform company. We deliver insights as a service to answer your most important IT and business questions.

Featured Content

Nothing found.

How to Use AI for Smarter Financial Institution Service

Data has long been used in decision making in the financial services industry. Statistical scoring models based on consumer data like FICO® have been used for half a century to guide lending decisions in the financial services sector. But today’s analytics space has evolved to the point where many other factors not easily digested by credit scoring bureaus play a roll. Imagine a deeper understanding of lending risk factors not commonly reported in credit scores:

- Number of changes of residence in the past five years

- Householding status (single or cohabiting/married)

Imagine having the ability to look at a particular client and understand based on past data how that individual compares in terms of various factors driving that business relationship:

- Which of our financial products is this customer most likely to choose next?

- How likely is this customer to default or become past due on a mortgage?

- What is churn likelihood for this customer?

- What is the probable lifetime value of this customer relationship?

Aunalytics financial services experts understand the most pressing business questions specific for this industry. Working with our financial services experts, Aunalytics’ Innovation Lab data scientists have developed proprietary machine learning, AI and deep learning algorithms based on a solid understanding of the data commonly collected by financial institutions. Our data engineers understand the types of data commonly created and used by the industry, common data sources and have created integrations to bring data from across a bank together into a single analytics-ready feed. The end result is data organized into industry specific relational data marts ready to answer questions posed by business users from financial services institutions.

A SHAP value chart for a remarkably accurate loan default risk model we developed. A benchmark with testing data provided by one client was able to predict 30% of that customer’s loan defaults with 99% accuracy, or predict 75% of all loan defaults with 75% accuracy (i.e. 0.99 precision at 0.3 recall or 0.75 precision at 0.75 recall).

Take the example of a recent model we developed at Aunalytics to predict loan default risk. Looking at a chart of the SHAP (Shapley Additive Explanations) values for this model, we can see a number of common-sense observations confirmed. For example, high interest loans (represented by a pink dot in the Account_InterestRate line) and low FICO scores (represented by a blue dot in the Lend_OriginalFICOScore) positively correlate with default risk. This model discovered some much less intuitive characteristics of high risk loans as well: For some loans, payment frequency (Lend_PaymentFrequency) was actually the single most important factor for predicting loan defaults. Moreover, a well-known but not always properly appreciated factor to default risk is illustrated visually: the type of loan being underwritten (Account_ProductType) is in many cases just as important as a customer’s credit score to default risk. Auto loan applicants with high FICO scores might be more of a default risk than customers with low credit scores shopping for a home mortgage.

In so many cases, machine learning techniques enable more accurate and understandable models of risk, propensity, and customer churn because they represent a more complex model understanding of the various factors that go into risk modeling. Our models deliver greater accuracy than simpler, statistical models because they understand the relationship between multiple indicators.

Through AI and machine learning enriched data points, clients can easily understand a particular customer or product by comparing it to other customers with similar data. Whether you want to know if a customer is likely to select a new product, their default risk, churn likelihood, or any other number of questions, our data scientists and business analysts are experienced and committed to answering these questions based on years of experience with financial services businesses.

Aunalytics to Participate as a Silver Sponsor at the Michigan Bankers Association Annual Convention

Leading Data Platform Provider Will Feature Daybreak for Financial Services Providing Mid-sized and Community Banks with Valuable Business Insights Using Advanced Analytics to Accelerate Competitive Advantage

South Bend, IN (June 9, 2021) - Aunalytics, a leading data platform company delivering Insights-as-a-Service for enterprise businesses, will participate as a Silver Sponsor at the upcoming Michigan Bankers Association Annual Convention, June 16-18 on Mackinac Island, MI. The company will showcase its DaybreakTM for Financial Services solution that enables bankers to better target and deliver new services and solutions for their customers to remain competitive. On the last day of the convention Aunalytics’ Client Relationship Director, Taylor Oake, will have the honor of introducing the final keynote speaker, Kyle Carpenter, the youngest living recipient of the Medal of Honor.

Built from the ground up for mid-sized community banks and credit unions, Daybreak for Financial Services is a cloud-native data platform with advanced analytics that empowers users to focus on critical business outcomes. The solution seamlessly cleanses data for accuracy, ensures data governance and employs artificial intelligence (AI) and machine learning (ML) driven analytics to glean customer intelligence and business insights for competitive advantage.

“Financial institutions have a massive amount of data that is typically siloed across the organization. Aggregating and integrating this data is difficult and time consuming,” said Rich Carlton, President, Aunalytics. “The utilization of digital banking platforms enables them to harness the power of their data to gain valuable insights and better target and deliver new services and solutions for their customers. We’re pleased to be a silver sponsor at the upcoming Michigan Bankers Association convention and show how our Daybreak for Financial Services solution can help bankers intelligently anticipate customer needs and deliver the right products and services at the right time.”

Tweet this: .@Aunalytics will showcase its advanced analytics data platform at @mibankers Annual Convention #Dataplatform#Dataanalytics#Dataintegration#Dataaccuracy#ArtificialIntelligence#AI #Masterdatamanagement#MDM#DataScientist#MachineLearning#ML#DigitalTransformation#FinancialServices

About Aunalytics

Aunalytics is a data platform company delivering answers for your business. Aunalytics provides Insights-as-a-Service to answer enterprise and mid-sized companies’ most important IT and business questions. The Aunalytics® cloud-native data platform is built for universal data access, advanced analytics and AI while unifying disparate data silos into a single golden record of accurate, actionable business information. Its DaybreakTM industry intelligent data mart combined with the power of the Aunalytics data platform provides industry-specific data models with built-in queries and AI to ensure access to timely, accurate data and answers to critical business and IT questions. Through its side-by-side digital transformation model, Aunalytics provides on-demand scalable access to technology, data science, and AI experts to seamlessly transform customers’ businesses. To learn more contact us at +1 855-799-DATA or visit Aunalytics at https://www.aunalytics.com or on Twitter and LinkedIn.

PR Contact:

Sabrina Sanchez

The Ventana Group for Aunalytics

(925) 785-3014

sabrina@theventanagroup.com

What is the best analytics tool for business users?

What is the best data analytics tool for business users? As more business leaders face this question in recent years, most are finding just how hard it is to answer. The data analytics landscape has exploded over the past decade with an ever-growing landscape of products and services: literally thousands of tools exist to help business deploy and manage data lakes, ETL and ELT, machine learning, and business intelligence. With so many tools to piece together, how do business leaders find the best one or ones?

As with most things, the best tool set is simply the one that tailors itself best to the problems and questions that need to be solved. For some users, this could be how to integrate and clean data across siloed systems. Others may want to know how to publish analytical datasets of relevant data and metrics to analysts and marketing researchers. Others may have questions about how to derive value from large amounts of data with machine learning.

The Answers Platform

Aunalytics has built its data platform of tools to answer all of these questions. We believe in providing answers to questions with our integrated data analytics platform and leveraging our industry expertise to put these tools to work for you.

Unlike most tools on the market, Aunalytics provides a comprehensive, end-to-end data platform with all the tools your organization needs:

- Data integration, cleaning, and migration in the loud with Aunsight™ Golden Record

- Data transformation, processing, and delivery with Aunsight Data Platform

- Machine Learning and Artificial Intelligence with Aunsight Data Lab

- Delivery and exploration of the data lake with the Daybreak™ Analytical Database

Side-by-Side Service Model

More importantly, Aunalytics’ side-by-side service model provides value that goes beyond most other tools and platforms on the market by providing access to human intelligence in data engineering, machine learning, and business analytics. While many companies offer one or two similar products, and many consulting firms can provide guidance in choosing and implementing tools, Aunalytics integrates all the tools and expertise in one company as your trusted partner in digital transformation.

A Comprehensive Platform

While there are a large number of options to choose from, we at Aunalytics believe our distinctive approach and comprehensive platform tools provide the best solution for all but the largest companies who may wish to create custom analytics solutions in-house. Wherever you are on the data analytics journey, from just beginning to explore the possibilities in your data to global companies with established data science teams, Aunalytics can provide a path through the complicated landscape of tools and infrastructure to grow your company’s data analytics program.